|

BAC611C- BUSINESS ACCOUNTING 1B- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

CENTERFOR ENTERPRISEDEVELOPMENT(CED)

QUALIFICATION: DIPLOMA IN BUSINESSPROCESSMANAGEMENT

QUALIFICATIONCODE:06DBPM LEVEL:6

COURSECODE: BAC611C

COURSENAME: BUSINESSACCOUNTING 2A

SESSION:JANUARY2024

PAPER:PAPER2

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Lameck Odada

MODERATOR Gerhardt Sheehama

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer ALLthe questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 6 PAGES(excluding this front page)

|

2 Page 2 |

▲back to top |

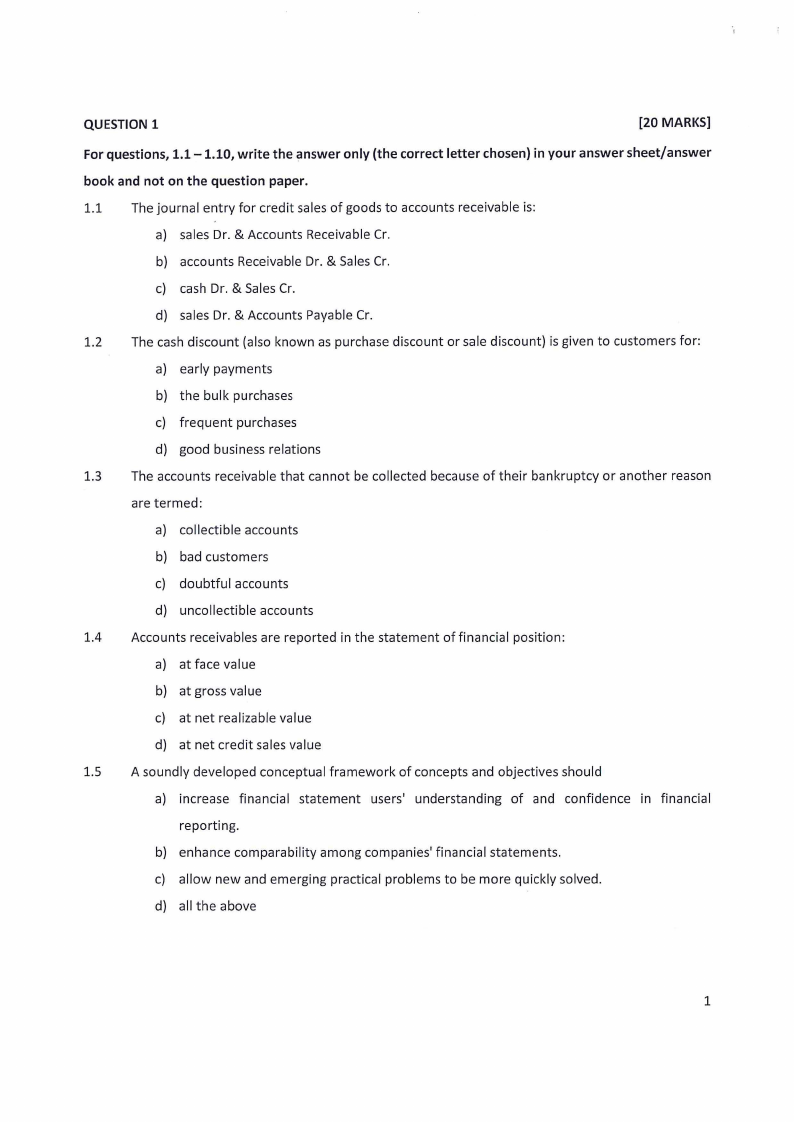

QUESTION 1

[20 MARKS]

For questions, 1.1-1.10, write the answer only (the correct letter chosen) in your answer sheet/answer

book and not on the question paper.

1.1 The journal entry for credit sales of goods to accounts receivable is:

a) sales Dr. & Accounts Receivable Cr.

b) accounts Receivable Dr. & Sales Cr.

c) cash Dr. & Sales Cr.

d) sales Dr. & Accounts Payable Cr.

1.2 The cash discount (also known as purchase discount or sale discount) is given to customers for:

a) early payments

b) the bulk purchases

c) frequent purchases

d) good business relations

1.3 The accounts receivable that cannot be collected because of their bankruptcy or another reason

are termed:

a) collectible accounts

b) bad customers

c) doubtful accounts

d) uncollectible accounts

1.4 Accounts receivables are reported in the statement of financial position:

a) at face value

b) at gross value

c) at net realizable value

d) at net credit sales value

1.5 A soundly developed conceptual framework of concepts and objectives should

a) increase financial statement users' understanding of and confidence in financial

reporting.

b) enhance comparability among companies' financial statements.

c) allow new and emerging practical problems to be more quickly solved.

d) all the above

1

|

3 Page 3 |

▲back to top |

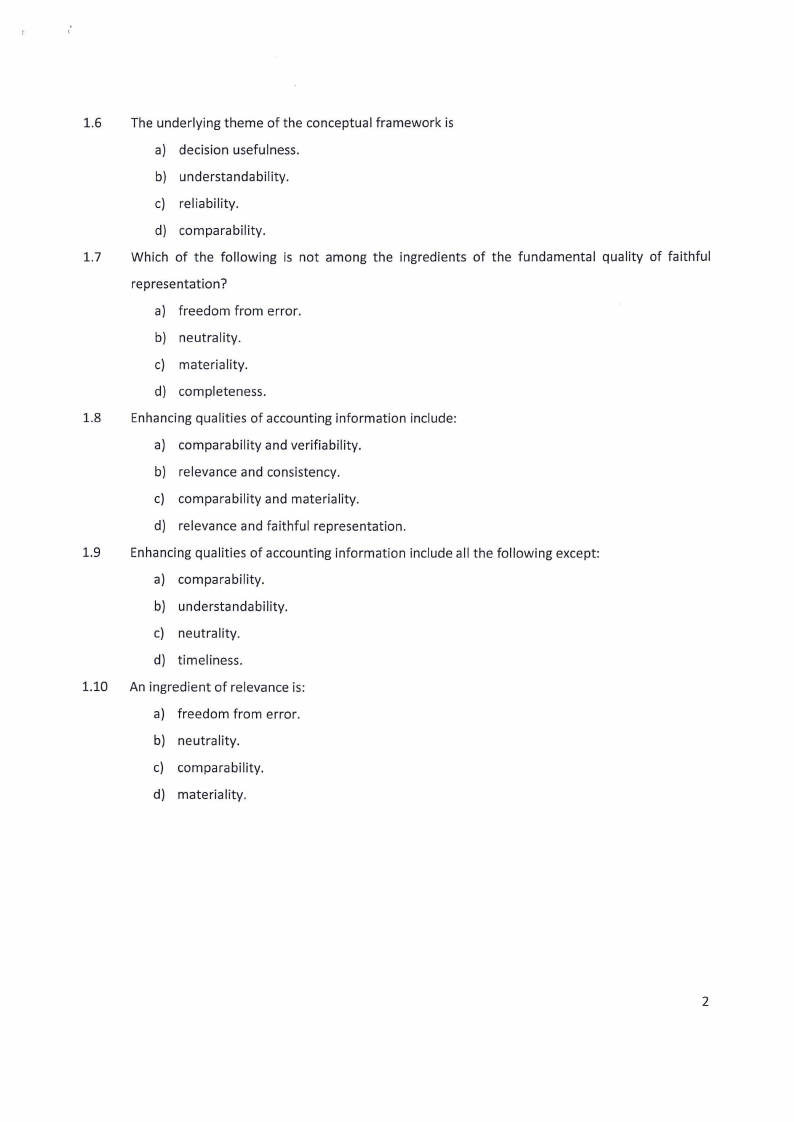

1.6 The underlying theme of the conceptual framework is

a) decision usefulness.

b) understandability.

c) reliability.

d) comparability.

1.7 Which of the following is not among the ingredients of the fundamental quality of faithful

representation?

a) freedom from error.

b) neutrality.

c) materiality.

d) completeness.

1.8 Enhancing qualities of accounting information include:

a) comparability and verifiability.

b) relevance and consistency.

c) comparability and materiality.

d) relevance and faithful representation.

1.9 Enhancing qualities of accounting information include all the following except:

a) comparability.

b) understandability.

c) neutrality.

d) timeliness.

1.10 An ingredient of relevance is:

a) freedom from error.

b) neutrality.

c) comparability.

d) materiality.

2

|

4 Page 4 |

▲back to top |

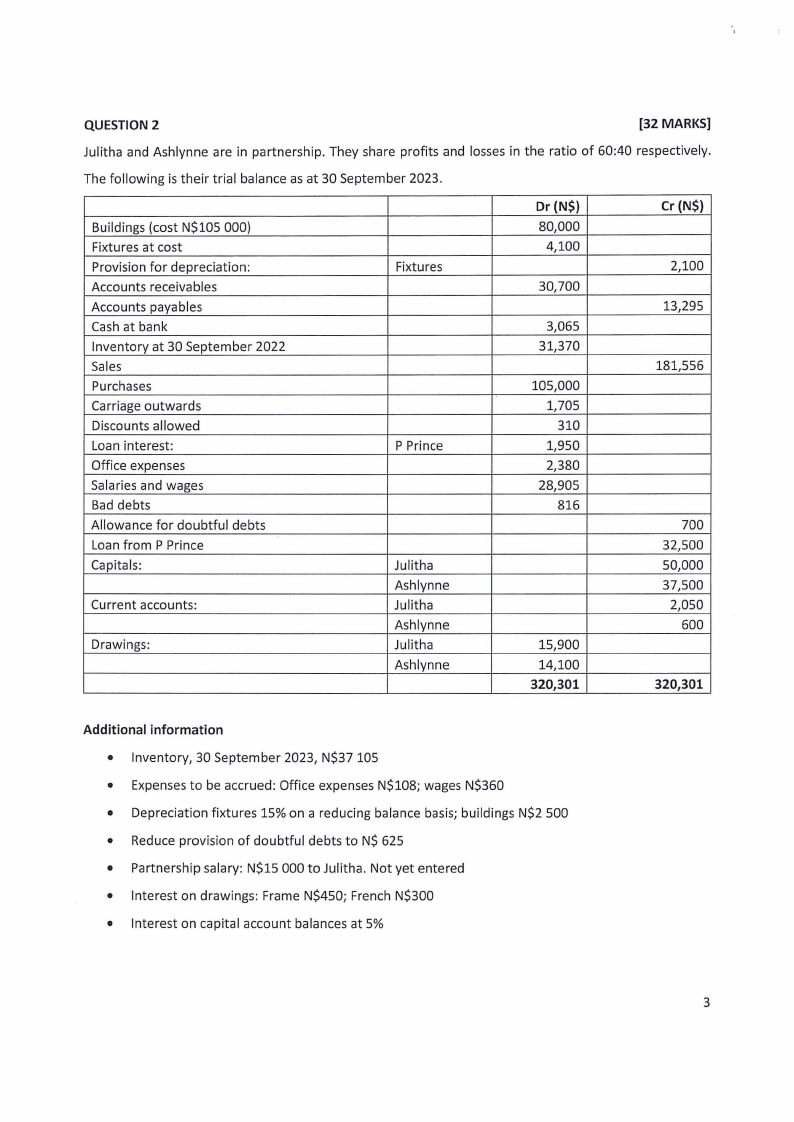

QUESTION 2

[32 MARKS]

Julitha and Ashlynne are in partnership. They share profits and losses in the ratio of 60:40 respectively.

The following is their trial balance as at 30 September 2023.

Buildings (cost N$105 000)

Fixtures at cost

Provision for depreciation:

Accounts receivables

Accounts payables

Cash at bank

Inventory at 30 September 2022

Sales

Purchases

Carriage outwards

Discounts allowed

Loan interest:

Office expenses

Salaries and wages

Bad debts

Allowance for doubtful debts

Loan from P Prince

Capitals:

Current accounts:

Drawings:

Fixtures

P Prince

Julitha

Ashlynne

Julitha

Ashlynne

Julitha

Ashlynne

Dr (N$)

80,000

4,100

30,700

3,065

31,370

105,000

1,705

310

1,950

2,380

28,905

816

15,900

14,100

320,301

Cr (N$)

2,100

13,295

181,556

700

32,500

50,000

37,500

2,050

600

320,301

Additional information

• Inventory, 30 September 2023, N$37 105

• Expensesto be accrued: Office expenses N$108; wages N$360

• Depreciation fixtures 15% on a reducing balance basis; buildings N$2 500

• Reduce provision of doubtful debts to N$ 625

• Partnership salary: N$15 000 to Julitha. Not yet entered

• Interest on drawings: Frame N$450; French N$300

• Interest on capital account balances at 5%

3

|

5 Page 5 |

▲back to top |

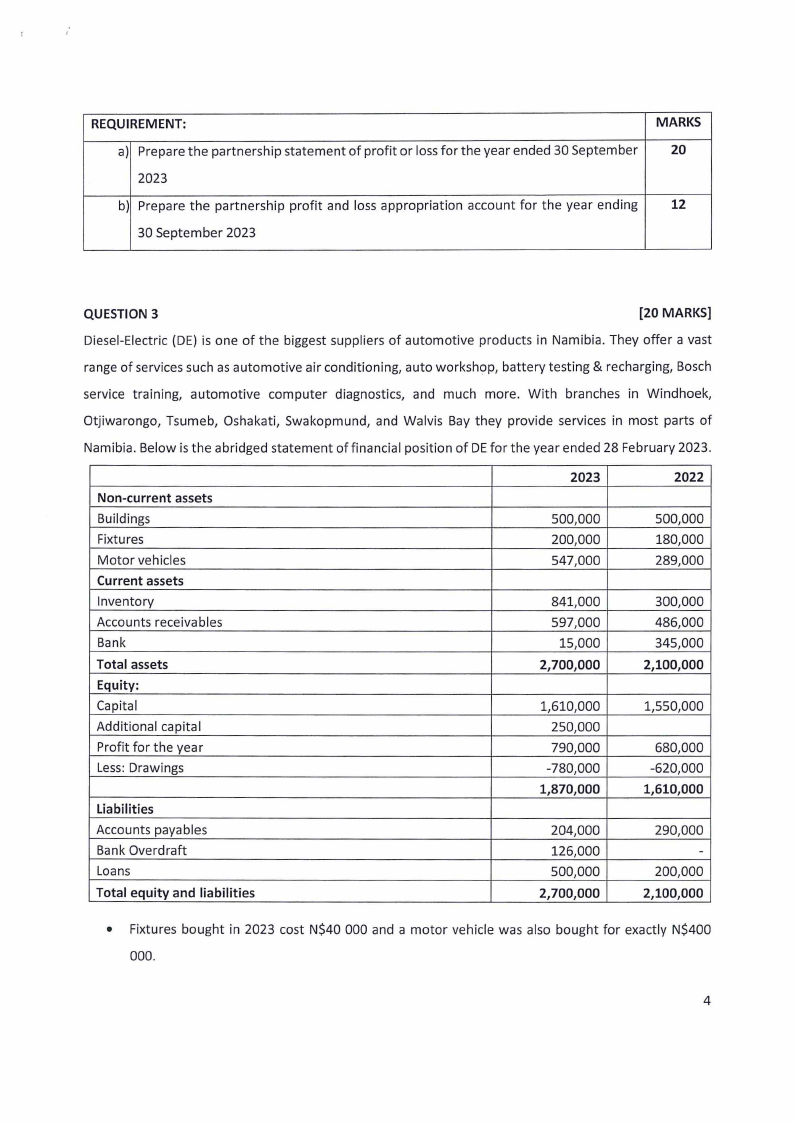

REQUIREMENT:

a) Prepare the partnership statement of profit or loss for the year ended 30 September

2023

b) Prepare the partnership profit and loss appropriation account for the year ending

30 September 2023

MARKS

20

12

QUESTION 3

[20 MARKS]

Diesel-Electric (DE) is one of the biggest suppliers of automotive products in Namibia. They offer a vast

range of services such as automotive air conditioning, auto workshop, battery testing & recharging, Bosch

service training, automotive computer diagnostics, and much more. With branches in Windhoek,

Otjiwarongo, Tsumeb, Oshakati, Swakopmund, and Walvis Bay they provide services in most parts of

Namibia. Below is the abridged statement of financial position of DEfor the year ended 28 February 2023.

Non-current assets

Buildings

Fixtures

Motor vehicles

Current assets

Inventory

Accounts receivables

Bank

Total assets

Equity:

Capital

Additional capital

Profit for the year

Less: Drawings

Liabilities

Accounts payables

Bank Overdraft

Loans

Total equity and liabilities

2023

500,000

200,000

547,000

841,000

597,000

15,000

2,700,000

1,610,000

250,000

790,000

-780,000

1,870,000

204,000

126,000

500,000

2,700,000

2022

500,000

180,000

289,000

300,000

486,000

345,000

2,100,000

1,550,000

680,000

-620,000

1,610,000

290,000

-

200,000

2,100,000

• Fixtures bought in 2023 cost N$40 000 and a motor vehicle was also bought for exactly N$400

000.

4

|

6 Page 6 |

▲back to top |

REQUIREMENT

MARKS

a) Draw up the statement of cash flows of Diesel Electric for the year ended 28

13

February 2023 using the indirect method.

b) Highlight any three (3) uses of a statement of cash flows

3

c) Explain any two (2) limitations of a cash flow statement

4

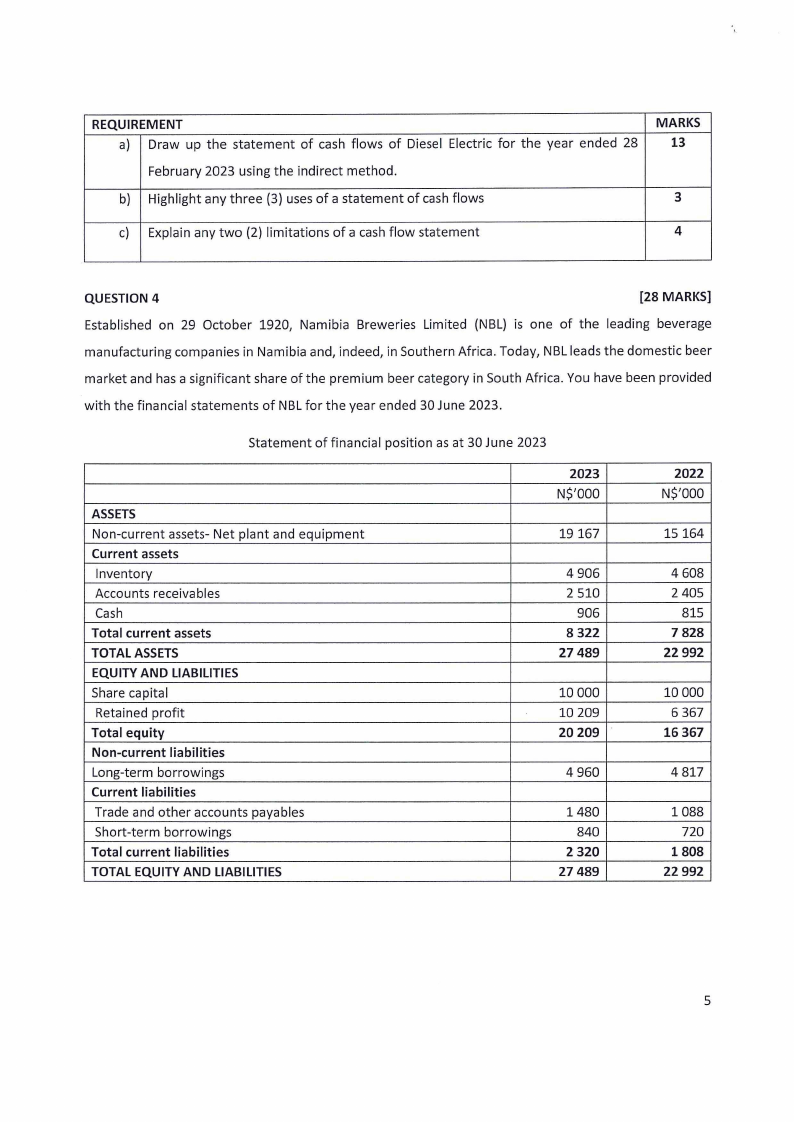

QUESTION 4

[28 MARKS]

Established on 29 October 1920, Namibia Breweries Limited (NBL) is one of the leading beverage

manufacturing companies in Namibia and, indeed, in Southern Africa. Today, NBL leads the domestic beer

market and has a significant share of the premium beer category in South Africa. You have been provided

with the financial statements of NBL for the year ended 30 June 2023.

Statement of financial position as at 30 June 2023

ASSETS

Non-current assets- Net plant and equipment

Current assets

Inventory

Accounts receivables

Cash

Total current assets

TOTAL ASSETS

EQUITY AND LIABILITIES

Share capital

Retained profit

Total equity

Non-current liabilities

Long-term borrowings

Current liabilities

Trade and other accounts payables

Short-term borrowings

Total current liabilities

TOTAL EQUITY AND LIABILITIES

2023

N$'000

19167

4 906

2 510

906

8 322

27 489

10 000

10 209

20 209

4960

1480

840

2 320

27 489

2022

N$'000

15164

4 608

2 405

815

7 828

22 992

10 000

6 367

16 367

4 817

1088

720

1808

22 992

5

|

7 Page 7 |

▲back to top |

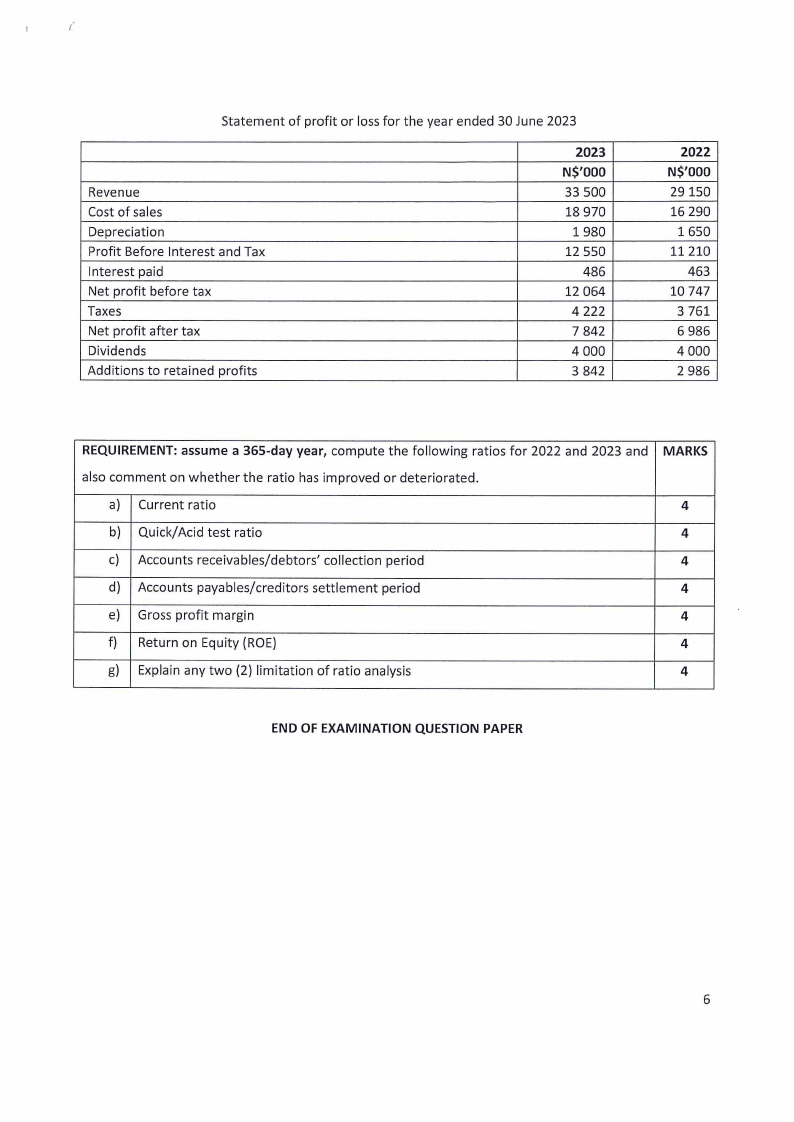

Statement of profit or loss for the year ended 30 June 2023

Revenue

Cost of sales

Depreciation

Profit Before Interest and Tax

Interest paid

Net profit before tax

Taxes

Net profit after tax

Dividends

Additions to retained profits

2023

N$'000

33 500

18 970

1980

12 550

486

12 064

4 222

7 842

4000

3 842

2022

N$'000

29150

16 290

1650

11210

463

10 747

3 761

6 986

4000

2 986

REQUIREMENT: assume a 365-day year, compute the following ratios for 2022 and 2023 and MARKS

also comment on whether the ratio has improved or deteriorated.

a) Current ratio

4

b) Quick/ Acid test ratio

4

c) Accounts receivables/debtors' collection period

4

d) Accounts payables/creditors settlement period

4

e) Gross profit margin

4

f) Return on Equity (ROE)

4

g) Explain any two (2) limitation of ratio analysis

4

END OF EXAMINATION QUESTION PAPER

6

|

8 Page 8 |

▲back to top |