|

LEM621S - LAND ECONOMICS - 1ST OPP - NOV 2022 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIAL SCIENCES

(LAND AND PROPERTY SECTION}

QUALIFICATION(S): BACHELOR OF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

BACHELOR OF LAND ADMINISTRATION

QUALIFICATION(S) CODE: 08BPRS

06DPRS

NQF LEVEL: 6

07BLAM

COURSE CODE: LEM621S

COURSE NAME: LAND ECONOMICS

EXAMS SESSION: NOVEMBER 2022

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION PAPER

UAURIKA KAHIREKE

MODERATOR: SAMUEL ATO K. HAYFORD

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 6 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S}.

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page}

|

2 Page 2 |

▲back to top |

t:.and Economics

Question 1

LEM621S

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer

carries 1 mark.

(20)

a) Property tax satisfies the principle of equity because as a progressive tax system, the rate of

tax rises with increasing rateable values of property.

b) In situations where the law fixes the rate of property tax in primary legislation, the tax

revenues will vary according to changes in market values and regular revaluations.

c) Given any urban use of land (i.e., Residential, industrial or commercial), operations carried

out within their areas of highest and best use are profitable, but not as profitable as those

carried out within their zones of transference.

d) Land use capacity measures the productive potential of a given parcel of land utilized for a

given use at a given time with a specified technological and production conditions.

e) According to Von Thunen's Theory of Least-cost location activities located beyond the no-

rent margin can be profitable only when the gains in reduction in labour and management

costs more than compensate transportation cost (loss).

f) Bid rent theory assumes that in a free market the highest bidder will obtain the use of the

land. It stands to reason that the highest bidder is likely to be the one who can obtain the

maximum profit per square metre from the site and so can pay the highest rent.

g) Profit-making land uses are those uses that produce satisfaction (utility) to the users of land

whilst non-profit making land uses are those that give only monetary benefits to the users of

land.

h) The concept of use capacity is used in land economics to give an indication of relative

abilities of a single parcel to provide net returns or other satisfactions.

First Opportunity Examination Question Paper Page 2 of 6

November 2022

|

3 Page 3 |

▲back to top |

land Economics

LEM621S

i) Anticipated flows of land rent provide a guide for the decisions operators make concerning

prospective investments in new or existing land resource development.

j) The taxability of a property owner in term of property tax is determined by the product of

the tax base and the tax rate expressed as a percentage of the tax base as the case may be.

k) The base for (especially residential) property tax is typically calculated using an estimate of

the market value of the property. The determination of this assessment ratio is typically at

the discretion of the taxing authority.

I) The success of the primary task of using the cost approach to estimate the market value of

all taxable properties requires data on a substantial number of recent sales of comparable

properties.

m) The income capitalization approach for estimating the rental value of taxable property

requires information on income and operating expenses for the property. The gross income

stream is generated by the property is discounted at an appropriate rate to determine the

property's value.

n) The property tax rate adopted annually by a taxing authority is typically set by the central

government.

o) Property taxes are normally accompanied by tax limitations. This may take the form of

limitation by the central government on percentage of rates.

p) Rental value assessment seems likely to lead to inaccurate estimates of property values with

a high tendency towards underestimation by property owners.

q) Landlords usually make rental concessions during periods when the supply of tenants is low.

This occurs during and when an economy experiences rapid growth.

r) A method of assessment that requires property owners to tax themselves without a credible

verification process will obviously boast the size of the tax base.

First Opportunity Examination Question Paper Page 3 of 6

November 2022

|

4 Page 4 |

▲back to top |

!:.and Economics

LEM621S

s) Land by itself has little economic value until it is used in conjunction with inputs of capital,

labour and management.

t) Property as a medium of investment differs considerably in its qualities and characteristics

compared with other forms of investment.

[20]

Question 2

a) Define land economics from a legal perspective?

(2)

b) Are markets for land economically efficient? How can governments assist with the

achievement of market efficiency?

(5)

c) What is the role of institutions in the allocation of land resources? Explain in the context of

economic allocation of land resource to different users.

(4)

d) Discus the significance of land as:

i) A consumption good;

(3)

ii) Situation; and

(3)

iii) Property

(3)

[20]

First Opportunity Examination Question Paper Page 4 of 6

November 2022

|

5 Page 5 |

▲back to top |

Land Economics

Question 3

LEM621S

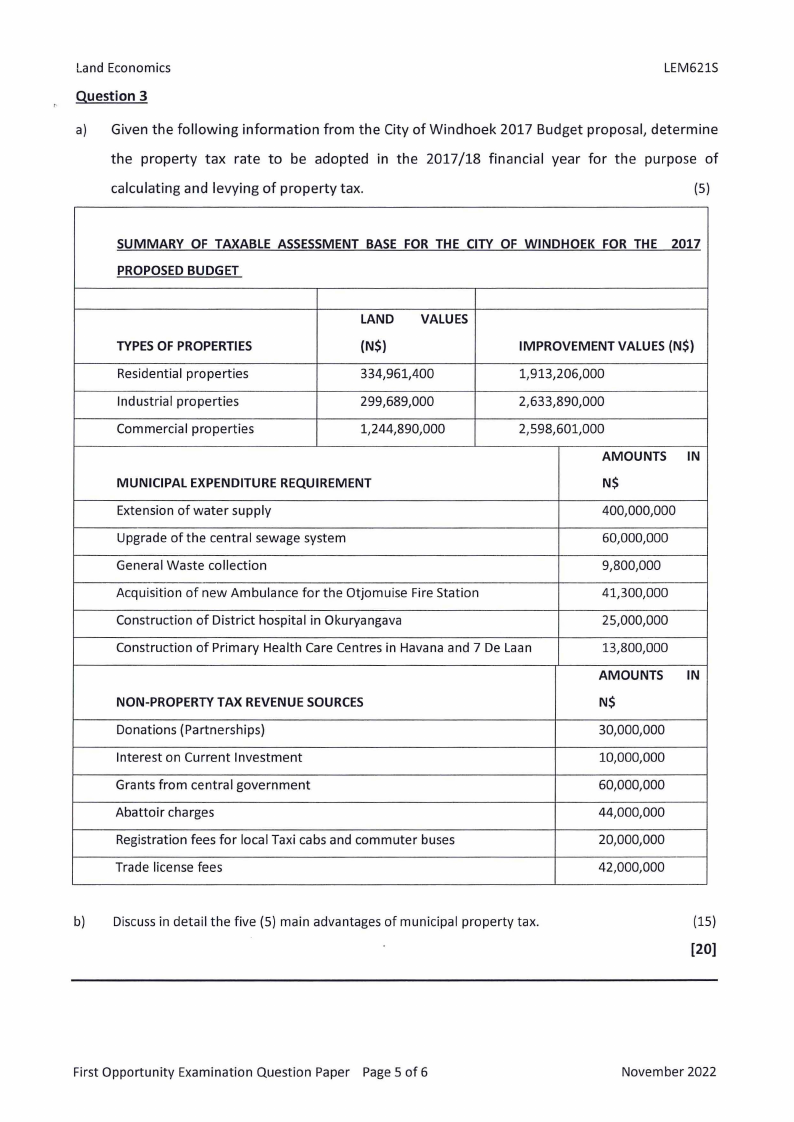

a) Given the following information from the City of Windhoek 2017 Budget proposal, determine

the property tax rate to be adopted in the 2017/18 financial year for the purpose of

calculating and levying of property tax.

(5)

SUMMARY OF TAXABLE ASSESSMENT BASE FOR THE CITY OF WINDHOEK FOR THE 2017

PROPOSED BUDGET

LAND VALUES

TYPES OF PROPERTIES

(N$)

IMPROVEMENT VALUES (N$)

Residential properties

334,961,400

1,913,206,000

Industrial properties

299,689,000

2,633,890,000

Commercial properties

1,244,890,000

2,598,601,000

AMOUNTS IN

MUNICIPAL EXPENDITURE REQUIREMENT

N$

Extension of water supply

400,000,000

Upgrade of the central sewage system

60,000,000

General Waste collection

9,800,000

Acquisition of new Ambulance for the Otjomuise Fire Station

41,300,000

Construction of District hospital in Okuryangava

25,000,000

Construction of Primary Health Care Centres in Havana and 7 De Laan

13,800,000

AMOUNTS IN

NON-PROPERTY TAX REVENUE SOURCES

N$

Donations (Partnerships)

30,000,000

Interest on Current Investment

10,000,000

Grants from central government

60,000,000

Abattoir charges

44,000,000

Registration fees for local Taxi cabs and commuter buses

20,000,000

Trade license fees

42,000,000

b) Discuss in detail the five (5) main advantages of municipal property tax.

(15)

[20]

First Opportunity Examination Question Paper Page 5 of 6

November 2022

|

6 Page 6 |

▲back to top |

1,and Economics

Question 4

LEM621S

a) Supply of land for specific uses is comparatively static in the short term i.e., it takes some

time to react to changes in demand. Fully outline on the reasons for the above.

(6)

b) Outline why it is important for local authorities to introduce property tax?

(7)

c) Inflation is termed as a one of the influential demand factors in an urban land market. Fully

account how property investment becomes attractive during an increasing inflation

environment?

(4)

d) Von Thunen's and Ricardo Theories of Least-cost location and fertility attributed the

formation of land rent over a piece of land to various factors. Outline the factors responsible

for land rent formation.

(3)

[20]

Question 5

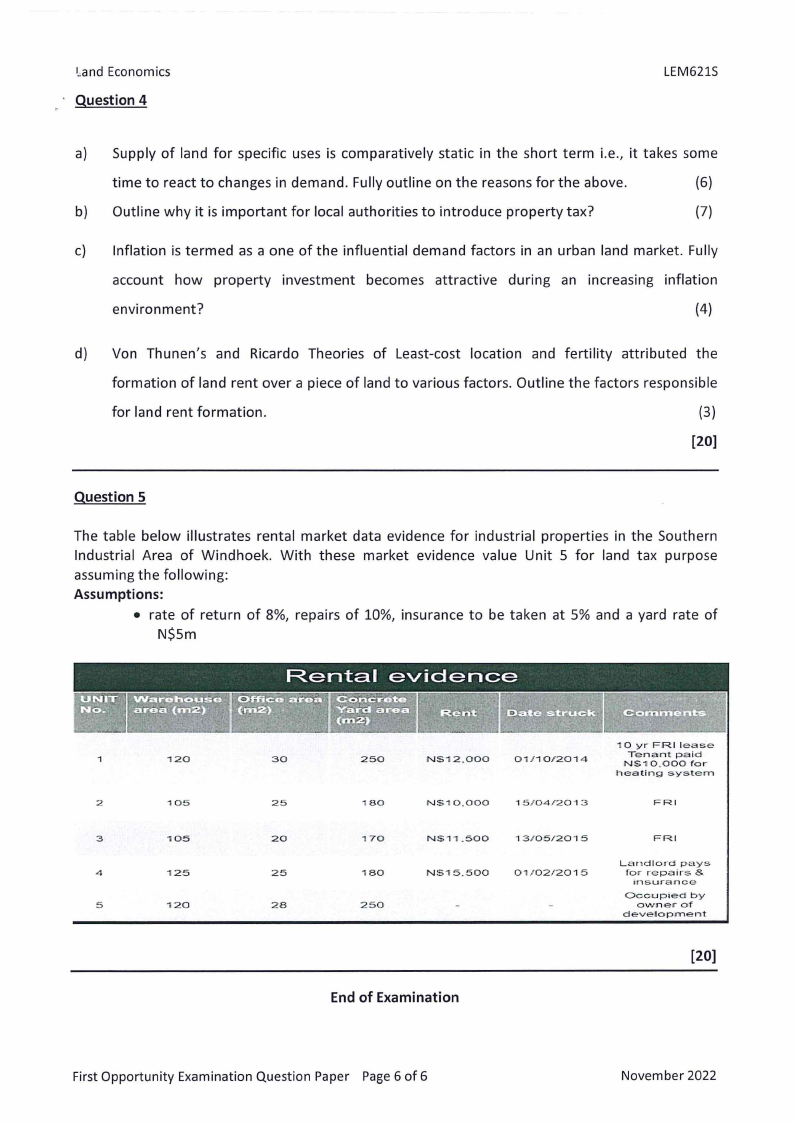

The table below illustrates rental market data evidence for industrial properties in the Southern

Industrial Area of Windhoek. With these market evidence value Unit 5 for land tax purpose

assuming the following:

Assumptions:

• rate of return of 8%, repairs of 10%, insurance to be taken at 5% and a yard rate of

N$Sm

120

2

105

3

105

4

125

5

120

30

250

NS"12,000

0"1/10/2014

25

180

NS,0.000

15/04.l2013

20

170

Nrs·11.soo

13/05/2015

25

180

NS15.500

01/02/2015

28

250

End of Examination

"10 yr FRI lease

Tenant

pai-d

NS10,000

for

heating

si,·stem

FRI

FRI

Landlo,·d

for repairs

insurance

Occup,ed

o-\\.vne,-

development

pays

&

by

o,f

[20]

First Opportunity Examination Question Paper Page 6 of 6

November 2022