|

GFA711S- FINANCIAL ACCOUNTING 310- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCEH, UMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICSA, CCOUNTING& FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07 BOAC

COURSE: FINANCIAL ACCOUNTING 310

DATE: June 2023

DURATION: 3 HRS

LEVEL: 7

COURSE CODE: GFA 711S

SESSION: Jun 2023

MARl<S: 100

EXAMINER{S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Kamotho, D.W., Ketjiganda, A., Garas, E., Kamana, R.,

MODERATOR:

M Tondota

THIS QUESTION PAPER CONSISTS OF _5_ PAGES (including this front page)

INSTRUCTIONS

1. Answer all the questions in blue or black ink

2. Start each question on a new page in your answer booklet & show all your workings

3. Questions relating to this examination may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

1. Non programmable scientific or financial calculator

1

|

2 Page 2 |

▲back to top |

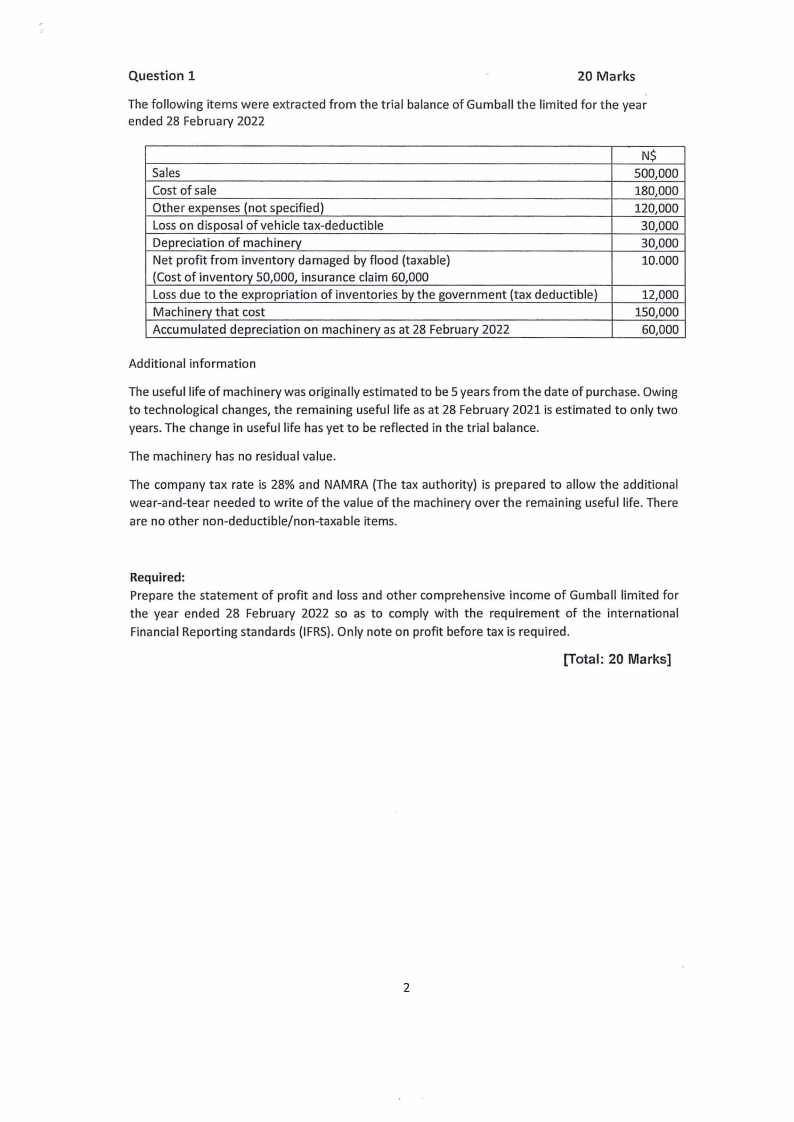

Question 1

20 Marks

The following items were extracted from the trial balance of Gum ball the limited for the year

ended 28 February 2022

Sales

Cost of sale

Other expenses (not specified)

Loss on disposal of vehicle tax-deductible

Depreciation of machinery

Net profit from inventory damaged by flood (taxable)

(Cost of inventory 50,000, insurance claim 60,000

Loss due to the expropriation of inventories by the government (tax deductible)

Machinery that cost

Accumulated depreciation on machinery as at 28 February 2022

N$

500,000

180,000

120,000

30,000

30,000

10.000

12,000

150,000

60,000

Additional information

The useful life of machinery was originally estimated to be 5 years from the date of purchase. Owing

to technological changes, the remaining useful life as at 28 February 2021 is estimated to only two

years. The change in useful life has yet to be reflected in the trial balance.

The machinery has no residual value.

The company tax rate is 28% and NAMRA (The tax authority) is prepared to allow the additional

wear-and-tear needed to write of the value of the machinery over the remaining useful life. There

are no other non-deductible/non-taxable items.

Required:

Prepare the statement of profit and loss and other comprehensive income of Gumball limited for

the year ended 28 February 2022 so as to comply with the requirement of the international

Financial Reporting standards (IFRS).Only note on profit before tax is required.

[Total: 20 Marks]

2

|

3 Page 3 |

▲back to top |

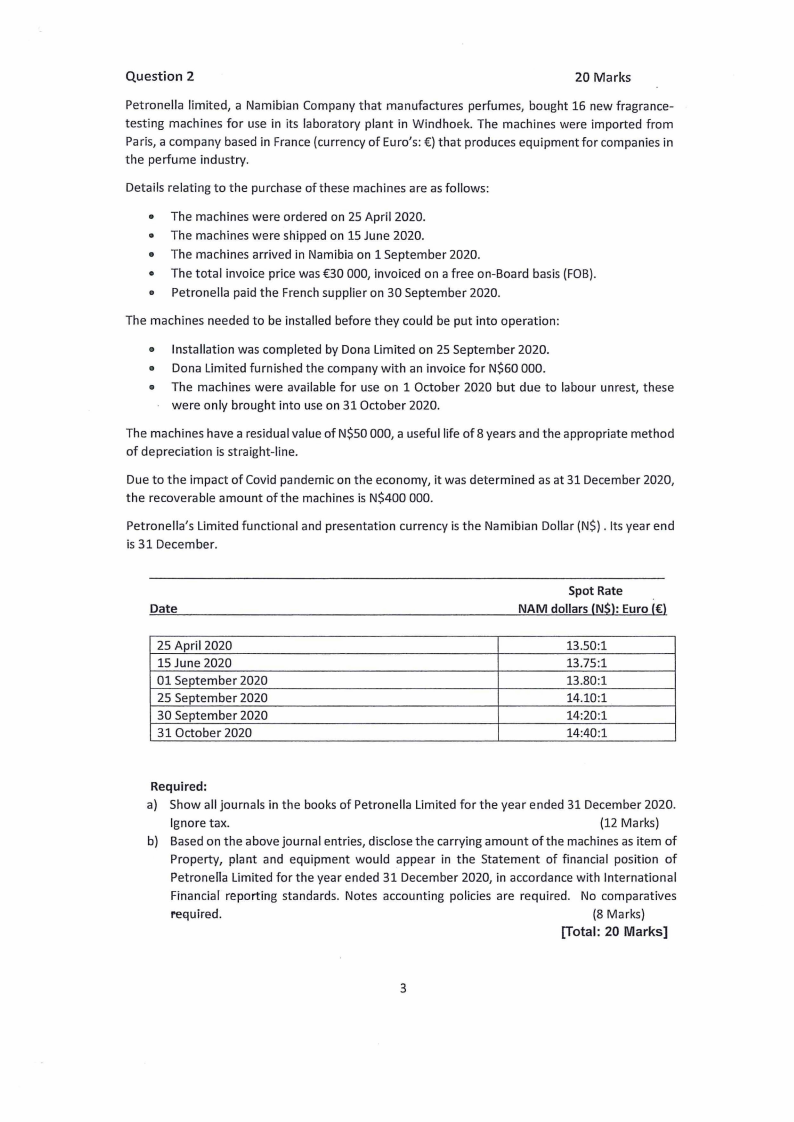

Question 2

20 Marks

Petronella limited, a Namibian Company that manufactures perfumes, bought 16 new fragrance-

testing machines for use in its laboratory plant in Windhoek. The machines were imported from

Paris, a company based in France (currency of Euro's: €) that produces equipment for companies in

the perfume industry.

Details relating to the purchase ofthese machines are as follows:

• The machines were ordered on 25 April 2020.

• The machines were shipped on 15 June 2020.

• The machines arrived in Namibia on 1 September 2020.

• The total invoice price was €30 000, invoiced on a free on-Board basis (FOB).

• Petronella paid the French supplier on 30 September 2020.

The machines needed to be installed before they could be put into operation:

• Installation was completed by Dona Limited on 25 September 2020.

• Dona Limited furnished the company with an invoice for N$60 000.

• The machines were available for use on 1 October 2020 but due to labour unrest, these

were only brought into use on 31 October 2020.

The machines have a residual value of N$50 000, a useful life of 8 years and the appropriate method

of depreciation is straight-line.

Due to the impact of Covid pandemic on the economy, it was determined as at 31 December 2020,

the recoverable amount of the machines is N$400 000.

Petronella's Limited functional and presentation currency is the Namibian Dollar (N$). Its year end

is 31 December.

Date

25 April 2020

15 June 2020

01 September 2020

25 September 2020

30 September 2020

31 October 2020

Spot Rate

NAM dollars (N$}: Euro (€}

13.50:1

13.75:1

13.80:1

14.10:1

14:20:1

14:40:1

Required:

a) Show all journals in the books of Petronella Limited for the year ended 31 December 2020.

Ignore tax.

(12 Marks)

b) Based on the above journal entries, disclose the carrying amount of the machines as item of

Property, plant and equipment would appear in the Statement of financial position of

Petronella Limited for the year ended 31 December 2020, in accordance with International

Financial reporting standards. Notes accounting policies are required. No comparatives

required.

(8 Marks)

[Total: 20 Marks]

3

|

4 Page 4 |

▲back to top |

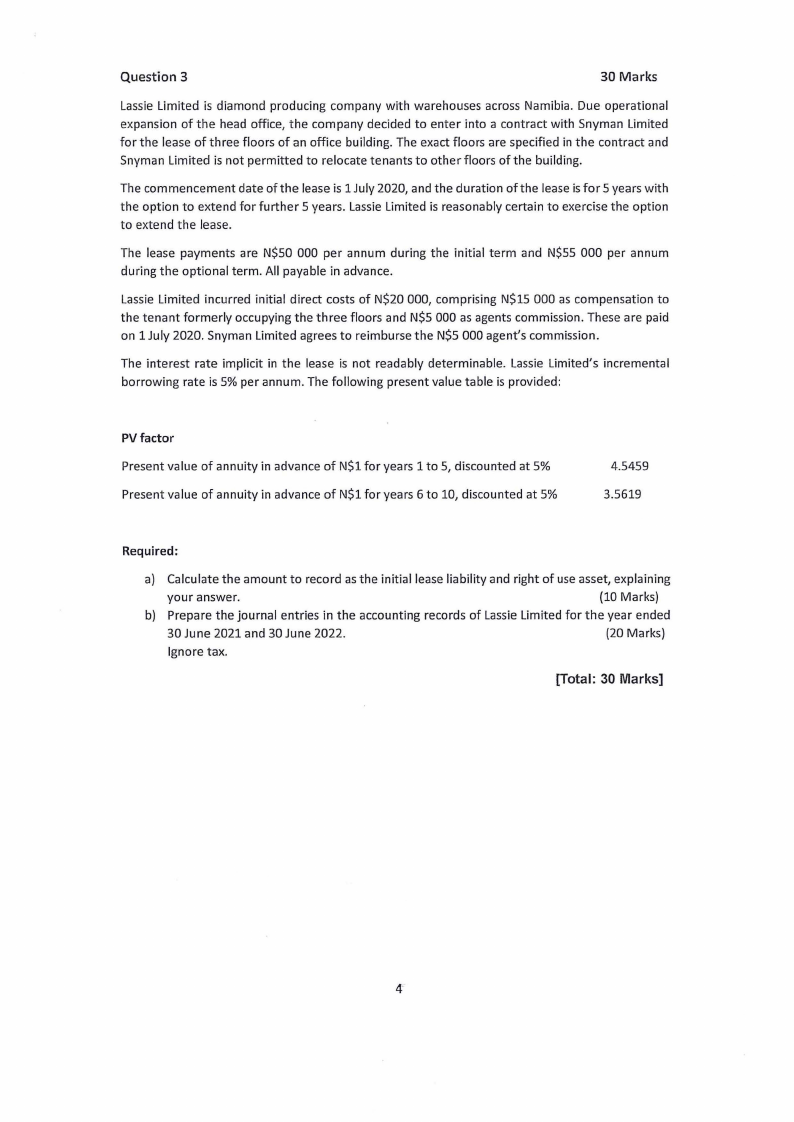

Question 3

30 Marks

Lassie Limited is diamond producing company with warehouses across Namibia. Due operational

expansion of the head office, the company decided to enter into a contract with Snyman Limited

for the lease of three floors of an office building. The exact floors are specified in the contract and

Snyman Limited is not permitted to relocate tenants to other floors of the building.

The commencement date of the lease is 1 July 2020, and the duration of the lease is for 5 years with

the option to extend for further 5 years. Lassie Limited is reasonably certain to exercise the option

to extend the lease.

The lease payments are N$50 000 per annum during the initial term and N$55 000 per annum

during the optional term. All payable in advance.

Lassie Limited incurred initial direct costs of N$20 000, comprising N$15 000 as compensation to

the tenant formerly occupying the three floors and N$5 000 as agents commission. These are paid

on 1 July 2020. Snyman Limited agrees to reimburse the N$5 000 agent's commission.

The interest rate implicit in the lease is not readably determinable. Lassie Limited's incremental

borrowing rate is 5% per annum. The following present value table is provided:

PV factor

Present value of annuity in advance of N$1 for years 1 to 5, discounted at 5%

Present value of annuity in advance of N$1 for years 6 to 10, discounted at 5%

4.5459

3.5619

Required:

a) Calculate the amount to record as the initial lease liability and right of use asset, explaining

your answer.

{10 Marks)

b) Prepare the journal entries in the accounting records of Lassie Limited for the year ended

30 June 2021 and 30 June 2022.

(20 Marks)

Ignore tax.

[Total: 30 Marks]

|

5 Page 5 |

▲back to top |

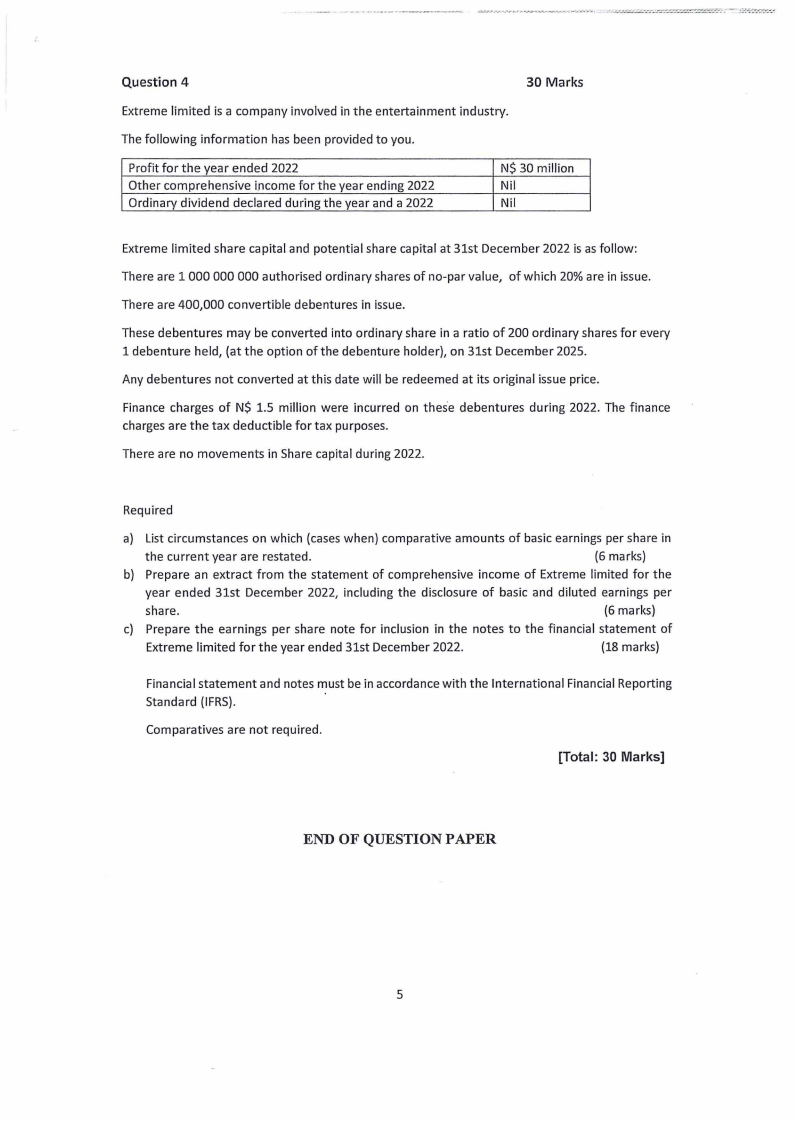

Question 4

30 Marks

Extreme limited is a company involved in the entertainment industry.

The following information has been provided to you.

Profit for the year ended 2022

Other comprehensive income for the year ending 2022

Ordinary dividend declared during the year and a 2022

N$ 30 million

Nil

Nil

Extreme limited share capital and potential share capital at 31st December 2022 is as follow:

There are 1 000 000 000 authorised ordinary shares of no-par value, of which 20% are in issue.

There are 400,000 convertible debentures in issue.

These debentures may be converted into ordinary share in a ratio of 200 ordinary shares for every

1 debenture held, (at the option of the debenture holder), on 31st December 2025.

Any debentures not converted at this date will be redeemed at its original issue price.

Finance charges of N$ 1.5 million were incurred on thes·e debentures during 2022. The finance

charges are the tax deductible for tax purposes.

There are no movements in Share capital during 2022.

Required

a) List circumstances on which (cases when) comparative amounts of basic earnings per share in

the current year are restated.

(6 marks)

b) Prepare an extract from the statement of comprehensive income of Extreme limited for the

year ended 31st December 2022, including the disclosure of basic and diluted earnings per

share.

(6 marks)

c) Prepare the earnings per share note for inclusion in the notes to the financial statement of

Extreme limited for the year ended 31st December 2022.

(18 marks)

Financial statement and notes must be in accordance with the International Financial Reporting

Standard (IFRS).

Comparatives are not required.

[Total: 30 Marks]

END OF QUESTION PAPER

5