|

BES712S -SME STRATEGY - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF MANAGEMENT

QUALIFICATION: BACHELOR OF BUSINESS MANAGEMENT

QUALIFICATION CODE: 07BBMA

LEVEL: 7

COURSE CODE: BES712S

COURSE NAME: SME STRATEGY

SESSION:

JANUARY 2020

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SUPPLEMENTARY / SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) DR. CHRIS VAN ZYL

MODERATOR: MIR. RAINER RITTER

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Business calculator

THIS QUESTION PAPER CONSISTS OF 3 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

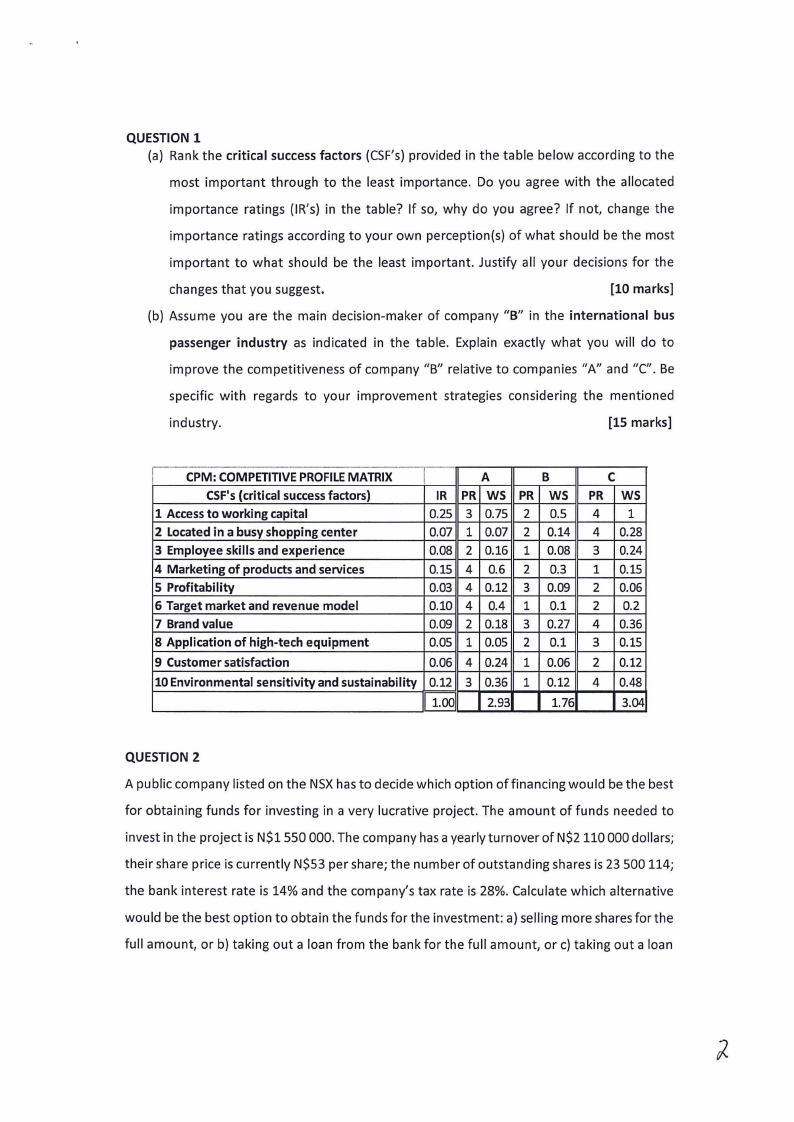

QUESTION 1

(a) Rank the critical success factors (CSF’s) provided in the table below according to the

most important through to the least importance. Do you agree with the allocated

importance ratings (IR’s) in the table? If so, why do you agree? If not, change the

importance ratings according to your own perception(s) of what should be the most

important to what should be the least important. Justify all your decisions for the

changes that you suggest.

[10 marks]

(b) Assume you are the main decision-maker of company “B” in the international bus

passenger industry as indicated in the table. Explain exactly what you will do to

improve the competitiveness of company “B” relative to companies “A” and “C”. Be

specific with regards to your improvement strategies considering the mentioned

industry.

[15 marks]

CPM: COMPETITIVE PROFILE MATRIX

CSF's (critical success factors)

IR

1 Access to working capital

0.25)

2 Located in a busy shopping center

0.07]

3 Employee skills and experience

0.08]

4 Marketing of products and services

0.15]

5 Profitability

0.03}

6 Target market and revenue model

0.10)

7 Brand value

0.09}

8 Application of high-tech equipment

0.05)

9 Customer satisfaction

0.06]

10 Environmental sensitivity and sustainability | 0.12]|

1.00

A

|PR} WS]

3 | 0.75]

1 | 0.07}

2 |0.16//

4} 0.6]

4 | 0.12]

4] 04]

2 |0.18]

1|0.05]

4)0.24)

3 |0.36])

2.93

B

PR| WS |

2 | 0.5

2 | 0.14]

1 | 008}

2 | 03

3 | 0.09]

1] O01

3 | 0.27)

2] O21

1) 0.06)

1 | 0.12)

1.76

Cc

PR | WS

4

1

4 |0.28

3 |0.24

1 {0.15

2 | 0.06

2 | 0.2

4 |0.36

3 |0.15

2 |0.12

4 | 0.48

3.04

QUESTION 2

A public company listed on the NSX has to decide which option of financing would be the best

for obtaining funds for investing in a very lucrative project. The amount of funds needed to

invest in the project is NS1 550 000. The company has a yearly turnover of NS2 110 000 dollars;

their share price is currently NS53 per share; the number of outstanding shares is 23 500 114;

the bank interest rate is 14% and the company’s tax rate is 28%. Calculate which alternative

would be the best option to obtain the funds for the investment: a) selling more shares for the

full amount, or b) taking out a loan from the bank for the full amount, or c) taking out a loan

|

3 Page 3 |

▲back to top |

from the bank for 8% of the required amount and 92% of the required amount from the selling

of more shares, or d) taking out a loan from the bank for 73% of the required amount and 27%

of the required amount from the selling of more shares? Show all your calculations and

indicate how you interpret the findings in each situation.

[25 marks]

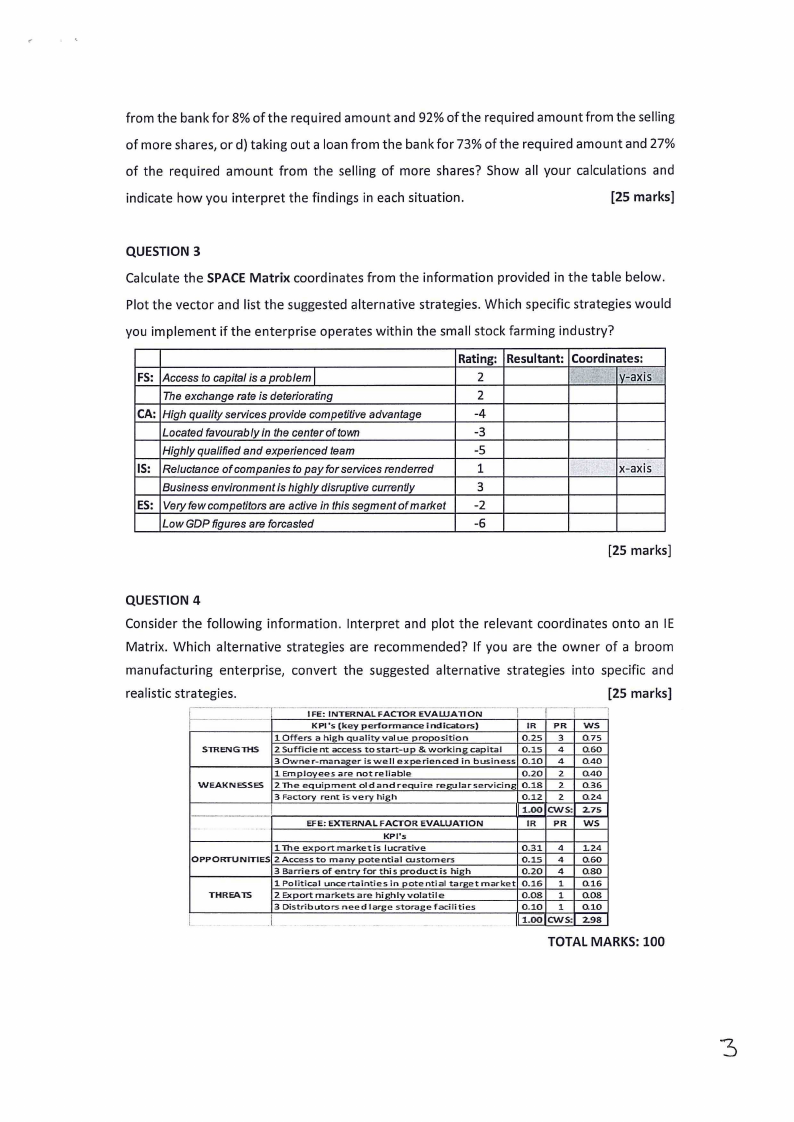

QUESTION 3

Calculate the SPACE Matrix coordinates from the information provided in the table below.

Plot the vector and list the suggested alternative strategies. Which specific strategies would

you implement if the enterprise operates within the small stock farming industry?

FS: |Access to capital is a problem|

The exchange rate is deteriorating

CA: | High quality services provide competitive advantage

Located favourably in the center of town

Highly qualified and experienced team

IS: | Reluctance of companies to pay for services renderred

Business environment is highly disruptive currently

ES: | Very few competitors are active in this segment of market

Low GDP figures are forcasted

Rating:

2

2

-4

-3

-5

L

3

-2

-6

|Resultant: | Coordinates:

y-axis

x-axis

[25 marks]

QUESTION 4

Consider the following information. Interpret and plot the relevant coordinates onto an IE

Matrix. Which alternative strategies are recommended? If you are the owner of a broom

manufacturing enterprise, convert the suggested alternative strategies into specific and

realistic strategies.

[25 marks]

IFE: INTERNAL FACTOR EVALUATION

KPI's (key performance indicators)

1 Offers a high quality value proposition

STRENG THS

2 Sufficie nt access tostart-up & working capital

3 Owner-manager is well experienced in business|

1Employees are not reliable

WEAKNESSES |2 The equipment oldandrequire regularservicing|

3 Factory rent is very high

OPPORTUNITIES|

THREATS

EFE: EXTERNAL FACTOR EVALUATION

KPI's

1The export marketis lucrative

2 Access to many potential aistomers

3 Barriers of entry for this productis high

1 Political uncertainties in potential target market|

2 Export markets are highly volatile

3 Distributors need large storage Facilities

[|

IR

PR

ws

0.25

3

0.75

0.15

4

0.60

0.10

4

0.40

0.20

2

040

0.18

2

0.36

0.12

2

O24

1.00/CWS:| 275

IR

PR

ws

0.31

4

1.24

0.15

4

0.60

0.20}

4

0.80

0.16

1

0.16

0.08

1

008

0.10

1

0.10

1.00|/CWs:] 298

TOTAL MARKS: 100