|

MEF811S - Mineral Economics and Financial Valuation - 2nd OPP - JUN 2023 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENTOF Civil, Mining and Process Engineering

QUALIFICATION : Bachelors of Engineering in Mining Engineering

QUALIFICATION CODE: 08MEG

LEVEL: 7

COURSE CODE: MEF811S

COURSE NAME: MINERAL ECONOMICS AND

FINANCIAL VALUATION

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER(S)

MODERATOR:

SECOND OPPORTUNITY QUESTION PAPER

Dr Lawrence Madziwa

Dr Victor Mutambo

INSTRUCTIONS

1. Answer all questions.

2. Read all the questions carefully before answering.

3. Marks for each questions are indicated at the end of each question.

4. Please ensure that your writing is legible, neat and presentable.

PERMISSIBLEMATERIALS

1. Examination paper.

THIS QUESTION PAPER CONSISTS OF S PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

1. A sum of$ 2,500,000 was spent on purchasing and developing a mine with an

estimated reserves of 230,000 tonnes of ore. During the first year, 20,000 tonnes of

ore were extracted. A re-estimate of the remaining reserve was then revised to

170,000 tonnes. During the second year 18,000 tonnes were extracted. Compute the

depletion allowance for the first and second years.

[1O]

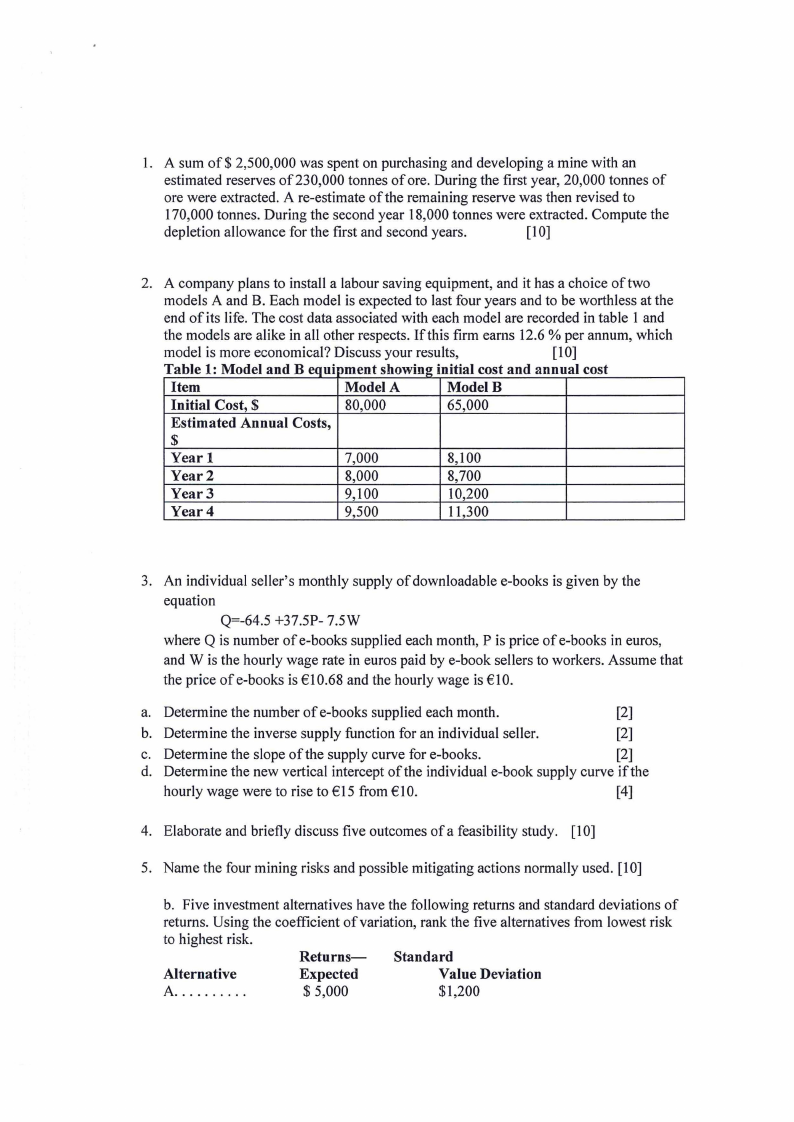

2. A company plans to install a labour saving equipment, and it has a choice of two

models A and B. Each model is expected to last four years and to be worthless at the

end of its life. The cost data associated with each model are recorded in table 1 and

the models are alike in all other respects. If this firm earns 12.6 % per annum, which

model is more economical? Discuss your results,

[l O]

Table 1: ModeI and B eqm. 1ment showm. e m. 1"fIa I cost and annua I cost

Item

Model A

ModelB

Initial Cost, $

80,000

65,000

Estimated Annual Costs,

$

Year 1

7,000

8,100

Year2

8,000

8,700

Year3

9,100

10,200

Year4

9,500

11,300

3. An individual seller's monthly supply of downloadable e-books is given by the

equation

Q=-64.5 +37.5P- 7.5W

where Q is number of e-books supplied each month, P is price of e-books in euros,

and W is the hourly wage rate in euros paid by e-book sellers to workers. Assume that

the price of e-books is €10.68 and the hourly wage is €10.

a. Determine the number of e-books supplied each month.

[2]

b. Determine the inverse supply function for an individual seller.

[2]

c. Determine the slope of the supply curve fore-books.

[2]

d. Determine the new vertical intercept of the individual e-book supply curve if the

hourly wage were to rise to €15 from €10.

[4]

4. Elaborate and briefly discuss five outcomes of a feasibility study. [10]

5. Name the four mining risks and possible mitigating actions normally used. [10]

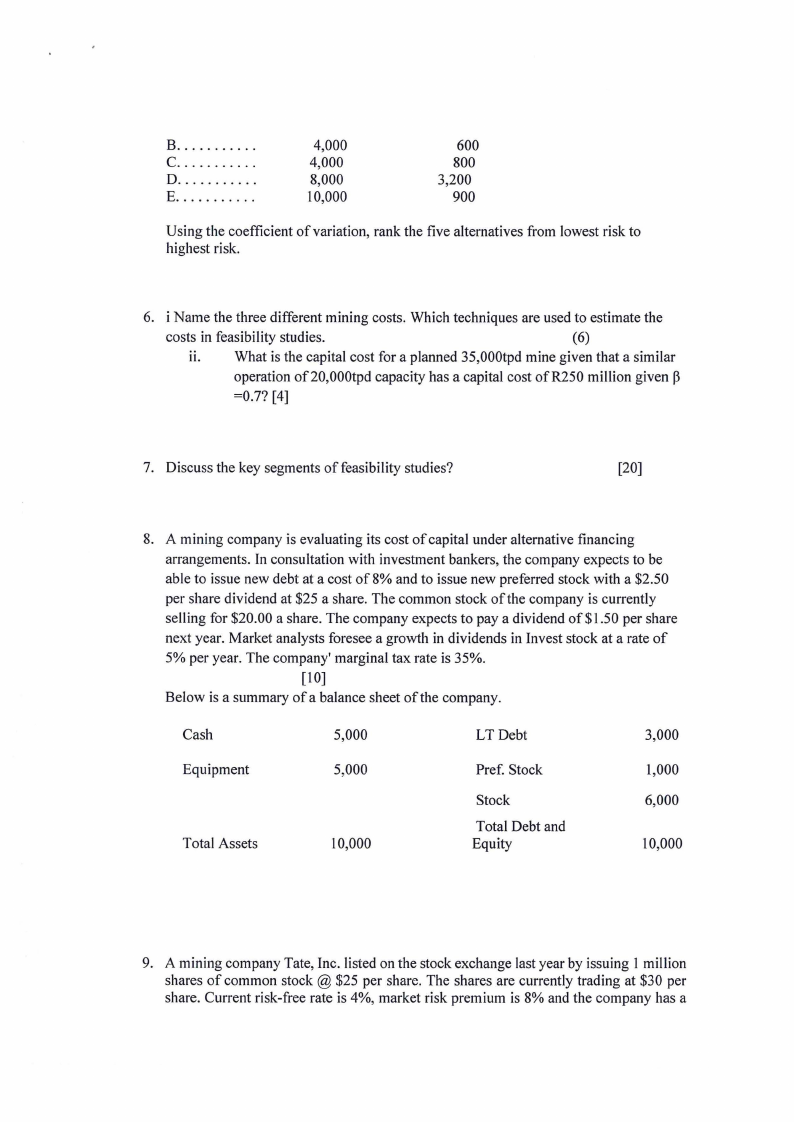

b. Five investment alternatives have the following returns and standard deviations of

returns. Using the coefficient of variation, rank the five alternatives from lowest risk

to highest risk.

Returns-

Standard

Alternative

Expected

Value Deviation

A ......... .

$5,000

$1,200

|

3 Page 3 |

▲back to top |

B.......... .

c .......... .

0 ..........

.

E ..........

.

4,000

4,000

8,000

10,000

600

800

3,200

900

Using the coefficient of variation, rank the five alternatives from lowest risk to

highest risk.

6. i Name the three different mining costs. Which techniques are used to estimate the

costs in feasibility studies.

(6)

ii. What is the capital cost for a planned 35,000tpd mine given that a similar

operation of20,000tpd capacity has a capital cost of R250 million given p

=0.7? [4]

7. Discuss the key segments of feasibility studies?

[20]

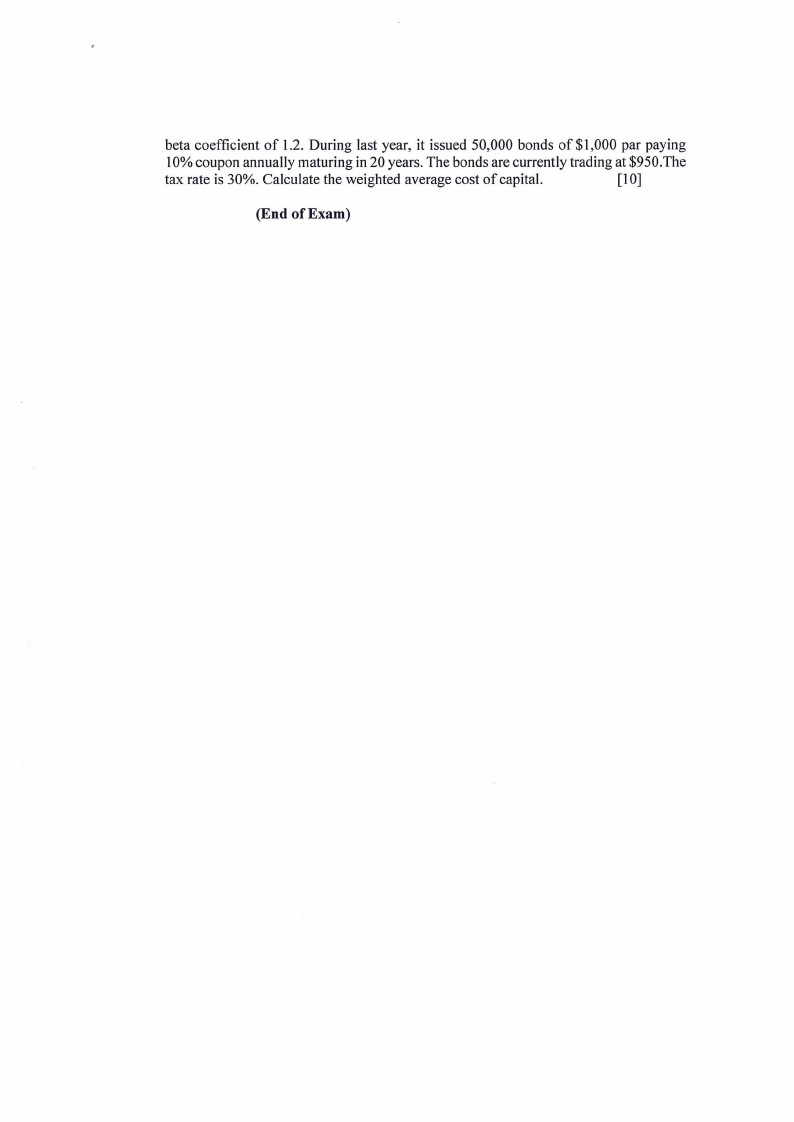

8. A mining company is evaluating its cost of capital under alternative financing

arrangements. In consultation with investment bankers, the company expects to be

able to issue new debt at a cost of 8% and to issue new preferred stock with a $2.50

per share dividend at $25 a share. The common stock of the company is currently

selling for $20.00 a share. The company expects to pay a dividend of $1.50 per share

next year. Market analysts foresee a growth in dividends in Invest stock at a rate of

5% per year. The company' marginal tax rate is 35%.

[IO]

Below is a summary of a balance sheet of the company.

Cash

Equipment

Total Assets

5,000

5,000

10,000

LT Debt

Pref. Stock

Stock

Total Debt and

Equity

3,000

1,000

6,000

10,000

9. A mining company Tate, Inc. listed on the stock exchange last year by issuing I million

shares of common stock @ $25 per share. The shares are currently trading at $30 per

share. Current risk-free rate is 4%, market risk premium is 8% and the company has a

|

4 Page 4 |

▲back to top |

beta coefficient of 1.2. During last year, it issued 50,000 bonds of $1,000 par paying

l 0% coupon annually maturing in 20 years. The bonds are currently trading at $950.The

tax rate is 30%. Calculate the weighted average cost of capital.

[IO]

(End of Exam)

|

5 Page 5 |

▲back to top |

FV =

FV =

PV(eyt

PV(l +1)11

FORMULAE LIST

PVA=

A[(l+i)"-ll

i(l + i)"

l PVA [ i(l + i)"

(1+ i)" -1

BEV= TFC

UR-UVC

TR= UR* V

TC=TFC+ UVC

Re = Rr + (Rm- Rr)

EVA= [NOPA T - Cost of Capital * Invested Capital]

PV Ratio = PV of returns / PV of investments

PI Ratio = PV Ratio - 1

Current Ratio = current assets I current liabilities

Total Debt Ratio= total debt/ total assets

Debt to Equity Ratio = total debt/ total equity

Net Profit Margin = Profit after interest and tax/ sales

Return on Equity= profit after tax/ shareholders' equity