|

ITA412S- INTRODUCTION TO ACCOUNTING- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BRIDGING PROGRAMME

QUALIFICATION CODE: 04NBR

COURSE CODE: ITA412S

LEVEL: 4

COURSE NAME: INTRODUCTION TO

ACCOUNTING

SESSION: NOVEMBER 2023

DURATION: 3 HOURS

PAPER: THEORY AND APPLICATION

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Kuhepa Tjondu

MODERATOR: Daniel Kamotho

INSTRUCTIONS

• This question paper is made up of THREE (3) questions.

• Answer ALL the questions and in blue or black ink.

• Start each question on a new page in your answer booklet & show all your workings

• Questions relating to this test may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

• The names of people and businesses used throughout this test paper do not reflect the

reality and are purely coincidental.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

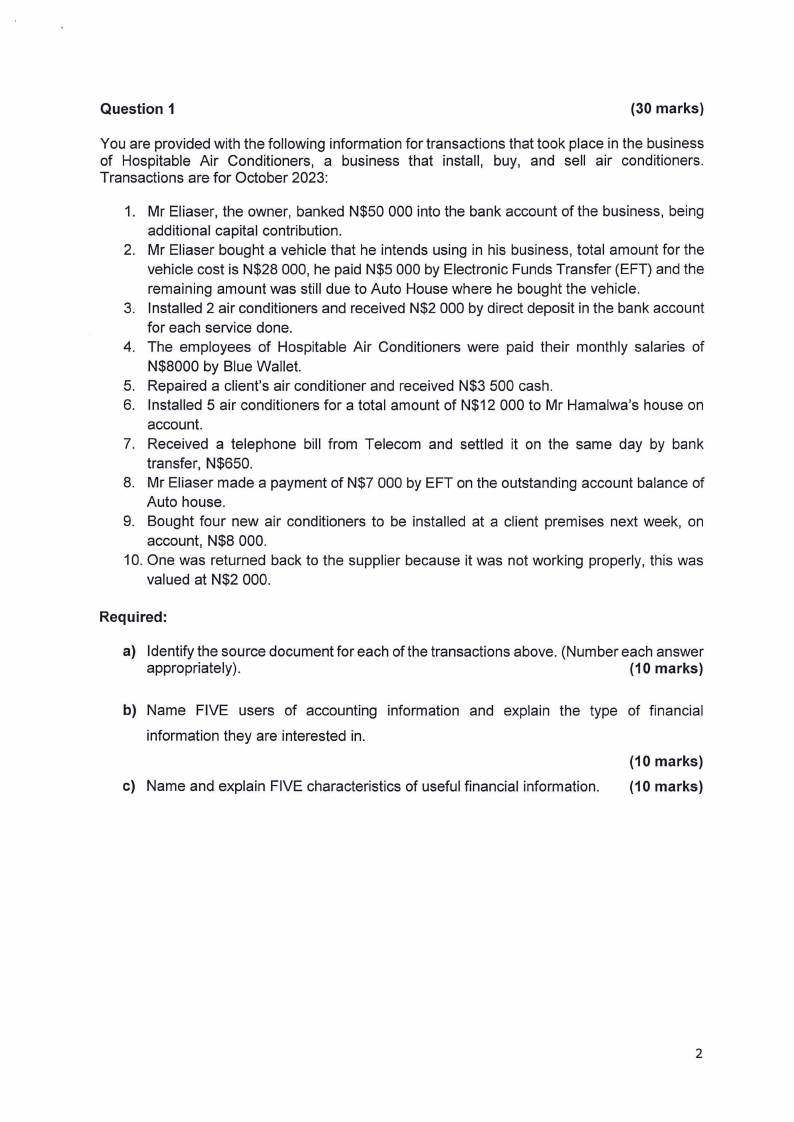

Question 1

(30 marks)

You are provided with the following information for transactions that took place in the business

of Hospitable Air Conditioners, a business that install, buy, and sell air conditioners.

Transactions are for October 2023:

1. Mr Eliaser, the owner, banked N$50 000 into the bank account of the business, being

additional capital contribution.

2. Mr Eliaser bought a vehicle that he intends using in his business, total amount for the

vehicle cost is N$28 000, he paid N$5 000 by Electronic Funds Transfer (EFT) and the

remaining amount was still due to Auto House where he bought the vehicle.

3. Installed 2 air conditioners and received N$2 000 by direct deposit in the bank account

for each service done.

4. The employees of Hospitable Air Conditioners were paid their monthly salaries of

N$8000 by Blue Wallet.

5. Repaired a client's air conditioner and received N$3 500 cash.

6. Installed 5 air conditioners for a total amount of N$12 000 to Mr Hamalwa's house on

account.

7. Received a telephone bill from Telecom and settled it on the same day by bank

transfer, N$650.

8. Mr Eliaser made a payment of N$7 000 by EFT on the outstanding account balance of

Auto house.

9. Bought four new air conditioners to be installed at a client premises next week, on

account, N$8 000.

10. One was returned back to the supplier because it was not working properly, this was

valued at N$2 000.

Required:

a) Identify the source document for each of the transactions above. (Number each answer

appropriately).

(10 marks)

b) Name FIVE users of accounting information and explain the type of financial

information they are interested in.

(10 marks)

c) Name and explain FIVE characteristics of useful financial information. (10 marks)

2

|

3 Page 3 |

▲back to top |

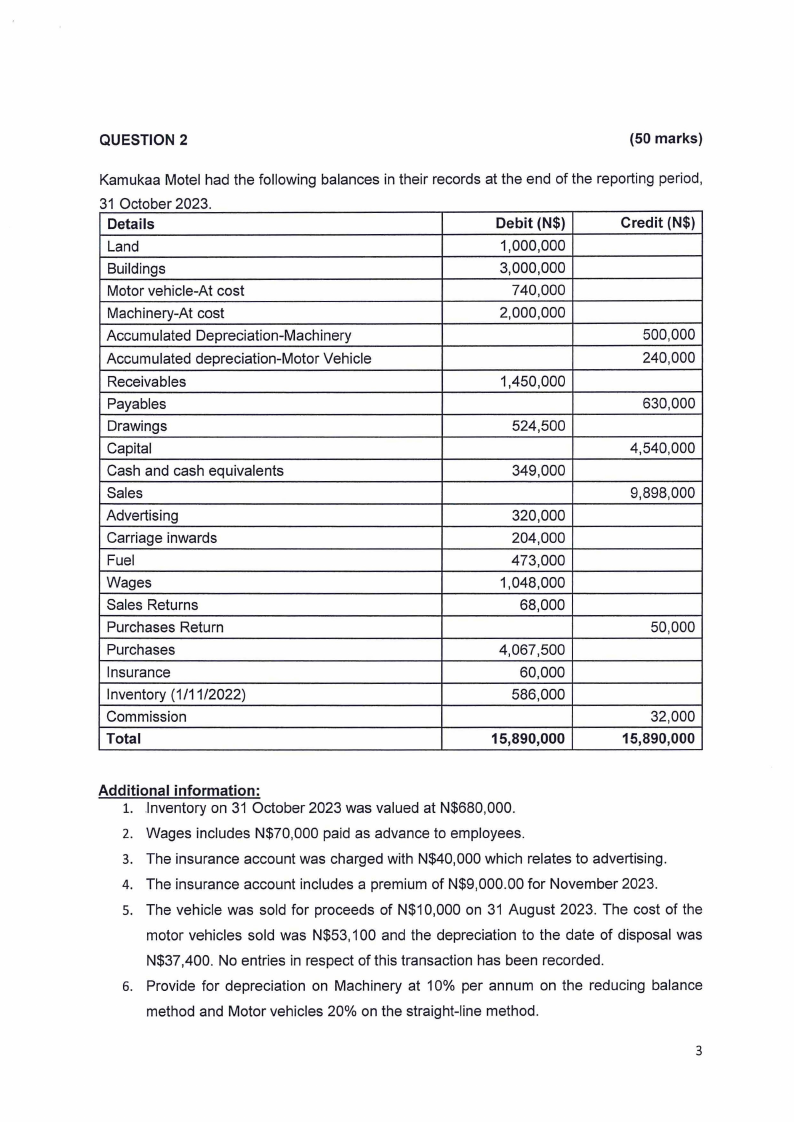

QUESTION 2

(50 marks)

Kamukaa Motel had the following balances in their records at the end of the reporting period,

31 October 2023.

Details

Land

Buildings

Motor vehicle-At cost

Machinery-At cost

Accumulated Depreciation-Machinery

Accumulated depreciation-Motor Vehicle

Debit (N$)

1,000,000

3,000,000

740,000

2,000,000

Credit (N$)

500,000

240,000

Receivables

1,450,000

Payables

630,000

Drawings

524,500

Capital

4,540,000

Cash and cash equivalents

349,000

Sales

9,898,000

Advertising

320,000

Carriage inwards

204,000

Fuel

473,000

Wages

1,048,000

Sales Returns

Purchases Return

68,000

50,000

Purchases

4,067,500

Insurance

Inventory (1/11/2022)

Commission

60,000

586,000

32,000

Total

15,890,000

15,890,000

Additional information:

1. .Inventory on 31 October 2023 was valued at N$680,000.

2. Wages includes N$70,000 paid as advance to employees.

3. The insurance account was charged with N$40,000 which relates to advertising.

4. The insurance account includes a premium of N$9,000.00 for November 2023.

s. The vehicle was sold for proceeds of N$10,000 on 31 August 2023. The cost of the

motor vehicles sold was N$53, 100 and the depreciation to the date of disposal was

N$37,400. No entries in respect of this transaction has been recorded.

6. Provide for depreciation on Machinery at 10% per annum on the reducing balance

method and Motor vehicles 20% on the straight-line method.

3

|

4 Page 4 |

▲back to top |

Required:

a) Journalise the above adjusting entries in the general journal of Kamukaa (Pty) Ltd.

Journal narrations are NOT required.

(15 marks)

b) Prepare the Statement of Profit of Loss for incorporating adjustments the reporting

period ended 31 October 2023.

(19 marks)

c) Prepare the statement of financial position incorporating adjustments as at 31 October

2023.

(16 marks)

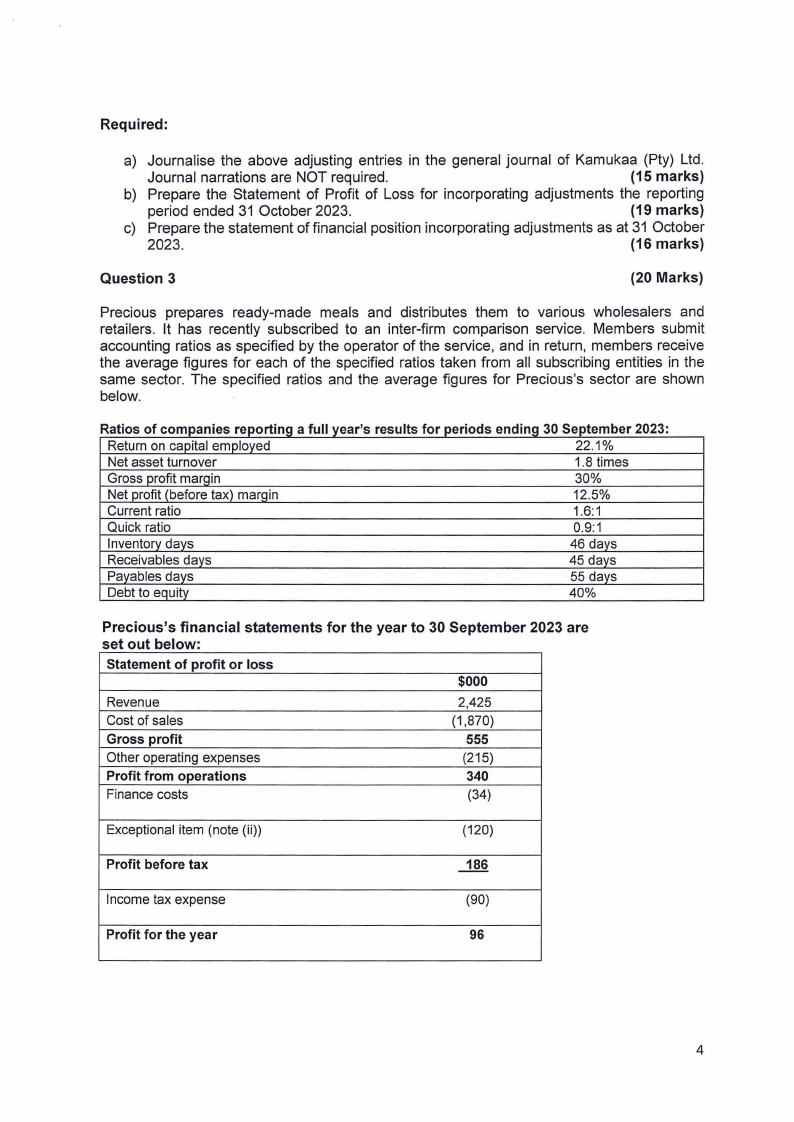

Question 3

(20 Marks)

Precious prepares ready-made meals and distributes them to various wholesalers and

retailers. It has recently subscribed to an inter-firm comparison service. Members submit

accounting ratios as specified by the operator of the service, and in return, members receive

the average figures for each of the specified ratios taken from all subscribing entities in the

same sector. The specified ratios and the average figures for Precious's sector are shown

below.

Rat1. 0s of companies reportina a full vear's results for periods endina 30 Seotember 2023:

Return on capital employed

22.1%

Net asset turnover

1.8 times

Gross profit marain

30%

Net profit (before tax) marain

12.5%

Current ratio

1.6:1

Quick ratio

0.9:1

Inventory days

46 days

Receivables days

45 davs

Payables days

55 davs

Debt to equity

40%

Precious's financial statements for the year to 30 September 2023 are

set out below:

Statement of profit or loss

$000

Revenue

Cost of sales

2,425

(1,870)

Gross profit

555

Other operating expenses

(215)

Profit from operations

340

Finance costs

(34)

Exceptional item (note (ii))

(120)

Profit before tax

186

Income tax expense

(90)

Profit for the year

96

4

|

5 Page 5 |

▲back to top |

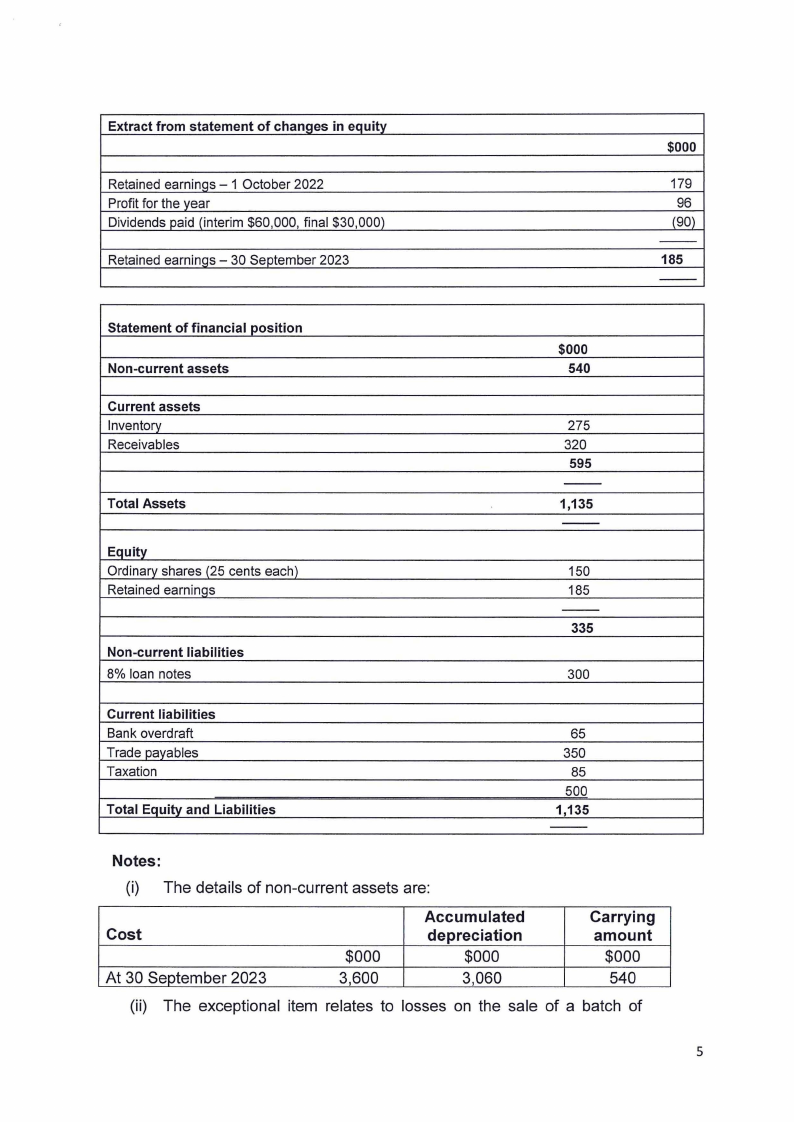

Extract from statement of changes in equity

Retained earnings - 1 October 2022

Profit for the year

Dividends paid (interim $60,000, final $30,000)

Retained earnings - 30 September 2023

$000

179

96

(90)

--

185

--

Statement of financial position

Non-current assets

$000

540

Current assets

Inventory

Receivables

Total Assets

Equity

Ordinary shares (25 cents each)

Retained earninqs

Non-current liabilities

8% loan notes

275

320

595

--

1,135

--

150

185

--

335

300

Current liabilities

Bank overdraft

Trade payables

Taxation

Total Equity and Liabilities

65

350

85

500

1,135

--

Notes:

(i) The details of non-current assets are:

Cost

At 30 September 2023

$000

3,600

Accumulated

depreciation

$000

3,060

Carrying

amount

$000

540

(ii) The exceptional item relates to losses on the sale of a batch of

5

|

6 Page 6 |

▲back to top |

computers that had become worthless due to improvements in

microchip design.

(iii) The market price of Precious's shares throughout the year averaged $6

each.

Required:

a) Calculate the ratios for Precious which are equivalent to those provided by the

comparison service.

(20 marks)

--------------------End

of Examination -------------------------

6