|

AMA811S- ADVANCED MANAGEMENT ACCOUNTING- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmI BIA un IVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (HONOURS)

QUALIFICATION CODE: 08BOAC

COURSE CODE: AMA811 S

SESSION: JULY 2023

LEVEL: 8

COURSE NAME: ADVANCED MANAGEMENT

ACCOUNTING

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Lameck Odada

MODERATOR Lazarus Shinkeva

INSTRUCTIONS

1. Answer ALL FOUR questions in blue or black ink only. NO PENCIL.

2. Start each question on a new page, number the answers correctly and clearly.

3. Write clearly, and neatly and show all your workings/assumptions.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities and any assumptions the candidate makes should be

clearly stated.

PERMISSIBLE MATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (excluding this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 MARKS]

The Food Company Ltd (hereafter FCL) is a Namibian Stock Exchange (NSX) listed company

operating in the fast-moving consumer goods industry. The industry average debt-to-equity

ratio for both 2021 and 2022 is 38%. FCL manufactures and distributes everyday food items

such as bread, pasta, rice, sauces, and canned food throughout Namibia. FCL's success is

mainly attributed to its strategy of continuous improvement and innovation.

The company requires a large amount of capital expenditure to upgrade its plant and

equipment. Energy efficiency will be a key part of this upgrade. Facilities will be fitted with

energy-efficient lighting and refrigeration. FCL is also planning to use biodegradable

packaging for some if its products. While this project will require a significant capital outlay, it

will also result in a significant cash injection into the economy and the creation of job

opportunities.

The following information relates to FCL.

2022

2021

Skills development spend (N$'m)

39,32

36,86

Energy (Kwh)

86,19

83,32

Production (tons)

1 545 880

1 557 276

Carbon emissions

0,17

0,15

Capital structures (debt/equity)

45:55

35:65

During the current year at one of the manufacturing sites in the Khomas region, the food

inspection officer realised expired ingredients were being used while baking bread. The

inspector was afraid to notify management as, in the past, colleagues of his were fired

immediately for not timeously identifying and removing expired ingredients, despite the error

being their first. He thought it would be best if he and his team managed the problem

independently. He called a friend, who owns a fleet of trucks, loaded all the 'damaged' loaves

of bread onto his trucks, and asked his friend to dump the loaves of bread onto an unoccupied

piece of land about 100km away from the manufacturing facility.

Some of the initiatives undertaken by FCL, post-year end, include significantly reducing the

salt and sugar content of various products and increasing the level of detail about ingredients

on the packaging.

REQUIRED

a) Discuss the non-financial performance of FCL.

MARKS

20

Advise FCL on whether it should fund the plant and equipment upgrade

5

b)

using debt financing. Provide reasons for your answer.

1

|

3 Page 3 |

▲back to top |

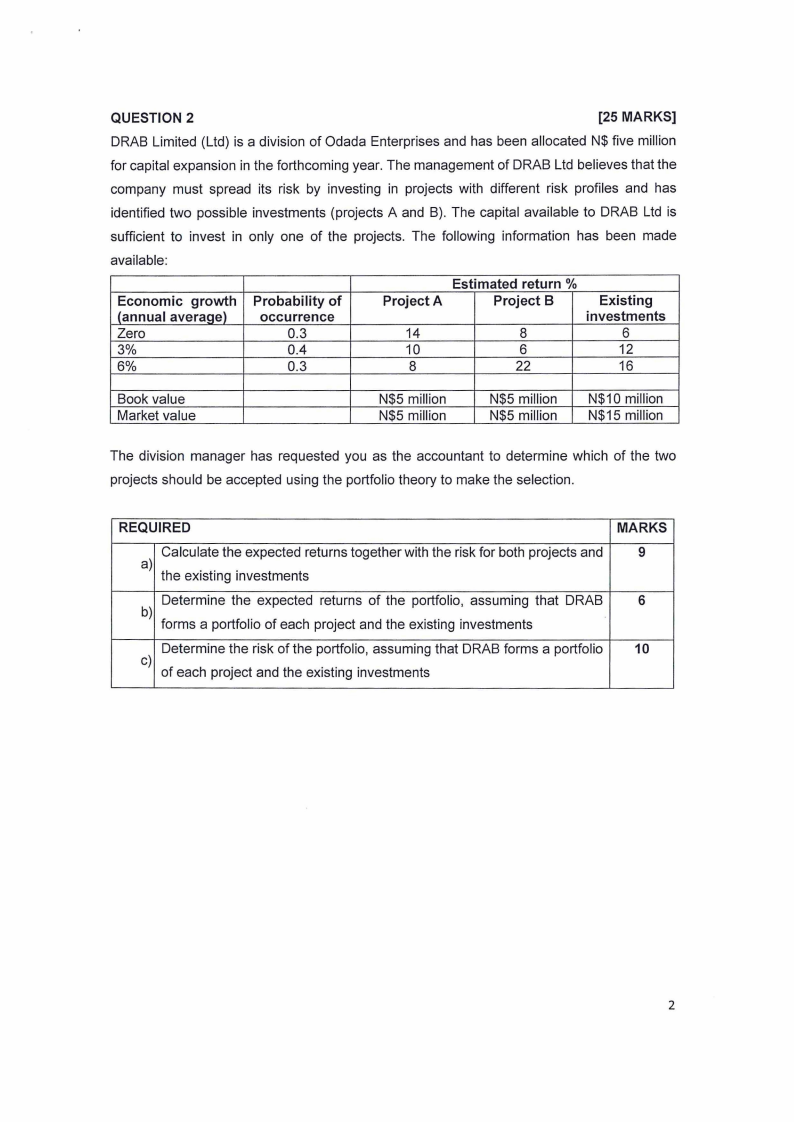

QUESTION 2

[25 MARKS]

DRAB Limited (Ltd) is a division of Odada Enterprises and has been allocated N$ five million

for capital expansion in the forthcoming year. The management of DRAB Ltd believes that the

company must spread its risk by investing in projects with different risk profiles and has

identified two possible investments (projects A and B). The capital available to DRAB Ltd is

sufficient to invest in only one of the projects. The following information has been made

available:

Economic growth

(annual average)

Zero

3%

6%

Probability of

occurrence

0.3

0.4

0.3

Estimated return%

Project A

Project B

14

8

10

6

8

22

Existing

investments

6

12

16

Book value

Market value

N$5 million

N$5 million

N$5 million

N$5 million

N$10 million

N$15 million

The division manager has requested you as the accountant to determine which of the two

projects should be accepted using the portfolio theory to make the selection.

REQUIRED

MARKS

Calculate the expected returns together with the risk for both projects and

9

a)

the existing investments

Determine the expected returns of the portfolio, assuming that DRAB

6

b)

forms a portfolio of each project and the existing investments

Determine the risk of the portfolio, assuming that DRAB forms a portfolio

10

c)

of each project and the existing investments

2

|

4 Page 4 |

▲back to top |

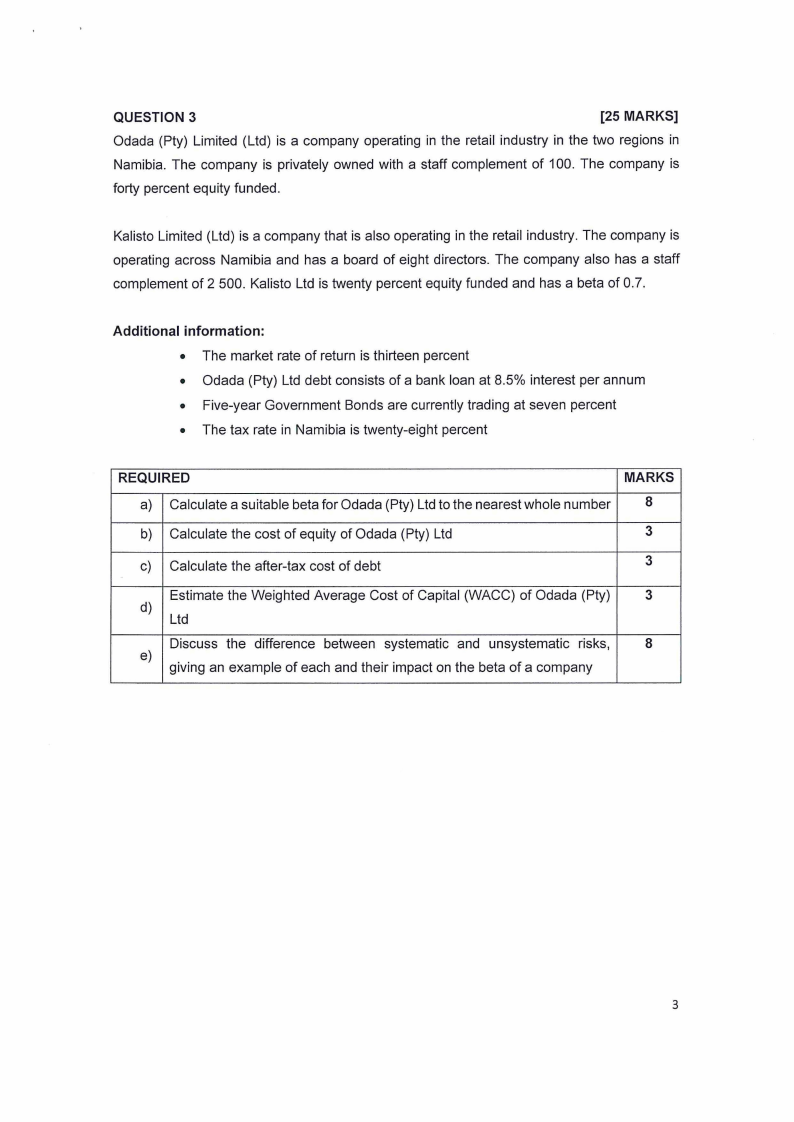

QUESTION 3

[25 MARKS]

Odada (Pty) Limited (Ltd) is a company operating in the retail industry in the two regions in

Namibia. The company is privately owned with a staff complement of 100. The company is

forty percent equity funded.

Kalista Limited (Ltd) is a company that is also operating in the retail industry. The company is

operating across Namibia and has a board of eight directors. The company also has a staff

complement of 2 500. Kalista Ltd is twenty percent equity funded and has a beta of 0.7.

Additional information:

• The market rate of return is thirteen percent

• Odada (Pty) Ltd debt consists of a bank loan at 8.5% interest per annum

• Five-year Government Bonds are currently trading at seven percent

• The tax rate in Namibia is twenty-eight percent

REQUIRED

MARKS

a) Calculate a suitable beta for Odada (Pty) Ltd to the nearest whole number

8

b) Calculate the cost of equity of Odada (Pty) Ltd

3

c) Calculate the after-tax cost of debt

3

Estimate the Weighted Average Cost of Capital (WACC) of Odada (Pty)

3

d)

Ltd

Discuss the difference between systematic and unsystematic risks,

8

e)

giving an example of each and their impact on the beta of a company

3

|

5 Page 5 |

▲back to top |

QUESTION 4

[25 MARKS]

Mzoli Chairs (Pty) Limited (hereafter Mzoli Chairs) is a company that manufactures and sells

two types of chairs that are sold locally, namely the "comfy" and the "modern". At the beginning

of the current financial year, the company produced the following budget:

Budgeted statement of profit or loss for the year ending 30 September 2023

Products

Sales units

Sales

Cost of sales

Material

Transferred in costs

Labour

ManufacturinQ overheads

Manufacturing gross profit

Marketing division

Transport

Administration

Profit

Comfy

30 000

N$

7 200 000

(2 400 000)

(1 500 000)

(1 650 000)

1650000

Modern

20 000

N$

3 400 000

(400 000)

(2 000 000)

(300 000)

(200 000)

500 000

Total

50 000

N$

2 150 000

(400 000)

(335 000)

(300 000)

1 115 000

Budget information:

1. The modern chair requires the base structure of a standard chair that is transferred in

from Vilikazi (Pty) Limited (hereafter Vilikazi), a company within the group. The

transferred-in price is set by Vilikazi.

2. All labour costs are variable.

3. Manufacturing overheads for the modern chair are variable. No fixed overheads are

allocated, as the modern chair is treated as a marginal product for manufacturing

purposes. The budget costs for the comfy chair consists of variable plus fixed

overheads.

4. The marketing division costs are all variable. The comfy chair incurs twice as much

cost per unit as the modern chair.

5. Transport costs have not been allocated to each product. Management is of the

opinion that N$85 000 fixed cost should be allocated to the modern chair. The balance

of the transport cost is incurred by the comfy chair, and 40% of this is considered fixed.

6. Administration costs are fixed. Where product profitability is assessed, one third of

the cost is allocated to the modern chair.

Actual results for the year ended 30 September 2023

Products

Sales units

Selling price per unit

Production units

Comfy

32 000

N$250

35 000

Modern

15 000

N$175

15 000

Total

47 000

50 000

4

|

6 Page 6 |

▲back to top |

Modern

1. Manufacturing costs incurred were per budget, except for transferred-in costs which

were charged by Vilikazi at a cost of N$114 per unit.

Comfy

1. Actual raw material cost incurred was 10% higher than budget cost per unit.

2. Labour cost incurred were per budget.

3. The total manufacturing overhead cost incurred for the comfy chair was N$1 825 000,

which represents the same cost structure per the budget cost above.

Other costs

1. Marketing costs incurred were per budget, as were the variable transport costs. Fixed

transport costs were however 20% higher.

2. Administrative costs were 10% below budget.

Transferred-in material for the modern chair:

Mzoli chairs ordered 20 000 standard chairs from Vilikazi, on condition that the purchase price

was fixed at N$100 per unit or lower. Vilikazi, however, stated that it was currently selling the

required standard chairs at a market price of N$114 and the selling price to Mzoli Chairs would

have to be the same.

Mzoli Chairs was very unhappy with the new selling price and as a result, cut its order to 15

000 units in order to maximise company profit.

Vilikazi sells its standard chairs in an imperfect market and is faced with the following selling

price/demand structures.

Sellin~ price

N$120

N$114

N$106

Demand

10 000

15 000

18 000

The company incurs a variable manufacturing cost of N$80 per unit and has a manufacturing

capacity of 35 000 units.

Mzoli Chairs, on the other hand, is faced with the following selling price/demand constraints.

Selling price

N$175

N$170

N$154

Demand

15 000

20 000

25 000

5

|

7 Page 7 |

▲back to top |

REQUIRED

MARKS

Re-evaluate the transfer price decision made by Vilikazi (Pty) Limited and state 25

what, in your opinion, the transfer price should have been and the consequences

for Mzoli Chairs (Pty) Limited.

END OF EXAMINATION PAPER

• i ,•,

i; ·, .. ,

6