|

FMA721S - FINANCIAL MANAGEMENT FOR AGRICULTURE - 2ND OPP - JAN 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF HEALTH,NATURAL RESOURCESAND APPLIEDSCIENCES

DEPARTMENT OF AGRICULTURE AND NATURAL RESOURCES SCIENCES

QUALIFICATION: BACHELOR OF SCIENCE IN AGRICULTURE

QUALIFICATION CODE:

07BAGA

COURSE CODE: FMA720S/FMA712S

LEVEL: 7

COURSE NAME: FINANCIAL MANAGEMENT

FOR AGRICULTURE

DATE: JANUARY 2023

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER($)

M LUBINDA

MODERATOR:

S KALUNDU

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Examination question paper

2. Answering book

3. Calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Excluding this front page)

|

2 Page 2 |

▲back to top |

Financial Management

FMA720S

QUESTION ONE

[MARKS]

a. Briefly describe three main types of business forms.

(6)

b. Consider a tractor whose purchasing cost and useful life are N$150,000 and 4 years,

respectively. Use the double decline balance method to prepare a depreciation schedule

(S)

for the tractor for the first four years.

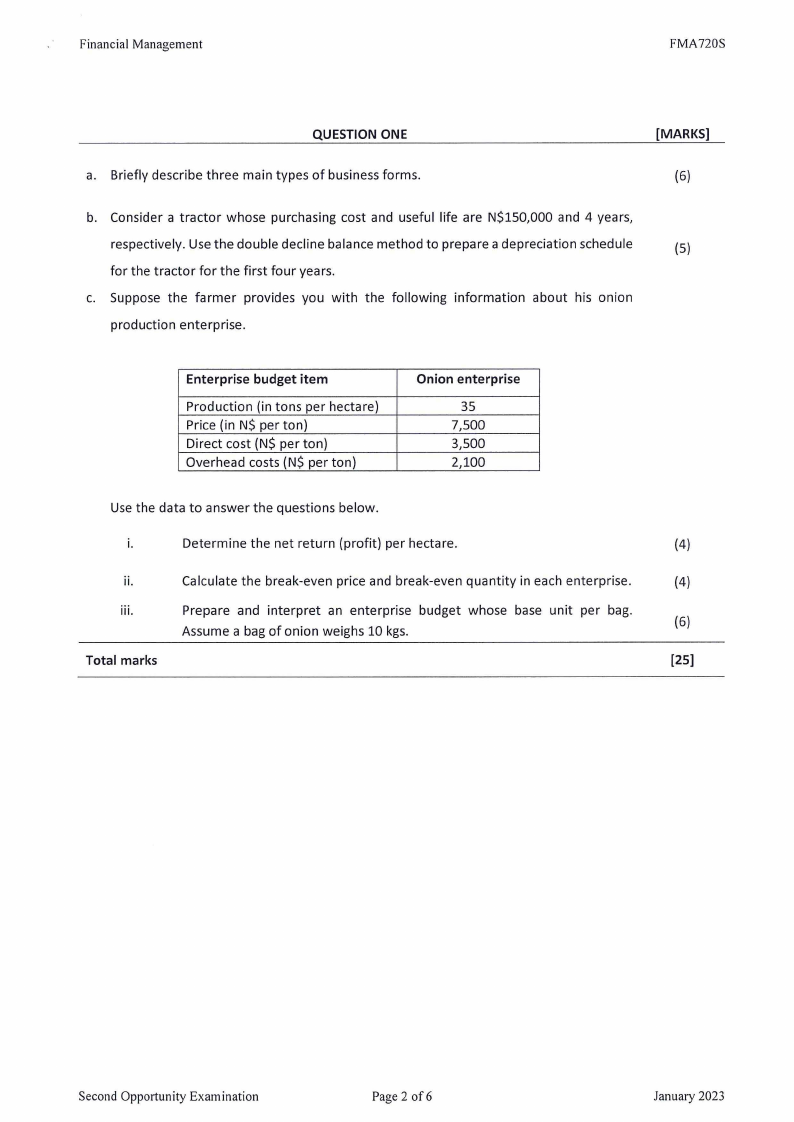

c. Suppose the farmer provides you with the following information about his onion

production enterprise.

Enterprise budget item

Production (in tons per hectare)

Price (in N$ per ton)

Direct cost (N$ per ton)

Overhead costs (N$ per ton)

Onion enterprise

35

7,500

3,500

2,100

Use the data to answer the questions below.

i.

Determine the net return (profit) per hectare.

(4)

ii.

Calculate the break-even price and break-even quantity in each enterprise.

(4)

iii.

Prepare and interpret an enterprise budget whose base unit per bag.

Assume a bag of onion weighs 10 kgs.

(6)

Total marks

[25]

Second Opportunity Examination

Page 2 of6

January 2023

|

3 Page 3 |

▲back to top |

Financial Management

FMA720S

QUESTION TWO

a. Briefly describe the cash flow statement.

[MARKS]

(5)

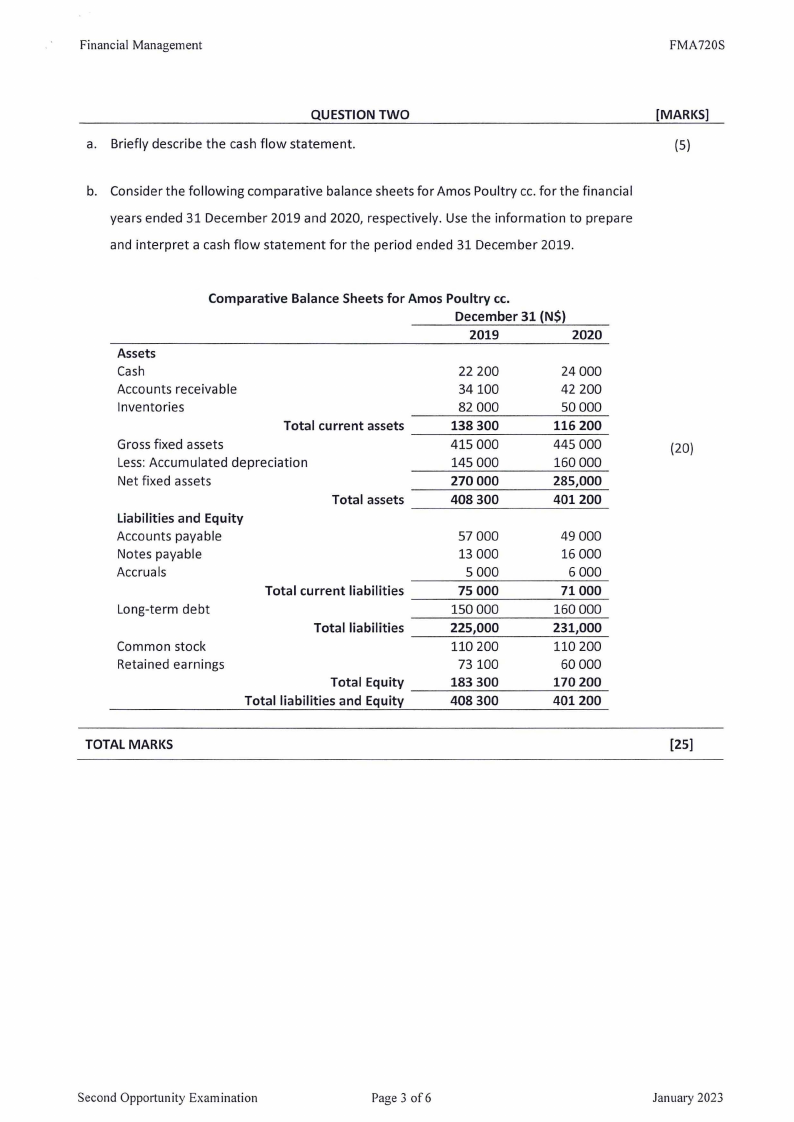

b. Consider the following comparative balance sheets for Amos Poultry cc. for the financial

years ended 31 December 2019 and 2020, respectively. Use the information to prepare

and interpret a cash flow statement for the period ended 31 December 2019.

Comparative Balance Sheets for Amos Poultry cc.

December 31 (N$)

2019

2020

Assets

Cash

22 200

24 000

Accounts receivable

34100

42 200

Inventories

82 000

50000

Total current assets

138 300

116 200

Gross fixed assets

Less:Accumulated depreciation

415 000

445 000

(20)

145 000

160 000

Net fixed assets

270 000

285,000

Total assets

408 300

401200

Liabilities and Equity

Accounts payable

57 000

49 000

Notes payable

13 000

16 000

Accruals

5 000

6 000

Total current liabilities

75 000

71000

Long-term debt

150 000

160 000

Total liabilities

225,000

231,000

Common stock

110 200

110 200

Retained earnings

73100

60000

Total Equity

183 300

170 200

Total liabilities and Equity

408 300

401200

TOTAL MARKS

(25)

Second Oppot1unity Examination

Page3of6

January 2023

|

4 Page 4 |

▲back to top |

Financial Management

FMA720S

QUESTION THREE

a. Briefly discuss the four key areas of financial performance evaluation.

[MARKS]

{8)

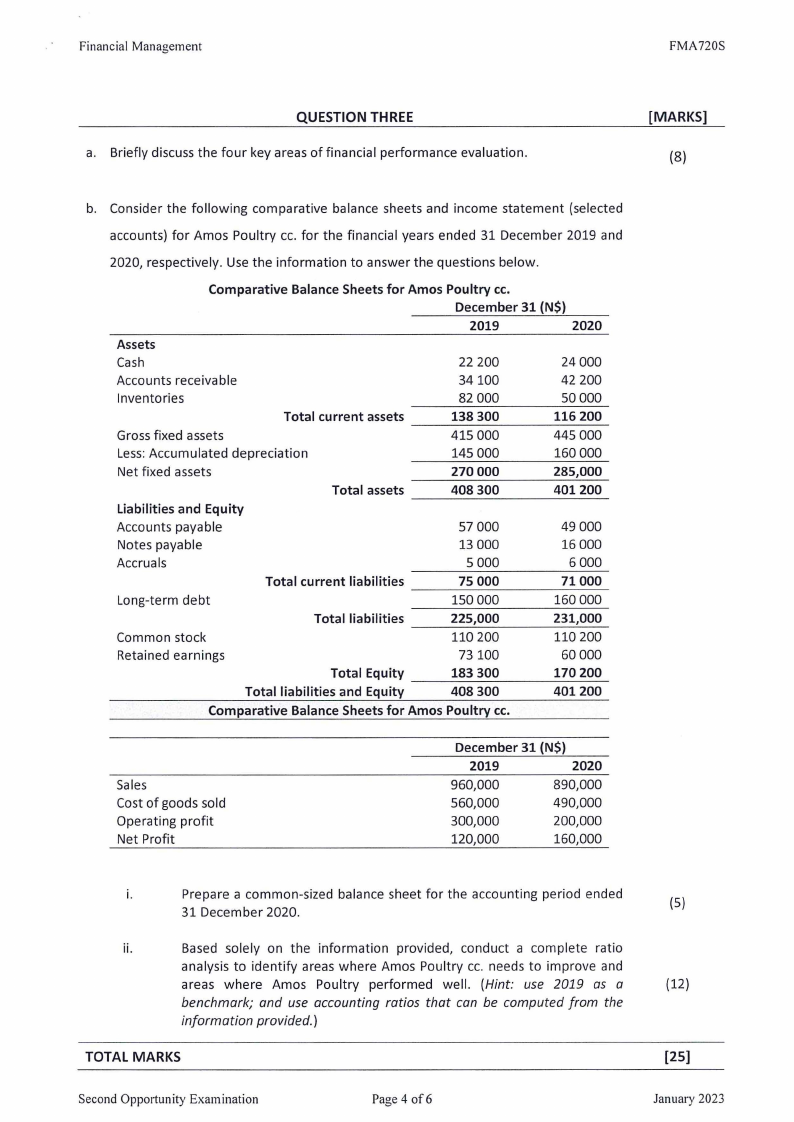

b. Consider the following comparative balance sheets and income statement (selected

accounts) for Amos Poultry cc. for the financial years ended 31 December 2019 and

2020, respectively. Use the information to answer the questions below.

Comparative Balance Sheets for Amos Poultry cc.

December 31 (N$)

2019

2020

Assets

Cash

22 200

24 000

Accounts receivable

34100

42 200

Inventories

82 000

50000

Total current assets

138300

116 200

Gross fixed assets

415 000

445 000

Less: Accumulated depreciation

145 000

160 000

Net fixed assets

270 000

285,000

Total assets

408 300

401200

Liabilities and Equity

Accounts payable

57 000

49 000

Notes payable

13 000

16 000

Accruals

5 000

6000

Total current liabilities

75 000

71000

Long-term debt

150 000

160 000

Total liabilities

225,000

231,000

Common stock

110 200

110 200

Retained earnings

73100

60000

Total Equity

183 300

170 200

Total liabilities and Equity

408 300

401200

Comparative Balance Sheets for Amos Poultry cc.

Sales

Cost of goods sold

Operating profit

Net Profit

December 31 (N$)

2019

2020

960,000

890,000

560,000

490,000

300,000

200,000

120,000

160,000

i.

Prepare a common-sized balance sheet for the accounting period ended

31 December 2020.

(5)

ii.

Based solely on the information provided, conduct a complete ratio

analysis to identify areas where Amos Poultry cc. needs to improve and

areas where Amos Poultry performed well. (Hint: use 2019 as a

(12)

benchmark; and use accounting ratios that can be computed from the

information provided.)

TOTAL MARKS

[25]

Second Opportunity Examination

Page 4 of6

January 2023

|

5 Page 5 |

▲back to top |

Financial Management

FMA720S

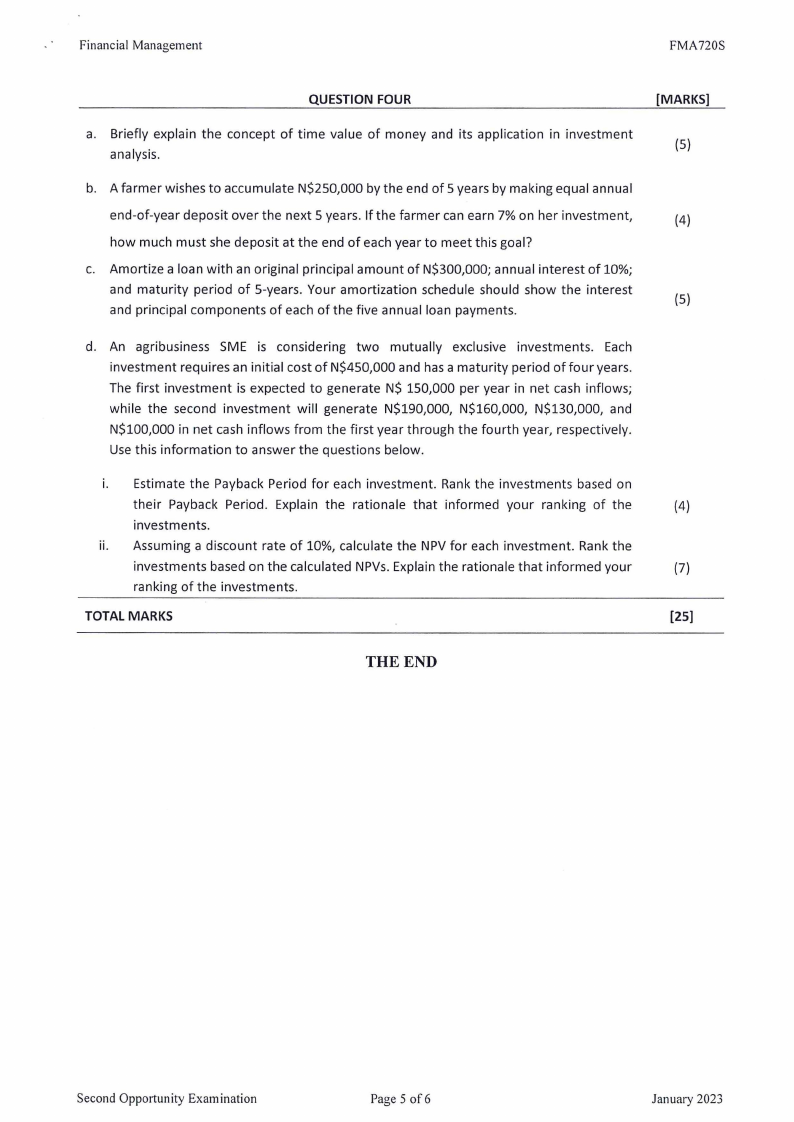

QUESTION FOUR

a. Briefly explain the concept of time value of money and its application in investment

analysis.

[MARKS]

(5)

b. A farmer wishes to accumulate N$250,000 by the end of 5 years by making equal annual

end-of-year deposit over the next 5 years. If the farmer can earn 7% on her investment,

(4)

how much must she deposit at the end of each year to meet this goal?

c. Amortize a loan with an original principal amount of N$300,000; annual interest of 10%;

and maturity period of 5-years. Your amortization schedule should show the interest

(5)

and principal components of each of the five annual loan payments.

d. An agribusiness SME is considering two mutually exclusive investments. Each

investment requires an initial cost of N$450,000 and has a maturity period of four years.

The first investment is expected to generate N$ 150,000 per year in net cash inflows;

while the second investment will generate N$190,000, N$160,000, N$130,000, and

N$100,000 in net cash inflows from the first year through the fourth year, respectively.

Use this information to answer the questions below.

i. Estimate the Payback Period for each investment. Rank the investments based on

their Payback Period. Explain the rationale that informed your ranking of the

(4)

investments.

ii. Assuming a discount rate of 10%, calculate the NPV for each investment. Rank the

investments based on the calculated NPVs. Explain the rationale that informed your

(7)

ranking of the investments.

TOTAL MARKS

[25]

THE END

Second Oppo1tunity Examination

Page5of6

January 2023

|

6 Page 6 |

▲back to top |

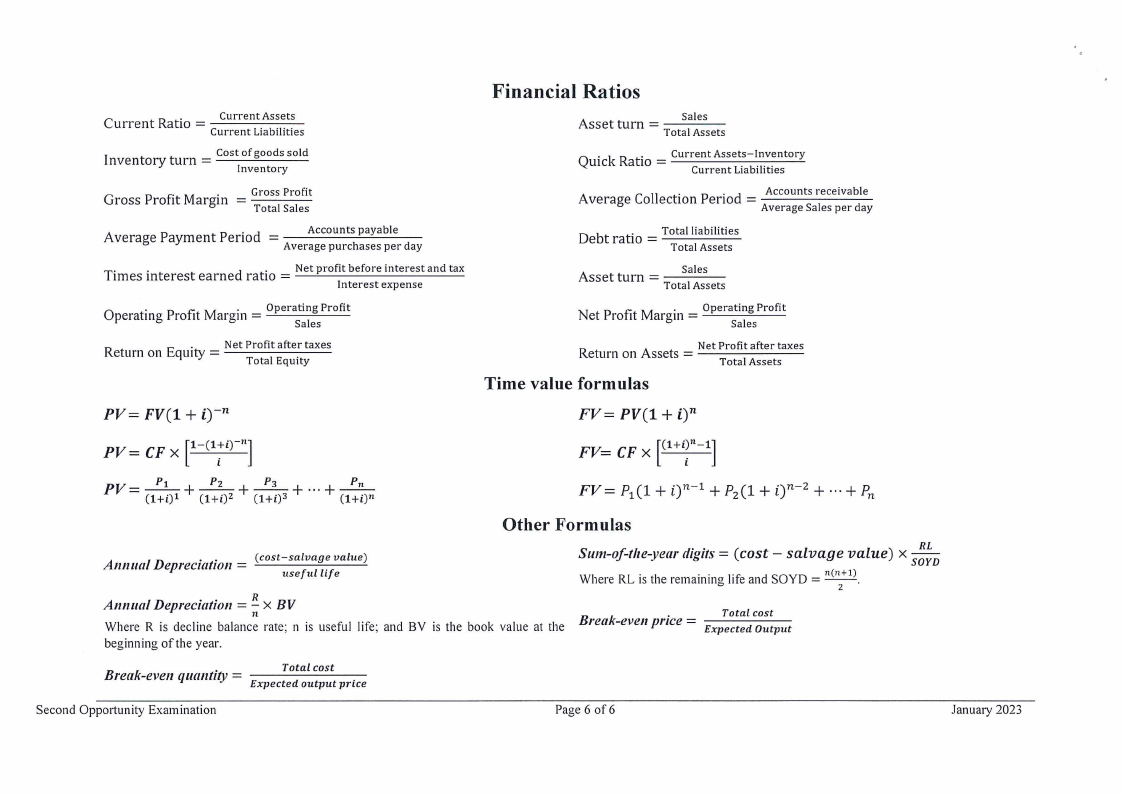

Current Ratio = Current Assets

Current Liabilities

Inventory turn = Cost of goods sold

Inventory

Gross Profit Margin = Gross Profit

Total Sales

Average Payment Period = Accounts payable

Average purchases per day

Times interest earned ratio = Net profit before interest and tax

Interest expense

Operating Profit Margin = Operating Profit

Sales

= Return on Equity Net Profit after taxes

Total Equity

PV= FV(1 + i)-n

PV = CF X[l-(l;1i1])-

Financial Ratios

Asset turn = ----Sales

Total Assets

= . QUI.C k RatI.O

Current Assets-Inventory

Current Liabilities

Average CoIIect1. 0n pen.o d = AAvcecraoguentssarIeecseipvearbldeay

Debt

rat1.0

=

-T-o-t-a-l liabilities

Total Assets

Asset turn=---- Sales

Total Assets

= Net Profi1tMarg1. 11

Operating Profit

Sa1es

= Return on A ssets

Net Profit after taxes

Tota 1Assets

Time value formulas

FV= PV(1 + i)n

FV= CF x [(1+1i]t-

+ + + PV - --.!.1._

+

- (l+i)l

(l+i)Z (l+i)3

..·

(l+i)11

FV= P1(l + i)n-1 + P2(l + i)n-2 + ...+ Pn

Other Formulas

= Annual Depreciation (cost-salvage value)

useful life

Annual Depreciation=!!.. x BV

1l

Where R is decline balance rate; n is useful life; and BY is the book value at the

beginning of the year.

Sum-of-the-year digits= (cost - salvage value) x siio

Where RL is the remaining life and SOYD = 11(11+ 1)_

2

= Total cost

Break-even price Expected Output

= Break-even quantit.y

Total cost

Expecte d output price

Second Oppmtunity Examination

Page 6 of6

January 2023