|

GMA711S- MANAGEMENT ACCOUNTING 310- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

'\\

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FA CUL TY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL:?

COURSE CODE: GMA711 S

COURSE NAME: MANAGEMENT ACCOUNTING 310

SESSION: JULY 2023

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS Sydney Lishokomosi and Lameck Odada

MODERATOR Alfred Makosa

INSTRUCTIONS

1. Answer ALL the FOUR (4) questions in blue or black ink only. NO PENCIL

2. Start each question on a new page, number the answers correctly and clearly.

3. Write clearly, neatly and show all your workings/assumptions.

4. Round off final answers to two (2) decimal places

5. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _5_ PAGES (excluding this front page and tables)

|

2 Page 2 |

▲back to top |

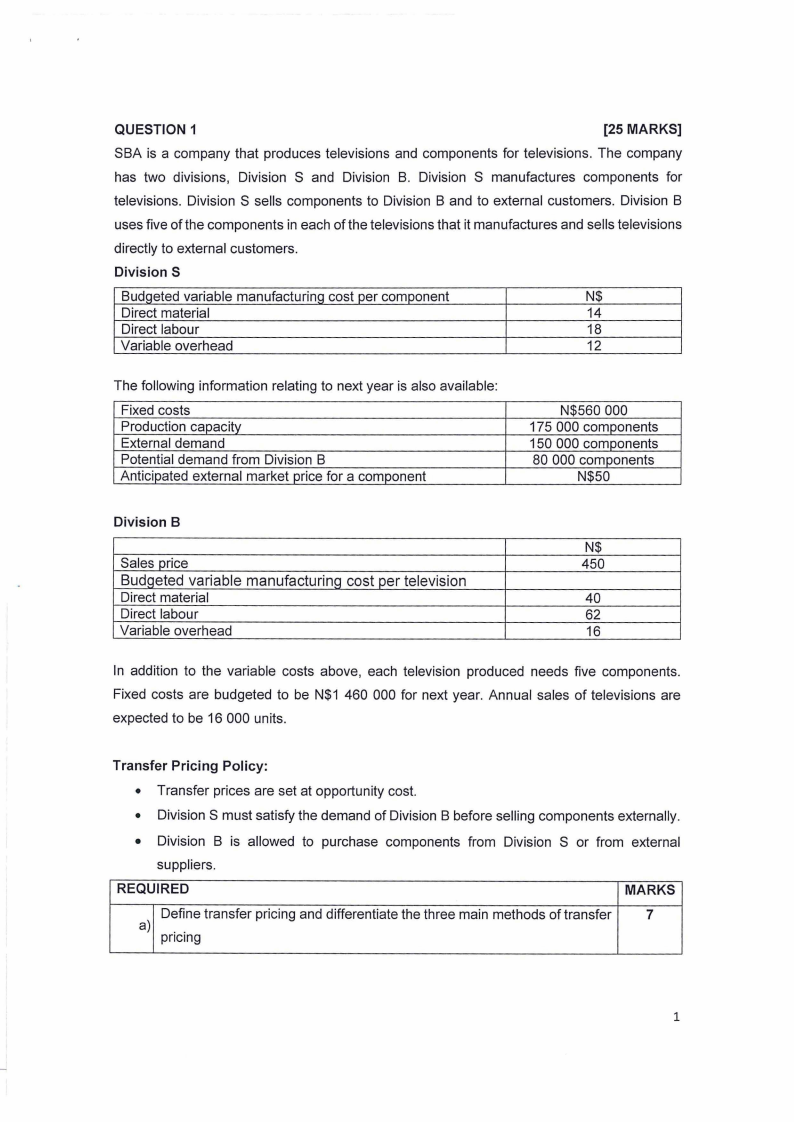

QUESTION 1

[25 MARKS]

SBA is a company that produces televisions and components for televisions. The company

has two divisions, Division S and Division B. Division S manufactures components for

televisions. Division S sells components to Division B and to external customers. Division B

uses five of the components in each of the televisions that it manufactures and sells televisions

directly to external customers.

Division S

Budqeted variable manufacturinq cost per component

N$

Direct material

14

Direct labour

18

Variable overhead

12

The following information relating to next year is also available:

Fixed costs

Production capacity

External demand

Potential demand from Division B

Anticipated external market price for a component

N$560 000

175 000 components

150 000 components

80 000 components

N$50

Division 8

N$

Sales price

450

Budqeted variable manufacturing cost per television

Direct material

40

Direct labour

62

Variable overhead

16

In addition to the variable costs above, each television produced needs five components.

Fixed costs are budgeted to be N$1 460 000 for next year. Annual sales of televisions are

expected to be 16 000 units.

Transfer Pricing Policy:

• Transfer prices are set at opportunity cost.

• Division S must satisfy the demand of Division B before selling components externally.

• Division B is allowed to purchase components from Division S or from external

suppliers.

REQUIRED

MARKS

Define transfer pricing and differentiate the three main methods of transfer

a)

7

pricing

1

|

3 Page 3 |

▲back to top |

Assume that Division B buys all the components it requires from Division

11

S. Produce a profit statement for each division detailing sales and costs,

b)

showing external sales and internal company transfers separately where

appropriate.

Division S has just received an enquiry from a new customer to produce

7

25 000 components. The manager of Division S requires a total profit for

the year for the division of N$450 000. Calculate the minimum price per

component to sell the 25 000 components to the new customer that would

enable the manager of Division S to meet the profit target.

c)

Note: this order will have no effect on the divisional fixed costs and no

impact on the 150 000 components Division S sells to its existing external

customers at N$50 per component. Division B will continue to purchase

the 80 000 components it requires from the specialist external supplier.

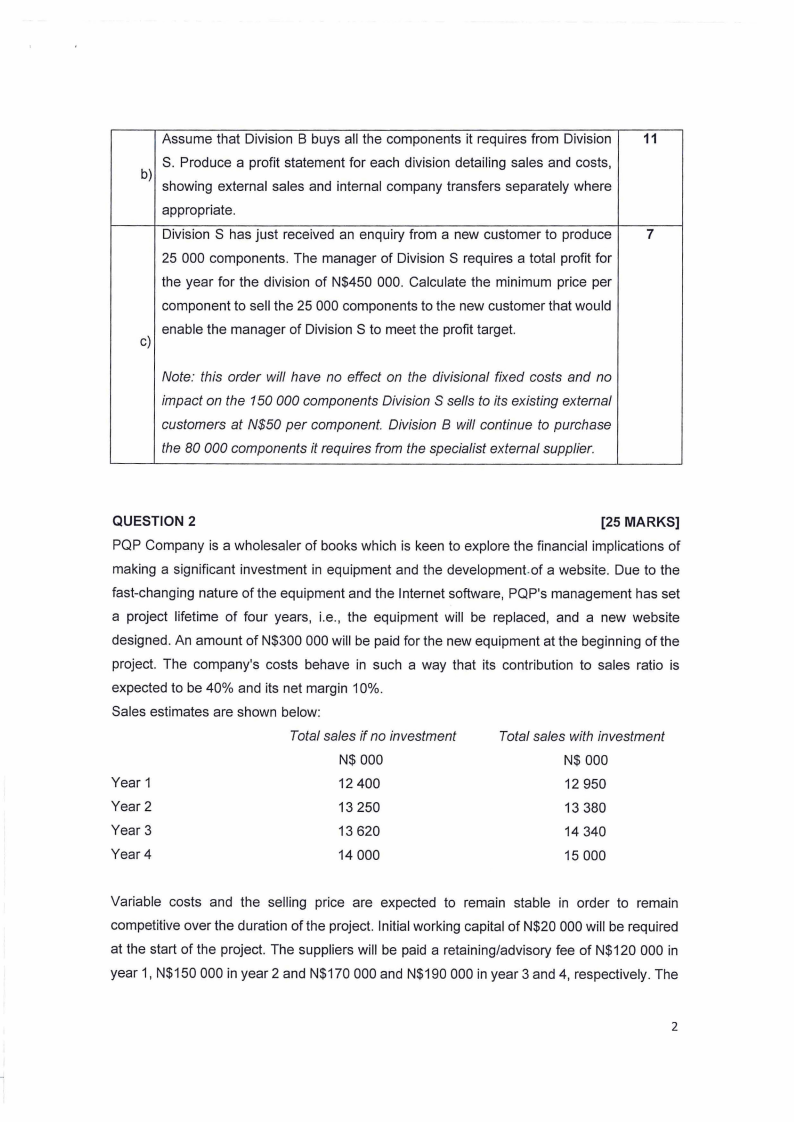

QUESTION 2

[25 MARKS]

PQP Company is a wholesaler of books which is keen to explore the financial implications of

making a significant investment in equipment and the development.of a website. Due to the

fast-changing nature of the equipment and the Internet software, PQP's management has set

a project lifetime of four years, i.e., the equipment will be replaced, and a new website

designed. An amount of N$300 000 will be paid for the new equipment at the beginning of the

project. The company's costs behave in such a way that its contribution to sales ratio is

expected to be 40% and its net margin 10%.

Sales estimates are shown below:

Total sales if no investment

Total sales with investment

N$ 000

N$ 000

Year1

12 400

12 950

Year2

13 250

13 380

Year3

13 620

14 340

Year4

14 000

15 000

Variable costs and the selling price are expected to remain stable in order to remain

competitive over the duration of the project. Initial working capital of N$20 000 will be required

at the start of the project. The suppliers will be paid a retaining/advisory fee of N$120 000 in

year 1, N$150 000 in year 2 and N$170 000 and N$190 000 in year 3 and 4, respectively. The

2

|

4 Page 4 |

▲back to top |

residual value at the end of the project will be N$30 000. PQP paid consultancy fees of N$150

000 to experts who worked on the equipment.

Additional information:

• PQP has cost of capital of 14% and pays tax at an annual rate of 32%.

• It can claim capital allowances on a 25% reducing balance basis.

• Half of the tax is payable in the year it is incurred and half the following year and there

has sufficient taxable profits from other parts of its business to enable the offset of any

pre-tax losses on this project

REQUIRED

Use the Net Present Value (NPV) technique to evaluate whether PQP should go

ahead with the project or not

MARKS

25

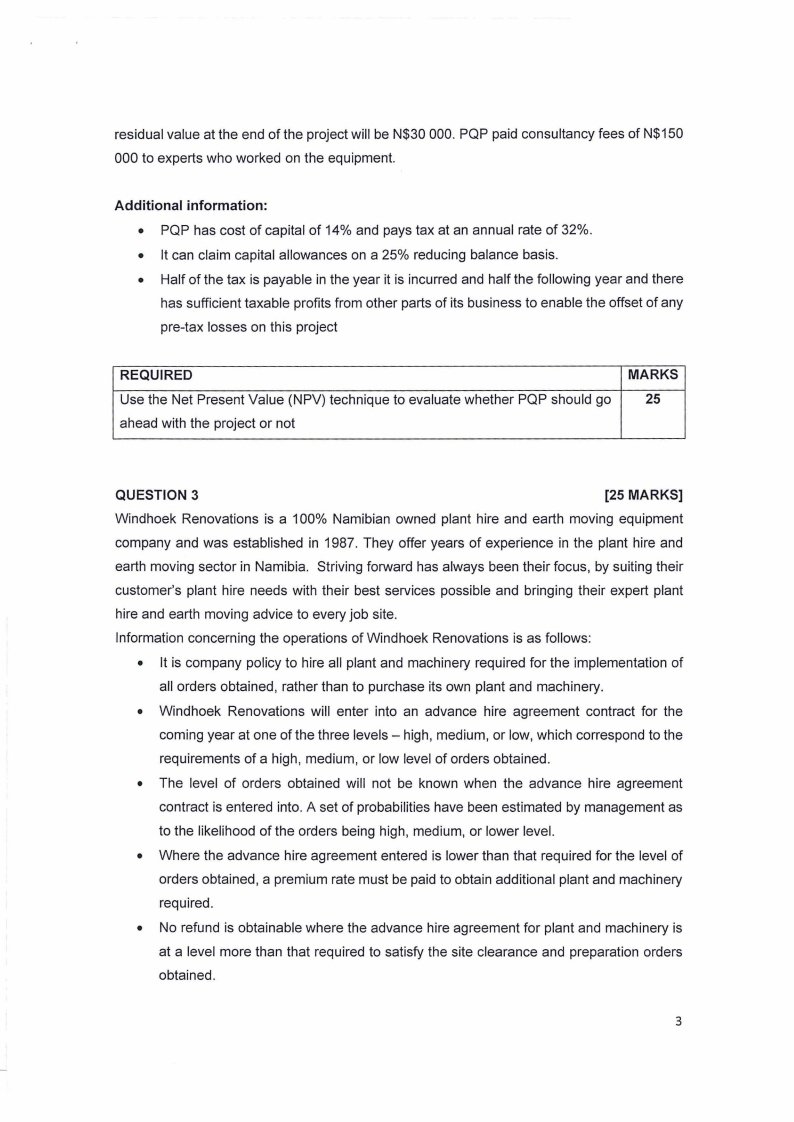

QUESTION 3

[25 MARKS]

Windhoek Renovations is a 100% Namibian owned plant hire and earth moving equipment

company and was established in 1987. They offer years of experience in the plant hire and

earth moving sector in Namibia. Striving forward has always been their focus, by suiting their

customer's plant hire needs with their best services possible and bringing their expert plant

hire and earth moving advice to every job site.

Information concerning the operations of Windhoek Renovations is as follows:

• It is company policy to hire all plant and machinery required for the implementation of

all orders obtained, rather than to purchase its own plant and machinery.

• Windhoek Renovations will enter into an advance hire agreement contract for the

coming year at one of the three levels - high, medium, or low, which correspond to the

requirements of a high, medium, or low level of orders obtained.

• The level of orders obtained will not be known when the advance hire agreement

contract is entered into. A set of probabilities have been estimated by management as

to the likelihood of the orders being high, medium, or lower level.

• Where the advance hire agreement entered is lower than that required for the level of

orders obtained, a premium rate must be paid to obtain additional plant and machinery

required.

• No refund is obtainable where the advance hire agreement for plant and machinery is

at a level more than that required to satisfy the site clearance and preparation orders

obtained.

3

|

5 Page 5 |

▲back to top |

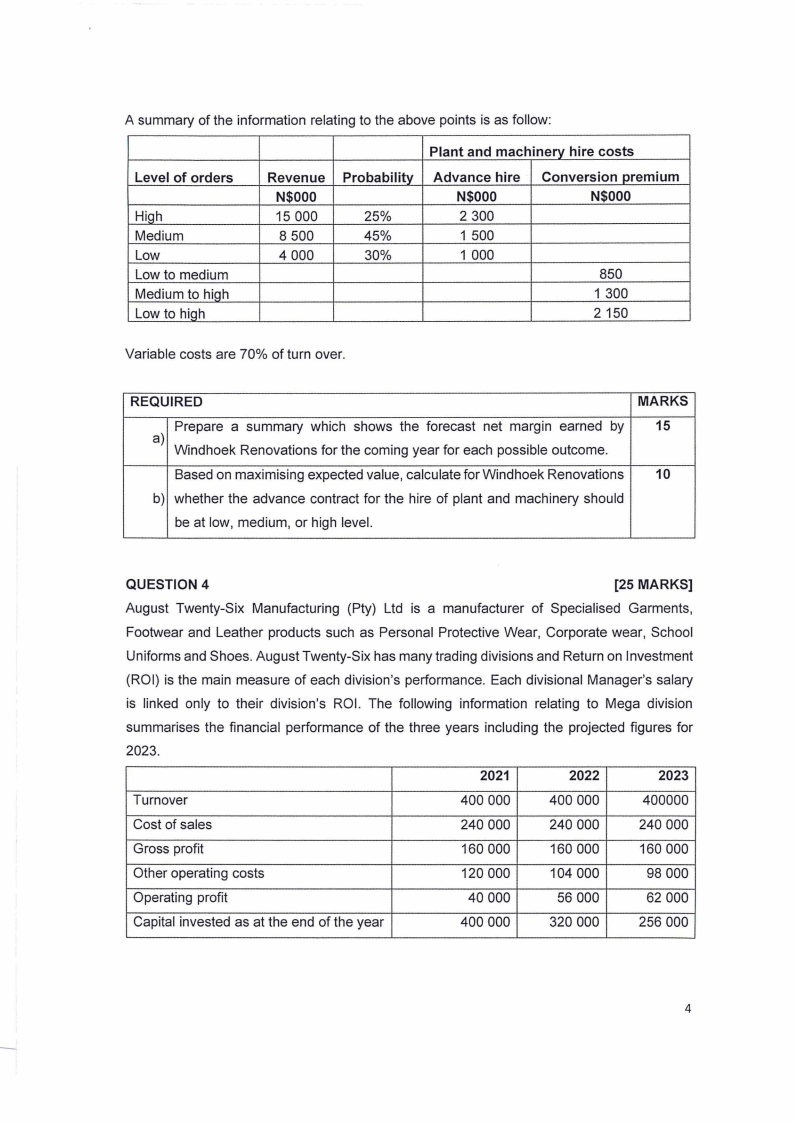

A summary of the information relating to the above points is as follow:

Level of orders

High

Medium

Low

Low to medium

Medium to hiqh

Low to high

Revenue

N$000

15 000

8 500

4 000

Probability

25%

45%

30%

Plant and machinery hire costs

Advance hire

N$000

2 300

1 500

1 000

Conversion premium

N$000

850

1 300

2 150

Variable costs are 70% of turn over.

REQUIRED

MARKS

Prepare a summary which shows the forecast net margin earned by 15

a)

Windhoek Renovations for the coming year for each possible outcome.

Based on maximising expected value, calculate for Windhoek Renovations

10

b) whether the advance contract for the hire of plant and machinery should

be at low, medium, or high level.

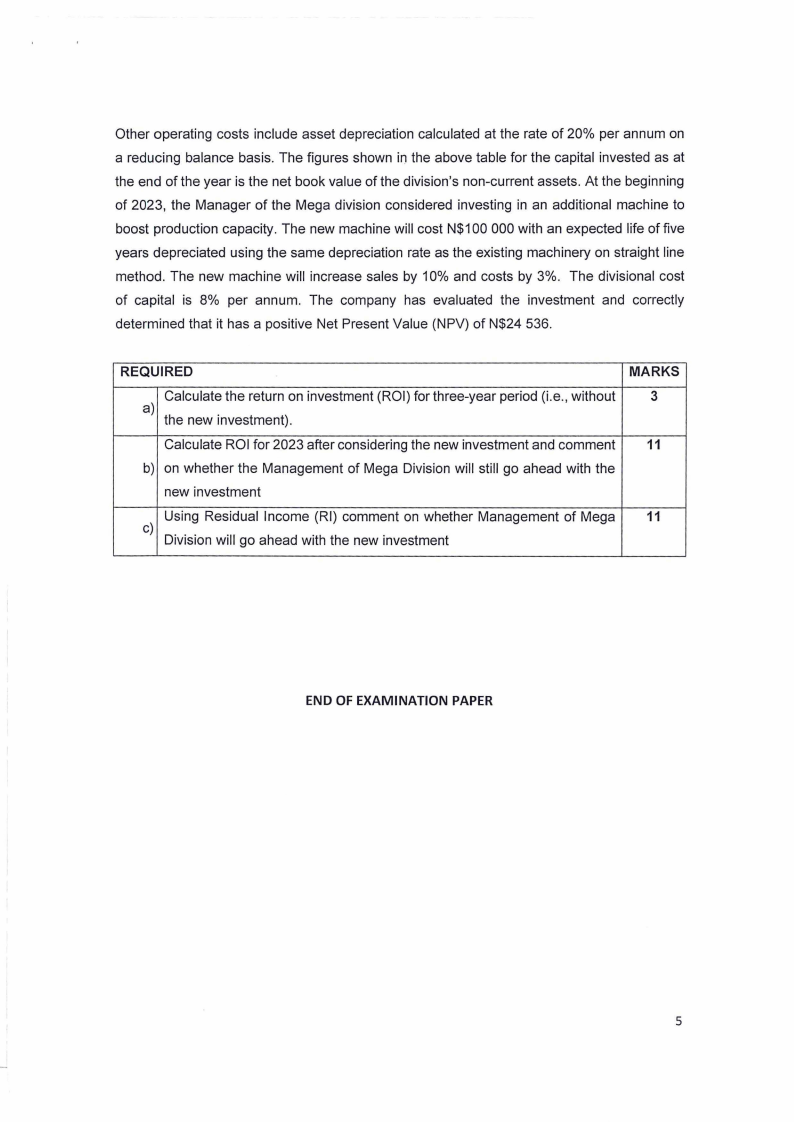

QUESTION 4

(25 MARKS]

August Twenty-Six Manufacturing (Pty) Ltd is a manufacturer of Specialised Garments,

Footwear and Leather products such as Personal Protective Wear, Corporate wear, School

Uniforms and Shoes. August Twenty-Six has many trading divisions and Return on Investment

(ROI) is the main measure of each division's performance. Each divisional Manager's salary

is linked only to their division's ROI. The following information relating to Mega division

summarises the financial performance of the three years including the projected figures for

2023.

2021

2022

2023

Turnover

400 000

400 000

400000

Cost of sales

240 000

240 000

240 000

Gross profit

160 000

160 000

160 000

Other operating costs

120 000

104 000

98 000

Operating profit

40 000

56 000

62 000

Capital invested as at the end of the year

400 000

320 000

256 000

4

|

6 Page 6 |

▲back to top |

Other operating costs include asset depreciation calculated at the rate of 20% per annum on

a reducing balance basis. The figures shown in the above table for the capital invested as at

the end of the year is the net book value of the division's non-current assets. At the beginning

of 2023, the Manager of the Mega division considered investing in an additional machine to

boost production capacity. The new machine will cost N$100 000 with an expected life of five

years depreciated using the same depreciation rate as the existing machinery on straight line

method. The new machine will increase sales by 10% and costs by 3%. The divisional cost

of capital is 8% per annum. The company has evaluated the investment and correctly

determined that it has a positive Net Present Value (NPV) of N$24 536.

REQUIRED

MARKS

Calculate the return on investment (ROI) for three-year period (i.e., without

3

a)

the new investment).

Calculate ROI for 2023 after considering the new investment and comment

11

b) on whether the Management of Mega Division will still go ahead with the

new investment

Using Residual Income (RI) comment on whether Management of Mega

11

c)

Division will go ahead with the new investment

END OF EXAMINATION PAPER

5

|

7 Page 7 |

▲back to top |

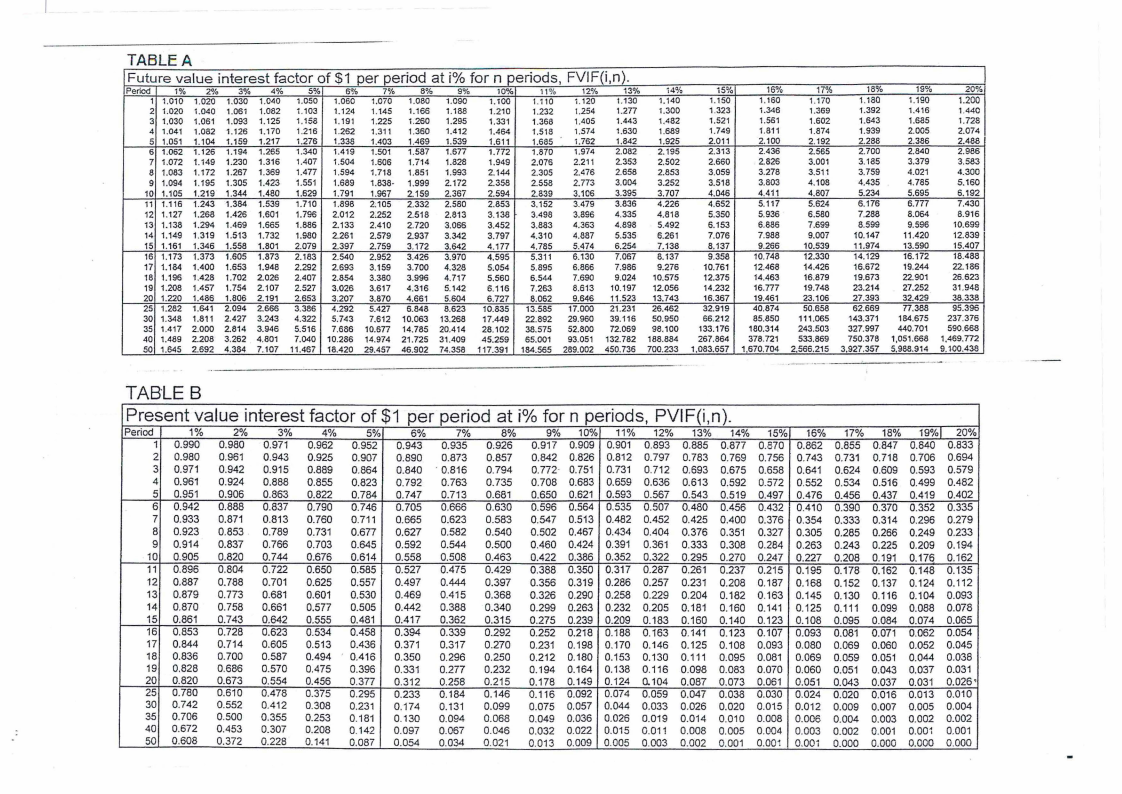

TABLEA

Future value interest factor of $1 per period at i% for n periods, FVIF(i,n).

Period

1%

1 1.010

2 1.020

3 1.030

4 1.041

5 1.051

6 1.062

7 1.072

8 1.083

9 1.094

10 1.105

11 1.116

12 1.127

13 1.138

14 1.149

15 1.161

16 1.173

17 1.184

18 1.196

19 1.208

20 1.220

25 1.282

30 1.348

35 1.417

40 1.489

50 1.645

2%

1.020

1.040

1.061

1.082

1.104

1.126

1.149

1.172

1.195

1.219

1.243

1.268

1.294

1.319

1.346

1.373

1.400

1.428

1.457

1.486

1.641

1.811

2.000

2.208

2.692

3%

1.030

1.061

1.093

1.126

1.159

1.194

1.230

1.267

1.305

1.344

1.384

1.426

1.469

1.513

1.558

1.605

1.653

1.702

1.754

1.806

2.094

2.427

2.814

3.262

4.384

4%

1.040

1.082

1.125

1.170

1.217

1.265

1.316

1.369

1.423

1.480

1.539

1.601

1.665

1.732

1.801

1.873

1.948

2.026

2.107

2.191

2.666

3.243

3.946

4.801

7.107

5%

1.050

1.103

1.158

1.216

1.276

1.340

1.407

1.477

1.551

1.629

1.710

1.796

1.886

1.980

2.079

2.183

2.292

2.407

2.527

2.653

3.386

4.322

5.516

7.040

11.467

6%

1.060

1.124

1. 19·1

1.262

1.338

1.419

1.504

1.594

1.689

1.791

1.898

2.012

2.133

2.261

2.397

2.540

2.693

2.854

3.026

3.207

4.292

5.743

7.686

10.286

18.420

7%

1.070

1.145

1.225

1.311

1.403

1.501

1.606

1.718

1.838-

1.967

2.105

2.252

2.410

2.579

2.759

2.952

3.159

3.380

3.617

3.870

5.427

7.612

10.677

14.974

29.457

8°/o

9%

1.080 1.090

1.166 1.188

1.260 1.295

1.360 1.412

1.469 1.539

1.587 1.677

1.714 1.828

1.851 1.993

1.999 2.172

2.159 2.367

2.332 2.580

2.518 2.813

2.720 3.066

2.937 3.342

3.172 3.642

3.426 3.970

3.700 4.328

3.996 4.717

4.316 5.142

4.661 5.604

6.848 8.623

10.063 13.268

14.785 20.414

21.725 31.409

46.902 74.358

10%

1.100

1.210

1.331

1.464

1.611

1.772

1.949

2.144

2.358

2.594

2.853

3.138

3.452

3.797

4.177

4.595

5.054

5.560

6.116

6.727

10.835

17.449

28.102

45.259

117.391

11C/o

12%

13%

1.110 1.120 1.130

1.232

1.368

1.254

1.405

1.277

1.443

1.518 1.574 1.630

1.685 1.762 1.842

1.870 1.974 2.082

2.076 2.211 2.353

2.305 2.476 2.658

2.558 2.773 3.004

2.839 3.106 3.395

3.152 3.479 3.836

3.498 3.896 4.335

3.883 4.363 4.898

4.310 4.887 5.535

4.785 5.474 6.254

5.311 6.130 7.067

5.895 6.866 7.986

6.544 7.690 9.024

7.263 8.613 10.197

8.062 9.646 11.523

13.585 17.000 21.231

22.892 29.960 39.116

38.575 52.800 72.069

65.001 93.051 132.782

184.565 289.002 450.736

i4°t~

1.140

1.300

1.482

1.689

1.925

2.195

2.502

2.853

3.252

3.707

4.226

4.818

5.492

6.261

7.138

8.137

9.276

10.575

12.056

13.743

26.462

50.950

98.100

188.884

700.233

15%

1.150

1.323

1.521

1.749

2.011

2.313

2.660

3.059

3.518

4.046

4.652

5.350

6.153

7.076

8.137

9.358

10.761

12.375

14.232

16.367

32.919

66.212

133.176

267.864

1,083.657

16%

1.160

1.346

1.561

1.811

2.100

2.436

2.826

3.278

3.803

4.411

5.117

5.936

6.886

7.988

9.266

10.748

12.468

14.463

16.777

19.461

40.874

85.850

180.314

378.721

1.670.704

17%

1.170

1.369

1.602

1.874

2.192

2.565

3.001

3.511

4.108

4.807

5.624

6.580

7.699

9.007

10.539

12.330

14.426

16.879

19.748

23.106

50.658

111.065

243.503

533.869

2.566.215

18%

1.180

1.392

1.643

1.939

2.288

2.700

3.185

3.759

4.435

5.234

6.176

7.288

8.599

10.147

11.974

14.129

16.672

19.673

23.214

27.393

62.669

143.371

327.997

750.378

3,927.357

19%

1.190

1.416

1.685

2.005

2.386

2.840

3.379

4.021

4.785

5.695

6.777

8.064

9.596

11.420

13.590

16.172

19.244

22.901

27.252

32.429

77.388

184.675

440.701

1,051.668

5.988.914

20%

1.200

1.440

1.728

2.074

2.488

2.986

3.583

4.300

5.160

6.192

7.430

8.916

10.699

12.839

15.407

18.488

22.186

26.623

31.948

38.338

95.396

237.376

590.668

1.469.n2

9.1-00.438

TABLE B

Present value interest factor of $1 per period at i% for n periods, PVIF(i,n).

Period

1%

2%

3%

4%

5%

6%

7%

8%

9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19%1 20%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.640 0.833

2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694

3 0.971

4 0.961

0.942

0.924

0.915

0.888

0.889

0.855

0.864

0.823

0.840 · 0.816

0.792 0.763

0.794

0.735

0.772· 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579

0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482

5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402

6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335

7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279

8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233

9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194

10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162

11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135

12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112

13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093

14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078

15 0.861

16 0.853

17 0.844

0.743

0.728

0.714

0.642

0.623

0.605

0.555

0.534

0.513

0.481

0.458

0.436

0.417

0.394

0.371

0.362

0.339

0.317

0.315

0.292

0.270

0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065

0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054

0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045

18 0.836

19 0.828

20 0.820

25 0.780

30 0.742

35 0.706

40 0.672

50 0.608

0.700

0.686

0.673

0.610

0.552

0.500

0.453

0.372

0.587

0.570

0.554

0.478

0.412

0.355

0.307

0.228

0.494

0.475

0.456

0.375

0.308

0.253

0.208

0.141

0.416

0.396

0.377

0.295

0.231

0.181

0.142

0.087

0.350

0.331

0.312

0.233

0.174

0.130

0.097

0.054

0.296

0.277

0.258

0.184

0.131

0.094

0.067

0.034

0.250

0.232

0.215

0.146

0.099

0.068

0.046

0.021

0.212

0.194

0.178

0.116

0.075

0.049

0.032

0.013

0.180

0.164

0.149

0.092

0.057

0.036

0.022

0.009

0.153

0.138

0.124

0.074

0.044

0.026

0.015

0.005

0.130

0.116

0.104

0.059

0.033

0.019

0.011

0.003

0.111

0.098

0.087

0.047

0.026

0.014

0.008

0.002

0.095

0.083

0.073

0.038

0.020

0.010

0.005

0.001

0.081

0.070

0.061

0.030

0.015

0.008

0.004

0.001

0.069

0.060

0.051

0.024

0.012

0.006

0.003

0.001

0.059

0.051

0.043

0.020

0.009

0.004

0.002

0.000

0.051

0.043

0.037

0.016

0.007

0.003

0.001

0.000

0.044

0.037

0.031

0.013

0.005

0.002

0.00~

0.000

0.038

0.031

0.026'

0.010

0.004

0.002

0.001

0.000

|

8 Page 8 |

▲back to top |

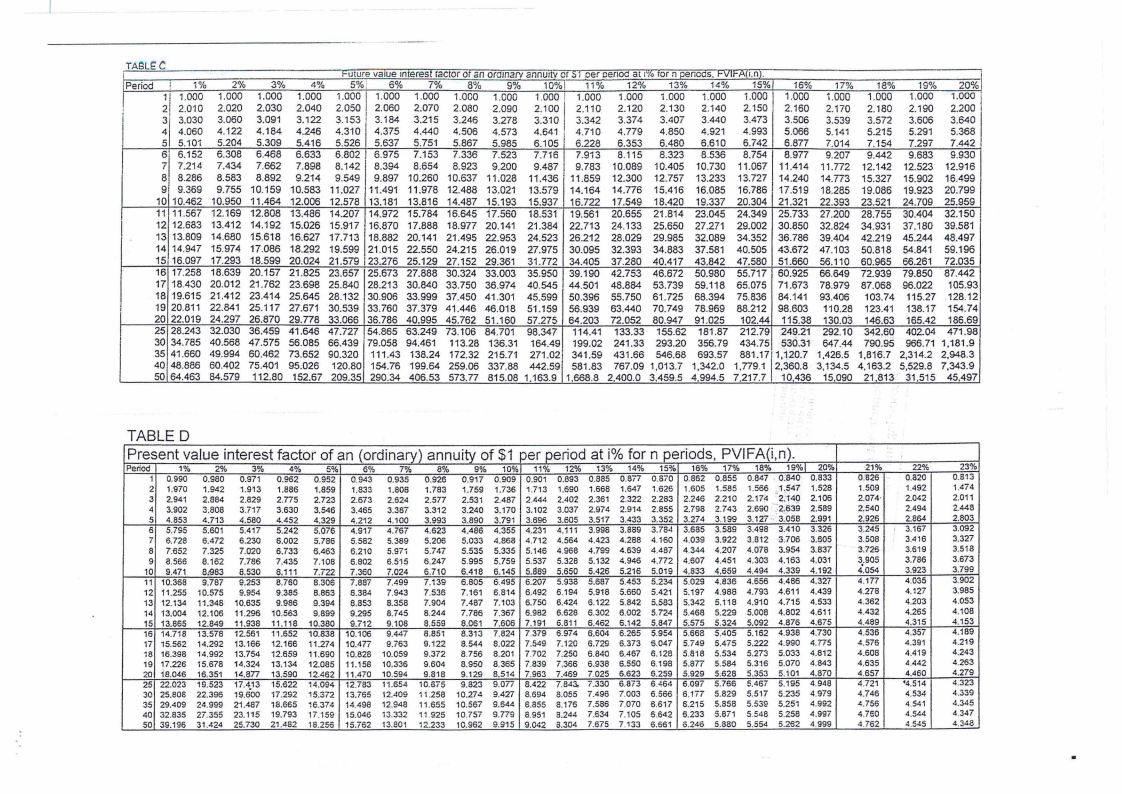

TABL~C

Future value 1nteres! ractor or an oramarv annu:tvor ;:,1per period at 1%ror n oenoas. Fl71t-A11.nJ.

Period ! 1%

2%

3%

4C!~ 5%1 6%

7%

8%

9% 10%1 11% 12% 13~{, 14% 15% 16% 17% 18% ·19% 20%

1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 i .000 1.000 1.000 1.000 i.000 1.000 1.000 1.000

2 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 2.120 2.130 2.140 2.150 2.160 2.170 2.180 2.190 2.200

3 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 3.374 3.407 3.440 3.473 3.506 3.539 3.572 3,606 3.640

4 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4,506 4.573 4.641 4.710 4.779 4.850 4.921 4.993 5.066 5.141 5.215 5.291 5.368

5 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6.353 6.480 6.610 6.742 6.877 7.014 7.154 7.297 7.442

6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 8.115 8.323 8.536 8.754 8.977 9.207 9.442 9.683 9.930

7 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 10.405 10.730 11.067 11.414 11.772 12.142 12.523 12.916

8 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 12.300 12.757 13.233 13.727 14.240 14.773 15.327 15.902 16.499

9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 14.776 15.416 16.085 16.786 17.519 18.285 19.086 19.923 20.799

10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 17.549 18.420 19.337 20.304 21.321 22.393 23.521 24.709 25.959

11 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19:561 20.655 21.814 23.045 24.349 25.733 27.200 28.755 30.404 32.150

12 12.683 13.412 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 25.650 27.271 29.002 30.850 32.824 34.931 37.180 39.581

13 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 28.029 29.985 32.089 34.352 36.786 39.404 42.219 45.244 48.497

14 14.947 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 32.393 34.883 37.581 40.505 43,672 47.103 50.818 54.841 59.196

15 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37.280 40.417 43,842 47.580 51.660 56.110 60.965 66.261 72.035

16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 46.672 50,980 55.717 60.925 66.649 72.939 79.850 87.442

17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48.884 53.739 59.118 65.075 71.673 78.979 87.068 96.022 105.93

18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 61.725 68.394 75.836 84.141 93.406 103.74 115.27 .128.12

19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 70.749 78.969 88.212 98.603 110.28 123.41 138.17 154.74

20 22.019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51 .160 57.275 64.203 72.052 80.947 91.025 102.44 115.38 130.03 146.63 165.42 186.69

25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 114.41 133.33 155.62 181.87 212.79 249.21 292.10 342.60 402.04 471.98

30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.28 136.31 164.49 199.02 241.33 293.20 356.79 434.75 530.31 647.44 790.95 966.71 1,181.9

35 41.660 49.994 60.462 73.652 90.320 111.43 138.24 172.32 215.71 271.02 341.59 431.66 546.68 693.57 881.17 1,1_20.7 1,426.5 1,816.7 2,314.2 2,948.3

40 48.886 60.402 75.401 95.026 120.80 154.76 199.64 259.06 337.88 442.59 581.83 767.09 1,013.7 1,342.0 1,779.1 2,360.8 3,134.5 4,16~.2 5,529.8 7,343.9

50 64.463 84.579 112.80 152.67 209.35 290.34 406.53 573,77 815.08 1,163.9 1,668.8 2.400.0 3.459.5 4,994.5 7,217.7 10 436 15,090 21,813 31,515 45.497

TABLED

Present value interest factor of an (ordinary) annuity of $1 per period at i% for n periods, PVIFA(i,n).

Period

1%

1 0.990

2 1.970

3 2.941

4 3.902

5 4.853

6 5.795

7 6.728

8 7.652

9 8.566

10 9.471

11 10.368

12 11.255

13 12.134

14 13,004

15 13.865

16 14.718

17 15.562

18 16.398

19 17.226

20 18.046

25 22.023

30 25,808

35 29.409

40 32.835

so 39.196

2%

0.980

1.942

2.884

3.808

4.713

5.601

6.472

7.325

8.162

8:983

9.787

10.575

11.348

12.106

12,849

13.578

14.292

14.992

15.678

16.351

19.523

22.396

24.999

27.355

31.424

3%

0.971

1.913

2.829

3.717

4.580

5.417

6.230

7.020

7.786

8.530

9.253

9.954

10.635

11.296

11.938

12.561

13.166

13.754

14.324

14.8TT

17.4_13

19.600

21.487

23.115

25.730

4%

0.962

1.886

2.n5

3.630

4.452

5.242

6.002

6,733

7.435

8,111

8.760

9.385

9.986

10.563

11.118

11.652

12.166

12.659

13.134

13.590

15.622

17.292

18.665

19.793

21.482

5%

0.952

1.859

2.723

3.546

4.329

5.076

5.786

6.463

7.108

7.722

8.306

8.863

9.394

9.899

10.380

10.838

11.274

11.690

12.085

12.462

14.094

15.372

16.374

17.159

18.256

6%

0.943

1.833

2.673

3.465

4.212

4.917

5.582

6.210

6.802

7.360

7.887

8.384

8.853

9.295

9.712

10.106

10.477

10.828

11.158

11.470

12.783

13.765

14.498

15.046

15.762

7%

0.935

1.808

2.624

3.387

4.100

4.767

5.389

5.97,

6.515

7.024

7.499

7.943

8.358

8.745

9.108

9.447

9.763

10.059

10.336

10.594

11.654

12.409

12.948

13.332

13.801

8%

0.926

1.783

2.577

3.312

3.993

4.623

5.206

5.747

6.247

6.710

7.139

7.536

7.904

8.244

8.559

8.851

9.122

9,372

9.604

9.818

10.675

11.258

11.655

11.925

12.233

9%

0.917

1.759

2.531

3.240

3.890

4.486

5.033

5.535

5.995

6.418

6.805

7.161

7.487

7.786

8.061

8.313

8.544

8.756

8.950

9.129

9.823

10.274

10.567

10.757

10.962

10%

0.909

1.736

2.487

3.170

3.791

4.355

4.868

5.335

5.759

6.145

6.495

6.814

7.103

7.367

7.606

7.824

8.022

8.201

8.365

8.514

9.0rr

9.427

9.644

9.779

9.915

11% 12%

0.901 0.893

1.713 1.690

2.444 2.402

3.102 3.037

3.696 3.605

4.231 4.111

4.712 4.564

5.146 4.968

5.537 5.328

5.S89 5.650

6.207 5.938

6.492 6.194

6.750 6.424

6.982 6.628

7.191 6.811

7.379 6.974

7.549 7.120

7.702 7.250

7.839 7.366

7.963 7.469

8.422 7.843,

8.694 8.055

8.855 8.176

8.951 8.244

9.042 8.304

13%

0.885

1.668

2.361

2.974

3.517

3.996

4.423

4.799

5.132

5.426

5.687

5.918

6.122

6.302

6.462

6.604

6.729

6.840

6.938

7.025

7.330

7.496

7.586

7.534

7.675

14%

0.877

1.647

2.322

2.914

3.433

3.889

4.288

4.639

4.946

5.216

5.453

5.660

5.842

6.002

6.142

6.265

6.373

6.467

6.550

6.623

6.873

7.003

7.070

7.105

7.133

153/o 16%

0.670 0.862

1.626 1.605

2.283 2.246

2.855 2.798

3.352 3.274

3.78.J 3.685

4.160 4.039

4.487 4.344

4.TT2 4.607

5.019 4.833

5.234 5.029

5.421 5.197

5.583 5.342

5.724 5.468

5.847 5.575

5.954 5.668

5.047 5.749

6.128 5.818

6.198 5.0n

6.259 5.929

6.464 6.097

6.566 6.177

6.617 6.215

6.642 5.233

6.561 6,246

17%

0.855

1.585

2.210

2.743

3.199

3.589

3.922

4.207

4.451

4.659

4.836

4.988

5.118

5.229

5.324

5.405

5.475

5.534

5.584

5.628

5.766

5.829

5.858

5.871

5.880

18% 19%1 20%

0.847 . 0.840 0.833

1.566 , 1.547 1.528

2.174 2.t40 2.106

2.690 -::2.639 2.589

3.127·• 3.058 2.991

3.498 3.410 3.326

3.812 3.706 3.605

4.078 3.954 3.837

4.303 4.163 4.031

4.494 4.339 4.192

4.656 4.486 4,327

4.793 4.611 4.439

4.910 4.715 4.533

5.008 4.802 4.611

5,092 4.876 4.675

5.162 4.938 4.730

5.222 4.990 4.TT5

5.273 5.033 4.812

5.316 5.070 4.843

5.353 5.101 4.870

5.467 5.195 4.948

5.517 5.235 4.979

5.539 5.251 4.992

5.548 5.258 4.997

5.554 5.262 4.999

..

21%

0:826

1.509

2.074·

2.540

2.926

3.245

3.508

3.725

3.905

4.054

4.177

4.278

4.362

4.432

4.489

4.536

4.576

4.608

4.635

4.657

4.721

4.746

4,756

4.750

4.762

22%

0.820

1.492

2.042

2.494

2.864

'

3.167

3.416

3.619

3.786

3.923

4.035

4.127

4.203

4.265

4.315

4.357

4.391

4.419

4.442

4.460

'4.514

4.534

4.541

4.544

4.545

23%

0.813

1.474

2.011

2.448

2.803

3.092

3.327

3.518

3.673

3.799

3.902

3.985

4.053

4.108

4.153

4.189

4.219

4.243

4.263

4.279

4.323

4.339

4.345

4.347

4.348