|

PDM611S - PROPERTY DEVELOPMENT AND MARKETING - 2ND OPP - JULY 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOF ENGINEERINGAND SPATIALSCIENCES

DEPARTMENT OF ARCHITECTURE AND SPATIAL SCIENCES

(LANDAND PROPERTYSECTION}

QUALIFICATION(S): BACHELOR OF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION(S) CODE: 08BPRS

06DPRS

NQF LEVEL: 6

COURSE CODE: PDM611S

COURSE NAME: PROPERTYDEVELOPMENT AND

MARKETING

EXAMS SESSION: JULY 2022

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SECOND OPPORTUNITY /SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S) SAMUEL ATO K. HAYFORD

MODERATOR: UAURIKA KAHIREKE

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 4 questions.

4. You must answer ALL QUESTIONS .

5. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Property Development and Marketing

PDM6115

Question 1

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer

carries 1 mark.

(16)

a) The trend in the local property development for sale market that most investor watch

continually in order to make real estate investment decision is the trend in occupancy rate.

b) Given the way supply and demand cycles works in the property market, a low absorption

rate causes softer rental market (falling market rentals) rather than falling property prices.

c) The rental demand cycle of property owners is defined and determined on the basis of

absorption rate, and the trend can be observed by following the local absorption trend.

d) If existing properties are experiencing higher occupancy rates, prospective tenants may see

an opportunity to negotiate lower rents in older properties, thereby limiting the income

potential of a new building.

e) Real estate market analysis can be defined as identification and study of demand and supply.

The supply side are competitors; both existing stock and those at various stages in the

development pipeline.

f) Public development spending by government tends to correlate directly with the economic

climate, being increased when expansion of the economy is desired and decreased when it is

necessary to apply the brakes.

g) Public development decisions by government as a stakeholder in property development are

mostly undertaking on a political grounds.

h) Insurance companies enjoy the benefit of more control with an investment in property

company share than a direct Investment in property.

Second Opportunity Examination Question Paper Page 2 of 6

July 2022

|

3 Page 3 |

▲back to top |

Property Development and Marketing

PDM6115

i) Commercial estate agents are employed by firms to find accommodation. Estate Agents are,

therefore, a source of information on the assessment of unsatisfied demand relating to the

quantity and quality of space and preferred location.

j) The demand for space is to some extent a function of the strength of the local economy.

Types of employment and level of unemployment can help to show where the gaps exist in

the market or the manner in which the local economy might more successfully be filled.

k) Rentals are a reflection of scarcity, rising rent will tend to indicate unsatisfied demand whilst

static or falling rent are likely to indicate an oversupply of premises.

I) Real estate research for investment decision making focuses exclusively on design, layout,

services and building specifications required by users.

m) Market analysis for proposed real estate development considers market area, economic

trends, supply and demand indicators, market conditions, and feasibility factors. No due

cognizance must be given to Institutional factors such as culture, customs and traditions,

habitual ways of thinking and of doing things.

n) Residential developers who focus on building owner-occupied facilities usually only require

short-term development finance often over months rather than years.

o) The amount of money Residential developers need to borrow is comparatively larger in

contrast to commercial real estate developers.

p) Private sector developers may become involved in the initial land acquisition stage. To

assemble a large site from many landowners with smaller units they can use their legal

powers of compulsory purchase to ensure the tenure to the land is secured.

[16]

Second Opportunity Examination Question Paper Page 3 of 6

July 2022

|

4 Page 4 |

▲back to top |

Property Development and Marketing

PDM611S

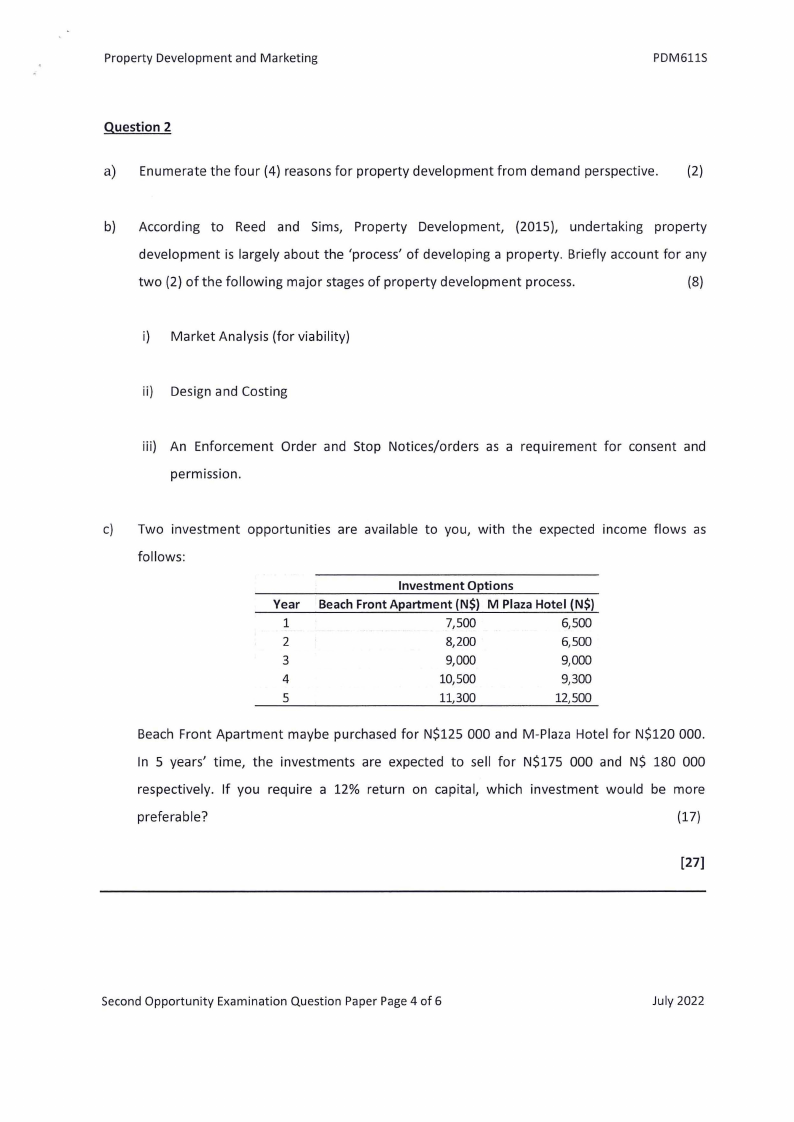

Question 2

a) Enumerate the four (4) reasons for property development from demand perspective. (2)

b) According to Reed and Sims, Property Development, (2015), undertaking property

development is largely about the 'process' of developing a property. Briefly account for any

two (2) of the following major stages of property development process.

(8)

i) Market Analysis (for viability)

ii) Design and Costing

iii) An Enforcement Order and Stop Notices/orders as a requirement for consent and

permission.

c) Two investment opportunities are available to you, with the expected income flows as

follows:

Year

1

2

3

4

5

Investment Options

Beach Front Apartment (N$) M Plaza Hotel (N$)

7,500

&~

6,500

9,000

9,000

10,500

9,300

11,300

12,500

Beach Front Apartment maybe purchased for N$125 000 and M-Plaza Hotel for N$120 000.

In 5 years' time, the investments are expected to sell for N$175 000 and N$ 180 000

respectively. If you require a 12% return on capital, which investment would be more

preferable?

(17)

[27]

Second Opportunity Examination Question Paper Page 4 of 6

July 2022

|

5 Page 5 |

▲back to top |

Property Development and Marketing

PDM611S

Question 3

a) Identify and briefly explain any two (2) types of listing contract (mandates) that may be

created in an agency relationship.

(6)

b) Discuss any three (3) significance of fiduciary relationship that exist between an estate agent

and their principals regarding their duties in an agency relationship.

(9)

c) Estate agents, in their relationship with prospective purchasers or lessees, have certain legal

and ethical obligations to serve their interest in a professional manner.

i) Briefly explain the process of qualifying the buyer in a professional manner by an Estate

Agent.

(8)

ii) Briefly discuss any three (3) areas that constitute rendering a professional service to a

prospective buyer.

(9)

[32]

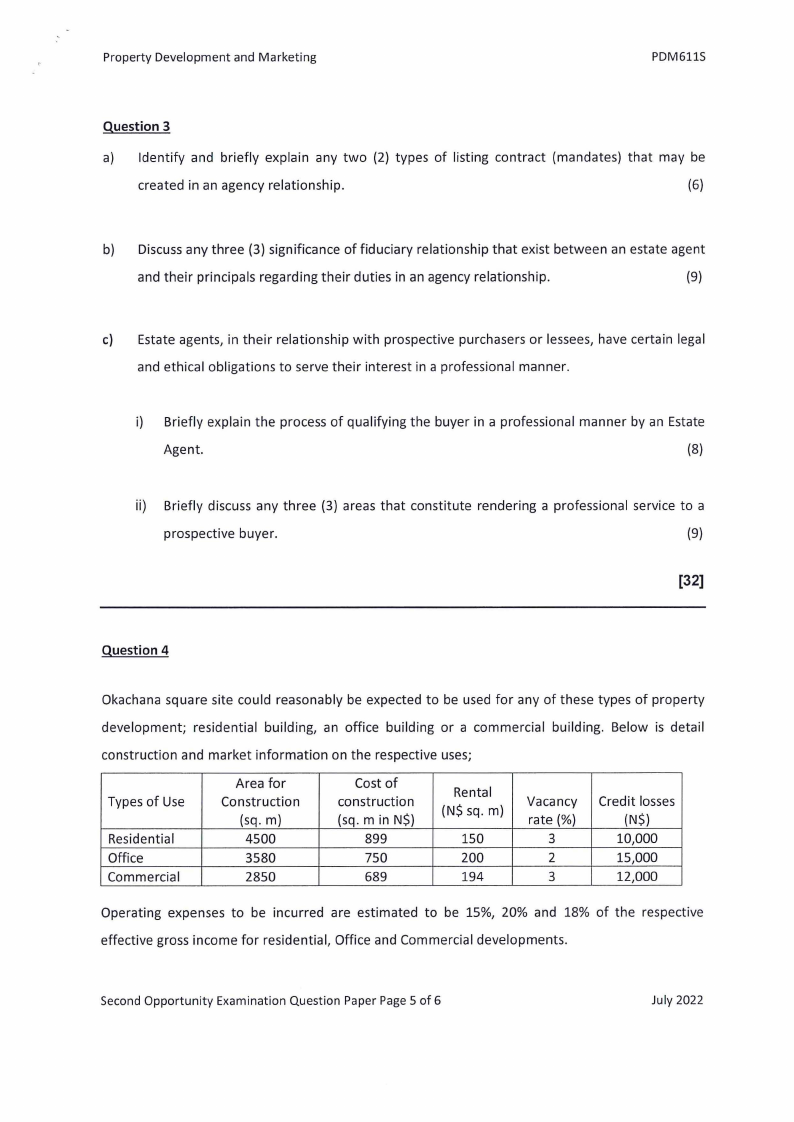

Question 4

Okachana square site could reasonably be expected to be used for any of these types of property

development; residential building, an office building or a commercial building. Below is detail

construction and market information on the respective uses;

Types of Use

Residentia I

Office

Commercial

Area for

Construction

(sq. m)

4500

3580

2850

Cost of

construction

(sq.min N$)

899

750

689

Rental

(N$ sq. m)

150

200

194

Vacancy

rate(%)

3

2

3

Credit losses

(N$)

10,000

15,000

12,000

Operating expenses to be incurred are estimated to be 15%, 20% and 18% of the respective

effective gross income for residential, Office and Commercial developments.

Second Opportunity Examination Question Paper Page 5 of 6

July 2022

|

6 Page 6 |

▲back to top |

Property Development and Marketing

PDM611S

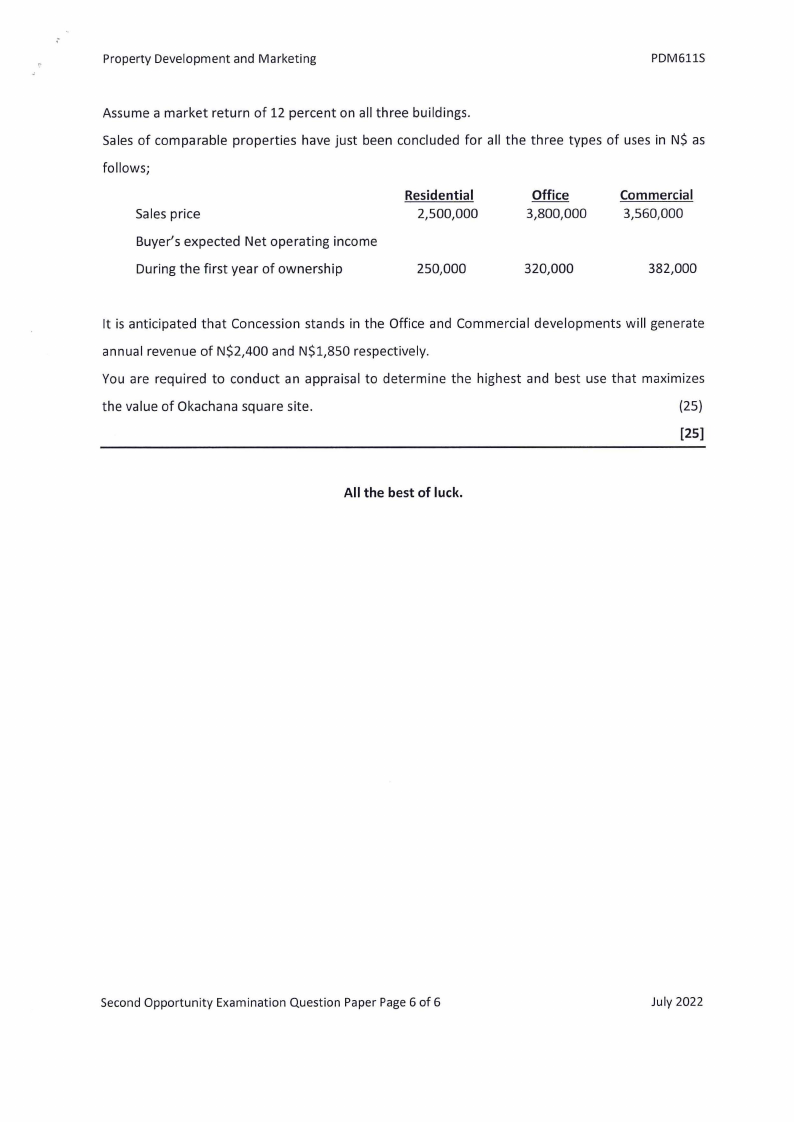

Assume a market return of 12 percent on all three buildings.

Sales of comparable properties have just been concluded for all the three types of uses in N$ as

follows;

Sales price

Residential

2,500,000

Office

3,800,000

Commercial

3,560,000

Buyer's expected Net operating income

During the first year of ownership

250,000

320,000

382,000

It is anticipated that Concession stands in the Office and Commercial developments will generate

annual revenue of N$2,400 and N$1,850 respectively.

You are required to conduct an appraisal to determine the highest and best use that maximizes

the value of Okachana square site.

(25}

[25]

All the best of luck.

Second Opportunity Examination Question Paper Page 6 of 6

July 2022