|

FAC611S-FINANCIAL ACCOUNTING 201-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OFSCIEnCE Ano TECHn OLOGY

FACULTYOFCOMMERCEH, UMANSCIENCEAS ND EDUCATION

DEPARTMENTOFACCOUNTINGE, CONOMICSAND FINANCE

QUALIFICATION:BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL:6

COURSECODE: FAC611S

COURSENAME: FINANCIALACCOUNTING201

SESSION:JUNE 2022

PAPER:THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

EXAMINER(S}

FIRSTOPPORTUNITYEXAMINATION QUESTION PAPER

Mr. C. Mahindi, Mr. C. Simasiku and Dr. A. Simasiku

MODERATOR: Dr. D. Kamotho

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. Do not write in pencil and do not use tip-ex, as this will not be marked.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

6. The names of people and businesses used throughout this assessment do not reflect the reality

and may be purely coincidental.

7. Show all workings!

PERMISSABLME ATERIALS

1. Non- programmable calculator

THERQUESTIONPAPERCONSISTSOF5 PAGES(Excluding the front page)

|

2 Page 2 |

▲back to top |

Question 1

(15 marks)

Part A: Multiple choice questions

(5 marks)

Required: Write only the letter that represents the correct answer in your answer booklet.

1. Which of the following is not an example of directly attributable costs?

a. Costs of employee benefits arising directly from the construction or acquisition of the item

of property, plant and equipment

b. Costs of site preparation

c. Costs of conducting business in a new location or with a new class of customer

d. Initial delivery and handling costs

e. Professional fees

2. Multi part has purchased a budget airline and is discussing the way in which it should depreciate the

aircraft as aircraft have a lifespan of 10 years, engines have a lifespan of seven years and tyres have

a lifespan of 18 months. The aircraft should be depreciated on a straight-line basis over:

a. Seven years useful life

b. Seven years useful life of the engine, 1.5 years useful life of the tyres, and 10 years useful

life applied to the balance

c. 10 years composite useful life

d. 18.5 years

3. An entity constructs a machine for its own use. Construction is started on 1 January 2022 and is

completed on 1 March 2022. The machine is installed on 1 April 2022 and the entity does not begin

using the machine until 1 May 2022. The entity should begin charging depreciation on:

a. 1 January 2022

b. 1 May 2022

c. 1 April 2022

d. 1 March 2022

4. An entity purchased an asset on 1 January 2006 for $10m. The asset has a useful life of 10 years and

uses the straight-line method of depreciation. On 1 January 2009, the asset's useful life is revised

to add a further three years to it. The asset has no residual value. The depreciation charge for the

year to 31 December 2009 should be:

a. N$769,320

b. N$700,000

c. N$1,000,000

d. N$538,461

1

|

3 Page 3 |

▲back to top |

5. When the depreciated cost of a tangible asset is higher than its recoverable amount:

a. An impairment loss should be recognised only if the NRV is higher than the value in use

b. An impairment loss should be recognised as expense in the statement of profit or loss

immediately

c. The tangible asset must be reported at its fair value

d. An unrealised gain must be accounted for

Part B

(10 marks)

You have recently been approached by your cousin, Nailoke who has opened a car rental business.

Nailoke has acquired five vehicles at a total cost of N$1,250,000 and intends to rent out these vehicles

to tourists visiting Windhoek. Nailoke expects to each vehicle to have a useful life of 5 years.

Required:

Advise Nailoke on the appropriate accounting treatment to account for these vehicles. Your discussion

should focus on the definition and recognition criteria provided by the appropriate standard.

2

|

4 Page 4 |

▲back to top |

QUESTION 2

(65 marks)

Rainbow (Pty) Ltd "Rainbow" has a diverse portfolio of operations. Their revenue portfolio ranges

from retail, property, leisure and manufacturing operations, one of a few companies in Namibia with

such diversification. One of their successfactors is their ability to increase their return on assets based

on their investment decisions. They have been operational in the country for the last 25 years and its

head office is located in Walvis Bay. The current reporting date is 31 December 2021.

Part A

(41 marks)

Head Office building

Rainbow has occupied their office building for the last 15 years and decided per resolution on 2

January 2021 to sell it as is before the end of the current reporting period to generate cash flows in

this difficult economic environment. The following information pertains to the Office Building:

• Acquired: 1 January 2006

• Cost at acquisition: N$12 500 000

• Useful life: 20 years

• Residual value: N$450 000

The last impairment assessment was performed on 31 December 2020, when the recoverable amount

was determined to be N$2 500 000.

Rainbow's management regards the sale to be highly probable and have committed to a plan to

complete the sale by the anticipated date of 1 January 2022.

Advertising costs and estate agent fees of N$300 000 were paid on 2 April 2021 to attract potential

buyers.

No significant changes have been made to the plan up until April 2021 and the estate agent has

indicated that the price set is in line with market expectations and therefore regarded as reasonable.

On 02 April 2021, the fair value less cost to sell amounted to N$2 300 000 and N$2 100 000 on 31

December 2021. The sale was completed on 31 December 2021 and proceeds were received to the

amount of N$2 200 000.

Required:

i. Discusswhether the Head Office building should be classified as Held for Sale per IFRS5, and

if so, when it should be classified as such.

(14 marks)

ii. Calculate the carrying amount on 31 December 2020 and any impairment losses if applicable.

(5 marks)

iii. Assuming the Head Office building meets the IFRS5 classification criteria; provide the general

journal entries of Rainbow (Pty) Ltd for the reporting periods ended 31 December 2020 and

2021. Provide the classification of the accounts (SPL,SFP,OCI etc).

(22 marks)

3

|

5 Page 5 |

▲back to top |

Part B

Plant

(24 marks)

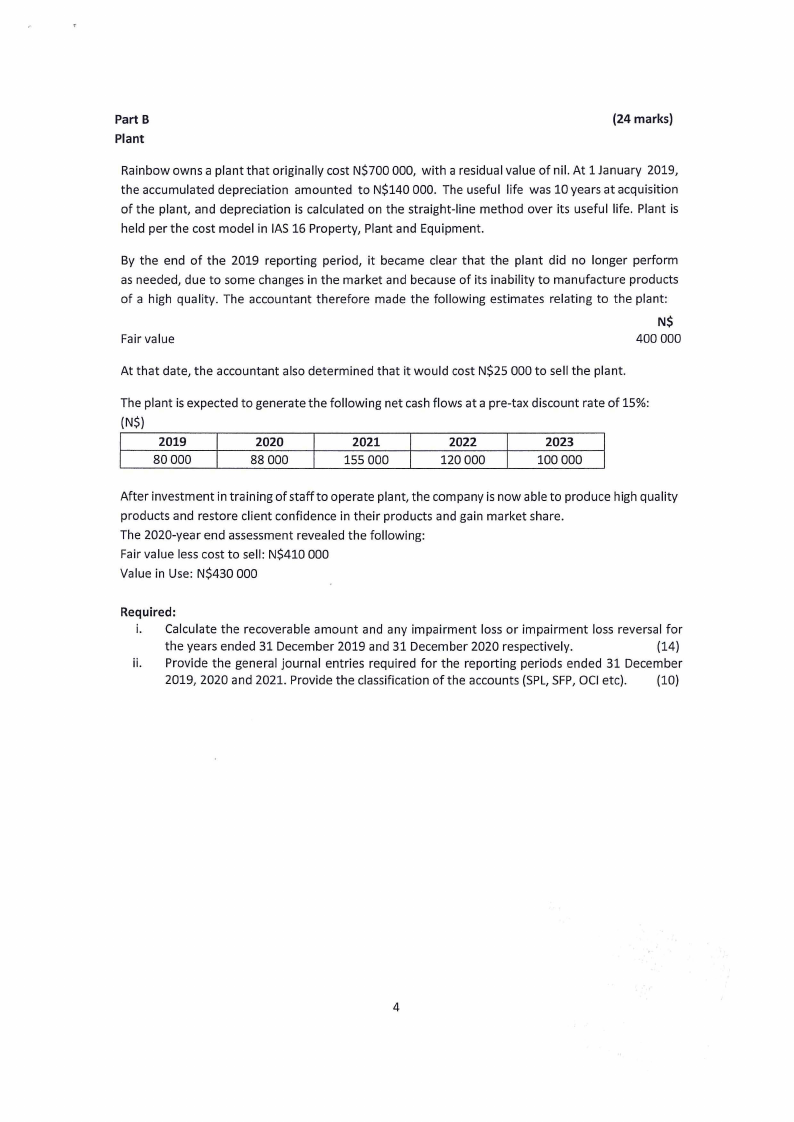

Rainbow owns a plant that originally cost N$700 000, with a residual value of nil. At 1 January 2019,

the accumulated depreciation amounted to N$140 000. The useful life was 10 years at acquisition

of the plant, and depreciation is calculated on the straight-line method over its useful life. Plant is

held per the cost model in IAS 16 Property, Plant and Equipment.

By the end of the 2019 reporting period, it became clear that the plant did no longer perform

as needed, due to some changes in the market and because of its inability to manufacture products

of a high quality. The accountant therefore made the following estimates relating to the plant:

Fair value

N$

400 000

At that date, the accountant also determined that it would cost N$25 000 to sell the plant.

The plant is expected to generate the following net cash flows at a pre-tax discount rate of 15%:

(N$)

2019

2020

2021

2022

2023

80000

88 000

155 000

120 000

100 000

After investment in training of staff to operate plant, the company is now able to produce high quality

products and restore client confidence in their products and gain market share.

The 2020-year end assessment revealed the following:

Fair value less cost to sell: N$410 000

Value in Use: N$430 000

Required:

i. Calculate the recoverable amount and any impairment loss or impairment loss reversal for

the years ended 31 December 2019 and 31 December 2020 respectively.

(14)

ii. Provide the general journal entries required for the reporting periods ended 31 December

2019, 2020 and 2021. Provide the classification of the accounts (SPL,SFP,OCI etc).

(10)

4

|

6 Page 6 |

▲back to top |

Question 3

(20 Marks)

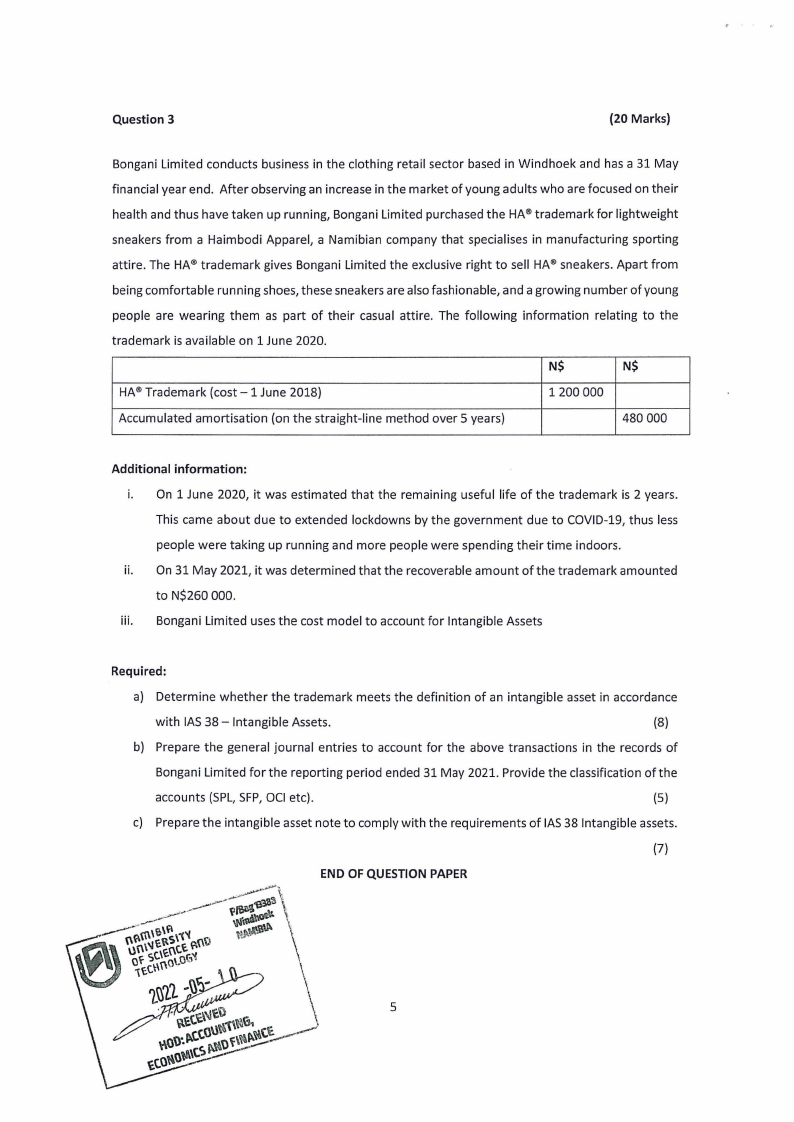

Bongani Limited conducts business in the clothing retail sector based in Windhoek and has a 31 May

financial year end. After observing an increase in the market of young adults who are focused on their

health and thus have taken up running, Bongani Limited purchased the HA®trademark for lightweight

sneakers from a Haimbodi Apparel, a Namibian company that specialises in manufacturing sporting

attire. The HA®trademark gives Bongani Limited the exclusive right to sell HA®sneakers. Apart from

being comfortable running shoes, these sneakers are also fashionable, and a growing number of young

people are wearing them as part of their casual attire. The following information relating to the

trademark is available on 1 June 2020.

N$

N$

HA®Trademark (cost -1 June 2018)

1200 000

Accumulated amortisation (on the straight-line method over 5 years}

480 000

Additional information:

i. On 1 June 2020, it was estimated that the remaining useful life of the trademark is 2 years.

This came about due to extended lockdowns by the government due to COVID-19, thus less

people were taking up running and more people were spending their time indoors.

ii. On 31 May 2021, it was determined that the recoverable amount of the trademark amounted

to N$260 000.

iii. Bongani Limited uses the cost model to account for Intangible Assets

Required:

a) Determine whether the trademark meets the definition of an intangible asset in accordance

with IAS38 - Intangible Assets.

(8}

b} Prepare the general journal entries to account for the above transactions in the records of

Bongani Limited for the reporting period ended 31 May 2021. Provide the classification of the

accounts (SPL,SFP,OCI etc).

(5)

c) Prepare the intangible asset note to comply with the requirements of IAS38 Intangible assets.

(7}

END OF QUESTION PAPER

5