|

CAC710S- COMPUTERISED ACCOUNTING 301- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCE AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING/BACHELOR OF ACCOUNTING (CA)

QUALIFICATION CODE: 07BOAC/07BACC

COURSE CODE: CAC710S

LEVEL: 7

COURSE NAME: COMPUTERISED

ACCOUNTING 301

SESSION: JANUARY 2024

PAPER: PRACTICAL

DURATION: 3 HOURS (Including printing and set

up)

MARKS: 100

EXAMINERS:

SECOND OPPORTUNITY QUESTION PAPER

H Namwandi, Y Elago and E Kangootui

MODERATOR: E Milijala

INSTRUCTIONS

• This question paper is made up of one (1) question.

• Make sure that your student number appears on all reports (Generated through the

system, not handwritten).

• It's your responsibility to ensure that all reports are printed and submitted at the end of

the session.

• Ensure that all work done during the assessment is your own.

• The use of the internet on any electronic device is prohibited during the assessment.

• Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

100 Marks

You are required to create a company on the "C" drive, using the following

information

Company Name:

Financial Year:

Date Format

Processing Method

Bankers

Printing

Supplier Processing

Student Number

1st September 2022 - 31 August 2023

01/09/2022

Balance Forward

FNB & Bank Windhoek

Plain Paper

No GRN or Purchase Orders

Background of the organisation.

Nekulilo established a restaurant a few years back when she saw an opportunity in the market

to help residents in the Windhoek-Katutura suburb who require a good hospitality service

within their neighbourhood to enjoy with their families. She named her business as "Nekulilo

For All cc". The restaurant has been doing well over the past financial years due to Nekulilo's

good customer service and in future she would like to expand the business in the Northern

part of the country. Since its inception, Nekulilo For All accounting records have been

recorded manually and the owner wants the records to be recorded in Patel V19, a program

that she recently bought. At the moment, her business is not registered for Tax purposes but

she is hoping that in the next financial year, she can register so that she can start competing

for government and private tenders. You are supplied with a list of account balances of the

restaurant to help the accountant who is on a month-long vacation leave.

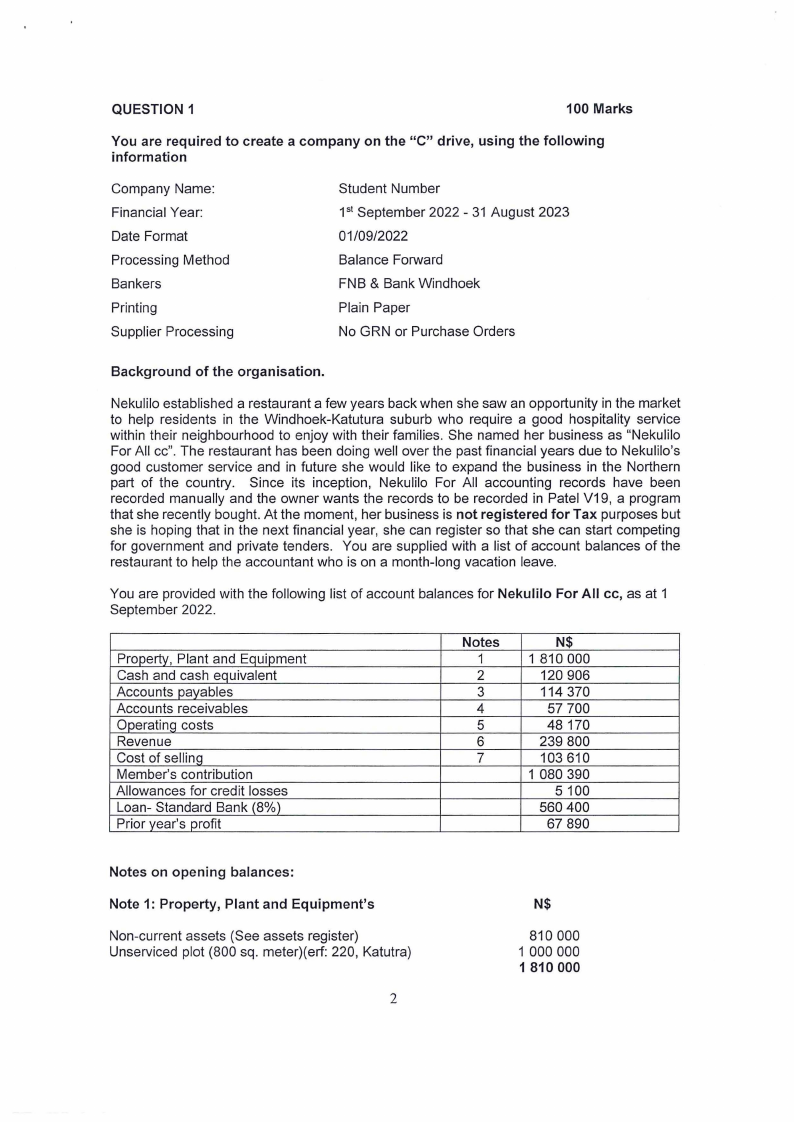

You are provided with the following list of account balances for Nekulilo For All cc, as at 1

September 2022.

Property, Plant and Equipment

Cash and cash equivalent

Accounts payables

Accounts receivables

Operatinq costs

Revenue

Cost of selling

Member's contribution

Allowances for credit losses

Loan- Standard Bank (8%)

Prior year's profit

Notes

1

2

3

4

5

6

7

N$

1 810 000

120 906

114 370

57 700

48 170

239 800

103 610

1 080 390

5100

560 400

67 890

Notes on opening balances:

Note 1: Property, Plant and Equipment's

Non-current assets (See assets register)

Unserviced plot (800 sq. meter)(erf: 220, Katutra)

2

N$

810 000

1 000 000

1 810 000

|

3 Page 3 |

▲back to top |

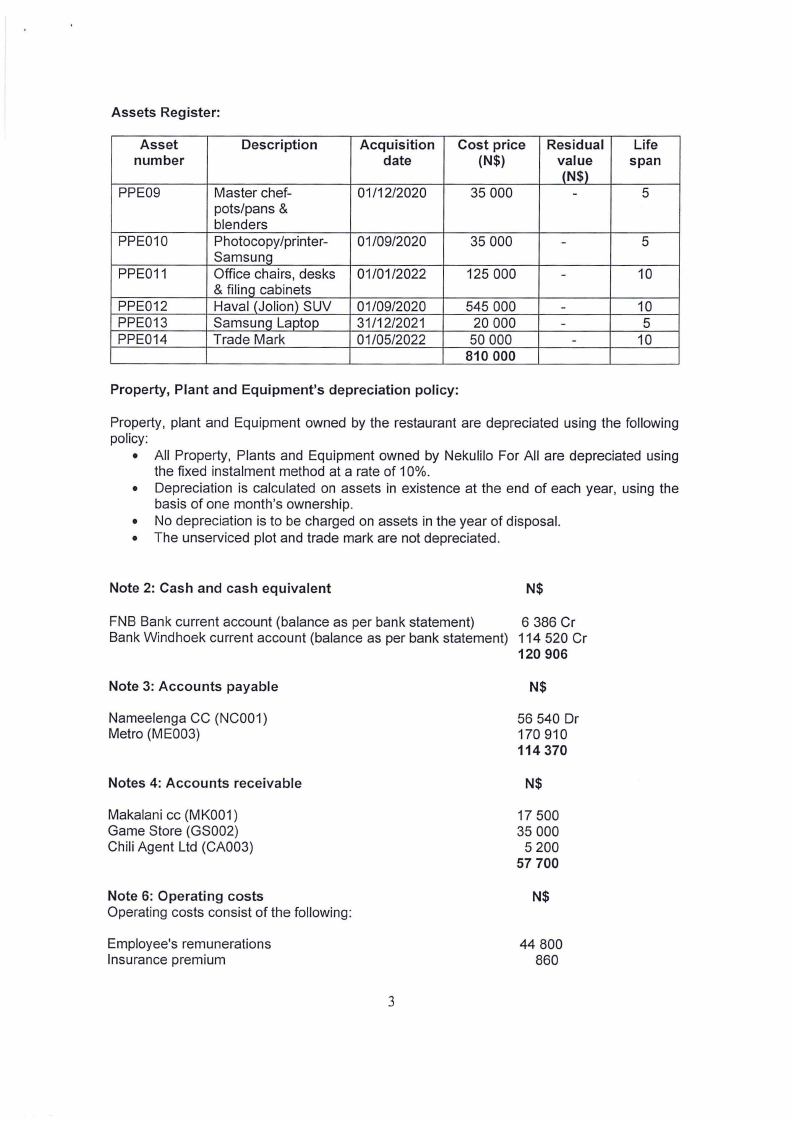

Assets Register:

Asset

number

PPE09

PPE010

PPE011

PPE012

PPE013

PPE014

Description

Master chef-

pots/pans &

blenders

Photocopy/printer-

SamsunQ

Office chairs, desks

& filing cabinets

Haval (Jolion) SUV

Samsung Laptop

Trade Mark

Acquisition

date

01/12/2020

01/09/2020

01/01/2022

01/09/2020

31/12/2021

01/05/2022

Cost price

(N$)

35 000

Residual

value

(N$)

-

35 000

-

125 000

-

545 000

-

20 000

-

50 000

-

810 000

Life

span

5

5

10

10

5

10

Property, Plant and Equipment's depreciation policy:

Property, plant and Equipment owned by the restaurant are depreciated using the following

policy:

• All Property, Plants and Equipment owned by Nekulilo For All are depreciated using

the fixed instalment method at a rate of 10%.

• Depreciation is calculated on assets in existence at the end of each year, using the

basis of one month's ownership.

• No depreciation is to be charged on assets in the year of disposal.

• The unserviced plot and trade mark are not depreciated.

Note 2: Cash and cash equivalent

N$

FNB Bank current account (balance as per bank statement)

6 386 Cr

Bank Windhoek current account (balance as per bank statement) 114 520 Cr

120 906

Note 3: Accounts payable

N$

Nameelenga CC (NC001)

Metro (ME003)

56 540 Dr

170 910

114 370

Notes 4: Accounts receivable

N$

Makalani cc (MK001)

Game Store (GS002)

Chili Agent Ltd (CA003)

17 500

35 000

5 200

57 700

Note 6: Operating costs

N$

Operating costs consist of the following:

Employee's remunerations

Insurance premium

44 800

860

3

|

4 Page 4 |

▲back to top |

Health inspection penalties

2 510

48170

Note 7: Revenue

N$

Revenue- soft drinks

Revenue- meals (lunch/dinner)

Revenue- alcoholic drinks

50 500

100 100

89 200

239 800

Note 8: Cost of selling

N$

Cost of selling- soft drinks

Cost of selling- meals (lunch/dinner)

Cost of selling- alcoholic drinks

25 300

41 400

36 910

103 610

Required:

You are required to capture the opening balances of Nekulilo For All cc accounts including

the accumulated depreciation for all non-current assets as at 1 September 2022 (Period

one).

UPDATE YOUR TRANSACTIONS BEFORE PROCEEDING TO THE NEXT QUESTION.

NB: No report is required to be printed at this stage.

Part B: Period One Transactions

You were informed that the transactions in period one for the FNB bank account were not all

recorded. The accountant asked you to assist in updating this account's transactions and

prepare a bank reconciliation after receiving the bank statement.

• 1 September, received cash sales from customers for lunch for N$600. The money

was paid directly into the bank account via point of sales (POS) depositing the

amount directly in the bank account (POS001 ).

• 02 September, paid business airtime through the banking application for N$50,

(EFT001).

• 06 September, paid business airtime through the banking application for N$60,

(EFT002).

• 10 September, received cash sales from customers for dinner for N$710. The money

was paid directly into the bank account via point of sales (POS) depositing the

amount directly in the bank account (POS005).

• 12 September, received cash sales from a customer for soft drinks for N$70. The

money was paid directly into the bank account via point of sales (POS) depositing the

amount directly in the bank account (POS006).

4

|

5 Page 5 |

▲back to top |

• 14 September, paid for business prepaid water token through the banking application

for N$100, (EFT003).

• 23 September, paid Metro's account through a banking application amounting to

N$650, (EFT004).

• 27 September, paid business fuel through the banking application for N$700,

(EFT018).

• 29 September, received cash sales from a customer for alcoholic drinks for N$380.

The money was paid directly into the bank account via point of sales (POS)

depositing the amount directly in the bank account (POS007).

• 30 September, received cash sales from customers for lunch for N$217. The money

was paid directly into the bank account via point of sales (POS) depositing the

amount directly in the bank account (POS008).

• 30 September, paid e-wallet to a temporary waiter her wages through the banking

application for N$370, (EWI00S).

• 31 September, paid for business pens/books and sticky notes through the banking

application for N$165, (EFT00G).

• 31 September, received cash sales from a customer for dinner for N$350. The

money was paid directly into the bank account via point of sales (POS) depositing the

amount directly in the bank account (POS008).

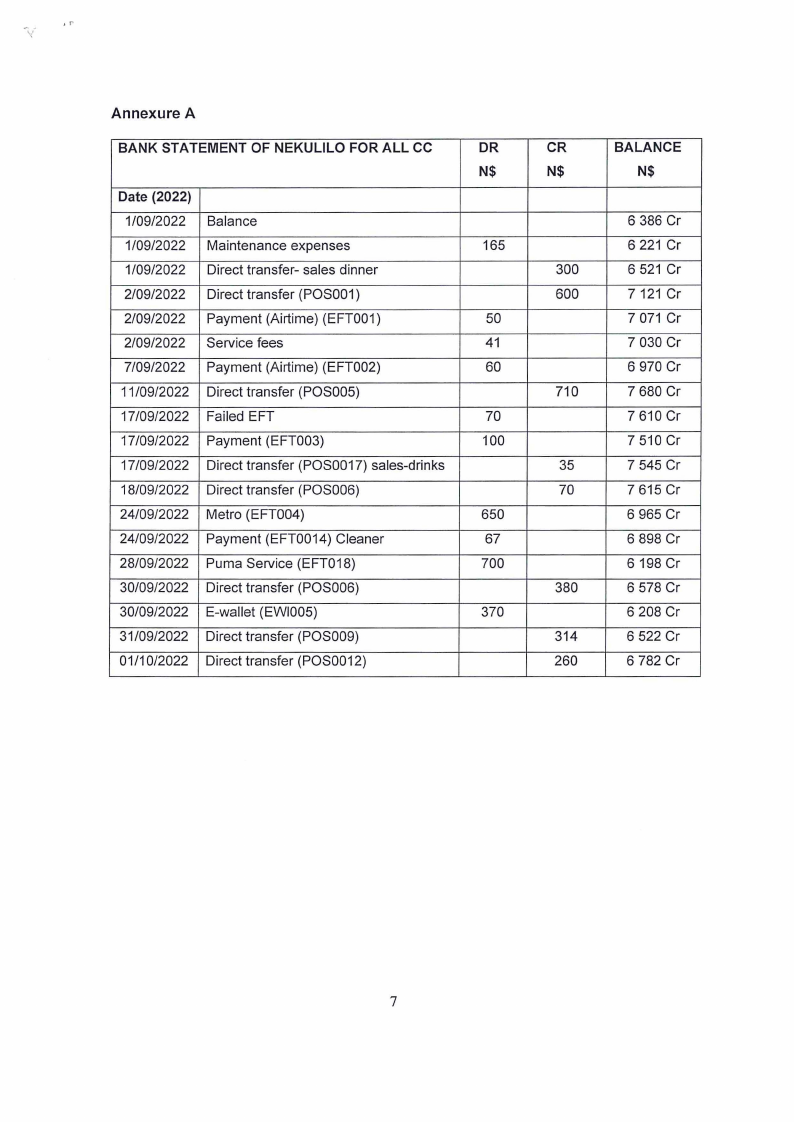

At the end of period one you were given the bank statement for the FNB account and

a review, the bank statement revealed the following: (see the bank statement at the

end of the question)

a) All outstanding items on the August 2022 reconciliation statement were debited and

credited by the bank on 1 September 2022.

b) On 17 September 2022 one of the regular customer wasn't able to pay for his drinks

due to a system error on the bank. He paid the money N$35 directly into the bank

account of Nekulilo for All cc the following day.

c) The failed EFT payment on 17 September 2022 was not reversed.

d) An EFT0014 was erroneously debited to the company's bank account on 24

September 2022.

e) The amount of N$314 credited to the company's bank account on 30 September

2022 was dinner sold to customers (POS009)

Required:

Make the necessary entries in the books of original entry for September transactions, (In

Period one). Prepare a bank reconciliation statement for September 2022 in period one. Print

out a bank reconciliation report on the same date. (See Annexure A on page 7 for the bank

statement)

5

|

6 Page 6 |

▲back to top |

Part C: Year-end adjustments

Nekulilo provided you with the following year-end adjustments which are not yet recorded in

the restaurant's books. All year-end adjustments should be processed in period 12.

• One of Nekulilo For All cc customers Chilli Agent Ltd was declared insolvent by the

high court. Nekulilo decided to write off the whole balance.

• Interest on loan for the current year has not yet been paid but must be accounted for

in the books.

• Nekulilo for All cc distributed an amount of N$12 000 from the restaurant's profit to its

owner as a return on investments.

• The accountant discovered that the Haval (Jolin) was overstated with an amount of

N$20 000 and recommended that an adjustment be made accordingly.

• Allowance for irrecoverable debts has been pegged at N$4 000 for the period under

review.

• The total amount for insurance costs paid during the year-end was from 1 September

2022 to 31 September 2023.

• A Defy Stove with a life span of 10 years was bought from Metro on 1 November 2022

on account. It was delivered on the same date at the restaurant premises. Nekulilo for

All cc received an invoice from Metro which is made up of the following items:

(a) The actual invoice amount for the defy stove is N$25 000.

(b) The installation cost of the stove done at the premises is N$4 500.

(c) The VAT cost of the machine is N$500.

• Income tax for the year was determined to be N$18 040 by NamRa, payable in the

following month.

• Provide for depreciation on all non-current assets owned by the entity during the

current financial period.

Required:

You are required to process the above year-end adjustments of Nekulilo For All cc.

Print out a detailed ledger as at 31 August 2023. (View - General ledger - Transaction -

Detailed ledger)

6

|

7 Page 7 |

▲back to top |

'r

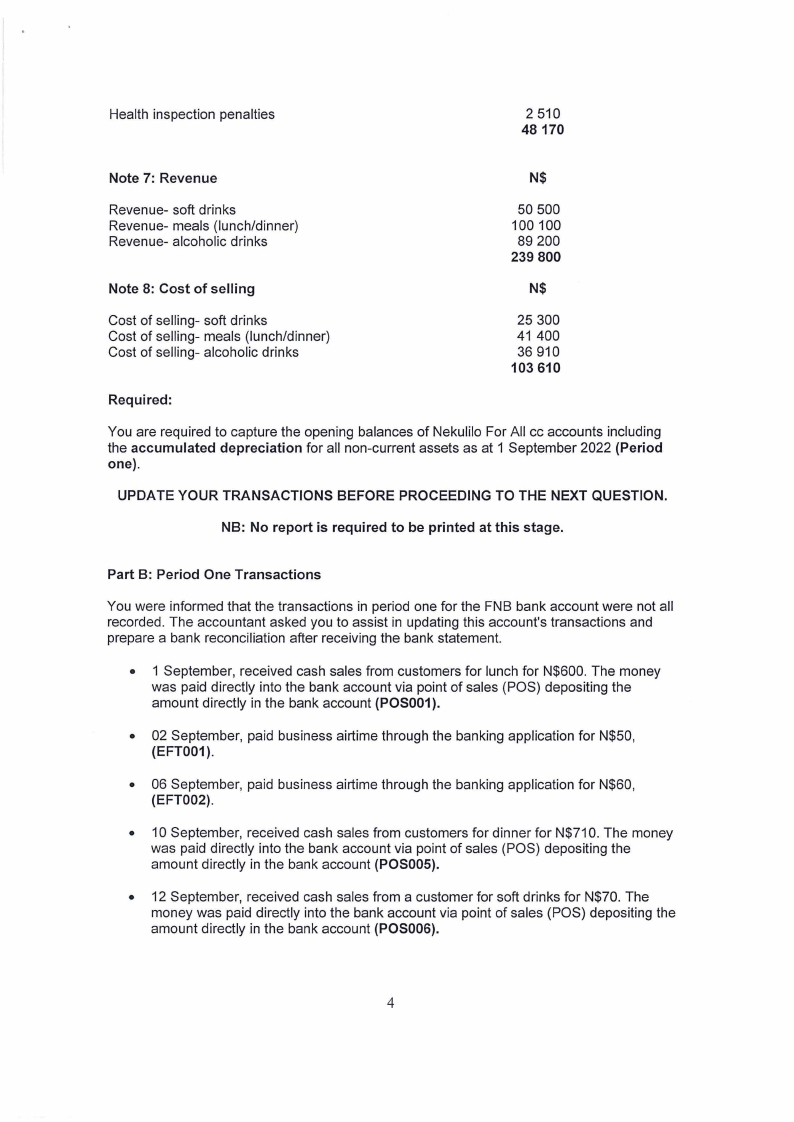

Annexure A

BANK STATEMENT OF NEKULILO FOR ALL CC

DR

N$

Date (2022)

1/09/2022 Balance

1/09/2022 Maintenance expenses

165

1/09/2022 Direct transfer- sales dinner

2/09/2022 Direct transfer (POS001)

2/09/2022 Payment (Airtime) (EFT001)

50

2/09/2022 Service fees

41

7/09/2022 Payment (Airtime) (EFT002)

60

11/09/2022 Direct transfer (POS005)

17/09/2022 Failed EFT

70

17/09/2022 Payment (EFT003)

100

17/09/2022 Direct transfer (POS0017) sales-drinks

18/09/2022 Direct transfer (POS006)

24/09/2022 Metro (EFT004)

650

24/09/2022 Payment (EFT0014) Cleaner

67

28/09/2022 Puma Service (EFT018)

700

30/09/2022 Direct transfer (POS006)

30/09/2022 E-wallet (EWI005)

370

31/09/2022 Direct transfer (POS009)

01/10/2022 Direct transfer (POS0012)

CR

BALANCE

N$

N$

6 386 Cr

6 221 Cr

300

6 521 Cr

600

7 121 Cr

7 071 Cr

7 030 Cr

6 970 Cr

710

7 680 Cr

7 610 Cr

7 510 Cr

35

7 545 Cr

70

7 615 Cr

6 965 Cr

6 898 Cr

6 198 Cr

380

6 578 Cr

6 208 Cr

314

6 522 Cr

260

6 782 Cr

7