|

BAC521C-BUSINESS ACCOUNTING 1B-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

r-

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

CENTERFOR ENTERPRISEDEVELOPMENT{CED)

QUALIFICATION: DIPLOMA IN BUSINESSPROCESSMANAGEMENT

QUALIFICATIONCODE:06DBPM LEVEL:6

COURSECODE: BAC521C

COURSENAME: BUSINESSACCOUNTING 1B

SESSION:JUNE 2022

PAPER:THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS L. Odada

MODERATOR H. Kangala

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer ALLthe questions and in blue or black ink. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 5 PAGES(including this front page)

|

2 Page 2 |

▲back to top |

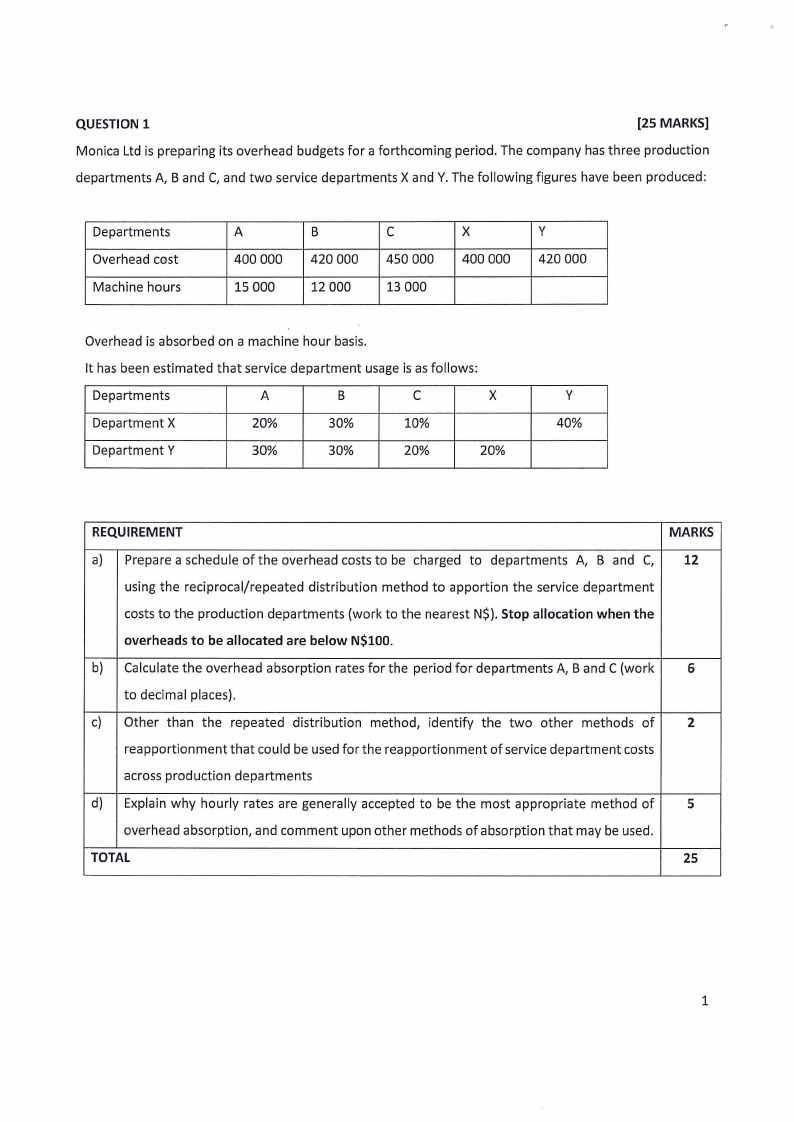

QUESTION 1

[25 MARKS]

Monica Ltd is preparing its overhead budgets for a forthcoming period. The company has three production

departments A, Band C, and two service departments X and Y. The following figures have been produced:

Departments

Overhead cost

Machine hours

A

400 000

15 000

B

420 000

12 000

C

450 000

13 000

X

400 000

y

420 000

Overhead is absorbed on a machine hour basis.

It has been estimated that service department usage is as follows:

Departments

A

B

C

X

y

Department X

20%

30%

10%

40%

Department Y

30%

30%

20%

20%

REQUIREMENT

MARKS

a) Prepare a schedule of the overhead costs to be charged to departments A, B and C, 12

using the reciprocal/repeated distribution method to apportion the service department

costs to the production departments (work to the nearest N$). Stop allocation when the

overheads to be allocated are below N$100.

b) Calculate the overhead absorption rates for the period for departments A, Band C (work

6

to decimal places).

c) Other than the repeated distribution method, identify the two other methods of

2

reapportionment that could be used for the reapportionment of service department costs

across production departments

d) Explain why hourly rates are generally accepted to be the most appropriate method of

5

overhead absorption, and comment upon other methods of absorption that may be used.

TOTAL

25

1

|

3 Page 3 |

▲back to top |

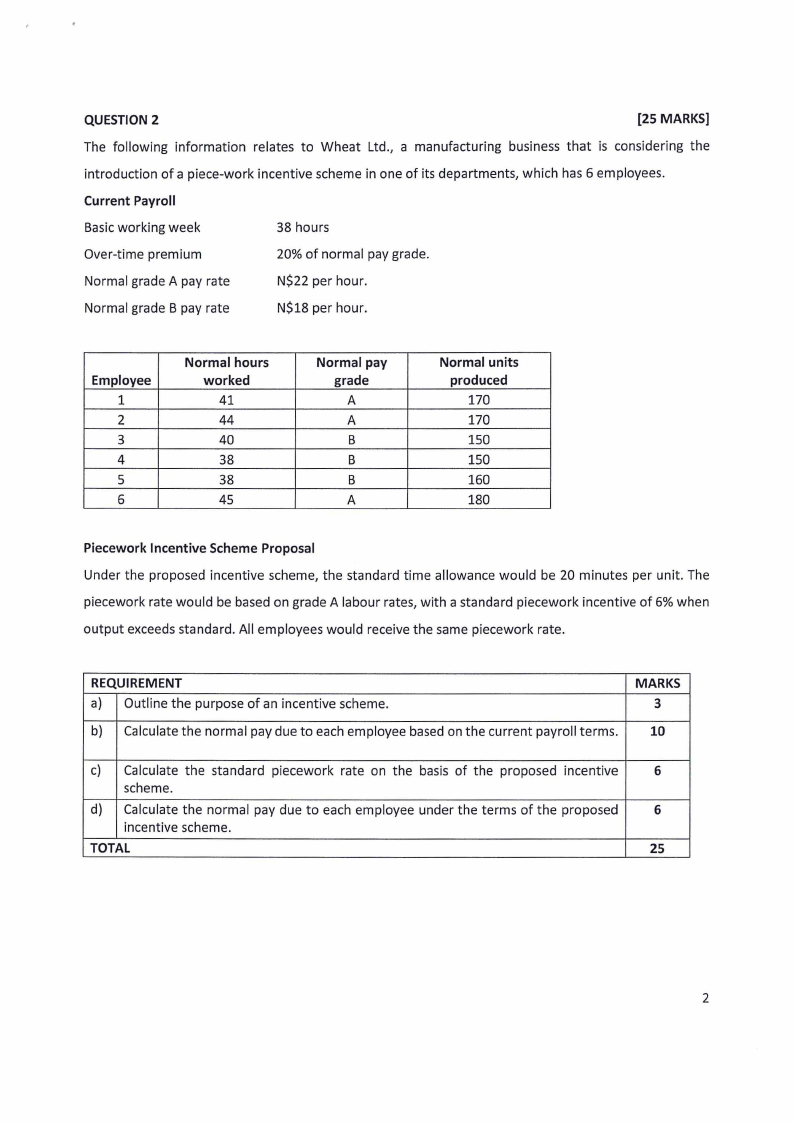

QUESTION 2

(25 MARKS]

The following information relates to Wheat Ltd., a manufacturing business that is considering the

introduction of a piece-work incentive scheme in one of its departments, which has 6 employees.

Current Payroll

Basicworking week

38 hours

Over-time premium

20% of normal pay grade.

Normal grade A pay rate

N$22 per hour.

Normal grade B pay rate

N$18 per hour.

Employee

1

2

3

4

5

6

Normal hours

worked

41

44

40

38

38

45

Normal pay

grade

A

A

B

B

B

A

Normal units

produced

170

170

150

150

160

180

Piecework Incentive Scheme Proposal

Under the proposed incentive scheme, the standard time allowance would be 20 minutes per unit. The

piecework rate would be based on grade A labour rates, with a standard piecework incentive of 6% when

output exceeds standard. All employees would receive the same piecework rate.

REQUIREMENT

a) Outline the purpose of an incentive scheme.

b) Calculate the normal pay due to each employee based on the current payroll terms.

MARKS

3

10

c) Calculate the standard piecework rate on the basis of the proposed incentive

6

scheme.

d) Calculate the normal pay due to each employee under the terms of the proposed

6

incentive scheme.

TOTAL

25

2

|

4 Page 4 |

▲back to top |

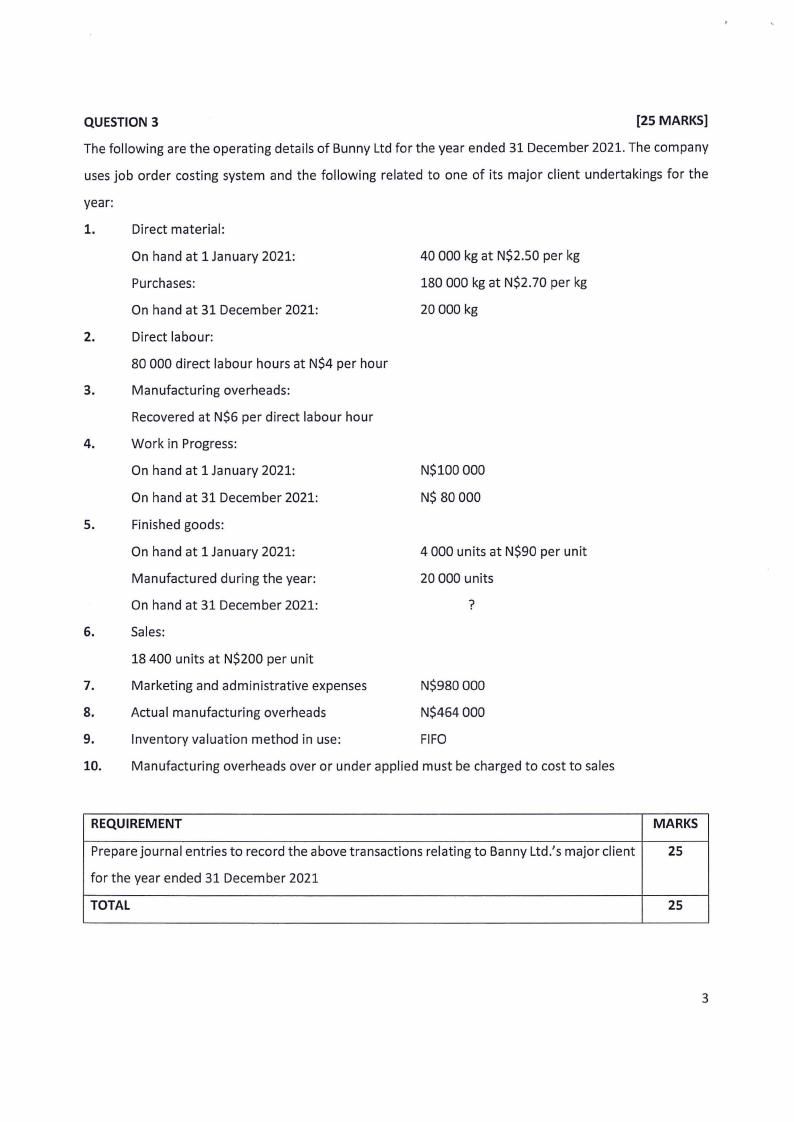

QUESTION 3

[25 MARKS]

The following are the operating details of Bunny Ltd for the year ended 31 December 2021. The company

uses job order costing system and the following related to one of its major client undertakings for the

year:

1.

Direct material:

On hand at 1 January 2021:

40 000 kg at N$2.50 per kg

Purchases:

180 000 kg at N$2.70 per kg

On hand at 31 December 2021:

20 000 kg

2.

Direct labour:

80 000 direct labour hours at N$4 per hour

3.

Manufacturing overheads:

Recovered at N$6 per direct labour hour

4.

Work in Progress:

On hand at 1 January 2021:

N$100 000

On hand at 31 December 2021:

N$ 80 000

5.

Finished goods:

On hand at 1 January 2021:

4 000 units at N$90 per unit

Manufactured during the year:

20 000 units

On hand at 31 December 2021:

?

6.

Sales:

18 400 units at N$200 per unit

7.

Marketing and administrative expenses

N$980 000

8.

Actual manufacturing overheads

N$464 000

9.

Inventory valuation method in use:

FIFO

10. Manufacturing overheads over or under applied must be charged to cost to sales

REQUIREMENT

Prepare journal entries to record the above transactions relating to Banny Ltd.'s major client

for the year ended 31 December 2021

TOTAL

MARKS

25

25

3

|

5 Page 5 |

▲back to top |

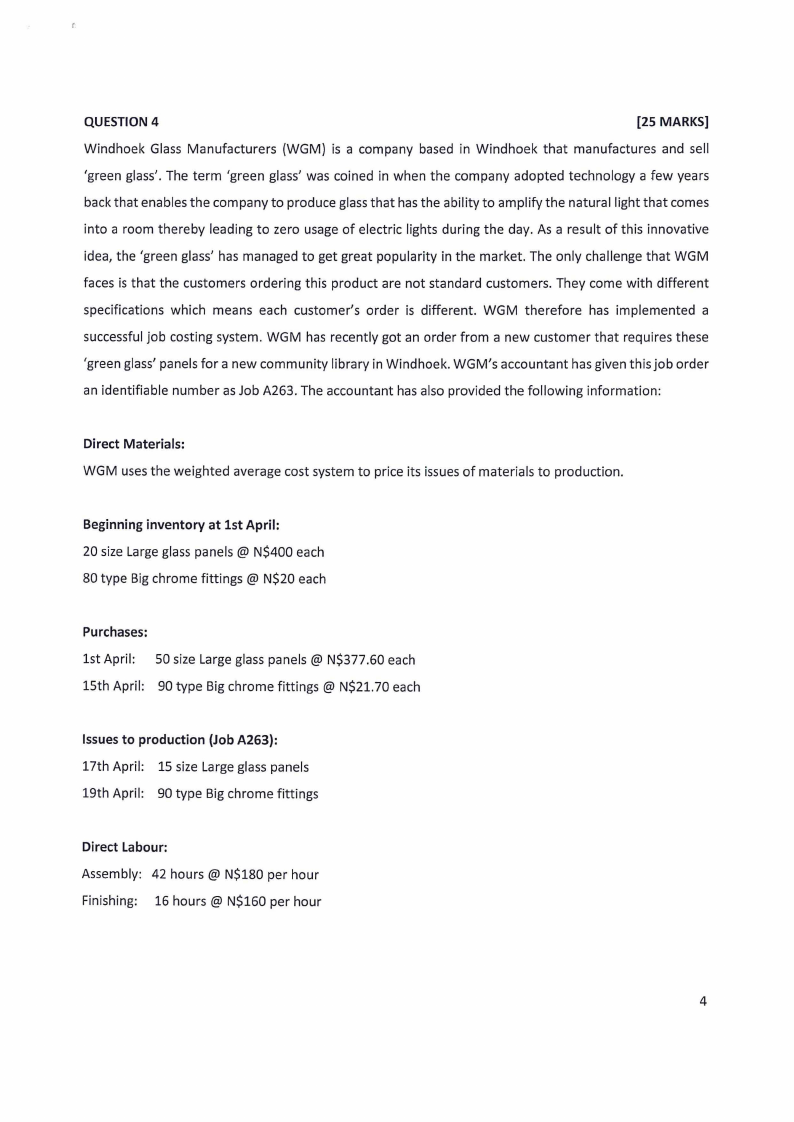

QUESTION 4

[25 MARKS]

Windhoek Glass Manufacturers (WGM} is a company based in Windhoek that manufactures and sell

'green glass'. The term 'green glass' was coined in when the company adopted technology a few years

back that enables the company to produce glassthat has the ability to amplify the natural light that comes

into a room thereby leading to zero usage of electric lights during the day. As a result of this innovative

idea, the 'green glass' has managed to get great popularity in the market. The only challenge that WGM

faces is that the customers ordering this product are not standard customers. They come with different

specifications which means each customer's order is different. WGM therefore has implemented a

successful job costing system. WGM has recently got an order from a new customer that requires these

'green glass' panels for a new community library in Windhoek. WGM's accountant has given this job order

an identifiable number as Job A263. The accountant has also provided the following information:

Direct Materials:

WGM uses the weighted average cost system to price its issues of materials to production.

Beginning inventory at 1st April:

20 size Large glass panels @ N$400 each

80 type Big chrome fittings @ N$20 each

Purchases:

1st April: 50 size Large glass panels@ N$377.60 each

15th April: 90 type Big chrome fittings@ N$21.70 each

Issuesto production (Job A263}:

17th April: 15 size Large glass panels

19th April: 90 type Big chrome fittings

Direct Labour:

Assembly: 42 hours @ N$180 per hour

Finishing: 16 hours @ N$160 per hour

4

|

6 Page 6 |

▲back to top |

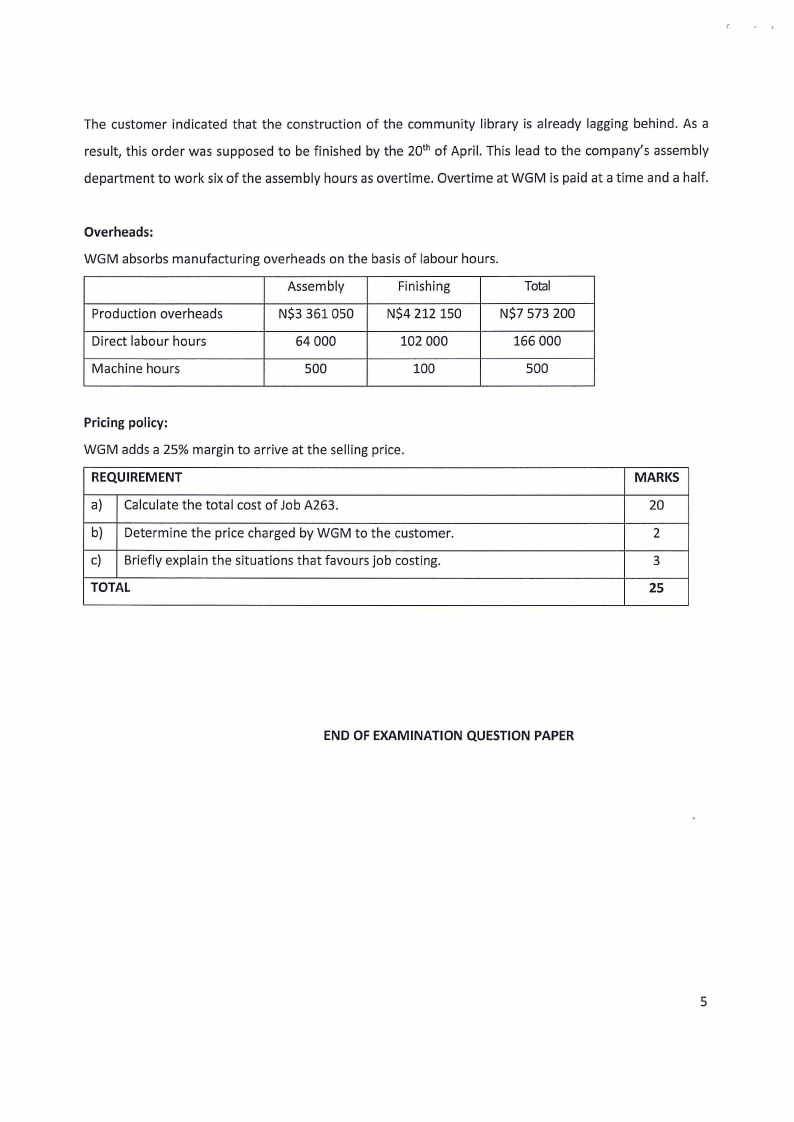

The customer indicated that the construction of the community library is already lagging behind. As a

result, this order was supposed to be finished by the 20th of April. This lead to the company's assembly

department to work six of the assembly hours as overtime. Overtime at WGM is paid at a time and a half.

Overheads:

WGM absorbs manufacturing overheads on the basis of labour hours.

Assembly

Finishing

Total

Production overheads

N$3 361050

N$4 212 150

N$7 573 200

Direct labour hours

64 000

102 000

166 000

Machine hours

500

100

500

Pricing policy:

WGM adds a 25% margin to arrive at the selling price.

REQUIREMENT

a) Calculate the total cost of Job A263.

b) Determine the price charged by WGM to the customer.

c) Briefly explain the situations that favours job costing.

TOTAL

MARKS

20

2

3

25

END OF EXAMINATION QUESTIONPAPER

5