|

AEM810S- APPLIED ECONOMETRICS- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE RS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION:

BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE: 08HECO LEVEL:

8

COURSE CODE: AEM810S

COURSE NAME: APPLIED ECONOMETRICS

SESSION:

JUNE 2023

DURATION:

3 HOURS

MARKS:

100

FIRST OPPORTUNITY QUESTION PAPER

EXAMINER($) Prof. Tafirenyika Sunde

MODERATOR: Dr. Reinhold Kamati

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Ruler

2. Calculator

THIS QUESTION PAPER CONSISTS OF 4 PAGES

1

|

2 Page 2 |

▲back to top |

QUESTION 1 [20 MARKS]

a) What is the difference between time-series and cross-sectional data?[5]

b) Explain the purpose of the following diagnostic tests and state their hypotheses

and decision rules.

i. Normality

[2]

ii. Autocorrelation

[2]

iii. Heteroscedasticity

[2]

iv. Ramsey RESET

[2]

V. CUSUM

[2]

c) Given the following unrestricted OLS regression equation

Ye = B0 + B1X1t + B2Xu + B3X3 c + B4 X4 c + B5X5c + et

i. State the hypothesis and decision rule used to test whether X2, X3 and X4

are redundant variables.

[4]

ii. If the explanatory variables in question c) i. are redundant, how would

the adjusted coefficient of determination be affected?

[1]

QUESTION 2 [20 MARKS]

a) What properties of time series data would make Ordinary Least Squares (OLS)

results spurious?

[4]

b) State the characteristics of the spurious OLS regression equation. [4]

c) Why should one conduct the unit-roots tests?

[4]

d) State the Augmented Dickey-Fuller (ADF) equations used to test for unit roots.

[4]

e) Compare and contrast the Dickey-Fuller and the Augmented Dickey-Fuller tests

for unit roots

[4]

QUESTION 3 [20 MARKS]

a) Under what circumstances do you use the ARDL econometrics method?

b) Given Gross Domestic Product (Y), Capital (K) and Labour (L) variables, where

Y is the dependent variable, and K and L are independent variables, answer

the following questions:

i. Write the ARDL equation for the three variables.

[4]

2

|

3 Page 3 |

▲back to top |

ii. How do you test for cointegration using the above equation in b) i.? State

the hypothesis and decision rule.

[4]

iii. If cointegration is confirmed, state the ARDL-ECM for these three

variables.

[4]

iv. Write down the short-run and long-run parameters in the ARDL-ECM

equation.

[4]

v. Explain the importance of the coefficient of the error correction term in

the ARDL-ECM model.

[4]

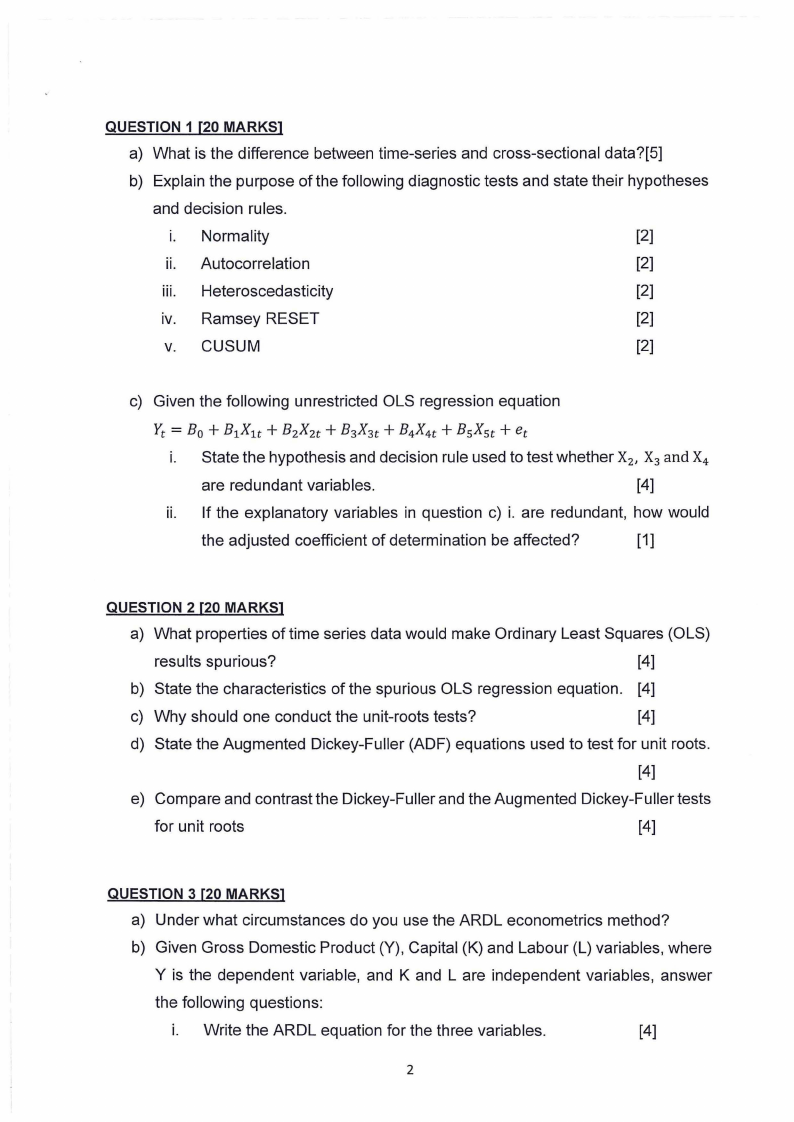

QUESTION 4 (20 marks)

The results below relate to the model, which has GDP per capita (GDPC) as the dependent

variable and capital (CAPITAL), Government Consumption Expenditure (GCE), exports

(EXPORT) and imports (IMPORT) as the independent variables. Use the information to:

a) Interpret the bounds test results in Table 1.

[4]

b) Interpret the significance of the short-run coefficients.

[4]

c) Interpret the meaning of the long-run coefficient results.

[4]

d) Interpret the diagnostic tests shown (note that the probability values are in brackets).

[4]

e) Given the results in (d) above, what is your overall conclusion about the robustness of

the estimated model?

[4]

Table 1: Bounds Test

F-statistic

Asymptotic

10%

5%

1%

Source: Authors' compilation

10bound

2.260

2.620

3.410

Model 1

8.6670

11 bound

3.350

3.790

4.680

3

|

4 Page 4 |

▲back to top |

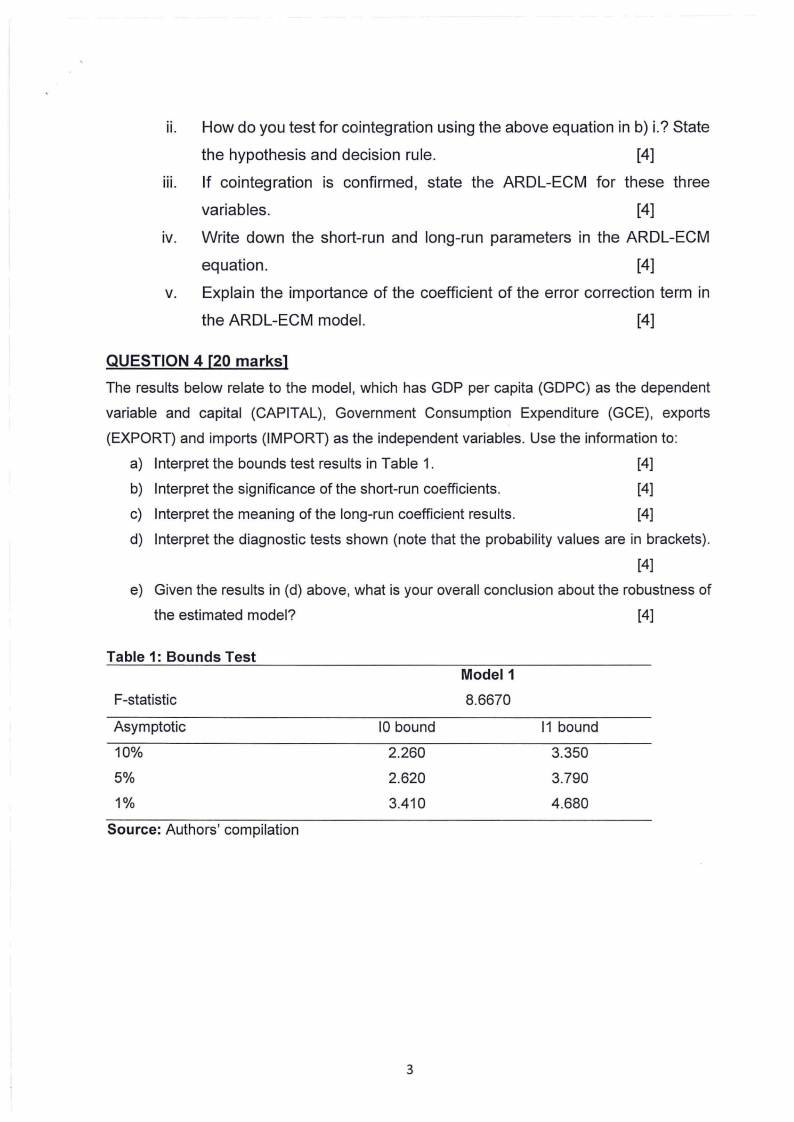

Table 2: Model 1 ARDL Error Correction Results

De~endent Variable: ~GDPC)

Variable

Coefficient

~GDPPCt-i

0.718561

~CAPITAL

0.023534

~CAPITALt-l

0.023481

~GCE

0.098649

~GCEt-l

0.064403

~EXPORT

0.193348

~EXPORTt-i

0.170057

~IMPORT

-0.107918

~IMPORTt-i

-0.089017

ECTt-l

-0.092793

R-squared

Adjusted R-squared

x2 Serial

x2 ARCH

x2 Normal

x2 RESET

Std. Error t-Statistic Prob.

0.109843 6.541717 0.0000

0.007184 3.275855 0.0021

0.007666 3.063024 0.0038

0.040458 2.438287 0.0190

0.041016 1.570206 0.1237

0.052318 3.695652 0.0006

0.049054 3.466700 0.0012

0.039872 -2.706626 0.0097

0.041593 -2.140167 0.0381

0.018807 -4.933906 0.0000

0.779004

0.707051

0.345567 (0.7686)

0.359706 (0.5526)

0.364725 (0.8333)

0.609020 (0.4443)

Source: Authors' compilation

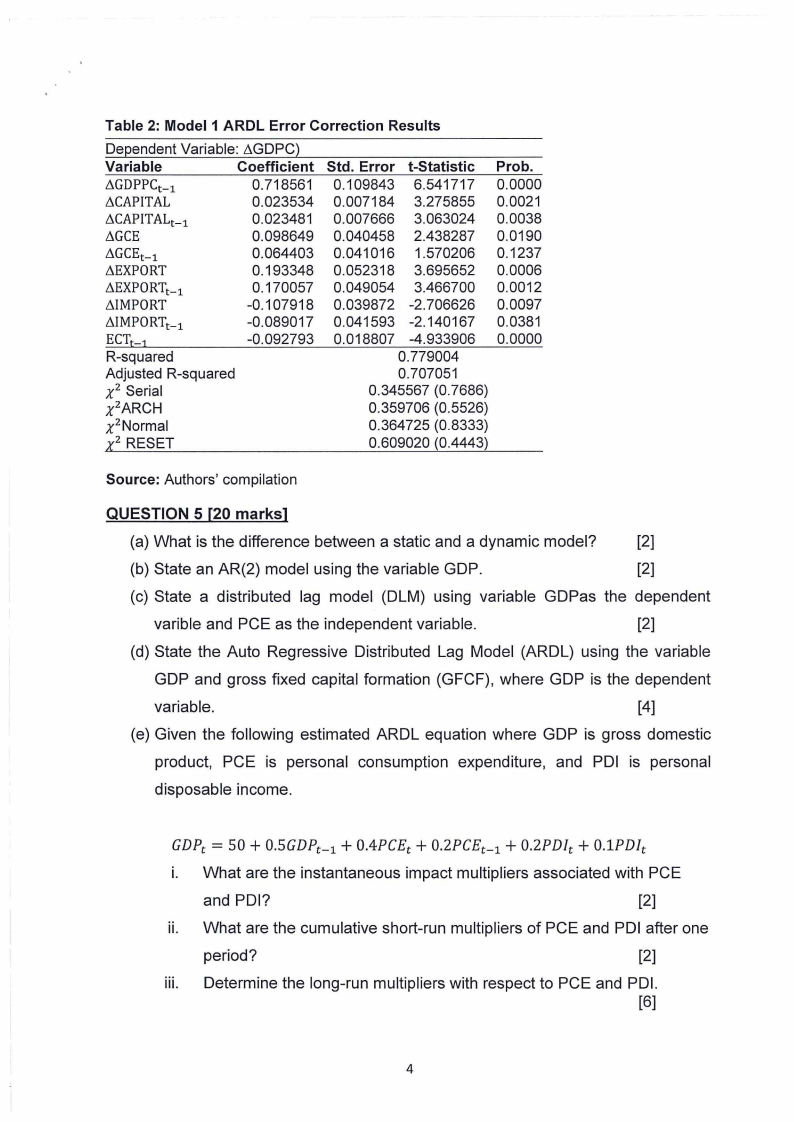

QUESTION 5 [20 marks]

(a) What is the difference between a static and a dynamic model?

[2]

(b) State an AR(2) model using the variable GDP.

[2]

(c) State a distributed lag model (OLM) using variable GDPas the dependent

varible and PCE as the independent variable.

[2]

(d) State the Auto Regressive Distributed Lag Model (ARDL) using the variable

GDP and gross fixed capital formation (GFCF), where GDP is the dependent

variable.

[4]

(e) Given the following estimated ARDL equation where GDP is gross domestic

product, PCE is personal consumption expenditure, and POI is personal

disposable income.

GDPt = 50 + 0.5GDPt-i + 0.4PCEt + 0.2PCEt-i + 0.2PDlt + 0.lPDlt

i. What are the instantaneous impact multipliers associated with PCE

and POI?

[2]

ii. What are the cumulative short-run multipliers of PCE and POI after one

period?

[2]

iii. Determine the long-run multipliers with respect to PCE and POI.

[6]

4