|

AEM810S- APPLIED ECONOMETRICS- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmI BI AunIVERS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE: 08HECO

COURSE CODE:

AEM810S

LEVEL:

8

COURSE NAME: APPLIEDECONOMETRICS

SESSION:

JULY 2023

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SECONDOPPORTUNITYQUESTIONPAPER

EXAMINER(S) Prof. Tafirenyika Sunde

MODERATOR: Dr. Reinhold Kamati

INSTRUCTIONS

1. Answer all questions.

2. Write clearly and neatly.

3. Number the answers.

PERMISSIBLEMATERIALS

1. Ruler

2. calculator

THISQUESTIONPAPERCONSISTSOF 4 PAGES

1

|

2 Page 2 |

▲back to top |

QUESTION 1 [20 marks]

a) Using examples, distinguish between cross-sectional and panel data.

[3 marks]

b) Explain the conditions under which you can use the Ordinary Least Squares

(OLS) methodology.

[3 marks]

c) State the informal methods of testing for nonstationarity.

[4 marks]

d) State the three equations used to test for nonstationarity when using the

Dickey-Fuller test.

[10 marks]

QUESTION 2 [20 marks]

Use Y as the dependent variable and X1 , X2 and X3 as the independent variables to:

a) Specify the long-run equation and the static error correction model (ECM).

[4 marks]

b) Describe how you conduct the cointegration test.

[4 marks]

c) Specify the dynamic error correction model (ECM). [4 marks]

d) State the short-run parameters of the model.

[4 marks]

e) State the long-run parameter(s) of the model.

[4 marks]

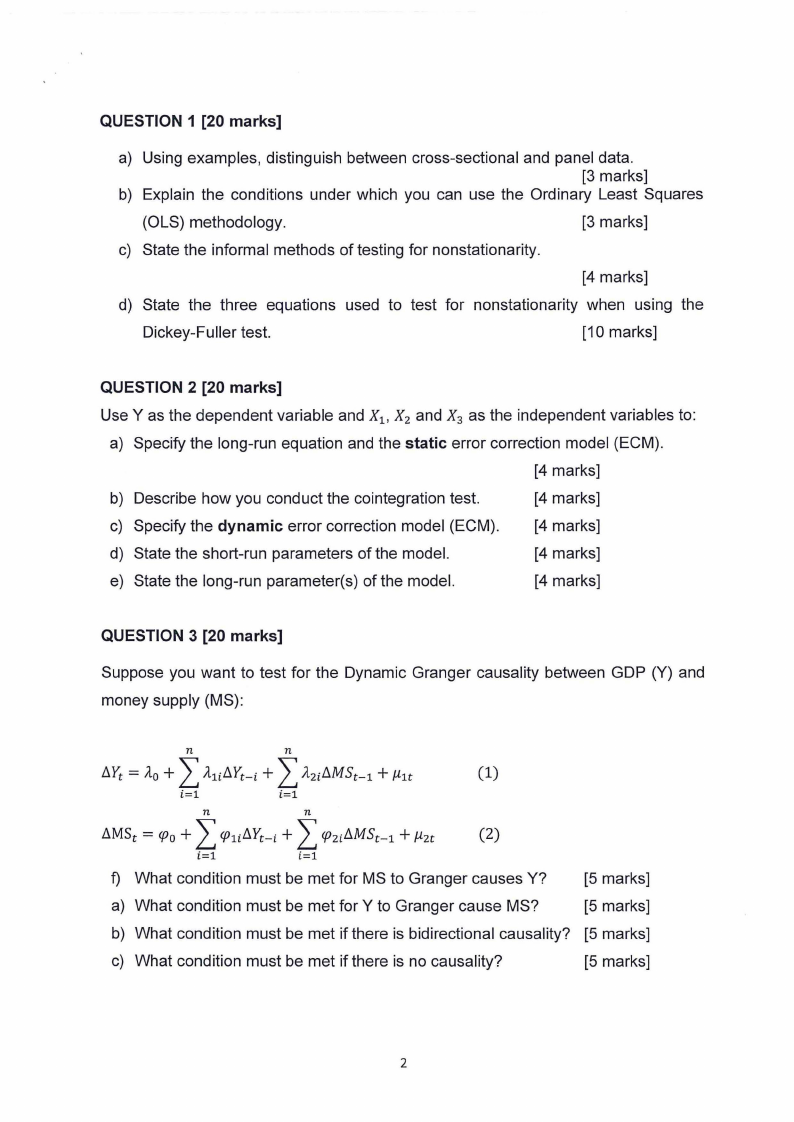

QUESTION 3 [20 marks]

Suppose you want to test for the Dynamic Granger causality between GDP (Y) and

money supply (MS):

L L n

n

.1Yt = ilo + illi.1Yt-i + ilu.1MSt-1 + µ1t

(1)

i=l

i=l

L L n

n

.1MSt = <fJo+ <fJ1i.1Yt-i+ <fJzi.1MSt-1+ µzt

(2)

i=l

i=l

f) What condition must be met for MS to Granger causes Y?

[5 marks]

a) What condition must be met for Y to Granger cause MS?

[5 marks]

b) What condition must be met if there is bidirectional causality? [5 marks]

c) What condition must be met if there is no causality?

[5 marks]

2

|

3 Page 3 |

▲back to top |

QUESTION 4 [20 marks]

(a) What is the difference between a static and a dynamic model?

[2]

(b) State an AR(2) model using the variable GDP.

[2]

(c) State a distributed lag model (OLM) using variable GDP.

[2]

(d) State the Auto Regressive Distributed Lag Model (ARDL) using the variable

GDP and gross fixed capital formation (GFCF), where GDP is the dependent

variable.

[4]

(e) Given the following ARDL equation:

GDPc= a 0 + a 1 GDPc-i + {30 PCEc+ {31PCEc-i + 00 PDic + 01PDlc

i. State all the short-run impact multipliers.

[2]

ii. What are the short-run impact multipliers associated with PCE and

POI?

[2]

iii. What are the cumulative short-run multipliers of PCE and POI after one

period?

[4]

iv. Determine the long-run multipliers with respect to PCE and POI.

[2]

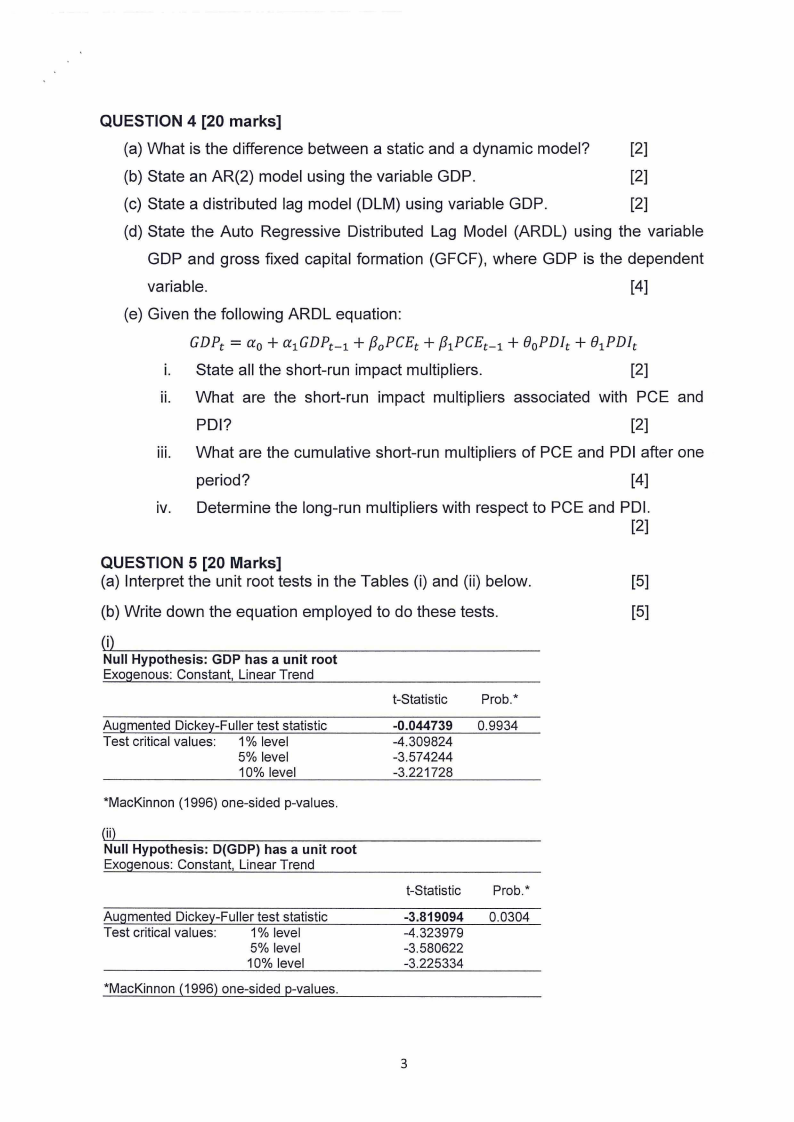

QUESTION 5 [20 Marks]

(a) Interpret the unit root tests in the Tables (i) and (ii) below.

[5]

(b) Write down the equation employed to do these tests.

[5]

Null Hypothesis: GDP has a unit root

Exogenous: Constant, Linear Trend

Augmented Dickey-Fuller test statistic

Test critical values: 1% level

5% level

10% level

*MacKinnon (1996) one-sided p-values.

ii

Null Hypothesis: D(GDP) has a unit root

Exogenous: Constant, Linear Trend

Augmented Dickey-Fuller test statistic

Test critical values:

1% level

5% level

10% level

*MacKinnon (1996) one-sided p-values.

t-Statistic

-0.044739

-4.309824

-3.574244

-3.221728

Prob.*

0.9934

t-Statistic

-3.819094

-4.323979

-3.580622

-3.225334

Prob.*

0.0304

3

|

4 Page 4 |

▲back to top |

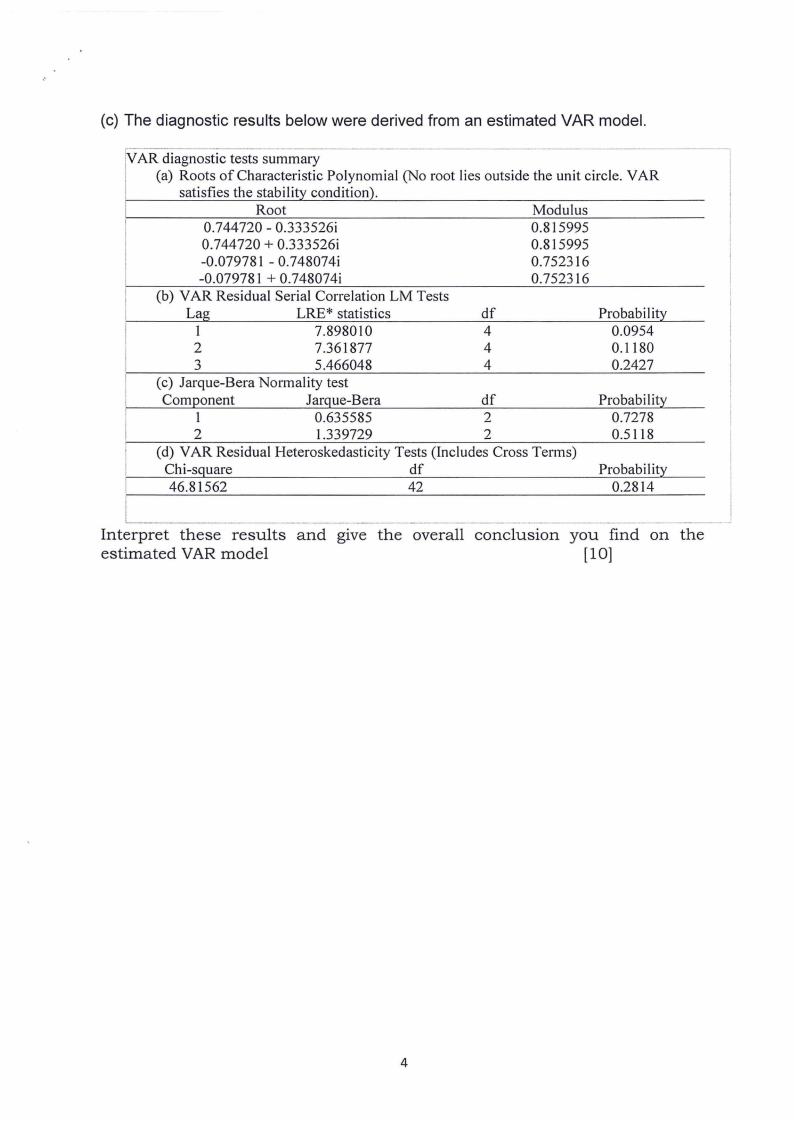

(c) The diagnostic results below were derived from an estimated VAR model.

----

VAR diagnostic tests summary

(a) Roots of Characteristic Polynomial (No root lies outside the unit circle. VAR

satisfies the stability condition).

Root

Modulus

0.744720 - 0.333526i

0.815995

0.744720 + 0.333526i

0.815995

-0.079781 - 0.748074i

-0.079781 + 0.748074i

0.752316

0.752316

(b) VAR Residual Serial Correlation LM Tests

Lag

LRE* statistics

df

Probability

1

7.898010

4

0.0954

2

7.361877

4

0.1180

3

5.466048

4

0.2427

(c) Jarque-Bera Normality test

Component

Jarque-Bera

df

Probability

1

0.635585

2

0.7278

2

1.339729

2

0.5118

(d) VAR Residual Heteroskedasticity Tests (Includes Cross Terms)

Chi-square

df

Probability

46.81562

42

0.2814

Interpret these results and give the overall conclusion you find on the

estimated VAR model

[10]

4