|

PDM611S - PROPERTY DEVELOPMENT AND MARKETING - 1ST OPP - JUNE 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF ENGINEERINGAND SPATIALSCIENCES

DEPARTMENT OF ARCHITECTURE AND SPATIAL SCIENCES

(LAND AND PROPERTYSECTION}

QUALIFICATION(S): BACHELOR OF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION(S) CODE: 08BPRS

06DPRS

NQF LEVEL: 6

COURSE CODE: PDM611S

COURSE NAME: PROPERTYDEVELOPMENT AND

MARKETING

EXAMS SESSION: JUNE 2022

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

SAMUEL ATO K. HAYFORD

MODERATOR: UAURIKA KAHIREKE

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 5 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 8 PAGES {Including this front page)

|

2 Page 2 |

▲back to top |

Property Development and Marketing

PDM611S

Question 1

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer

carries 1 mark.

(24)

a) Generally planning authorities in areas of low economic activities may influence property

development by imposing higher development standard in order to achieve a better balance

of land use and improved design of buildings.

b) Vacancy levels for commercial and retail spaces are measured in terms of rental units as

those for apartments are measured in square footage

c) Rental rates or levels provide a good indicator of the supply and demand situation for

income producing properties.

d) A positive Net Present Value (NPV) indicates that the projected earnings generated by a

project or investment - in future dollars terms - exceeds the anticipated costs, also in future

dollars.

e) By Discounted cash Flow technique for evaluating development projects, it is assumed that

an investment with a positive NPV will be profitable, and an investment with a negative NPV

will result in a net loss.

f) The decision criteria which form the basis for selection of mutually exclusive development

projects dictates that only investments with positive NPV values should be considered.

g) High vacancy rates indicate an oversupply of real estate which ultimately pressures rental

rates downward because there is so much competition among landlords for tenants.

h) When low occupancy rates occur, it is a landlord's market. The low rates create higher

demand for existing units which, in turn, keeps market prices higher.

First Opportunity Examination Question Paper Page 2 of 8

June 2022

|

3 Page 3 |

▲back to top |

Property Development and Marketing

PDM611S

i) Increase in number of properties listing for sale reflects a situation in which the cost of

renting a home is low as compared to the cost of buying a home

j) NPV is used in capital budgeting and investment planning to analyse the profitability of a

projected investment or project.

k) Market areas that boast of better highway network capacity usually tend to have

competitive advantage that enhances their ability to command high rent.

I) Rental revenues can be estimated by looking at comparable properties in the market and

benchmarking existing rental rates. Leasing brokers are the best sources for this type of

information.

m) Private sector developers may become involved in the initial land acquisition stage. To

assemble a large site from many landowners with smaller units, they can use their legal

powers of compulsory purchase to ensure the tenure to the land is secured.

n) Any time delay in the process of legal investigation for acquisition of site could potentially

delay commencement of work on the scheme and extend the total development period for

months or even years. Potential tenants are usually insensitive to this delay.

o) When selecting a site, careful consideration should be given to soil features of a site as this

can substantially impact the cost and even what can be built.

p) Market analysis for proposed real estate development considers market area, economic

trends, supply and demand indicators, market conditions, and feasibility factors. No due

cognizance must be given to Institutional factors such as culture, customs and traditions,

habitual ways of thinking and of doing things.

q) With an exclusive right to sell listing, the seller employs only one agent and must pay that

agent a commission regardless of whether it is the agent or the seller who finds a buyer

provided the buyer is found within the listing period.

r) Under an exclusive agency listing, the agent is given the exclusive right to represent the

First Opportunity Examination Question Paper Page 3 of 8

June 2022

|

4 Page 4 |

▲back to top |

Property Development and Marketing

PDM611S

seller, but the seller can avoid paying the agent a commission by selling the property to

someone not procured by the agent.

s) From the Real Estate investor's perspective, the client brief and spectacular architectural

design of the proposed development is central to the success of the development project

and its important cannot be underestimated.

t) Design and costing stages typically involve contribution from all the professional team

members. It is therefore the role of the Building Contractor to ensure there is fluent co-

ordination between each stage of the development when producing the design and costing.

u) By the Accounting Rate of Return (ARR) and the Discounted Cash Flow (DCF) techniques of

investment appraisal, a set of decision rules which can differentiate acceptable from

unacceptable alternatives is required.

v) The highest and best use of a site is usually the most costly building or the building producing

the highest net operating income.

w) In defining a market area for a housing project, a major link, for example, is place of

employment as determined by the time, expense and difficulty of the journey to work.

x) Failure to undertake market research deprives an investor the opportunity to know he is

offering an inferior product and service. Even worse, the investor may be trying to ask a

premium for an already outdated product.

[24]

First Opportunity Examination Question Paper Page 4 of 8

June 2022

|

5 Page 5 |

▲back to top |

Property Development and Marketing

PDM6115

Question 2

Existing building wear out or become less suitable to present use due to structural failure or

economic or functional obsolescence. Eventually rebuilding becomes necessary. Briefly account

for the three (3) forms by which Property Development response to such changes. Indicate the

basic requirement that is common to all of them.

(12)

[12]

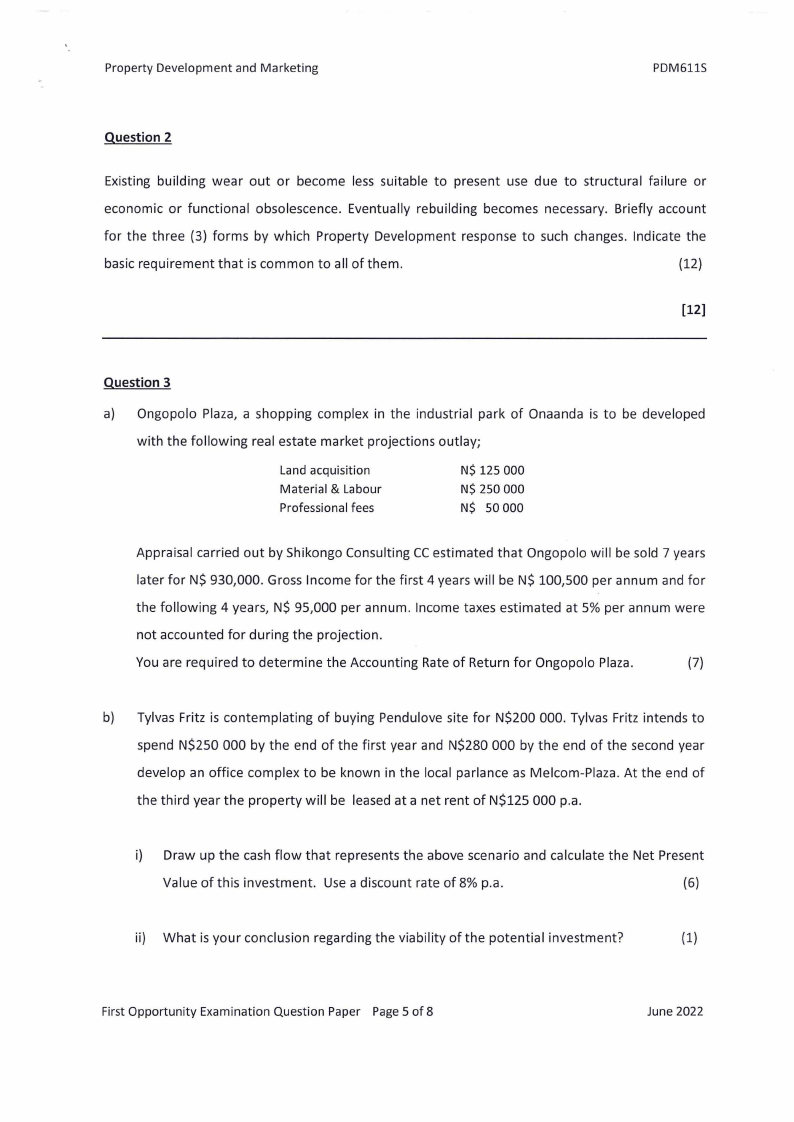

Question 3

a) Ongopolo Plaza, a shopping complex in the industrial park of Onaanda is to be developed

with the following real estate market projections outlay;

Land acquisition

Material & Labour

Professionalfees

N$ 125 000

N$ 250 000

N$ 50 000

Appraisal carried out by Shikongo Consulting CCestimated that Ongopolo will be sold 7 years

later for N$ 930,000. Gross Income for the first 4 years will be N$ 100,500 per annum and for

the following 4 years, N$ 95,000 per annum. Income taxes estimated at 5% per annum were

not accounted for during the projection.

You are required to determine the Accounting Rate of Return for Ongopolo Plaza.

(7)

b) Tylvas Fritz is contemplating of buying Pendulove site for N$200 000. Tylvas Fritz intends to

spend N$250 000 by the end of the first year and N$280 000 by the end of the second year

develop an office complex to be known in the local parlance as Melcom-Plaza. At the end of

the third year the property will be leased at a net rent of N$125 000 p.a.

i) Draw up the cash flow that represents the above scenario and calculate the Net Present

Value of this investment. Use a discount rate of 8% p.a.

(6)

ii) What is your conclusion regarding the viability of the potential investment?

(1)

FirstOpportunity Examination Question Paper Page5 of 8

June 2022

|

6 Page 6 |

▲back to top |

Property Development and Marketing

PDM611S

c) Briefly account for any one (1) of the following under main actors in Property development

process;

(3)

i) Landowner

(3)

ii) Estate Agents

(3)

iii) Local Authorities

(3)

d) Briefly explain the role of the Quantity Surveyor as an actor/consultant in a property

development process.

(3)

[20]

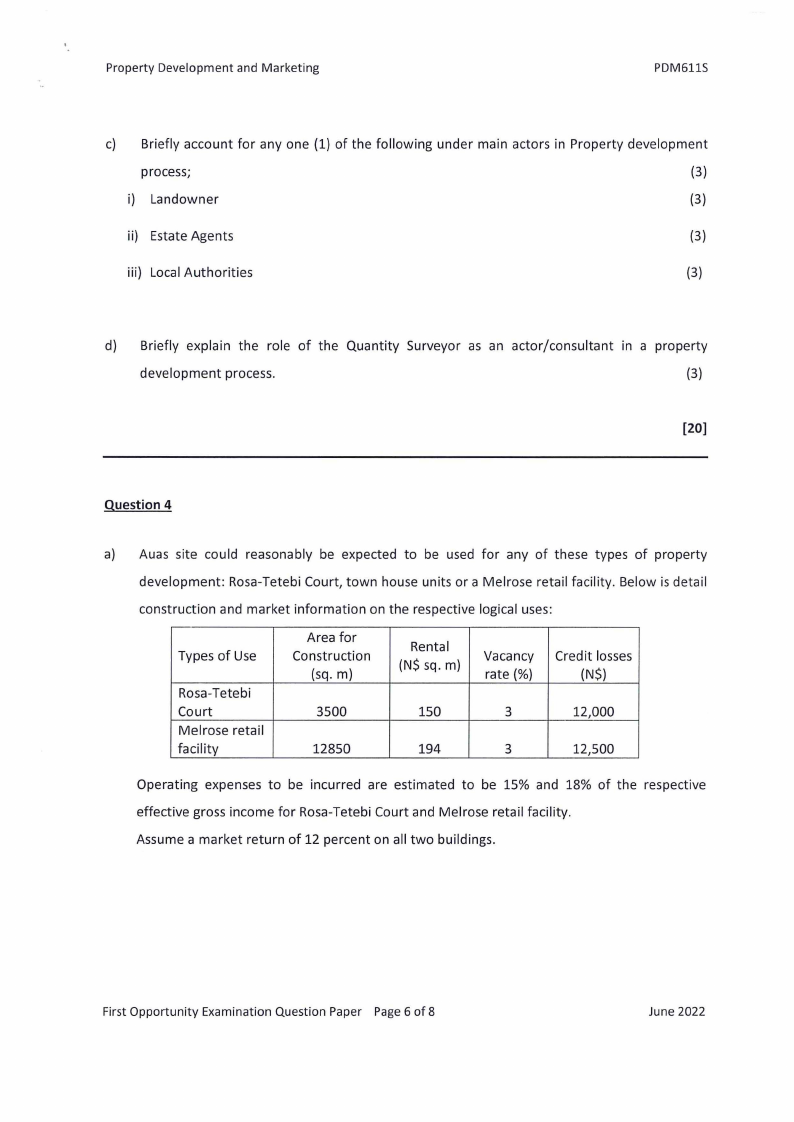

Question 4

a) Auas site could reasonably be expected to be used for any of these types of property

development: Rosa-Tetebi Court, town house units or a Melrose retail facility. Below is detail

construction and market information on the respective logical uses:

Types of Use

Rosa-Tetebi

Court

Melrose retail

facility

Area for

Construction

(sq. m)

3500

12850

Rental

(N$ sq. m)

Vacancy

rate(%)

Credit losses

(N$)

150

3

12,000

194

3

12,500

Operating expenses to be incurred are estimated to be 15% and 18% of the respective

effective gross income for Rosa-Tetebi Court and Melrose retail facility.

Assume a market return of 12 percent on all two buildings.

First Opportunity Examination Question Paper Page 6 of 8

June 2022

|

7 Page 7 |

▲back to top |

Property Development and Marketing

PDM611S

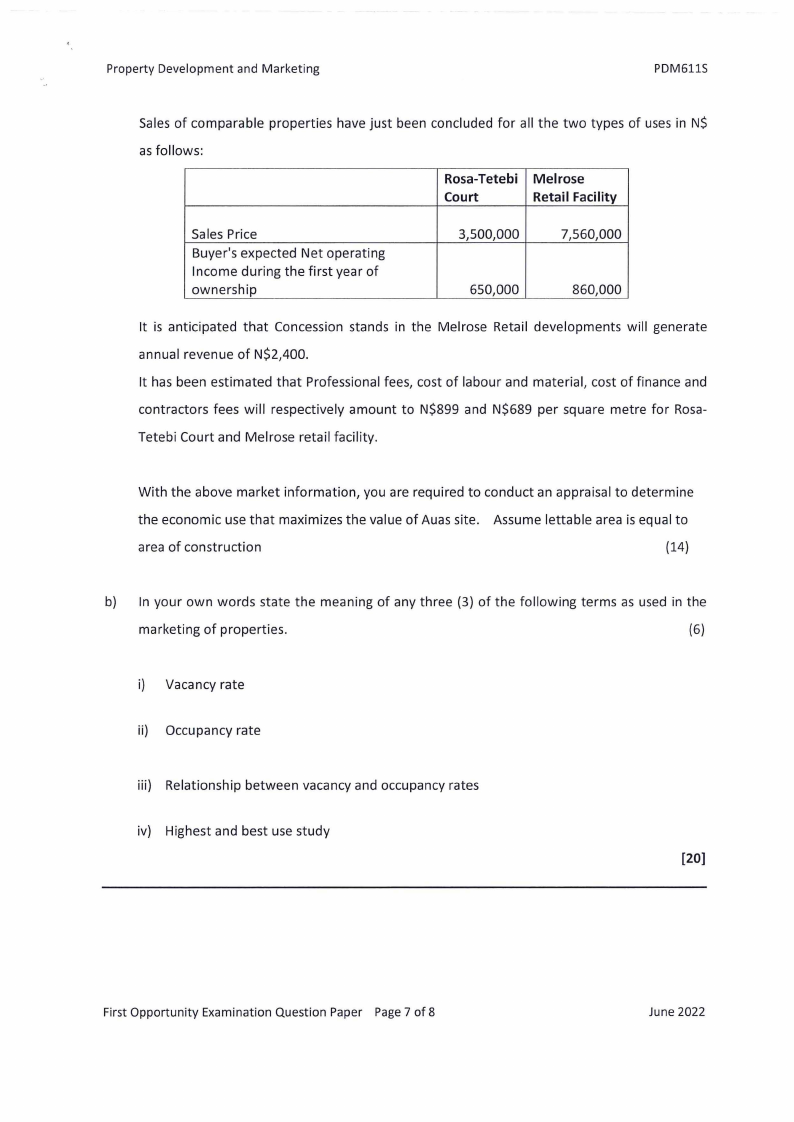

Sales of comparable properties have just been concluded for all the two types of uses in N$

as follows:

Rosa-Tetebi Melrose

Court

Retail Facility

Sales Price

Buyer's expected Net operating

Income during the first year of

ownership

3,500,000

7,560,000

650,000

860,000

It is anticipated that Concession stands in the Melrose Retail developments will generate

annual revenue of N$2,400.

It has been estimated that Professional fees, cost of labour and material, cost of finance and

contractors fees will respectively amount to N$899 and N$689 per square metre for Rosa-

Tetebi Court and Melrose retail facility.

With the above market information, you are required to conduct an appraisal to determine

the economic use that maximizes the value of Auas site. Assume lettable area is equal to

area of construction

(14)

b) In your own words state the meaning of any three (3) of the following terms as used in the

marketing of properties.

(6)

i) Vacancy rate

ii) Occupancy rate

iii) Relationship between vacancy and occupancy rates

iv) Highest and best use study

[20]

First Opportunity Examination Question Paper Page 7 of 8

June 2022

|

8 Page 8 |

▲back to top |

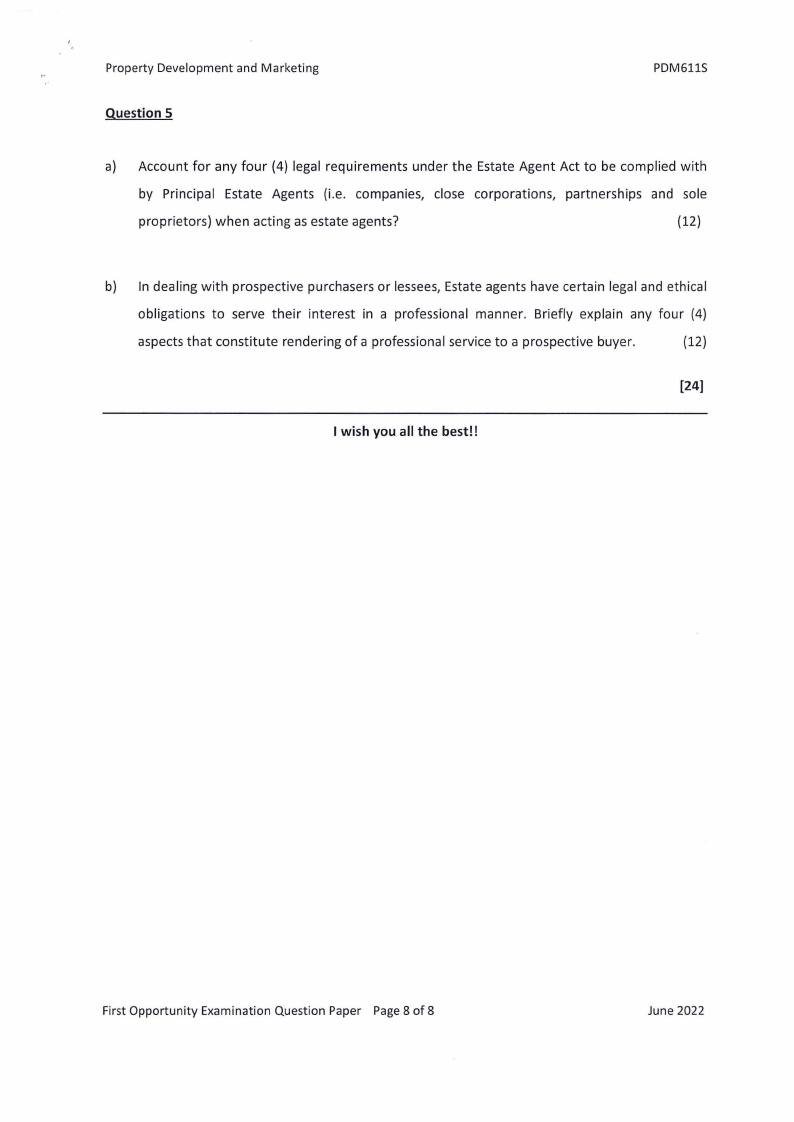

Property Development and Marketing

Question 5

PDM6115

a) Account for any four (4) legal requirements under the Estate Agent Act to be complied with

by Principal Estate Agents (i.e. companies, close corporations, partnerships and sole

proprietors) when acting as estate agents?

(12)

b) In dealing with prospective purchasers or lessees, Estate agents have certain legal and ethical

obligations to serve their interest in a professional manner. Briefly explain any four (4)

aspects that constitute rendering of a professional service to a prospective buyer.

(12)

[24]

I wish you all the best!!

First Opportunity Examination Question Paper Page 8 of 8

June 2022