|

LET621S - LAND ECONONICS AND TAXATION - 1ST OPP - NOV 2023 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIAL SCIENCES

QUALIFICATION(S): DIPLOMA IN PROPERTYSTUDIES

BACHELOR OF LAND ADMINISTRATION

BACHELOROF PROPERTYSTUDIES

QUALIFICATION(S) CODE: 06DPRS

07BLAM

08BPRS

NQF LEVEL: 6

COURSE CODE: LET621S

COURSE NAME: LAND ECONOMICS AND TAXATION

EXAMS SESSION: N8VEMBER 2023

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

EXAMINER(S}

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

MR SAMUELATO K. HAYFORD

MODERATOR: MR UAURIKA KAHIREKE

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 5 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 8 PAGES (including this front page and the graph attached as

Appendix A)

|

2 Page 2 |

▲back to top |

Land Economics and Taxation

Question 1

LET621S

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer

carries 1 mark.

(20)

a) Given any location, different competing land uses have the same rent paying abilities.

b) Rent payment ability of a land use is significantly influenced by the rent producing capacity

that will accrue from the use of that land.

c) Depending on accessibility character of a parcel of land, market forces of demand and supply

will set the price/rent to be paid by competing users of land.

d) Supply of land in the Central Business District is usually perfectly elastic and for that reason

level of rents and prices normally associated with central location use of land.

e) Profit-making land use is usually. associated with such uses that produce monetary benefits

that cannot be quantified to the users of land.

f) Given any urban use of land (i.e. Residential, industrial or commercial), operations carried on

within their areas of highest and best use are profitable, but not as profitable as those

carried on within their zones of transference

g) Landlords usually make rental concessions during periods when the supply of tenants is low.

This occurs during and when an economy experiences rapid growth.

h) When high supply of tenants prevails in a booming economy, landlords frequently demand

more rent.

i) Land resources managers and policymakers for land resource use must respect the

constraints posed by the three frameworks for analysing the use of land resources.

First Opportunity Question Paper

Page 2 of 8

November 2023

|

3 Page 3 |

▲back to top |

Land Economics and Taxation

LET621S

j) Biological framework concerned with the natural environment in which the operators find

themselves. This includes differences in weather, climate etc, such as hours of sunlight,

temperatures, rainfall, humidity.

k) Land use allocation is due to the fact that market forces of demand and supply set the

price/rent to be paid by competing users of land and for that reason determine how much

land will go to a particular type of use.

I) Land use capacity measures the productive potential of a given parcel of land utilised for a

given use at a given time with a specified technological and production conditions.

m) By Von Thunnen's theory of location, transportation costs have significant effects on rent

producing capacity and the extent of the areas within which many products can be produced

profitably.

n) Bid rent theory assumes that in a free market the highest bidder will obtain the use of the

land. It stands to reason that the highest bidder is likely to be the one who can obtain the

maximum profit per square metre from the site and so can pay the highest rent.

o) Land by itself has little economic value until it is used in conjunction with inputs of capital,

labour and management.

p) In most economic systems, the market is the primary mechanism for allocating resources,

with public intervention amending the market forces in certain spheres and replacing them

in others.

q) By Von Thunen's land rent theory, land rent basically emerges only when increase in demand

for land justify the use of less fertile lands

r) Monetary value placed on land usually reflects its use capacity and for that reason its rent

paying ability.

First Opportunity Question Paper

Page 3 of8

November 2023

|

4 Page 4 |

▲back to top |

Land Economics and Taxation

LET621S

s) Profit-making land uses are those uses that produce satisfaction (utility) to the users of land

whilst non-profit making land uses are those that give only monetary benefits to the users of

land.

t) The principle of equity is that taxes should be fair and based on people's 'ability to pay'.

u) Property tax satisfies the principle of equity because it is a progressive tax system, the rate of

tax rises with increasing rateable values of property.

v) In situations with declining property values in a taxing district due to declining economic

activities, revenues generated from property tax will decline.

w) Where the rate of tax is fixed annually by local government taking into account the budgeted

needs of the authority, annual fluctuation in the amount of tax is caused by fluctuation in the

amount of revenue generated from sources other than property tax and changing

expenditure requirements.

x) In situations where the law fixes the rate of property tax in primary legislation, the tax

revenues will vary according to changes in market values and regular revaluations.

y) There is fair and equity in regressive taxes because it is based on ability to pay as it is

assessed on the overall distribution of income.

z) Amount of tax payable on a taxable property satisfies the principle of equity and bears a

semblance of progressive tax system, because the amount of tax increases with increasing

rateable values.

[26)

First Opportunity Question Paper

Page 4 of8

November 2023

|

5 Page 5 |

▲back to top |

Land Economics and Taxation

Question 2

LET621S

a) According to von Thunen's Least-cost location theory as applied to agricultural land use, land

rent is a function of three factors. Mention any two (2) of these factors.

(2)

b) Enumerate the two (2) observations and conclusions by von Thunen's Least-cost location

theory as applied to agricultural land use.

(2)

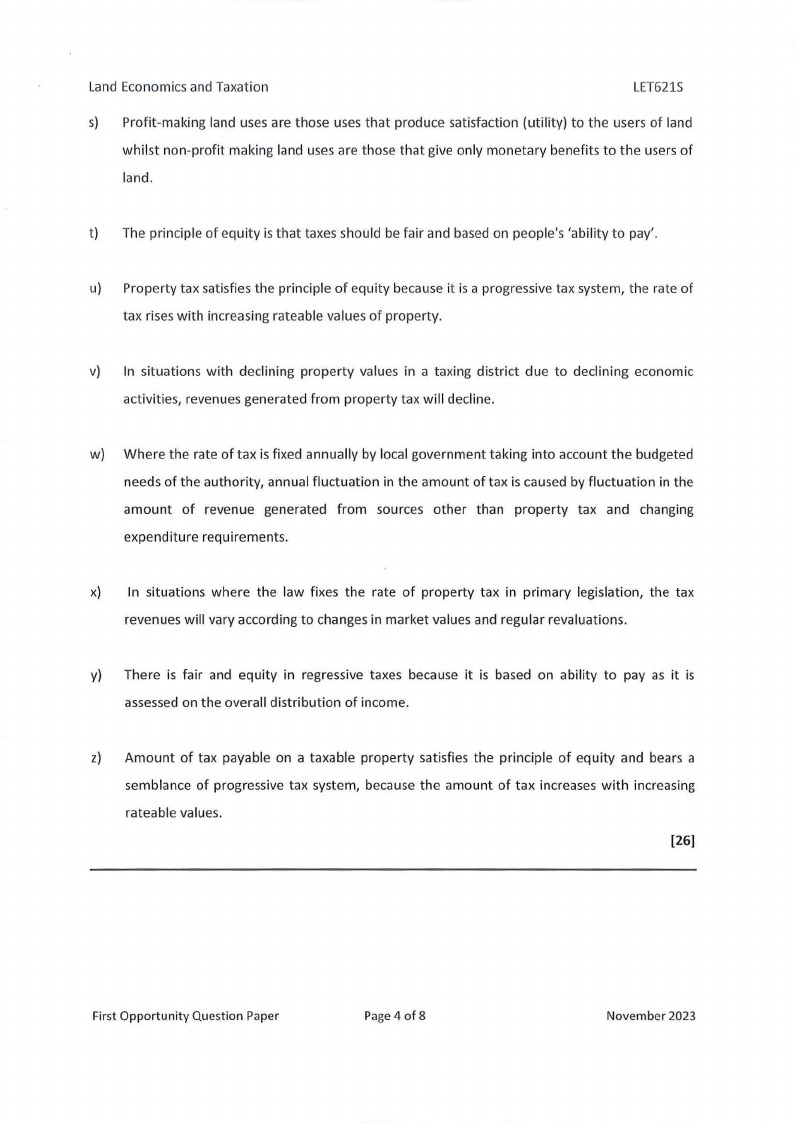

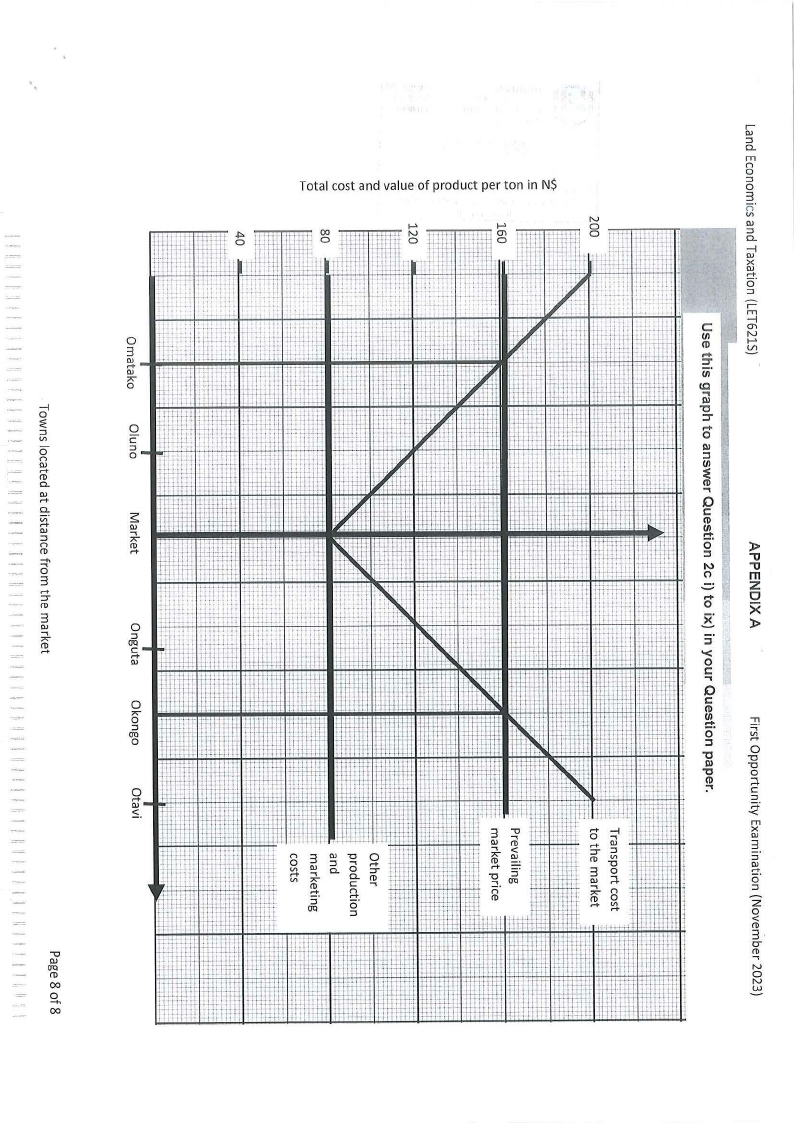

c) Attached as appendix A (i.e. Page 8) is a graph illustrating the effect of transportation cost on

land rent producing capacity associated with the use of land at various locations from the

market. With the information provided answer questions i) to viii) below.

(All figures are in N$ per ton of products. Output to the tune of 15 tonnes is harvested per

acre of land cultivated by each operator at their respective locations).

i) Where do the two 'No rent margins' occur and why?

(2)

ii) Between which two towns(locations) can profits be made by the operators?

(1)

iii) How much is earned for land rent for the use of land in Otavi?

(1)

iv) If operators of Otavi land are to enjoy land rent of N$250.00, what is expected of them

and by what amount (in your opinion) will lead to that?

(4)

v) Estimate the amount of land rent associated with the use of Oluno and Onguta lands

located at a distance of 20km and 25km respectively from the market.

(2)

vi) What is the amount of land rent associated with the 'optimal location'

(1)

vii) In your own words state the meaning of 'optimal location'

(1)

viii) At Onguta, what is the total cost of production including transport costs to the market?

(2)

First Opportunity Question Paper

Page 5 of8

November 2023

|

6 Page 6 |

▲back to top |

Land Economics and Taxation

LET621S

ix) In your own words state your understanding of "extensive margin of production" as

used in Von Thuunen's location theory.

(2)

[20)

Question 3

a) For each of the following state whether the relationship is POSITIVEor NEGATIVE.

(4)

i) Land value and Utility (satisfaction)

ii) Land value and Net land rent

iii) Rent paying ability and cost of transportation

iv) Rent paying ability and distance to the market

b) Profile of urban land Useson the basis of Returns earned is such that the highest value lands

at the centre of cities are used for commercial purposes, while areas with successively lower

values are used for residential, cropland etc.

Mention the four (4) areas where variations in this general profile usually take place. (4)

c) Given the following information for a hypothetical Municipal Authority, determine the

'property tax rate' to be adopted for the purpose of calculating and levying of property tax

for the ensuing financial year.

(10)

MuniciQal exQenditure reguirement

I

Extension of water supply

Extension of central sewage system

Acquisition of 5 Units of Fire Brigade@ N$2,500,000 each

Waste collection

I

Renovation of Municipal Swimming Pool

Acquisition of new Ambulance

Construction of District hospital

Construction of Primary Health Care Centre

I

N$

400,500,000

60,000,000

12,500,000

9,800,000

1,350,000

41,300,000

25,000,000

13,800,000

First Opportunity Question Paper

Page 6 of 8

November 2023

|

7 Page 7 |

▲back to top |

Land Economics and Taxation

Non Progerty tax revenue sources

Donations

Interest on Investment

Grants from central government

Abattoir charges

Registration fees for Taxi cabs and commuter buses

Trade license fees

Tyges of Progerties

Residential properties

Industrial properties

Commercial properties

LET621S

30,000,000

10,000,000

60,000,000

44,000,000

20,000,000

42,000,000

Land Values Improvement

(N$)

values(N$)

334,961,400 1,913,206,000

299,689,000 2,633,890,000

1,244,890,000 2,598,601,000

[18)

Question 4

a) Discuss any two (2) of the following:

(10)

i) Depreciated replacement cost method of valuation

ii) Site value taxation

iii) Rental value assessment

iv) Unit value assessment

b) Outline the three (3) main aims of the Agricultural (Commercial) Land Reforms Act of 1995

and any four (4) means (how) they are to be met.

(11)

[21)

Question 5

Discuss in detail any three (3) of the main advantages of municipal property tax.

(15)

[15)

First Opportunity Question Paper

Page 7 of 8

November 2023

|

8 Page 8 |

▲back to top |

----l

0

:::1, :

0

V,

c::

0n

::,

0

Q)

r+

(D

Q..

Q)

r+

Q..

~-

Q)

Q..) .,

::,

n

;,;-

(D

(D

r+

-.+., .,

0

3

r+

:::r

(D

3

Q..) .,

;,;-

0

::,

(D

r+

(7Q

c::

r+

Q)

0

;,;-

0::,

(7Q

0

0

r+

Qs) .

"'O

Q)

(7Q

(D

00

0

-+,

00

Total cost and value of product per ton in N$

r-

Q)

::,

a.

mn

0

::,

0

3

n

V,

Q)

::,

a.

----l

Q)

X

Q)

r+

6'

::,

C

-VI

(1)

:,-

in"

tC

@

":C,-

0

D,)

:::i

VI

.,

0

C:

(1)

VI

!:!':

0

)>

:::i

"'O

IV

-(")

0

E

"mz'O

0

><

)>

:::i

'<

0C.,:

0

C:

(1)

VI

!:!':

...,

0

V,,.,.

:::i

"C

D,)

0

"O

"O

"C

0

(1)

:-.

c::

::,

;:::;:

-<

m

X

Q)

3

::,

0.>

r+

6'

::,

z

0

<

(D

3.

O"

(D

N

0

Nw