|

MEF811S - Mineral Economics and Financial Valuation - 1st OPP - JUN 2023 |

|

1 Page 1 |

▲back to top |

" n Am I BIA u n IVER s ITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF Civil, Mining and Process Engineering

QUALIFICATION : Bachelors of Engineering in Mining Engineering

QUALIFICATION CODE: O8MEG

LEVEL: 7

COURSE CODE: MEF811S

COURSE NAME: MINERAL ECONOMICS AND

FINANCIAL VALUATION

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER(S)

MODERATOR:

FIRST OPPORTUNITY QUESTION PAPER

Dr Lawrence Madziwa

Dr Victor Mutambo

INSTRUCTIONS

1. Answer all questions.

2. Read all the questions carefully before answering.

3. Marks for each questions are indicated at the end of each question.

4. Please ensure that your writing is legible, neat and presentable.

PERMISSIBLEMATERIALS

1. Examination paper.

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

1. A machine costing $42,000 will have a life of 5 years and a salvage value of

$3,000. It is estimated that 10,000 units will be produced on this machine,

distributed in this manner; $2000 in the first year, $2,400 in the second year,

$2100 in the third year, $1800 in the fourth and $1700 in the firth year. If

depreciation is allocated in the basis of production, calculate the depreciation

charges of the three years.

[6]

b. An asset costing $29,000 has a life expectancy of 5 years and an estimated

salvage value of $3,500. Calculate the depreciation charges of the first two

years applying first the declining balance method and the secondly the

straight line method.

[8]

2. The environmental rehabilitation costs required in 5 years' time for a small

mining operation amount to R10 million. The mine needs to provide for this cost

through an environmental rehabilitation sinking fund by putting away an equal

amount every year into a safe sinking fund with a nominal interest rate of 8%.

Determine the annual amount that must be invested every year and

demonstrate by tabulating the sinking fund schedule that it indeed grows to the

required R 10 million.

[1 0]

3. The orebody carries technical risk in terms of five main mining variables. Name

them and explain how you will handle them in a cashflow.

[10]

4. a. Discuss ten mining risks and possible mitigating actions normally used.

[10]

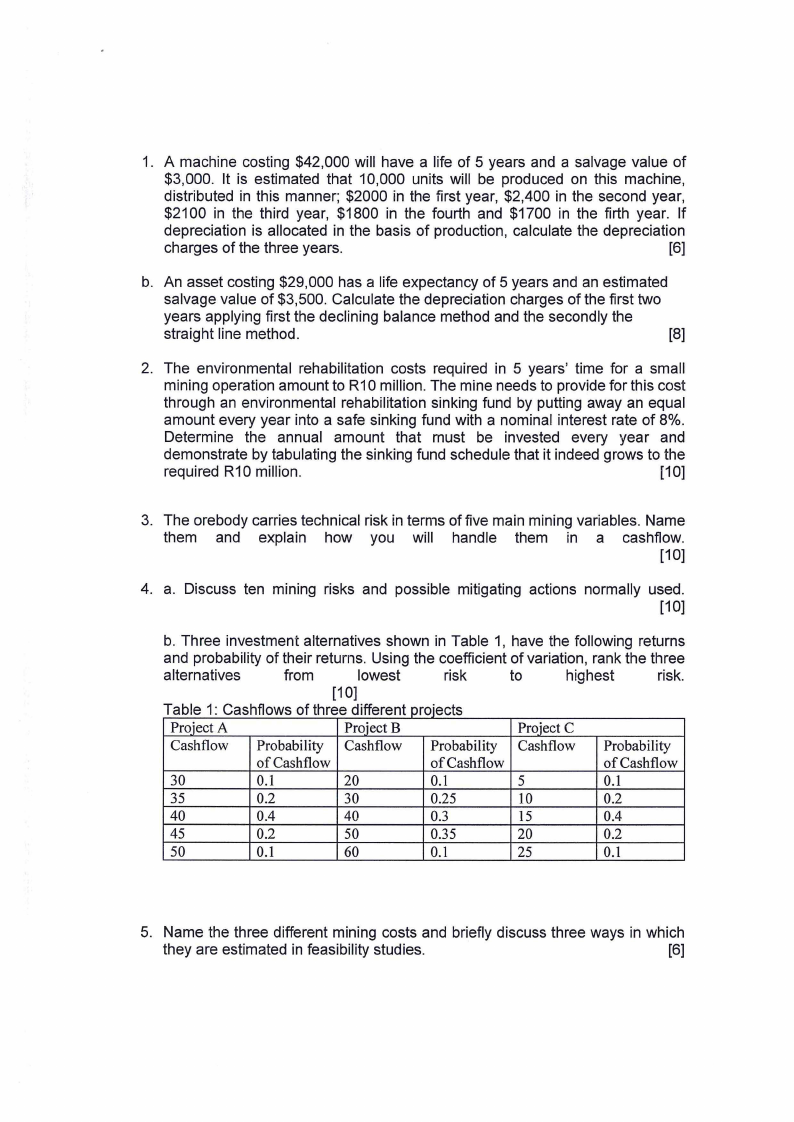

b. Three investment alternatives shown in Table 1, have the following returns

and probability of their returns. Using the coefficient of variation, rank the three

alternatives

from

lowest

risk

to

highest

risk.

[10]

Table 1 Cashflows 0 f three d"1fferen t oroIects

Project A

Project B

Proiect C

Cashflow Probability Cashflow Probability Cashflow Probability

of Cash flow

ofCashflow

ofCashflow

30

0.1

20

0.1

5

0.1

35

0.2

30

0.25

10

0.2

40

0.4

40

0.3

15

0.4

45

0.2

50

0.35

20

0.2

50

0.1

60

0.1

25

0.1

5. Name the three different mining costs and briefly discuss three ways in which

they are estimated in feasibility studies.

[6]

|

3 Page 3 |

▲back to top |

6. Mining is capital intensive business and capital is normally obtained from

different sources. Name three main sources of capital and explain how the final

cost is obtained.

[1O]

7. What are the factors that cause changes in supply and demand curves. [10]

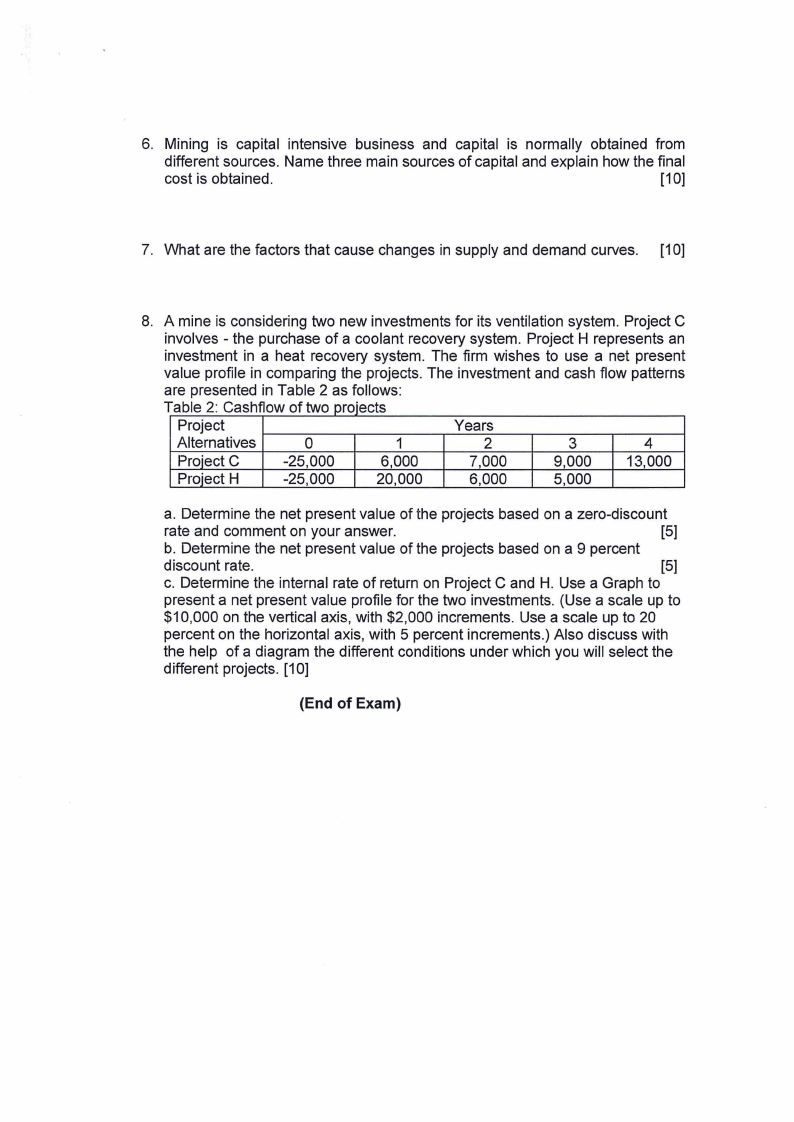

8. A mine is considering two new investments for its ventilation system. Project C

involves - the purchase of a coolant recovery system. Project H represents an

investment in a heat recovery system. The firm wishes to use a net present

value profile in comparing the projects. The investment and cash flow patterns

are presented in Table 2 as follows:

Table 2 Cashflowo f two proi.ects

Project

Years

Alternatives

0

1

2

3

4

Project C

-25,000

6,000

7,000

9,000

13,000

Project H

-25,000

20,000

6,000

5,000

a. Determine the net present value of the projects based on a zero-discount

rate and comment on your answer.

[5]

b. Determine the net present value of the projects based on a 9 percent

discount rate.

[5]

c. Determine the internal rate of return on Project C and H. Use a Graph to

present a net present value profile for the two investments. (Use a scale up to

$10,000 on the vertical axis, with $2,000 increments. Use a scale up to 20

percent on the horizontal axis, with 5 percent increments.) Also discuss with

the help of a diagram the different conditions under which you will select the

different projects. [10]

(End of Exam)

|

4 Page 4 |

▲back to top |

FV = PV(e)''

FORMULAE LIST

FV = PV(l+1) 11

Fv[ PV =

1

(l+i)n ]

FV =

[(I+ lJ PVA = A i)" -

i(l +i)"

]= A = FVA [(1+i)1n - 1

PVA [ i(l+i)" ]

(1 + i)" -1

BEV= TFC

UR-UVC

TR=UR*V

TC=TFC+ UVC

EVA= [NOPAT-Cost of Capital* Invested Capital]

PV Ratio = PV of returns / PV of investments

PI Ratio = PV Ratio - 1

Current Ratio = current assets / current liabilities

Total Debt Ratio= total debt/ total assets

Debt to Equity Ratio = total debt/ total equity

Net Profit Margin = Profit after interest and tax / sales

Return on Equity= profit after tax/ shareholders' equity