|

ATX812S-ADVANCED TAXATION-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 08BOAH LEVEL: 8

COURSE CODE: ATX812S

COURSE NAME: ADVANCED TAXATION

DATE: JANUARY2025

DURATION: 3 HOURS

PAPER: THEORYAND CALCULATIONS

MARKS: 100

2nd OPPORTUNITY EXAMINATION

EXAMINER(S) Dr. Moses Nyakuwanika

MODERATOR: Mrs. Marian Amakali

INSTRUCTIONS

1. Capture your full name, student number, mode of entry and assessment number on

the first page

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect

the reality and may be purely coincidental.

7. SHOWALLWORKINGS!

THIS QUESTION PAPER CONSISTS OF 5 PAGES (including the front page)

|

2 Page 2 |

▲back to top |

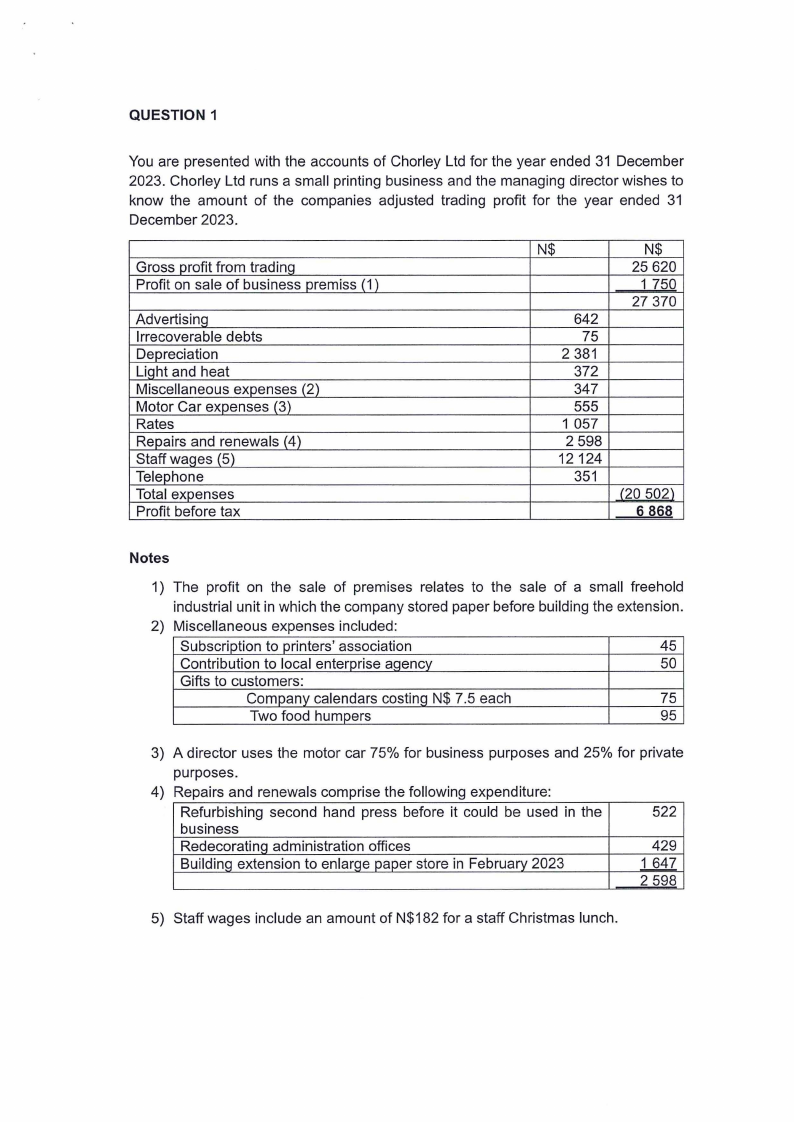

QUESTION 1

You are presented with the accounts of Chorley Ltd for the year ended 31 December

2023. Chorley Ltd runs a small printing business and the managing director wishes to

know the amount of the companies adjusted trading profit for the year ended 31

December 2023.

Gross profit from trading

Profit on sale of business premiss (1)

Advertisino

Irrecoverable debts

Depreciation

Liqht and heat

Miscellaneous expenses (2)

Motor Car expenses (3)

Rates

Repairs and renewals (4)

Staff wages (5)

Telephone

Total expenses

Profit before tax

N$

642

75

2 381

372

347

555

1 057

2 598

12124

351

N$

25 620

1 750

27 370

(20 502)

6 868

Notes

1) The profit on the sale of premises relates to the sale of a small freehold

industrial unit in which the company stored paper before building the extension.

2) Miscellaneous expenses included:

Subscription to printers' association

45

Contribution to local enterprise aqencv

50

Gifts to customers:

Company calendars costing N$ 7.5 each

75

Two food humpers

95

3) A director uses the motor car 75% for business purposes and 25% for private

purposes.

4) Repairs and renewals comprise the following expenditure:

Refurbishing second hand press before it could be used in the

522

business

RedecoratinQ administration offices

Building extension to enlarge paper store in February 2023

429

1 647

2 598

5) Staff wages include an amount of N$182 for a staff Christmas lunch.

|

3 Page 3 |

▲back to top |

REQUIREMENT

You are required to calculate Chorley Ltd.'s adjusted trading profit for the year ended

31 December 2023

[25 marks]

NB: You should indicate using zero any items in accounts for which no

adjustment is required.

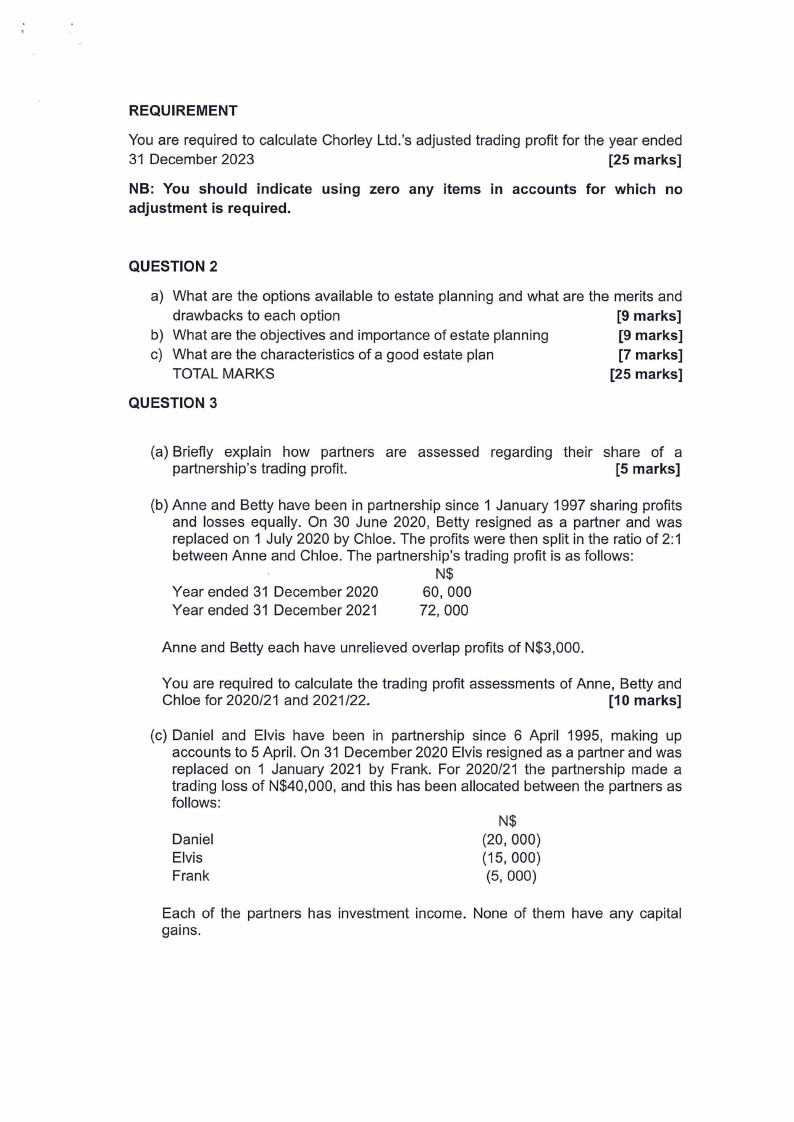

QUESTION 2

a) What are the options available to estate planning and what are the merits and

drawbacks to each option

[9 marks]

b) What are the objectives and importance of estate planning

[9 marks]

c) What are the characteristics of a good estate plan

[7 marks]

TOTAL MARKS

(25 marks]

QUESTION 3

(a) Briefly explain how partners are assessed regarding their share of a

partnership's trading profit.

[5 marks]

(b) Anne and Betty have been in partnership since 1 January 1997 sharing profits

and losses equally. On 30 June 2020, Betty resigned as a partner and was

replaced on 1 July 2020 by Chloe. The profits were then split in the ratio of 2:1

between Anne and Chloe. The partnership's trading profit is as follows:

N$

Year ended 31 December 2020

60,000

Year ended 31 December 2021

72,000

Anne and Betty each have unrelieved overlap profits of N$3,000.

You are required to calculate the trading profit assessments of Anne, Betty and

Chloe for 2020/21 and 2021/22.

[10 marks]

(c) Daniel and Elvis have been in partnership since 6 April 1995, making up

accounts to 5 April. On 31 December 2020 Elvis resigned as a partner and was

replaced on 1 January 2021 by Frank. For 2020/21 the partnership made a

trading loss of N$40,000, and this has been allocated between the partners as

follows:

N$

Daniel

(20, 000)

Elvis

(15, 000)

Frank

(5, 000)

Each of the partners has investment income. None of them have any capital

gains.

|

4 Page 4 |

▲back to top |

You are required to discuss how Daniel, Elvis and Frank can relieve their Trading

losses for 2020/21.

[10 marks]

TOTAL MARKS

[25 marks]

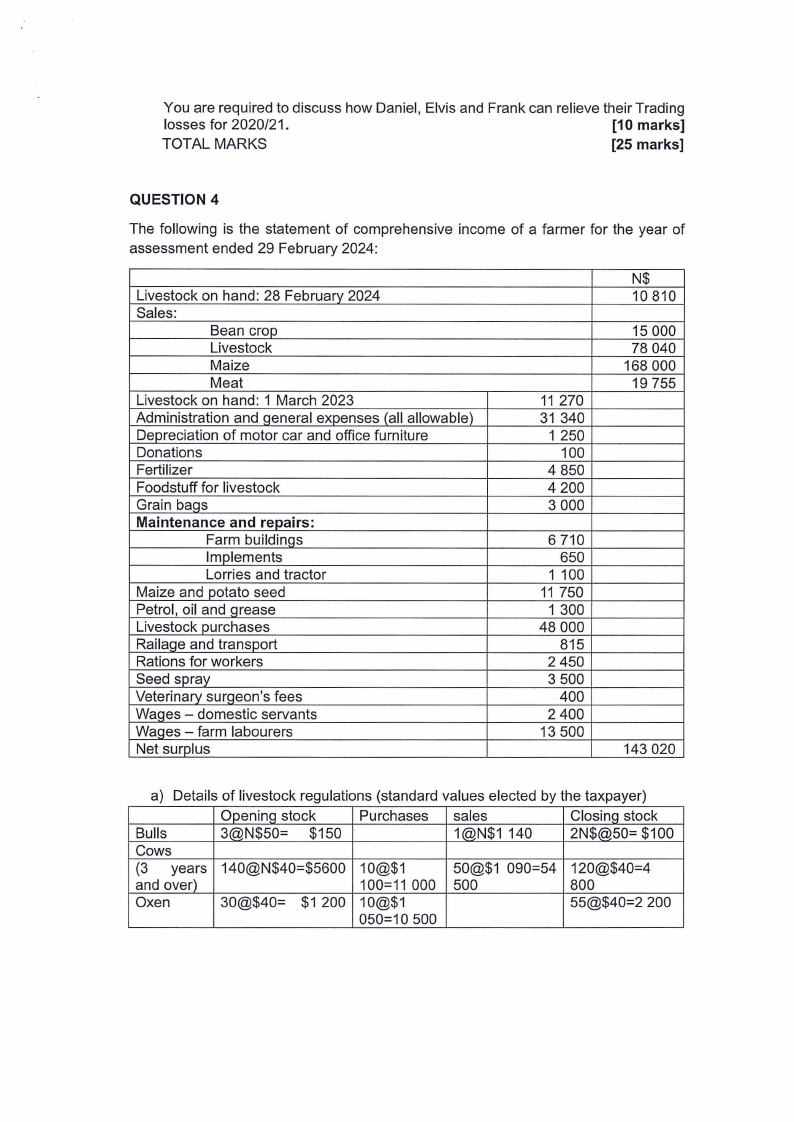

QUESTION 4

The following is the statement of comprehensive income of a farmer for the year of

assessment ended 29 February 2024:

Livestock on hand: 28 February 2024

Sales:

Bean crop

Livestock

Maize

Meat

Livestock on hand: 1 March 2023

Administration and general expenses (all allowable)

Depreciation of motor car and office furniture

Donations

Fertilizer

Foodstuff for livestock

Grain bags

Maintenance and repairs:

Farm buildings

Implements

Lorries and tractor

Maize and potato seed

Petrol, oil and grease

Livestock purchases

Railage and transport

Rations for workers

Seed spray

Veterinarv surqeon's fees

Waqes - domestic servants

Wages - farm labourers

Net surplus

11 270

31 340

1 250

100

4 850

4 200

3 000

6 710

650

1 100

11 750

1 300

48 000

815

2 450

3 500

400

2 400

13 500

N$

10 810

15 000

78 040

168 000

19 755

143 020

a) Details of livestock regulations (standard values elected by the taxpayer)

Opening stock

Purchases sales

Closing stock

Bulls

3@N$50= $150

1@N$1140

2N$@50= $100

Cows

(3 years 140@N$40=$5600 10@$1

50@$1 090=54 120@$40=4

and over)

100=11 000 500

800

Oxen

30@$40= $1 200 10@$1

55@$40=2 200

050=10 500

|

5 Page 5 |

▲back to top |

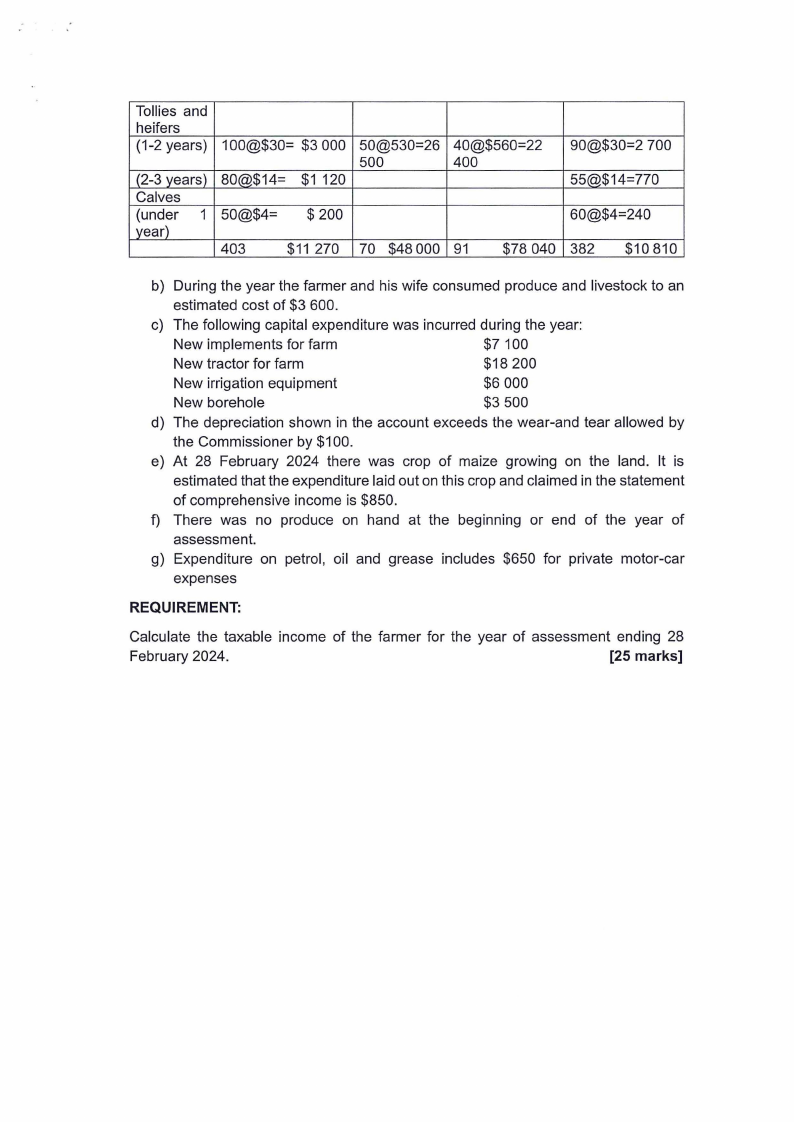

Tallies and

heifers

(1-2 years) 100@$30= $3 000

(2-3 years)

Calves

(under 1

year)

80@$14= $1 120

50@$4= $ 200

403

$11 270

50@530=26

500

70 $48 000

40@$560=22

400

91 $78 040

90@$30=2 700

55@$14=770

60@$4=240

382 $10 810

b) During the year the farmer and his wife consumed produce and livestock to an

estimated cost of $3 600.

c) The following capital expenditure was incurred during the year:

New implements for farm

$7 100

New tractor for farm

$18 200

New irrigation equipment

$6 000

New borehole

$3 500

d) The depreciation shown in the account exceeds the wear-and tear allowed by

the Commissioner by $100.

e) At 28 February 2024 there was crop of maize growing on the land. It is

estimated that the expenditure laid out on this crop and claimed in the statement

of comprehensive income is $850.

f) There was no produce on hand at the beginning or end of the year of

assessment.

g) Expenditure on petrol, oil and grease includes $650 for private motor-car

expenses

REQUIREMENT:

Calculate the taxable income of the farmer for the year of assessment ending 28

February 2024.

[25 marks]