|

BAC621C-BUSINESS ACCOUNTING 2B-2ND OPP-JULY 2022 |

|

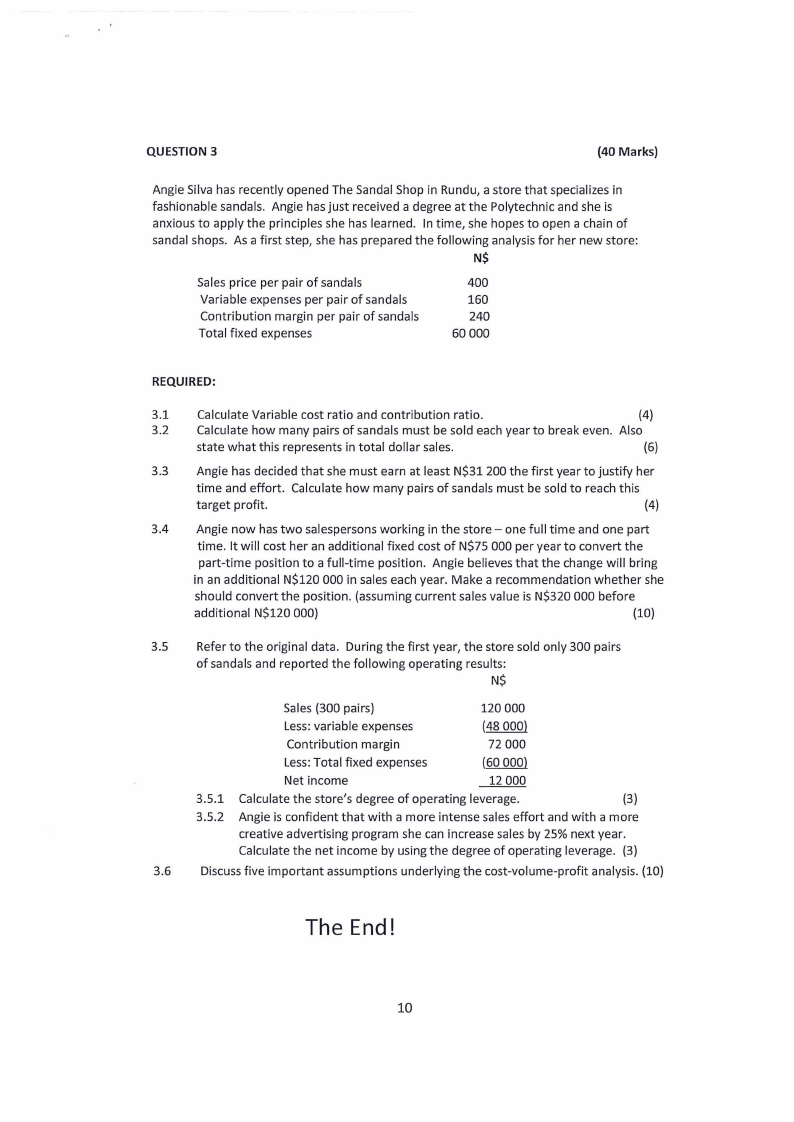

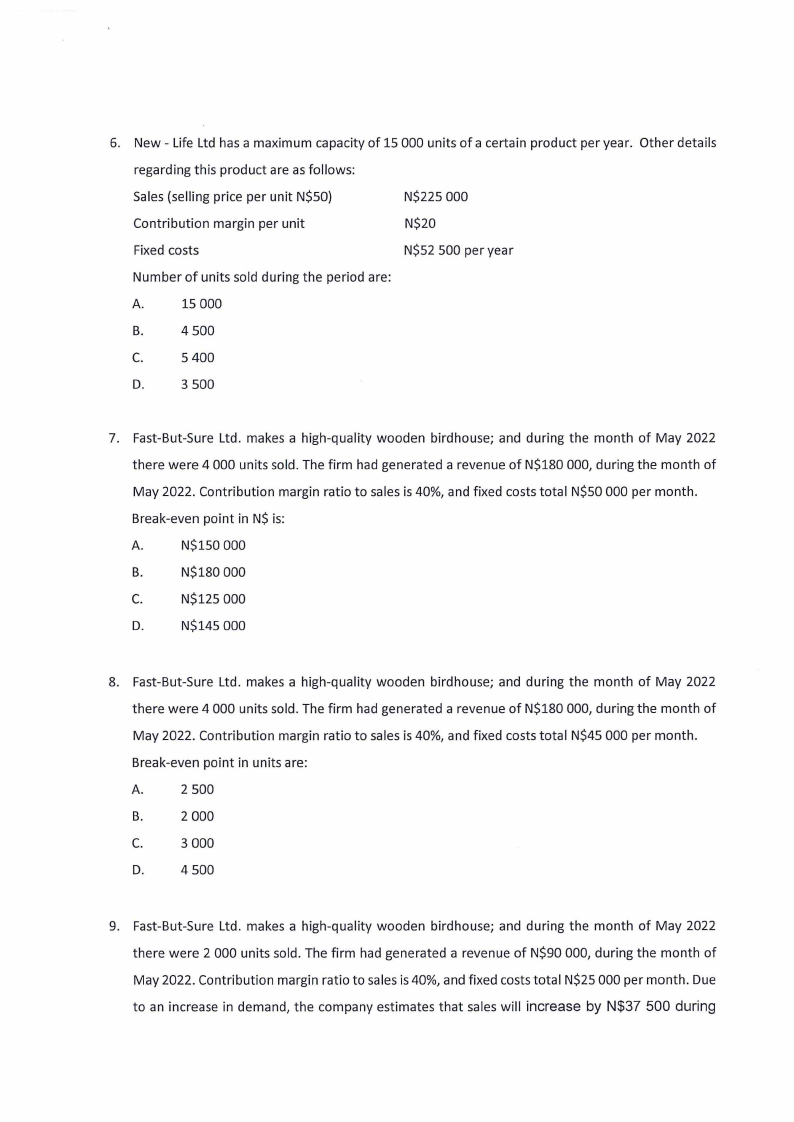

1 Page 1 |

▲back to top |

|

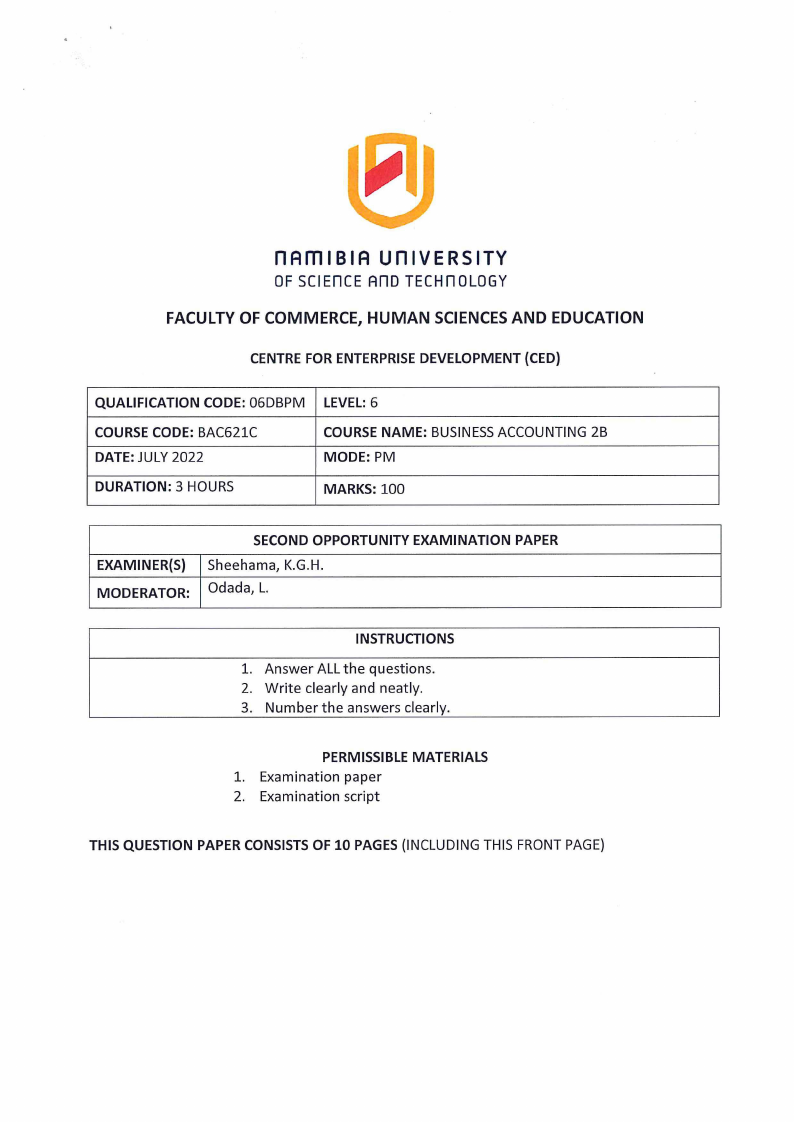

2 Page 2 |

▲back to top |

|

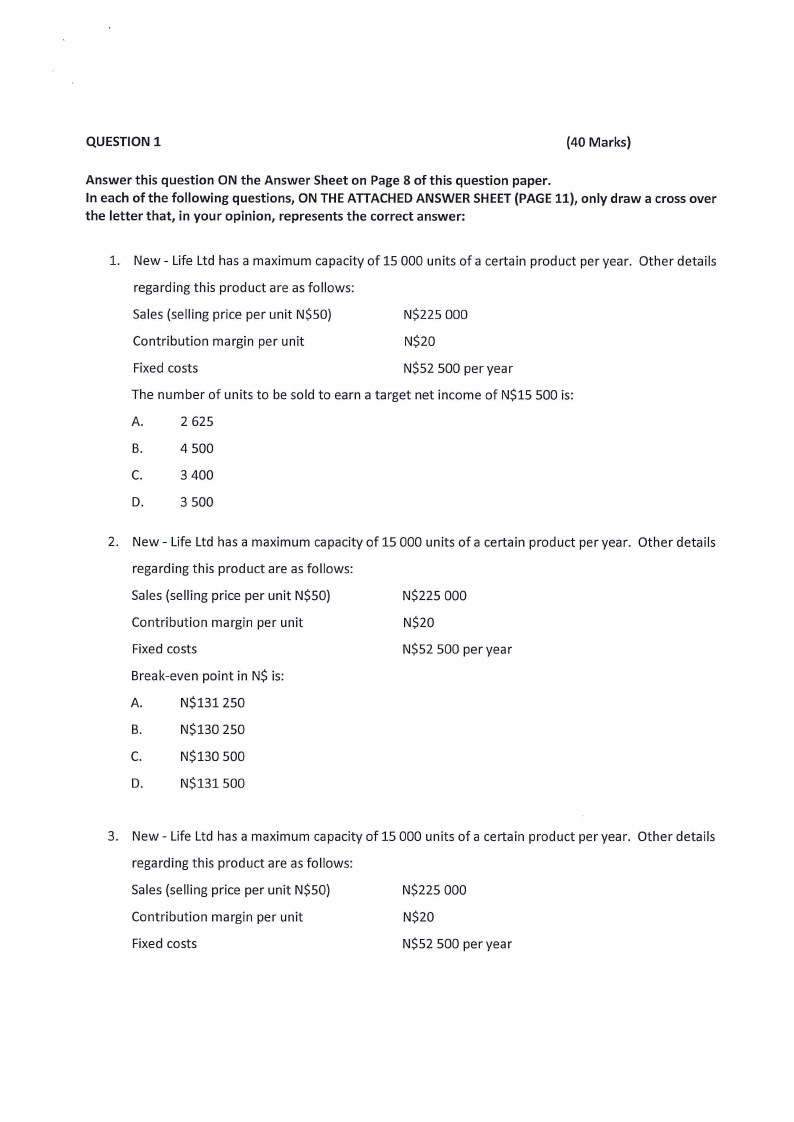

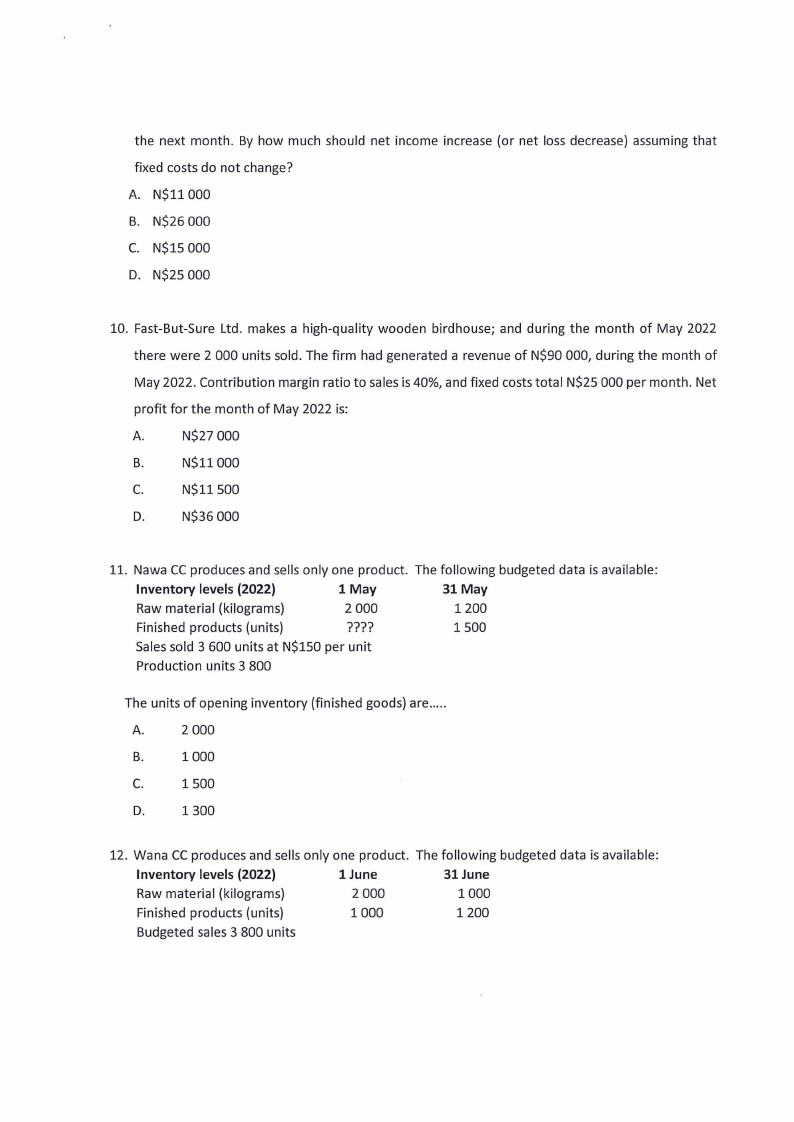

3 Page 3 |

▲back to top |

|

4 Page 4 |

▲back to top |

|

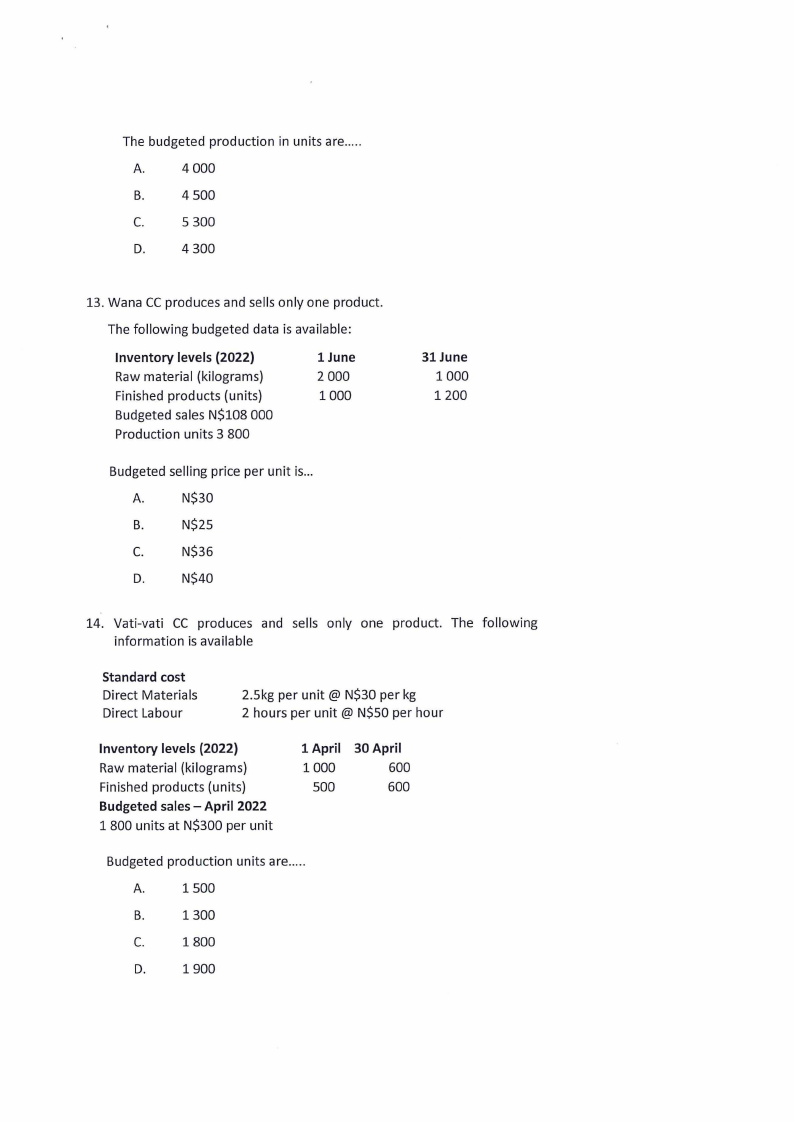

5 Page 5 |

▲back to top |

|

6 Page 6 |

▲back to top |

|

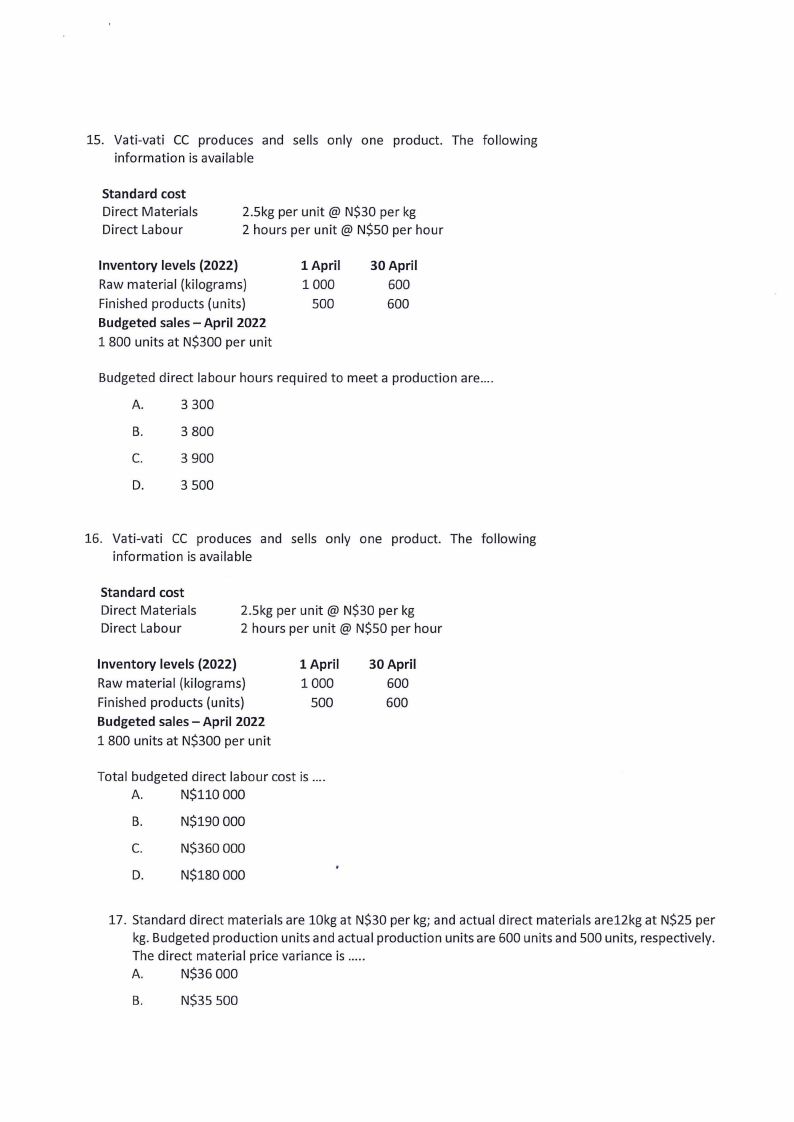

7 Page 7 |

▲back to top |

|

8 Page 8 |

▲back to top |

|

9 Page 9 |

▲back to top |

|

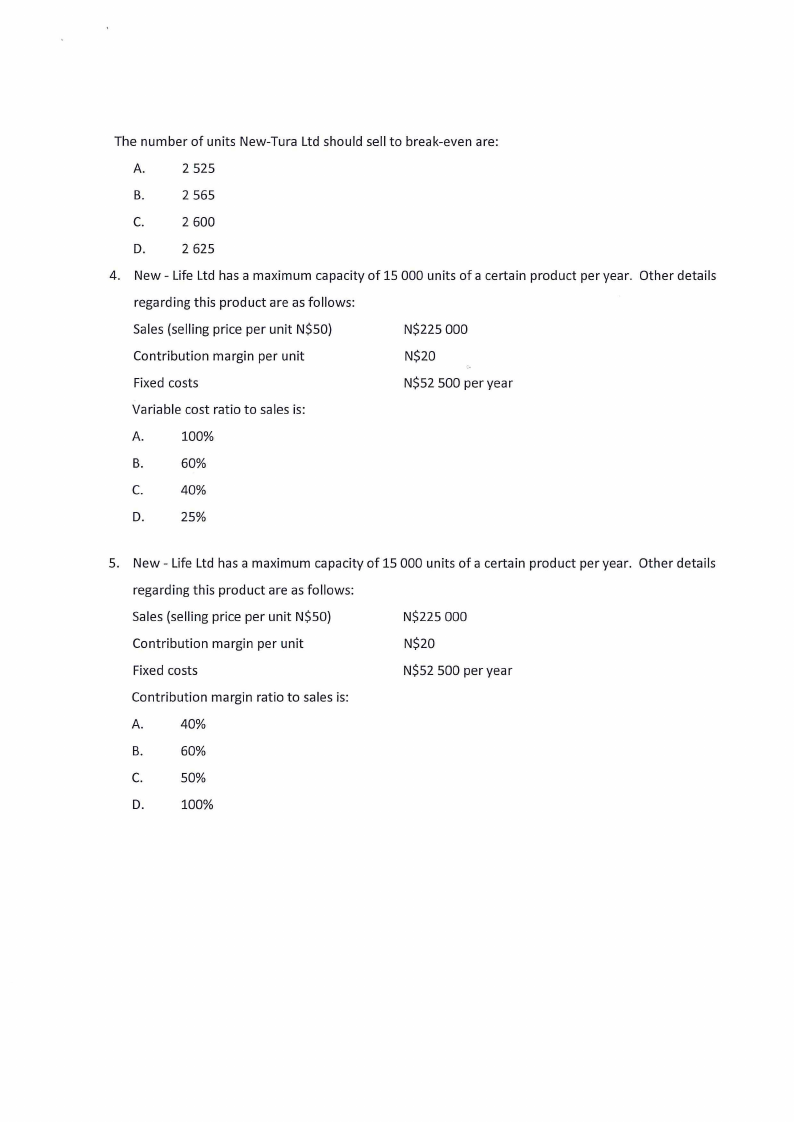

10 Page 10 |

▲back to top |