|

FAC511S-FINANCIAL ACCOUNTING 101-1ST OPP- NOV 2025 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE AnD TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF MARKETING/BACHELOR OF LOGISTICS AND SUPPLY

CHAIN MANAGEMENT

QUALIFICATION

07BLSC

CODE:

07MARB/

LEVEL: 5

COURSE CODE: FAC 511S

COURSE NAME: FINANCIAL ACCOUNTING 101

DATE: JANUARY2025

DURATION: 3 HOURS

PAPER: THEORYAND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION PAPER

EXAMINER(S) Dr. D.R. MUZIRA

MODERATOR: CALISTUS MAHINDI

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect

the reality and may be purely coincidental.

7. SHOW ALL WORKINGS!

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

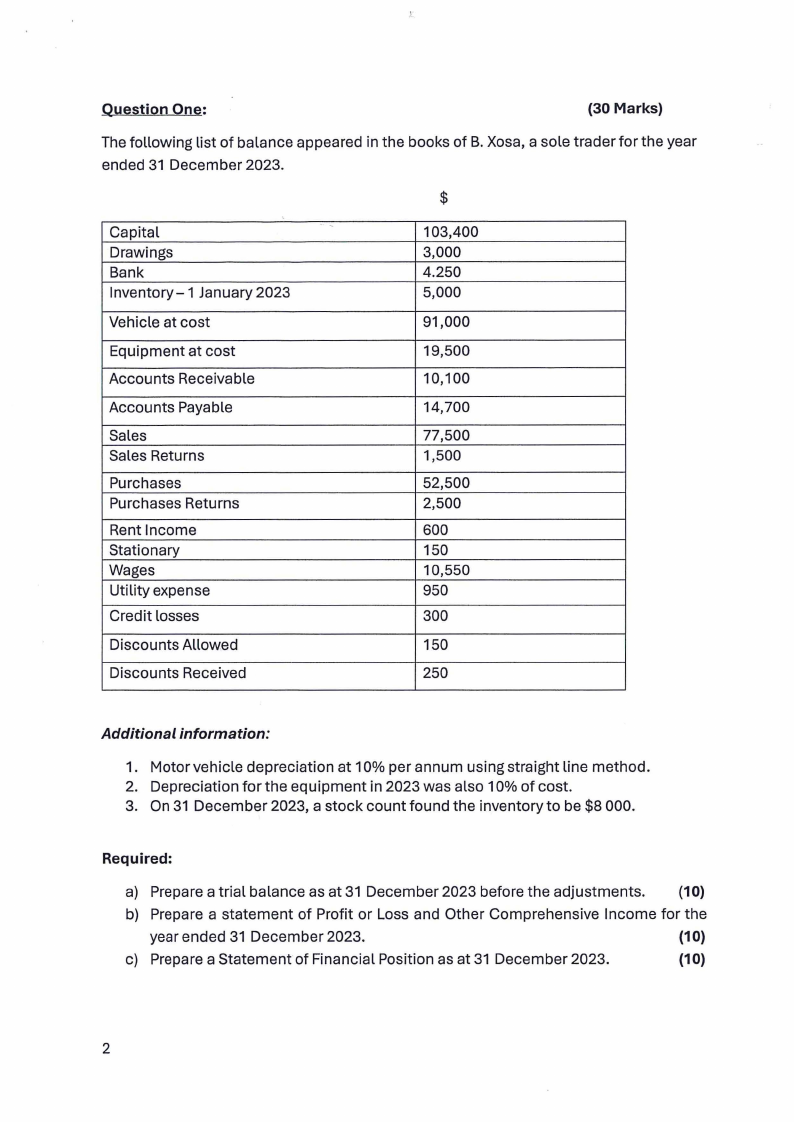

QuestionOne:

(30 Marks)

The following list of balance appeared in the books of B. Xosa, a sole trader for the year

ended 31 December 2023.

Capital

-

Drawings

Bank

lnventory-1 January 2023

Vehicle at cost

Equipment at cost

Accounts Receivable

Accounts Payable

Sales

Sales Returns

Purchases

Purchases Returns

Rent Income

Stationary

Wages

Utility expense

Credit losses

Discounts Allowed

Discounts Received

$

103,400

3,000

4.250

5,000

91,000

19,500

10,100

14,700

77,500

1,500

52,500

2,500

600

150

10,550

950

300

150

250

Additional information:

1. Motor vehicle depreciation at 10% per annum using straight line method.

2. Depreciation for the equipment in 2023 was also 10% of cost.

3. On 31 December 2023, a stock count found the inventory to be $8 000.

Required:

a) Prepare a trial balance as at 31 December 2023 before the adjustments.

(10)

b) Prepare a statement of Profit or Loss and Other Comprehensive Income for the

year ended 31 December 2023.

(10)

c) Prepare a Statement of Financial Position as at 31 December 2023.

(1 O)

2

|

3 Page 3 |

▲back to top |

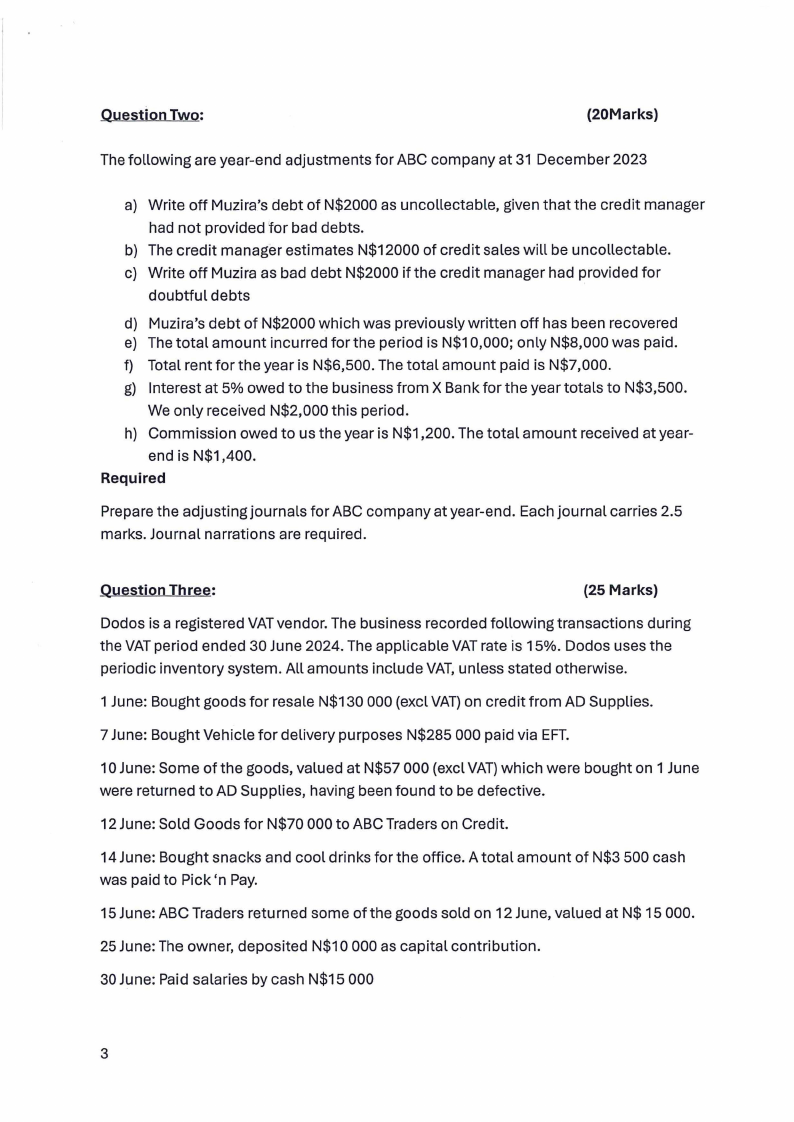

Question Two:

(20Marks)

The following are year-end adjustments for ABC company at 31 December 2023

a) Write off Muzira's debt of N$2000 as uncollectable, given that the credit manager

had not provided for bad debts.

b) The credit manager estimates N$12000 of credit sales will be uncollectable.

c) Write off Muzira as bad debt N$2000 if the credit manager had provided for

doubtful debts

d) Muzira's debt of N$2000 which was previously written off has been recovered

e) The total amount incurred for the period is N$10,000; only N$8,000 was paid.

f) Total rent for the year is N$6,500. The total amount paid is N$7,000.

g) Interest at 5% owed to the business from X Bank for the year totals to N$3,500.

We only received N$2,000 this period.

h) Commission owed to us the year is N$1,200. The total amount received at year-

end is N$1 ,400.

Required

Prepare the adjusting journals for ABC company at year-end. Each journal carries 2.5

marks. Journal narrations are required.

Question Three:

(25 Marks)

Dodos is a registered VATvendor. The business recorded following transactions during

the VATperiod ended 30 June 2024. The applicable VATrate is 15%. Dodos uses the

periodic inventory system. All amounts include VAT,unless stated otherwise.

1 June: Bought goods for resale N$130 000 (excl VAT)on credit from AD Supplies.

7 June: Bought Vehicle for delivery purposes N$285 000 paid via EFT.

10 June: Some of the goods, valued at N$57 000 (excl VAT}which were bought on 1 June

were returned to AD Supplies, having been found to be defective.

12 June: Sold Goods for N$70 000 to ABC Traders on Credit.

14 June: Bought snacks and cool drinks for the office. A total amount of N$3 500 cash

was paid to Pick 'n Pay.

15 June: ABC Traders returned some of the goods sold on 12 June, valued at N$ 15 000.

25 June: The owner, deposited N$10 000 as capital contribution.

30 June: Paid salaries by cash N$15 000

3

|

4 Page 4 |

▲back to top |

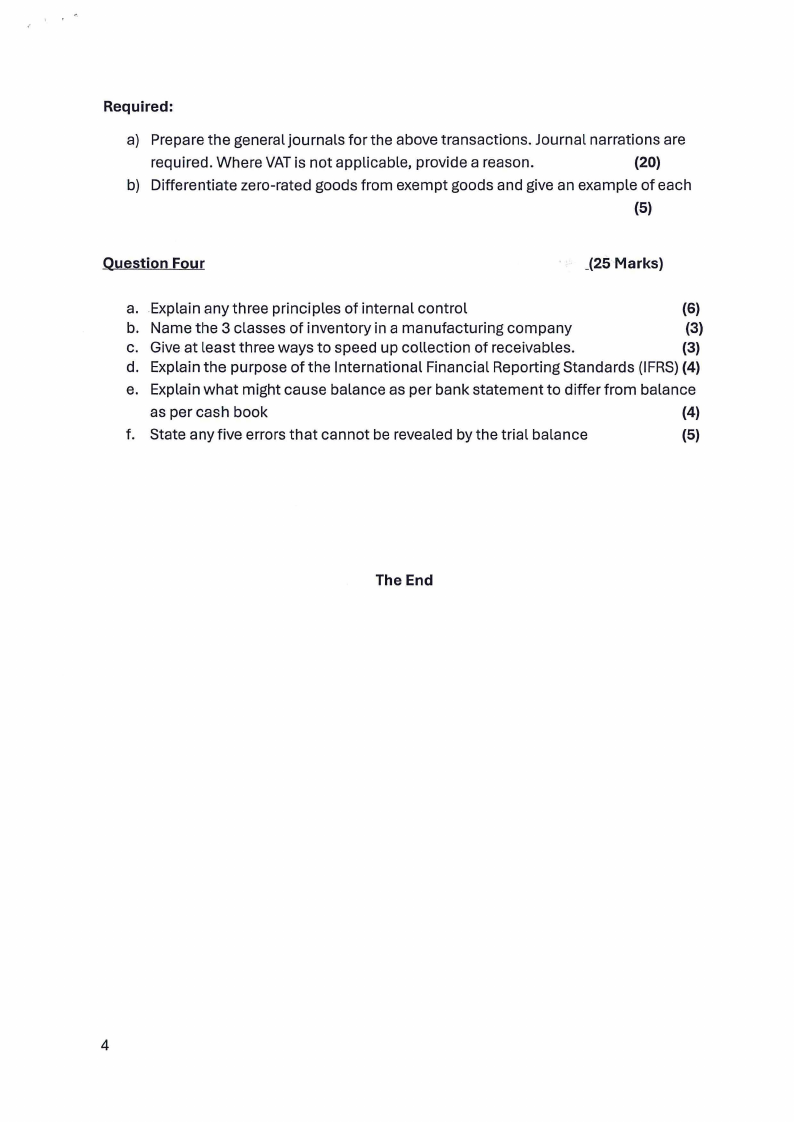

Required:

a) Prepare the general journals for the above transactions. Journal narrations are

required. Where VATis not applicable, provide a reason.

(20)

b) Differentiate zero-rated goods from exempt goods and give an example of each

(5)

Question Four

_(25 Marks)

a. Explain any three principles of internal control

(6)

b. Name the 3 classes of inventory in a manufacturing company

(3)

c. Give at least three ways to speed up collection of receivables.

(3)

d. Explain the purpose of the International Financial Reporting Standards (IFRS)(4)

e. Explain what might cause balance as per bank statement to differ from balance

as per cash book

(4)

f. State any five errors that cannot be revealed by the trial balance

(5)

The End

4