|

IHA512S-INTRO TO HOSP AND TOURISM ACCOUNTING-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

|

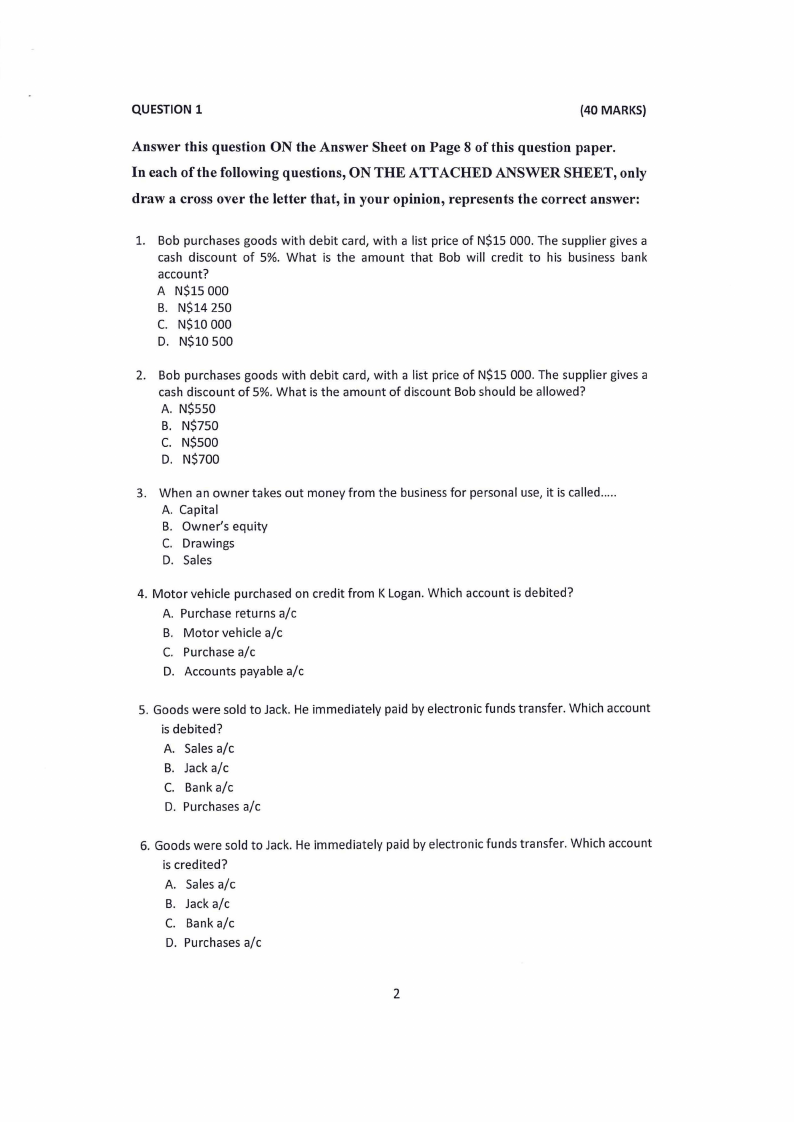

2 Page 2 |

▲back to top |

|

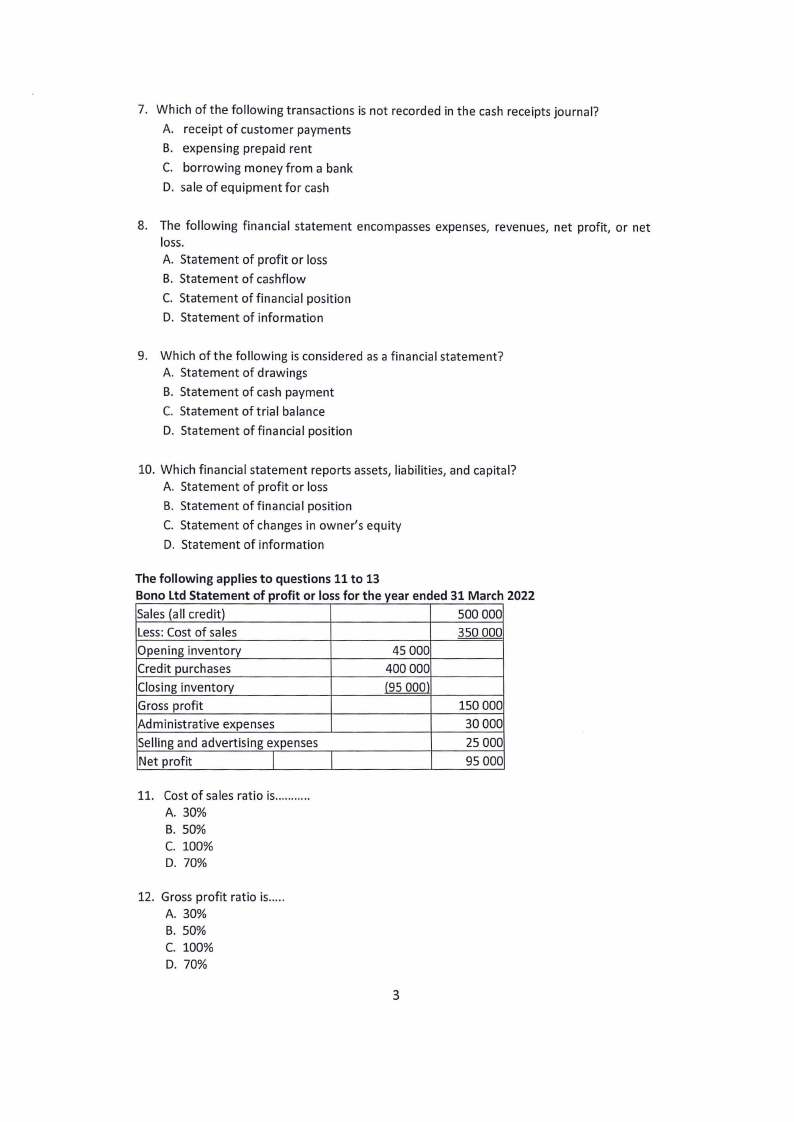

3 Page 3 |

▲back to top |

|

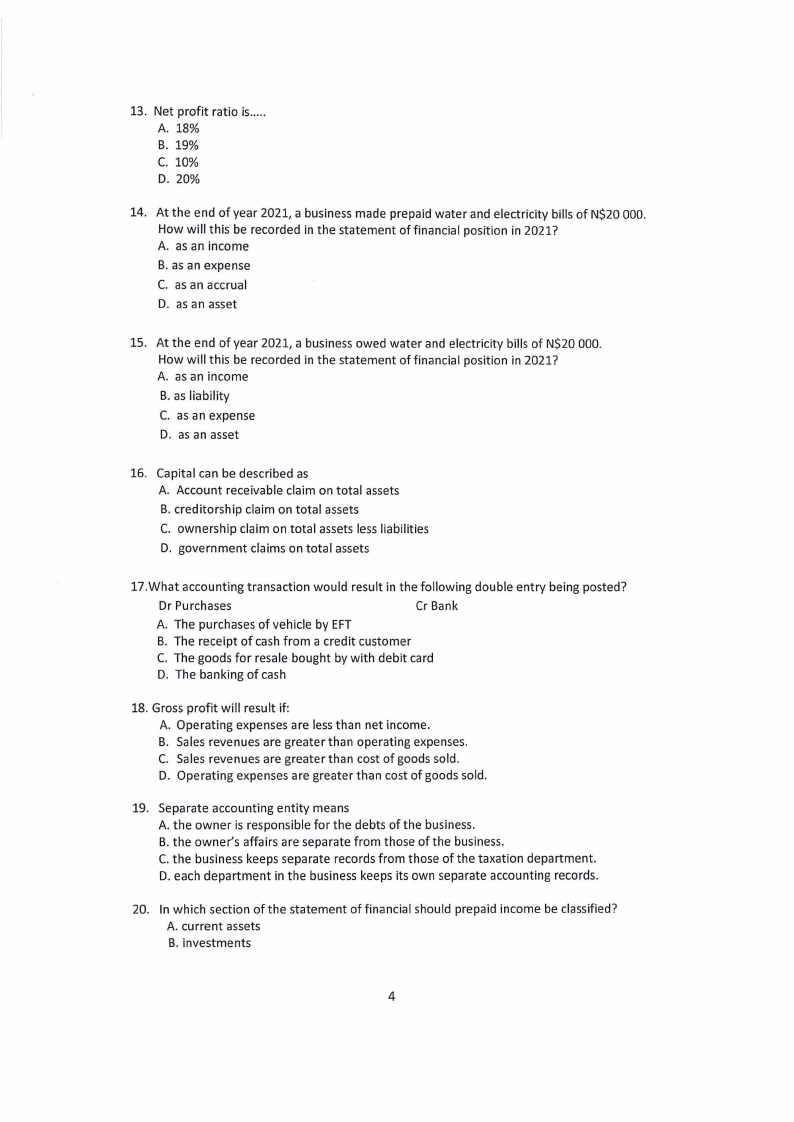

4 Page 4 |

▲back to top |

|

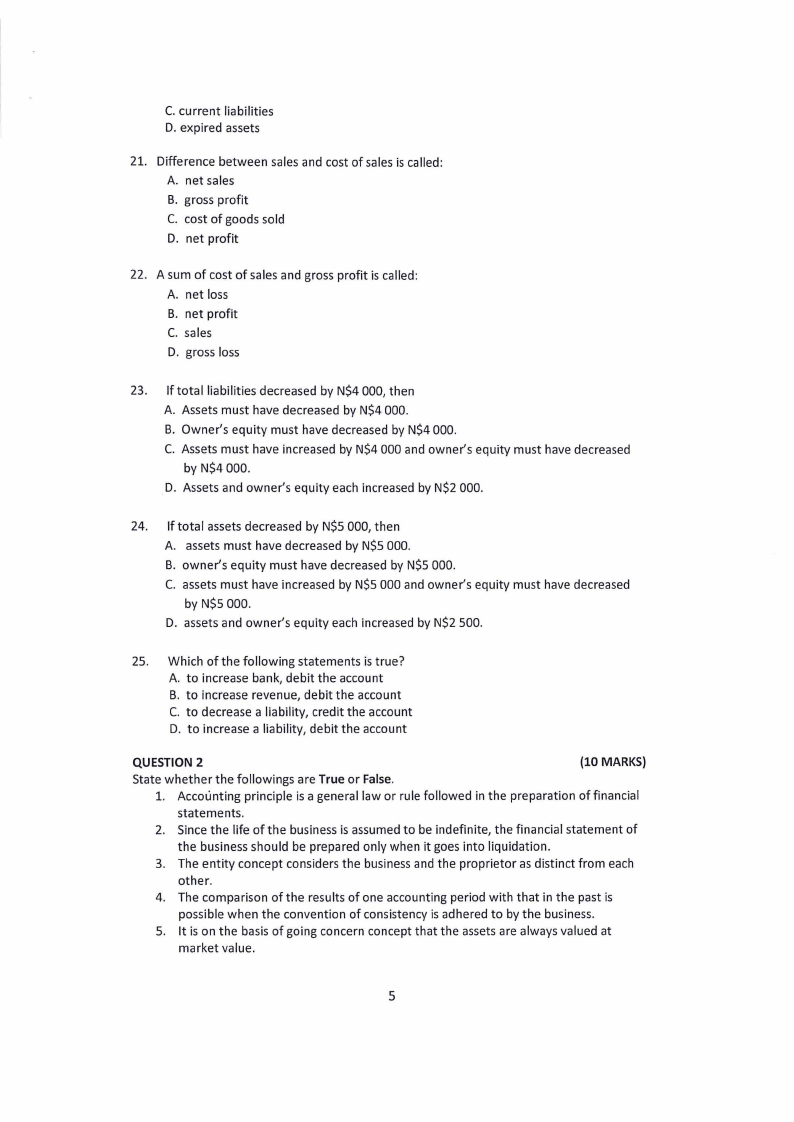

5 Page 5 |

▲back to top |

|

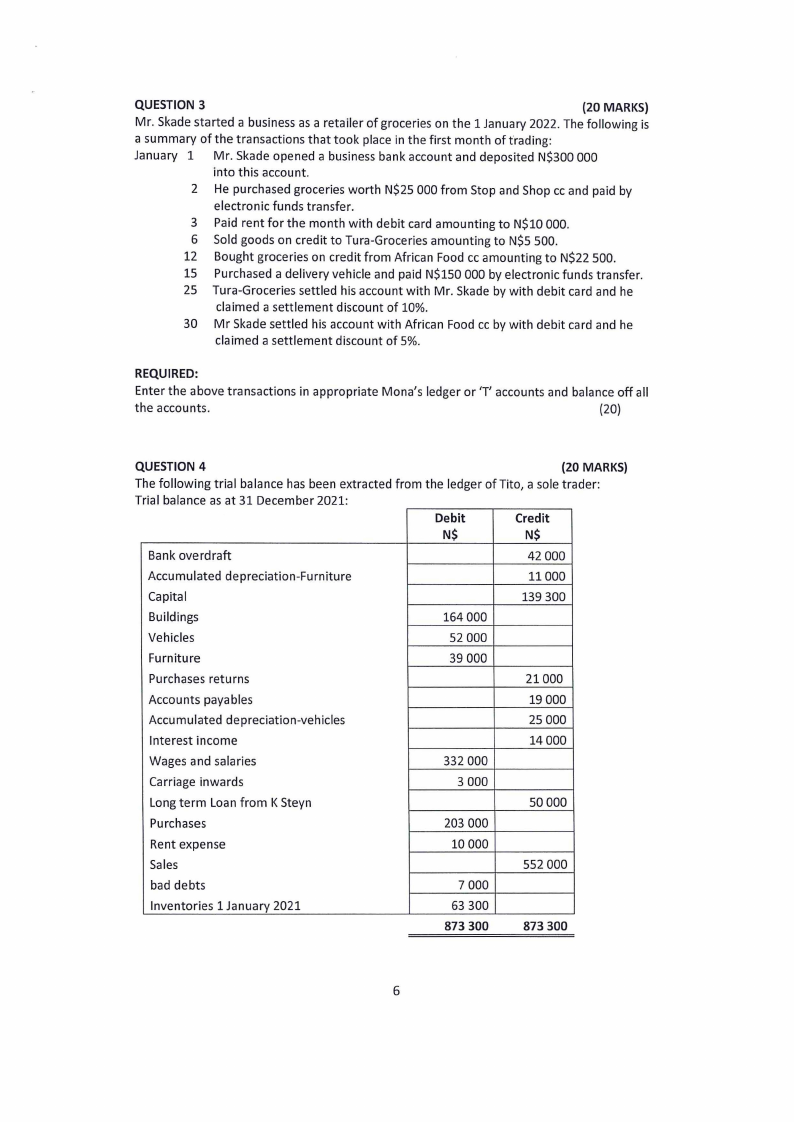

6 Page 6 |

▲back to top |

|

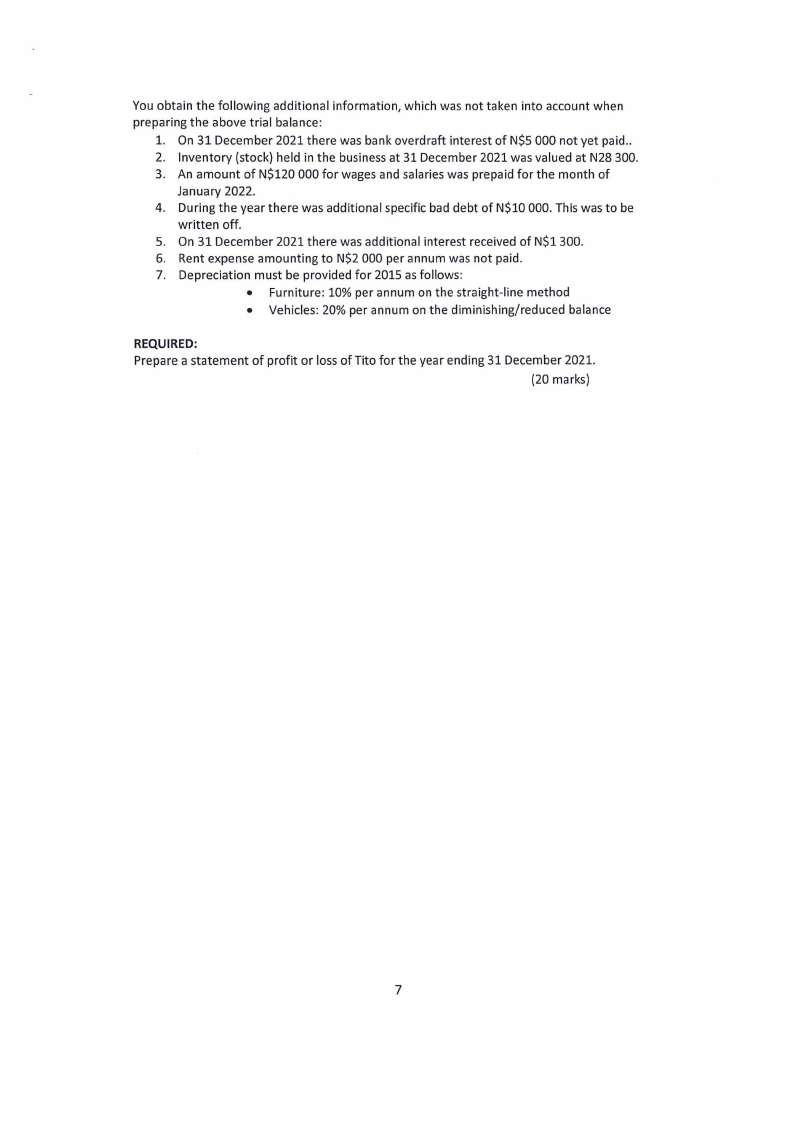

7 Page 7 |

▲back to top |

|

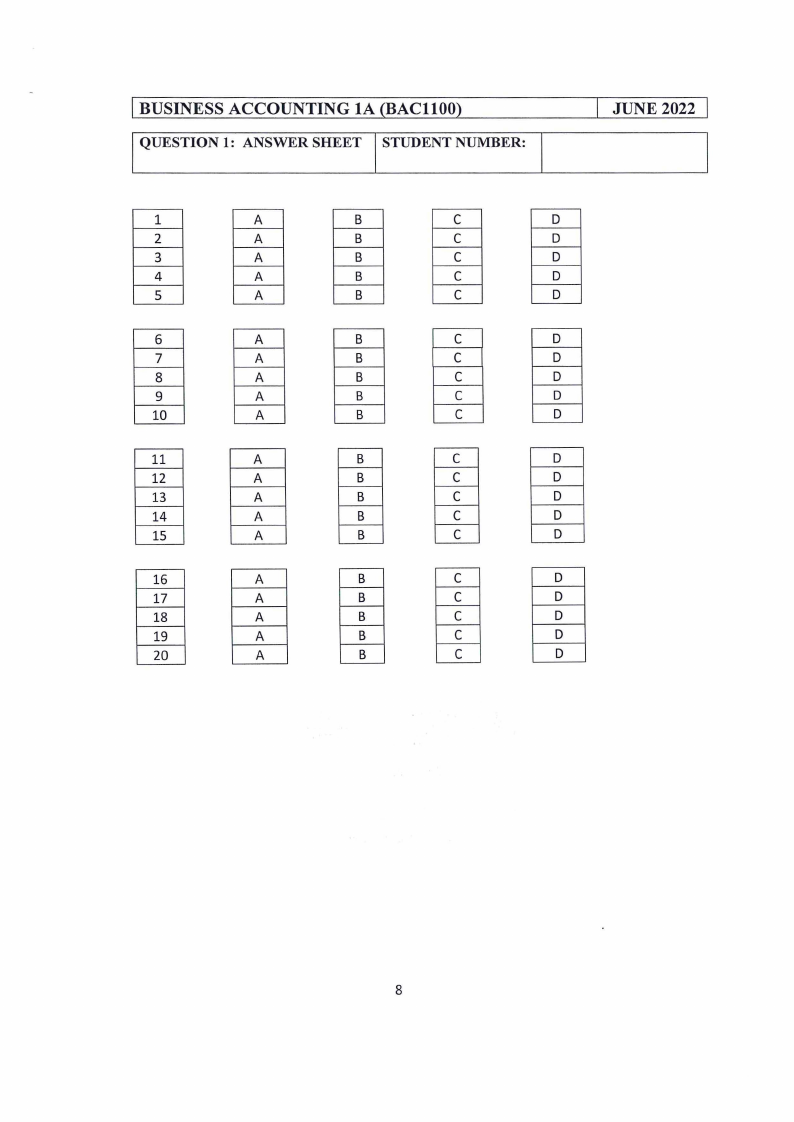

8 Page 8 |

▲back to top |

|

9 Page 9 |

▲back to top |