|

FMA720S - FINANCIAL MANAGEMENT AGRICULTURE - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

9

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF NATURAL RESOURCE AND SPATIAL SCIENCES

DEPARTMENT OF AGRICULTURE & NATURAL RESOURCES SCIENCES

QUALIFICATION: BACHELOR OF AGRICULTURE

QUALIFICATION CODE: 27BAGR | LEVEL: 7

COURSE CODE: FMA 720S

COURSE NAME: FINANCIAL MANAGEMENT (AGRICULTURE)

DATE: January 2020

PAPER: THEORY

DURATION: 3 Hours

MARKS: 100

SECOND OPPORTUNITY / SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S)

MODERATOR:

M. Lubinda

S. Kalundu

INSTRUCTIONS

Answer ALL four (4) questions.

Read all the questions carefully before answering.

Number your answers.

Make sure your student number appears on the answering script.

PERMISSIBLE MATERIALS

1. Examination paper.

2. Examination script.

3. Calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Financial Management

FMA 720S

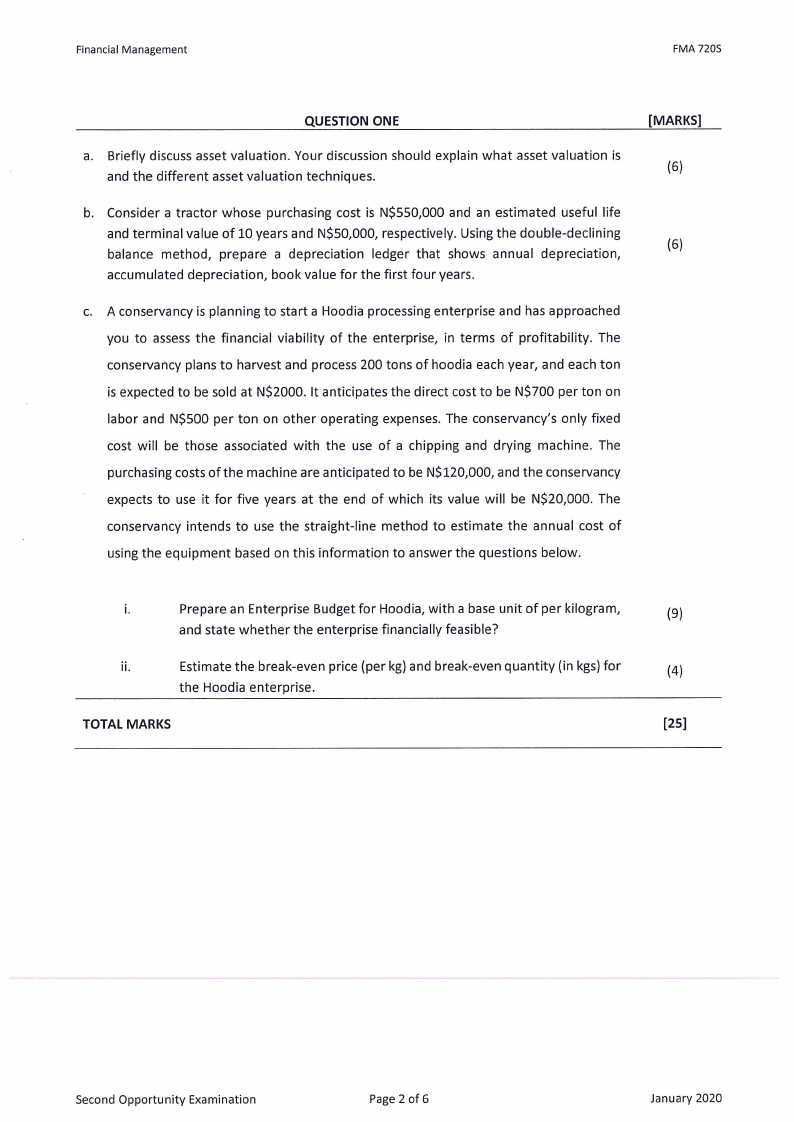

QUESTION ONE

a. Briefly discuss asset valuation. Your discussion should explain what asset valuation is

and the different asset valuation techniques.

b. Consider a tractor whose purchasing cost is NS550,000 and an estimated useful life

and terminal value of 10 years and N$50,000, respectively. Using the double-declining

balance method, prepare a depreciation ledger that shows annual depreciation,

accumulated depreciation, book value for the first four years.

c. Aconservancy is planning to start a Hoodia processing enterprise and has approached

you to assess the financial viability of the enterprise, in terms of profitability. The

conservancy plans to harvest and process 200 tons of hoodia each year, and each ton

is expected to be sold at NS2000. It anticipates the direct cost to be NS700 per ton on

labor and NS5OO per ton on other operating expenses. The conservancy’s only fixed

cost will be those associated with the use of a chipping and drying machine. The

purchasing costs of the machine are anticipated to be N$120,000, and the conservancy

expects to use it for five years at the end of which its value will be NS20,000. The

conservancy intends to use the straight-line method to estimate the annual cost of

using the equipment based on this information to answer the questions below.

[MARKS]

é

(6)

(6)

i.

Prepare an Enterprise Budget for Hoodia, with a base unit of per kilogram,

(9)

and state whether the enterprise financially feasible?

ii.

Estimate the break-even price (per kg) and break-even quantity (in kgs) for

(4)

the Hoodia enterprise.

TOTAL MARKS

[25]

Second Opportunity Examination

Page 2 of 6

January 2020

|

3 Page 3 |

▲back to top |

Financial Management

FMA 7208S

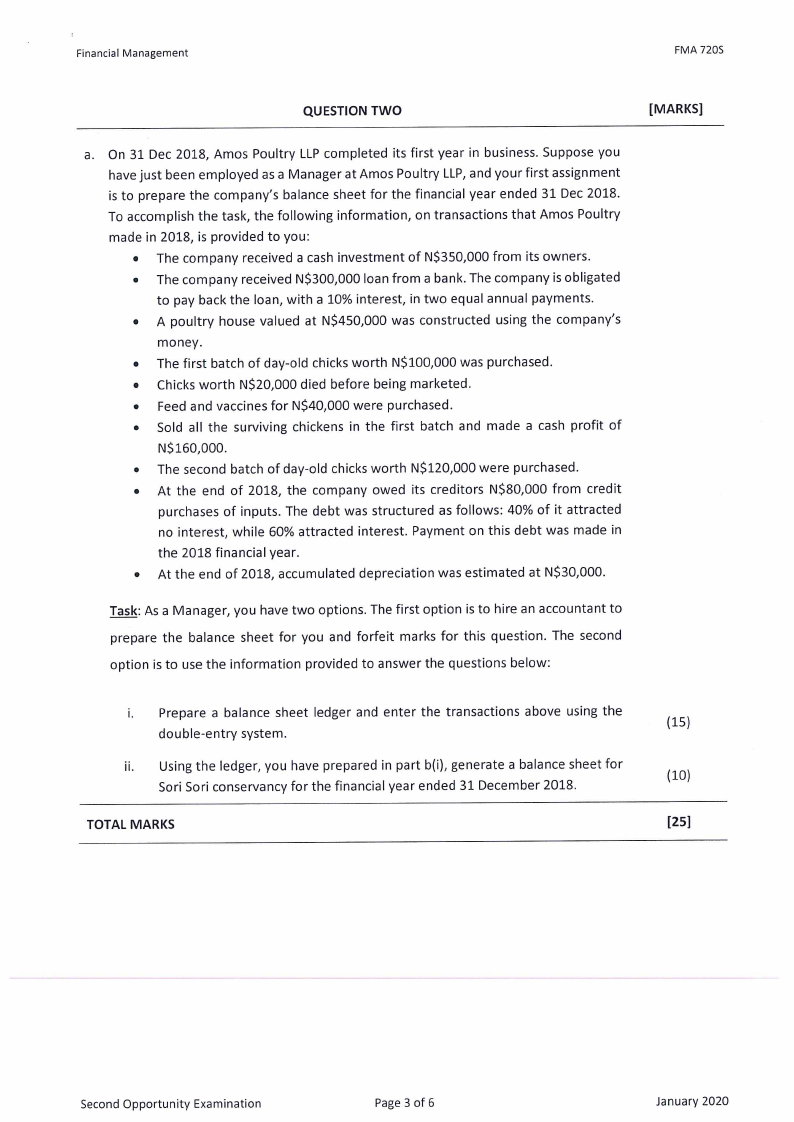

QUESTION TWO

[MARKS]

a. On 31 Dec 2018, Amos Poultry LLP completed its first year in business. Suppose you

have just been employed as a Manager at Amos Poultry LLP, and your first assignment

is to prepare the company’s balance sheet for the financial year ended 31 Dec 2018.

To accomplish the task, the following information, on transactions that Amos Poultry

made in 2018, is provided to you:

The company received a cash investment of N$350,000 from its owners.

The company received N$300,000 loan from a bank. The company is obligated

to pay back the loan, with a 10% interest, in two equal annual payments.

A poultry house valued at N$450,000 was constructed using the company’s

money.

The first batch of day-old chicks worth N$100,000 was purchased.

Chicks worth NS20,000 died before being marketed.

Feed and vaccines for NS40,000 were purchased.

Sold all the surviving chickens in the first batch and made a cash profit of

NS160,000.

The second batch of day-old chicks worth NS120,000 were purchased.

At the end of 2018, the company owed its creditors NS80,000 from credit

purchases of inputs. The debt was structured as follows: 40% of it attracted

no interest, while 60% attracted interest. Payment on this debt was made in

the 2018 financial year.

At the end of 2018, accumulated depreciation was estimated at N$30,000.

Task: As a Manager, you have two options. The first option is to hire an accountant to

prepare the balance sheet for you and forfeit marks for this question. The second

option is to use the information provided to answer the questions below:

Prepare a balance sheet ledger and enter the transactions above using the

(15)

double-entry system.

Using the ledger, you have prepared in part b(i), generate a balance sheet for

Sori Sori conservancy for the financial year ended 31 December 2018.

(10)

TOTAL MARKS

[25]

Second Opportunity Examination

Page 3 of 6

January 2020

|

4 Page 4 |

▲back to top |

Financial Management

FMA 7208

QUESTION THREE

[MARKS]

a. Describe the DuPont Analysis System, and briefly explain how you would use it to assess

'

the earning power of a company in terms of return on assets.

(5)

b. Briefly discuss the equity statement. Your discussion should highlight its structure,

.

purpose and use, and interpretation.

(5)

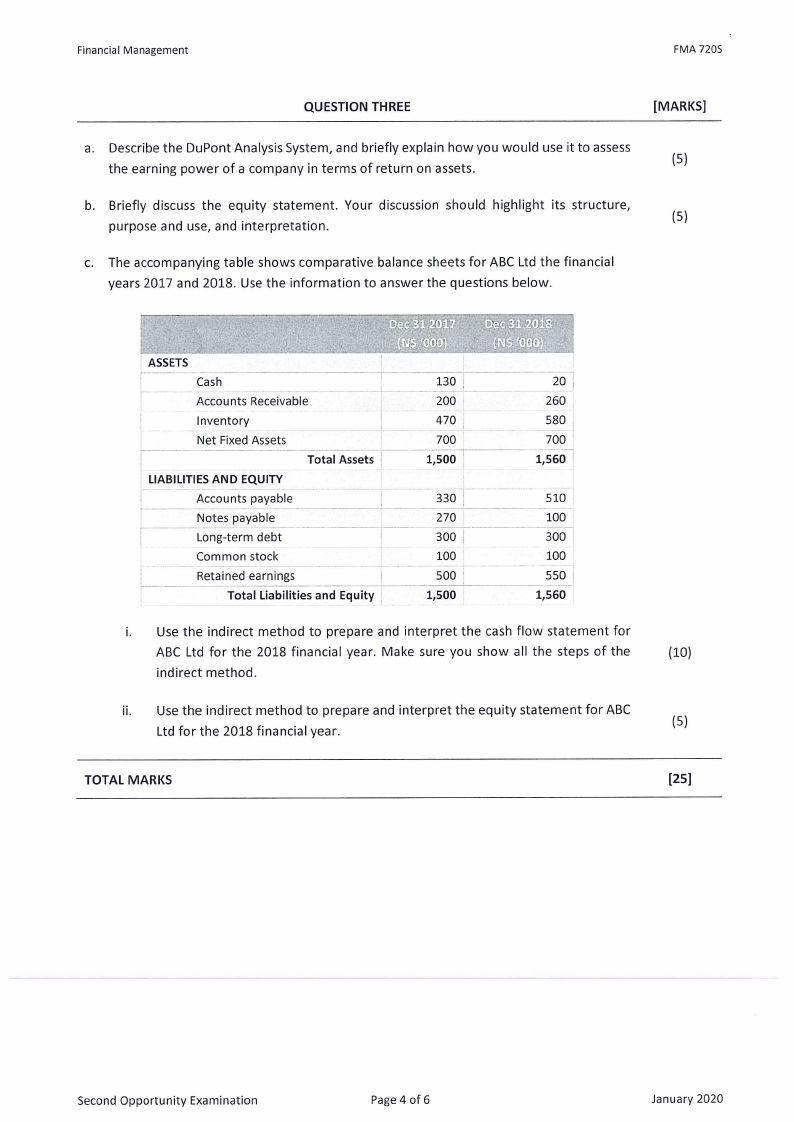

c. The accompanying table shows comparative balance sheets for ABC Ltd the financial

years 2017 and 2018. Use the information to answer the questions below.

“ASSETS

Cash

Accounts Receivable

Inventory

Net Fixed Assets

:

Total Assets ©

LIABILITIES AND EQUITY

Accounts payable

Notes payable

Long-term debt

Common stock

Retained earnings

Total Liabilities and Equity

130 |

200

470

700

1,500

330

270

300 |

100

500 ©

1,500

20

260

580

700

1,560

510

100

300

100

550

1,560

i. Use the indirect method to prepare and interpret the cash flow statement for

ABC Ltd for the 2018 financial year. Make sure you show all the steps of the

(10)

indirect method.

il. Use the indirect method to prepare and interpret the equity statement for ABC

.

Ltd for the 2018 financial year.

(5)

TOTAL MARKS

[25]

Second Opportunity Examination

Page 4 of 6

January 2020

|

5 Page 5 |

▲back to top |

Financial Management

FMA 7208S

QUESTION FOUR

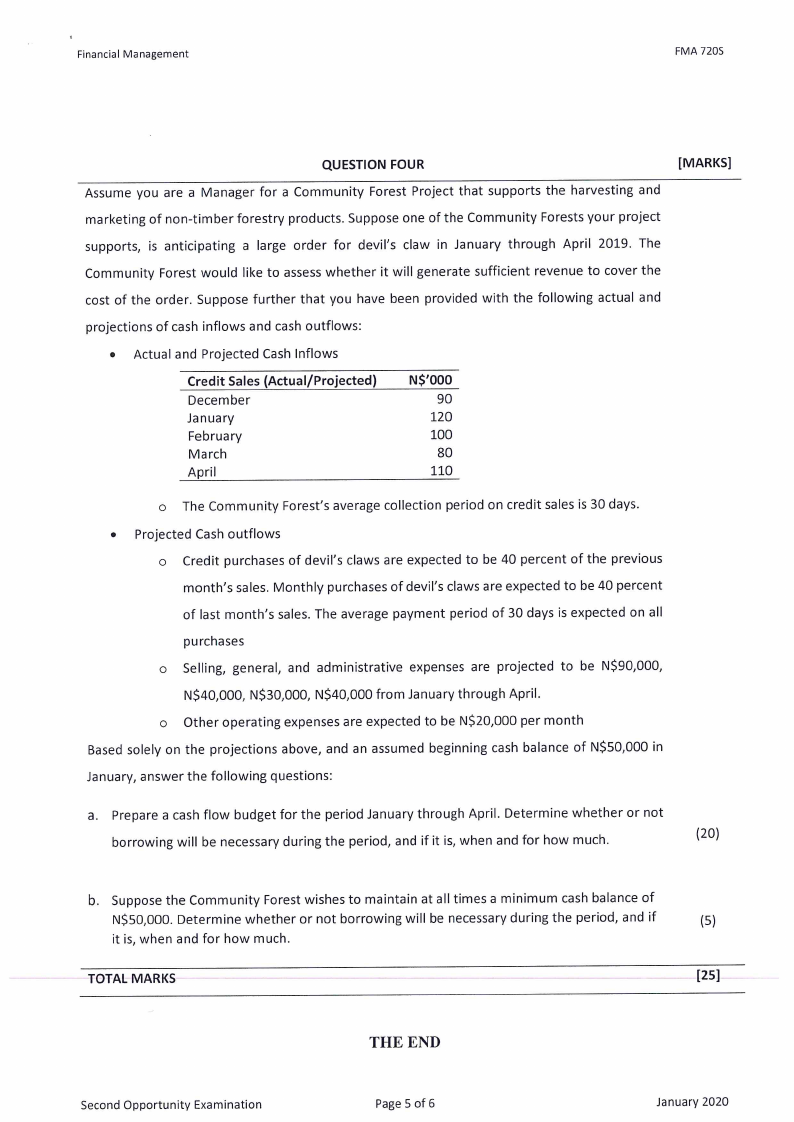

Assume you are a Manager for a Community Forest Project that supports the harvesting and

marketing of non-timber forestry products. Suppose one of the Community Forests your project

supports, is anticipating a large order for devil’s claw in January through April 2019. The

Community Forest would like to assess whether it will generate sufficient revenue to cover the

cost of the order. Suppose further that you have been provided with the following actual and

projections of cash inflows and cash outflows:

e Actual and Projected Cash Inflows

Credit Sales (Actual/Projected)

December

January

February

March

April

NS’000

90

120

100

80

110

[MARKS]

o The Community Forest’s average collection period on credit sales is 30 days.

e Projected Cash outflows

o Credit purchases of devil’s claws are expected to be 40 percent of the previous

month’s sales. Monthly purchases of devil’s claws are expected to be 40 percent

of last month’s sales. The average payment period of 30 days is expected on all

purchases

o Selling, general, and administrative expenses are projected to be N$90,000,

NS40,000, N$30,000, NS$40,000 from January through April.

o Other operating expenses are expected to be N$20,000 per month

Based solely on the projections above, and an assumed beginning cash balance of NS50,000 in

January, answer the following questions:

a. Prepare acash flow budget for the period January through April. Determine whether or not

borrowing will be necessary during the period, and if it is, when and for how much.

(20)

b. Suppose the Community Forest wishes to maintain at all times a minimum cash balance of

NS50,000. Determine whether or not borrowing will be necessary during the period, and if

(5)

it is, when and for how much.

TOTAL MARKS

[25]

Second Opportunity Examination

THE END

Page 5 of 6

January 2020

|

6 Page 6 |

▲back to top |