QUESTION 1

[25 MARKS]

MFP (Mutual Farm Products) was formed in 1910 as a co-operative shop network

owned by farmers in the country of Azania. It progressively opened small shops across

the country selling products produced by Azanian farmers. Over time its expanding

network of shops began to offer non-farming products from a wide range of suppliers,

but it has remained true to its co-operative roots. All employees are shareholders and

receive annual dividends. Customers can also become shareholders and are

rewarded with dividends which reflect the value of their spending in the shops. An

increasing number of customers are becoming shareholders, reflecting a renewed

interest in the country in mutual organisations, such as co-operatives. MFP only

operates in Azania and it has no plans to expand overseas. Azania itself is a wealthy,

industrialised country which continues to grow.

Supermarkets in Azania

When supermarkets were first introduced in Azania, MFP reflected this trend by

opening its own supermarkets. However, its supermarkets tended to be (and continue

to be) smaller than its well-known competitors and its network of smaller shops was

largely retained. In contrast, other supermarkets focused on developing large out-of-

town sites serving a large catchment population. In the top-ten supermarkets of

Azania, only MFP has, in addition, a network of smaller shops.

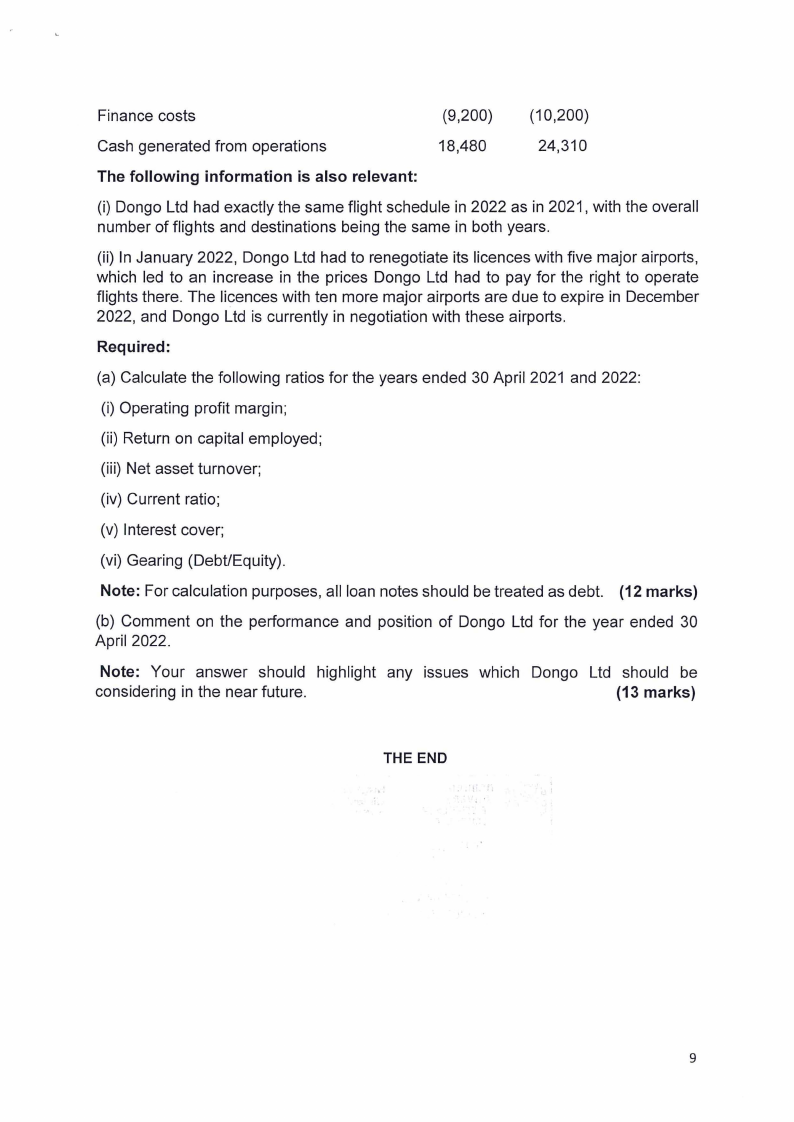

In 2017 MFP was the eighth largest shop and supermarket chain in Azania. It reported

revenues of N$10bn, compared to the N$40.5bn revenue of the market leader,

HypCo. By 2021, MFP was the ninth largest shop and supermarket chain in the

country, with revenues of N$11bn, compared with HypCo's N$45bn. During this

period, two new supermarket chains have entered the Azanian market. These two

new entrants, Super24/7 and Letta, already have a combined revenue of N$50bn and

are fourth and eighth respectively in the top ten Azanian supermarket chains. Both of

these companies are overseas-based supermarkets operating a no-frills approach to

retailing. Overall, the revenue of the top ten supermarket chains has increased from

N$300bn to N$350bn in the last five years.

Margins in the sector are always under pressure and the large supermarkets continue

to aggressively market their goods, highlighting price savings. They also provide

customer incentives, such as loyalty cards and account discount schemes in an

attempt to retain customers. For many products and services, price comparison

websites show consumers the prices charged by competing supermarkets.

With the exception of MFP, all supermarkets are quoted companies with their shares

largely owned by institutional investors who look for significant dividends and capital

appreciation. MFP is the only co-operative in the top ten Azanian supermarket chains.

Generally, suppliers to supermarkets are relatively small companies. Supermarkets'

control of consumer spending is so great that many suppliers aggressively compete

to have their products stocked by the supermarket chains.

MFP has continued to promote and follow its ethical principles. It ensures that new

shops and supermarkets are energy efficient. It also continues to pay its employees

significantly more than its competitors. This concern for its employees' welfare

2