|

IHA521S- INTRODUCTION TO HOSPITALITY AND TOURISM ACCOUNTING- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION CODE: 07BHOM

& 07BOTM

COURSE CODE: IHA521S

LEVEL: 6

COURSE NAME: INTRODUCTION TO HOSPITALITYAND

TOURISM ACCOUNTING

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY AND CALCULATIONS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

Sheehama, K.G.H.

MODERATOR Odada, L.

INSTRUCTIONS

• Answer ALL four (4) questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round

off only final answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after

the start of the examination. Thereafter, candidates must use their initiative to deal

with any perceived errors or ambiguities and any assumptions made by the

candidate should be clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _8_ PAGES (including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

(40 MARKS)

Answer this question ON the Answer Sheet provided and write down the letter that, in your

opinion, represents the correct answer:

1. What term is used for day-to-day dealings that are recorded in the book

of accounts of a business?

A. Business dealings

B. Bookkeeping

C. Business transactions

D. Accounting

2. Accounts receivables are increased by ...... and accounts payables are decreased by .........

A. Debits, Credits

B. Debits, Debits

C. Credits, Debits

D. Credits, Credits

3. When an owner contributes an asset into the business, it is called .....

A. Drawings

B. Income

C. Owner's equity

D. Sales

4. A company receives an order in April, posts the goods in May, and receives

payment in June. In this case, under the realization principle, revenue is

earned in which month?

A. April

B. May

C. June

D. None

5. Difference between sales and gross profit is called:

A. Net sales

B. Gross profit

C. Cost of goods sold

D. Net profit

2

|

3 Page 3 |

▲back to top |

6. A sum of expenses and net profit is called:

A. Net loss

B. Gross profit

C. Cost of goods sold

D. Gross loss

7. If total liabilities increased by N$4 000, then

A. Assets must have decreased by N$4 000.

B. Owner's equity must have decreased by N$4 000.

C. Assets must have increased by N$4 000 and owner's equity must have decreased by

N$4 000.

D. Assets and owner's equity each increased by N$2 000.

8. lftotal assets increased by N$5 000, then

A. Assets must have decreased by N$5 000.

B. Owner's equity must have decreased by N$5 000.

C. Assets must have increased by N$5 000 and owner's equity must have decreased by

N$5 000.

D. Assets and owner's equity each increased by N$2 500.

9. Which of the following statements is false?

A. to increase cash, debit the account

B. to increase revenue, credit the account

C. to decrease a liability, debit the account

D. to increase a liability, debit the account

10. Which ofthe following series of accounts all have debit balances?

A. building, cash, accrued salaries

B. building, salary expense, prepaid rent

C. building, depreciation expense, accrued rent

D. building, accumulated depreciation, cash

11. Which of the following series of accounts all have credit balances?

A. bank-overdraft, creditors, drawings

B. bank-overdraft, creditors, interest expense

C. capital, depreciation expense, sales

D. capital, accumulated depreciation, sales

3

|

4 Page 4 |

▲back to top |

12. State which one of the following errors would be discovered because of preparing a trial

balance:

A. The credit column of account has been overstated by N$100.

8. Drawings of N$200 has been entered in both drawings and bank account.

C. A transaction has been completely omitted from the books of account.

D. A transaction has been entered incorrectly in both accounts e.g. as N$59 instead of

as N$95.

13. Which ratio measures an evaluation of a business' ability to pay its

short term obligations?

A. Current ratio

8. Gross profit ratio

C. Net profit ratio

D. Ability period ratio

14. Debit entries in the ledger accounts will:

A. Increase both assets and liabilities.

8. Decrease both assets and liabilities.

C. Decrease assets and increase liabilities.

D. Increase assets and decrease liabilities

15. Net loss will result if:

A. Operating expenses are less than gross profit.

8. Operating expenses are greater than gross profit.

C. Sales revenues are greater than cost of sales.

D. Operating expenses are greater than cost of goods sold.

16. NamDancer has a dancing school and sells dancing shoes to clients. He won an important

dancing competition. NamDancer proposes to include his dancing skills and experience as

current asset in the statement of financial position. You advised him that this is not

allowed. Which ofthe following accounting rules apply?

A. The rule periodicity rule

8. The realization rule

C. The quantitative rule

D. The prudence rule

4

|

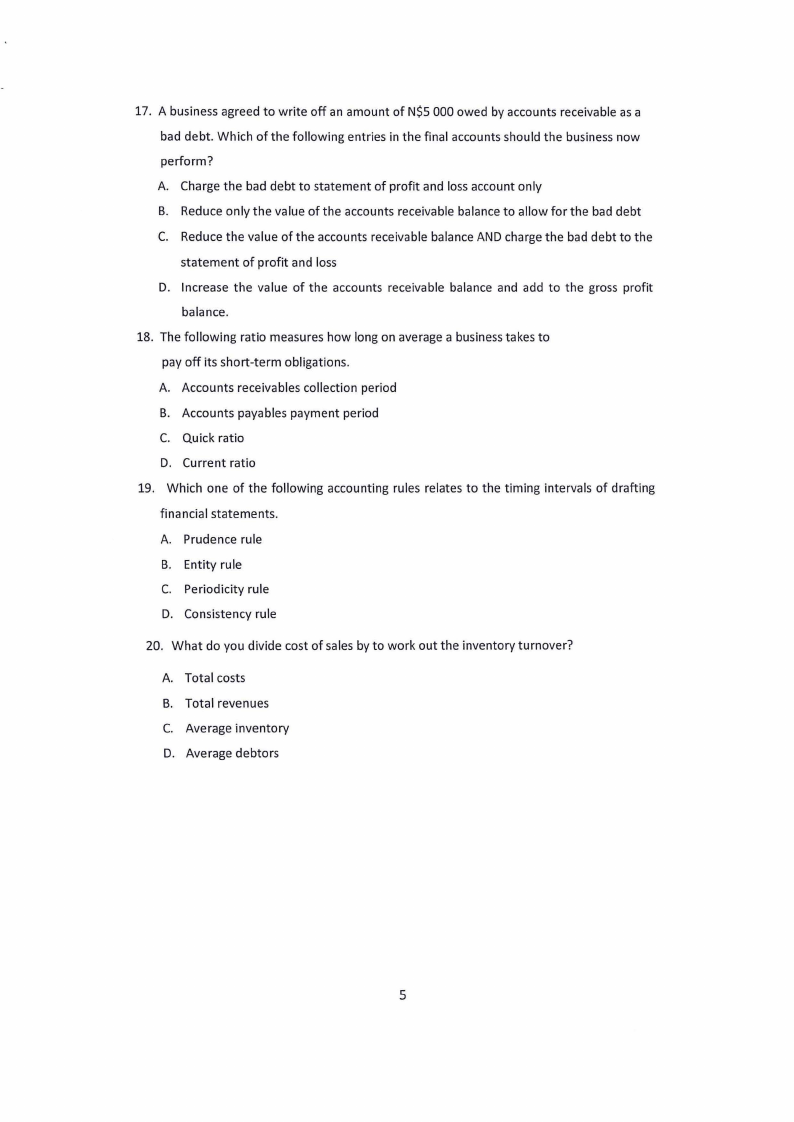

5 Page 5 |

▲back to top |

17. A business agreed to write off an amount of N$5 000 owed by accounts receivable as a

bad debt. Which of the following entries in the final accounts should the business now

perform?

A. Charge the bad debt to statement of profit and loss account only

B. Reduce only the value of the accounts receivable balance to allow for the bad debt

C. Reduce the value of the accounts receivable balance AND charge the bad debt to the

statement of profit and loss

D. Increase the value of the accounts receivable balance and add to the gross profit

balance.

18. The following ratio measures how long on average a business takes to

pay off its short-term obligations.

A. Accounts receivables collection period

B. Accounts payables payment period

C. Quick ratio

D. Current ratio

19. Which one of the following accounting rules relates to the timing intervals of drafting

financial statements.

A. Prudence rule

B. Entity rule

C. Periodicity rule

D. Consistency rule

20. What do you divide cost of sales by to work out the inventory turnover?

A. Total costs

B. Total revenues

C. Average inventory

D. Average debtors

5

|

6 Page 6 |

▲back to top |

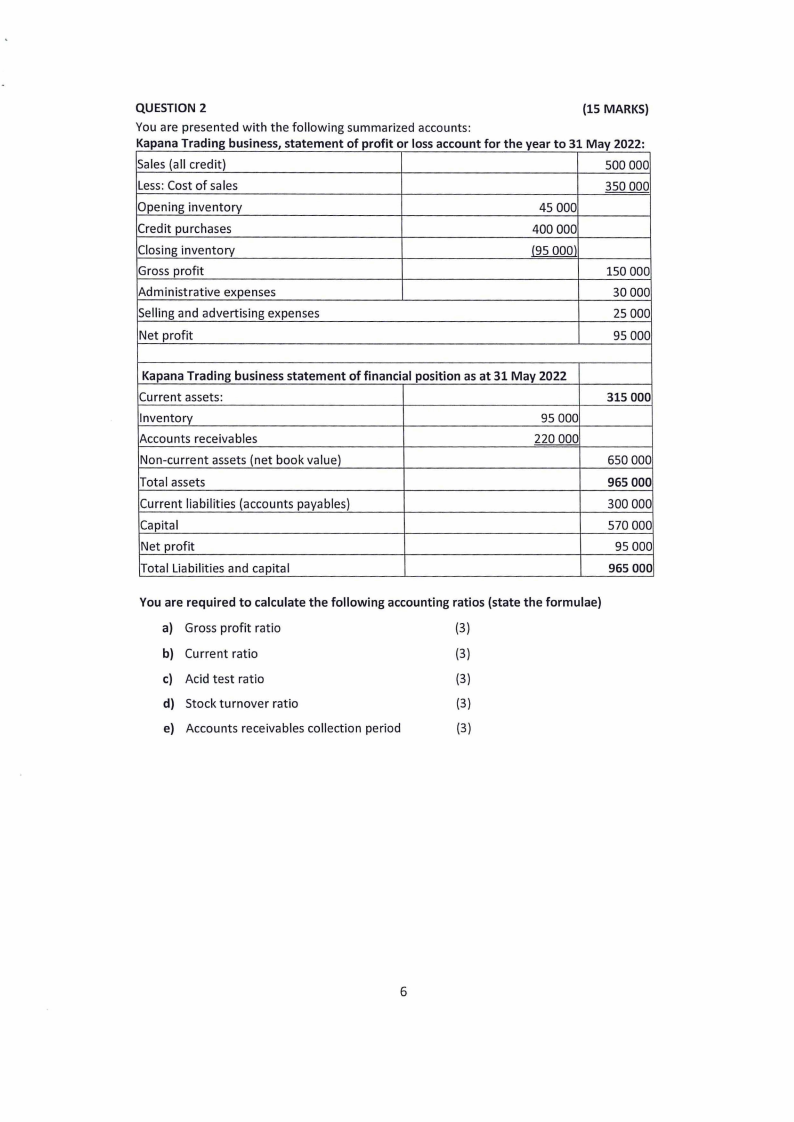

QUESTION 2

(15 MARKS)

You are presented with the following summarized accounts:

Kapana Trading business, statement of profit or loss account for the year to 31 May 2022:

Sales (all credit)

500 000

Less:Cost of sales

350 000

Opening inventory

45 000

Credit purchases

400 000

Closing inventory

(95 000)

Gross profit

150 000

Administrative expenses

30000

Selling and advertising expenses

25 000

Net profit

95 000

Kapana Trading business statement of financial position as at 31 May 2022

Current assets:

Inventory

95 000

Accounts receivables

220 000

Non-current assets (net book value)

Total assets

Current liabilities (accounts payables)

Capital

Net profit

Total Liabilities and capital

315 000

650 000

965 000

300 000

570 000

95 000

965 000

You are required to calculate the following accounting ratios (state the formulae)

a) Gross profit ratio

(3)

b) Current ratio

(3)

c) Acid test ratio

(3)

d) Stock turnover ratio

(3)

e) Accounts receivables collection period

(3)

6

|

7 Page 7 |

▲back to top |

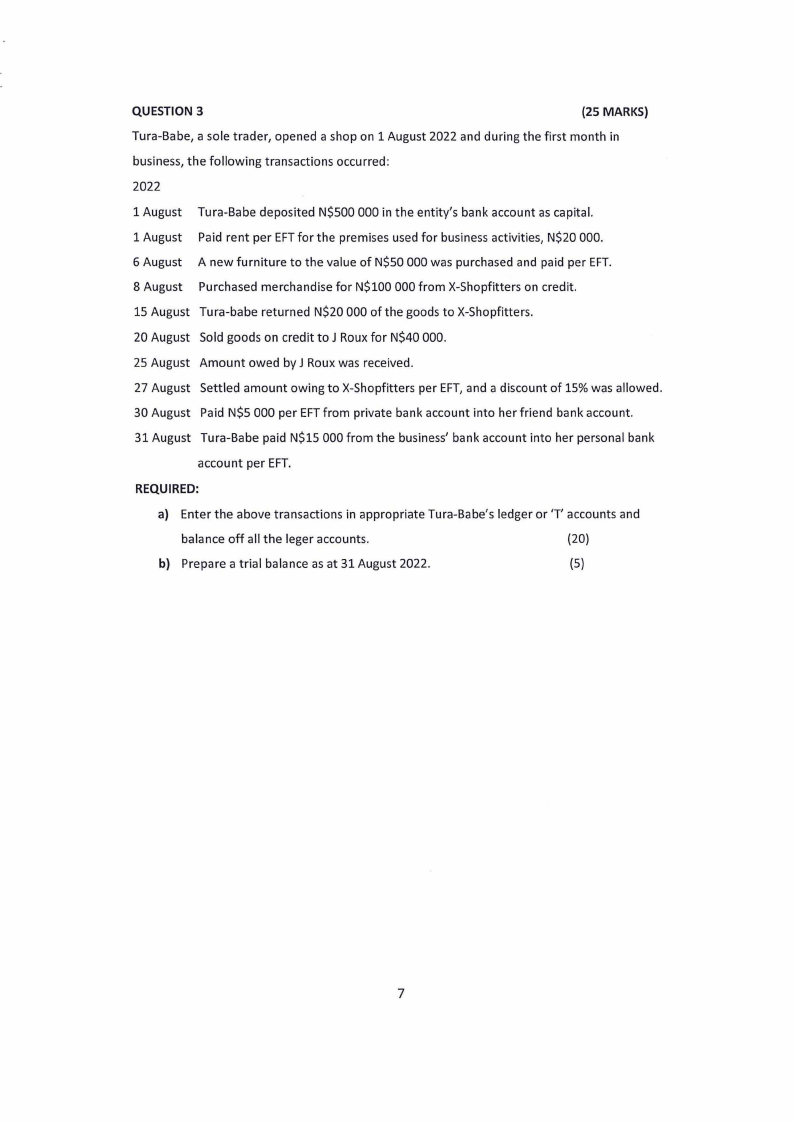

QUESTION 3

(25 MARKS)

Tura-Babe, a sole trader, opened a shop on 1 August 2022 and during the first month in

business, the following transactions occurred:

2022

1 August Tura-Babe deposited N$500 000 in the entity's bank account as capital.

1 August Paid rent per EFTfor the premises used for business activities, N$20 000.

6 August A new furniture to the value of N$50 000 was purchased and paid per EFT.

8 August Purchased merchandise for N$100 000 from X-Shopfitters on credit.

15 August Tura-babe returned N$20 000 of the goods to X-Shopfitters.

20 August Sold goods on credit to J Roux for N$40 000.

25 August Amount owed by J Roux was received.

27 August Settled amount owing to X-Shopfitters per EFT,and a discount of 15% was allowed.

30 August Paid N$5 000 per EFTfrom private bank account into her friend bank account.

31 August Tura-Babe paid N$15 000 from the business' bank account into her personal bank

account per EFT.

REQUIRED:

a) Enter the above transactions in appropriate Tura-Babe's ledger or 'T' accounts and

balance off all the leger accounts.

(20)

b) Prepare a trial balance as at 31 August 2022.

(5)

7

|

8 Page 8 |

▲back to top |

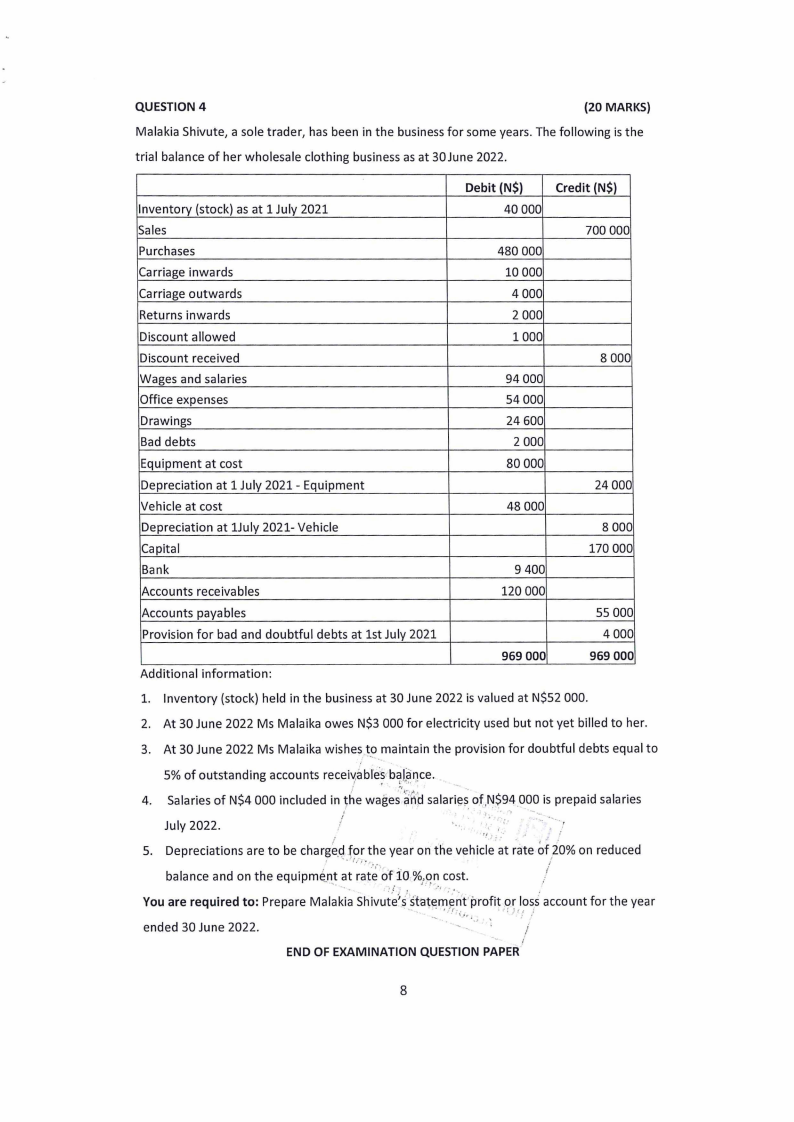

QUESTION 4

(20 MARKS)

Malakia Shivute, a sole trader, has been in the business for some years. The following is the

trial balance of her wholesale clothing business as at 30June 2022.

Inventory (stock) as at 1 July 2021

Sales

Purchases

Carriage inwards

Carriage outwards

Returns inwards

Discount allowed

Discount received

Wages and salaries

Office expenses

Drawings

Bad debts

Equipment at cost

Depreciation at 1 July 2021 - Equipment

Vehicle at cost

Depreciation at 1July 2021- Vehicle

Capital

Bank

Accounts receivables

Accounts payables

Provision for bad and doubtful debts at 1st July 2021

Additional information:

Debit (N$)

Credit (N$)

40 000

700 000

480 000

10 000

4 000

2 000

1000

8 000

94000

54000

24 600

2 000

80000

24000

48 000

8 000

170 000

9 400

120 000

55 000

4000

969 000

969 000

1. Inventory (stock) held in the business at 30 June 2022 is valued at N$52 000.

2. At 30 June 2022 Ms Malaika owes N$3 000 for electricity used but not yet billed to her.

3. At 30 June 2022 Ms Malaika wishes t9 maintain the provision for doubtful debts equal to

5% of outstanding accounts receiv,ables balance.

If

"

I., "'.,. I•

-.

4. Salaries of N$4 000 included in Jhe wages ;h'd salari~s.of,~$9~_000 is prepaid salaries

I

......

July 2022.

I

i

.

,/,.':··

', .

5. Depreciations are to be charge_tjfor the year on the vehicle at rate of 20% on reduced

, · - ·i,1-.,,_ _

/

balance and on the equipm~nt at rat~ ·o·fio %,on cost.

·

..

;,r

You are required to: Prepare Mal~k·i~Shivu~~1s"sfat~-~-~~t'profit .or loss·account for the year

· • lf i ,,, _

· · r;: _, /

ended 30 June 2022.

/

I

END OF EXAMINATION QUESTION PAPER

8