|

IHA521S- INTRODUCTION TO HOSPITALITY AND TOURISM ACCOUNTING- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION CODE: 07BHOM

&07BOTM

COURSE CODE: IHA521S

LEVEL: 6

COURSE NAME: INTRODUCTION TO HOSPITALITYAND

TOURISM ACCOUNTING

SESSION: JULY 2023

DURATION: 3 HOURS

PAPER: THEORY AND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

Sheehama, K.G.H.

MODERATOR Odada, L.

INSTRUCTIONS

• Answer ALL four (4) questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round

off only final answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after

the start of the examination. Thereafter, candidates must use their initiative to deal

with any perceived errors or ambiguities and any assumptions made by the

candidate should be clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

{40 MARKS)

Answer this question ON the Answer Sheet provided and write down the letter that, in your

opinion, represents the correct answer:

1. Bob purchases goods from a supplier which cost N$20 000. He gets a cash discount of

10%. What is the amount that Bob will pay to a supplier?

A N$20 000

B. N$18 000

C. N$19 000

D. N$10 000

2. Bob purchases goods from a supplier which cost N$20 000. The supplier gives a cash

discount of 5%. What is the amount of discount Bob should be allowed?

A. N$3 000

B. N$2 000

C. N$5 000

D. N$1000

3. When an owner contributes an asset into the business, it is called .....

A. Drawings

B. Income

C. Owner's equity

D. Sales

4. If opening inventory is N$120 000, cost of goods purchased is N$380 000, and

closing inventory is N$100 000, what is cost of goods sold under a periodic system?

A. N$SO0000

B. N$400 000

C. N$450 000

D. N$550 000

5. Goods were purchased from James. He was immediately paid by electronic funds transfer.

Which account is credited?

A. Sales a/c

B. James a/c

C. Bank a/c

D. Purchases a/c

6. Goods were purchased from James. He was immediately paid by electronic funds

transfer. Which account is debited?

A. Purchases a/c

B. Jack a/c

C. Bank a/c

D. Sales a/c

2

|

3 Page 3 |

▲back to top |

7. Which of the following transactions is recorded in the cash payment journal?

A. receipt of customer payments

B. purchases of equipment for cash

C. borrowing money from a bank

D. sale of equipment for cash

8. The following financial statement encompasses drawings, owner's equity, liabilities and

assets.

A. Statement of fin anciaI position

B. Statement of cashflow

C. Statement of profit or loss

D. Statement of information

9. Which of the following is not considered as a financial statement?

A. Statement of financial position

B. Statement of cashflow

C. Statement of profit or loss

D. Statement of trial balance

10. Which financial statement reports the performance of a business?

A. Statement of financial position

B. Statement of profit or loss

C. Statement of changes in owner's equity

D. Statement of information

The following applies to questions 11 to 13

Vuyo Ltd statement of financial position at 31 May 2017

Current assets:

Inventory

N$79 000

Account receivables

395 000

Non-current assets (net book value)

Total assets

Current liabilities (account payables)

Owner's equity

Net profit

Total Liabilities and capital

11. Return on owner's equity ratio is...........

A. 30%

B. 25%

C. 15%

D. 20%

N$474 000

491000

965 000

395 000

475 000

95 000

965 000

3

|

4 Page 4 |

▲back to top |

12. Current ratio is.....

A. 1.2

B. 1.5

C. 1.1

D. 1.4

13. Quick/acid test ratio is.....

A. 1

B. 2

C. 1.5

D. 2.5

14. At the end of year 2021, a business made payment of water and electricity bills of

N$20 000. How will this be recorded in the statement of profit or loss in 2021?

A. as an income

B. as an asset

C. as an accrual

D. as an expense

15. At the end of year 2021, a business borrowed N$20 000 from the bank.

How will this be recorded in the statement of financial position in 2021?

A. as an income

B. as liability

C. as an expense

D. as an asset

16. Liabilities can be described as

A. Account payables claim on total assets

B. creditorship claim on total assets

C. third parties claim on total assets less capital/owner's equity

D. government claims on total assets

17.What accounting transaction would result in the following double entry being posted?

Dr Vehicle

Cr Bank

A. The purchases of goods by EFT

B. The receipt of cash from a credit customer

C. The purchases of vehicle by EFT

D. The banking of cash

18. Gross loss will result if:

A. Operating expenses are less than net income.

B. Sales revenues are less than operating expenses.

C. Sales revenues are less than cost of goods sold.

D. Operating expenses are greater than cost of goods sold.

4

|

5 Page 5 |

▲back to top |

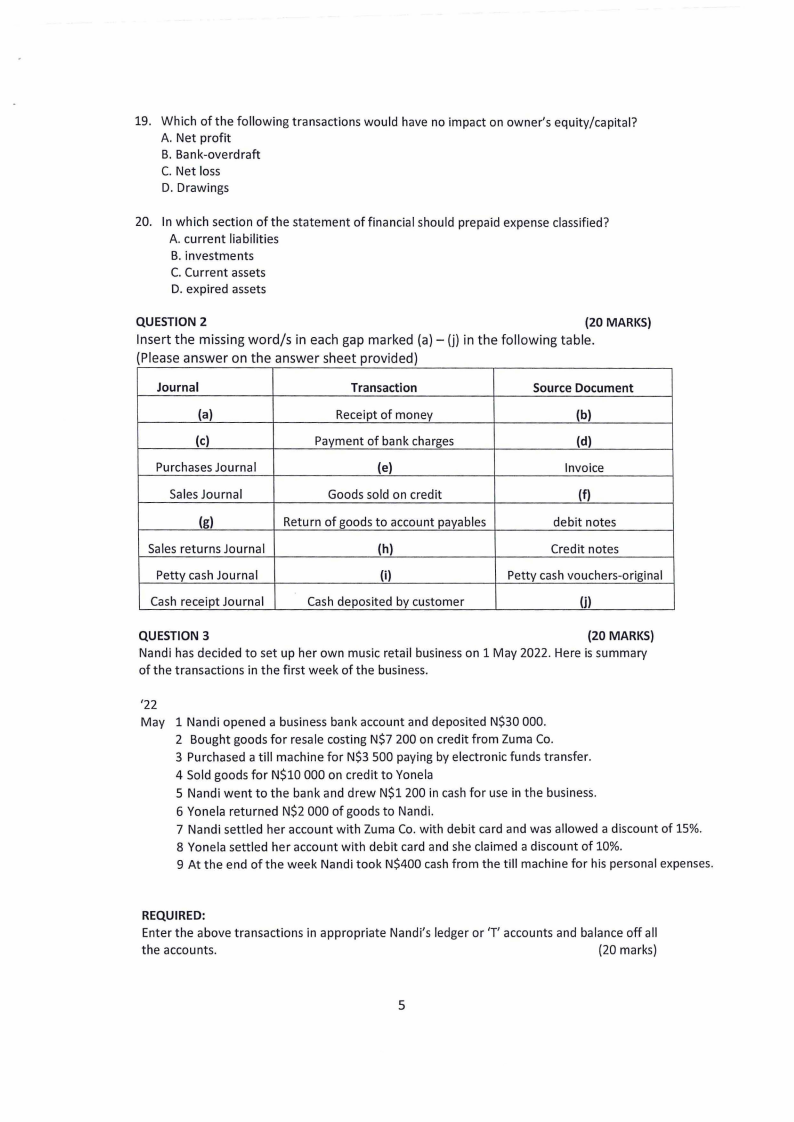

19. Which of the following transactions would have no impact on owner's equity/capital?

A. Net profit

B. Bank-overdraft

C. Net loss

D. Drawings

20. In which section of the statement of financial should prepaid expense classified?

A. current liabilities

B. investments

C. Current assets

D. expired assets

QUESTION 2

(20 MARKS)

Insert the missing word/s in each gap marked (a) - (j) in the following table.

(Please answer on the answer sheet provided)

Journal

(a)

(c)

Purchases Journal

Sales Journal

(g)

Sales returns Journal

Petty cash Journal

Cash receipt Journal

Transaction

Receipt of money

Payment of bank charges

(e)

Goods sold on credit

Return of goods to account payables

(h)

(i)

Cash deposited by customer

Source Document

(b)

(d)

Invoice

(f)

debit notes

Credit notes

Petty cash vouchers-original

(j)

QUESTION 3

(20 MARKS)

Nandi has decided to set up her own music retail business on 1 May 2022. Here is summary

of the transactions in the first week of the business.

'22

May 1 Nandi opened a business bank account and deposited N$30 000.

2 Bought goods for resale costing N$7 200 on credit from Zuma Co.

3 Purchased a till machine for N$3 500 paying by electronic funds transfer.

4 Sold goods for N$10 000 on credit to Yonela

5 Nandi went to the bank and drew N$1 200 in cash for use in the business.

6 Yonela returned N$2 000 of goods to Nandi.

7 Nandi settled her account with Zuma Co. with debit card and was allowed a discount of 15%.

8 Yonela settled her account with debit card and she claimed a discount of 10%.

9 At the end of the week Nandi took N$400 cash from the till machine for his personal expenses.

REQUIRED:

Enter the above transactions in appropriate Nandi's ledger or 'T' accounts and balance off all

the accounts.

(20 marks)

5

|

6 Page 6 |

▲back to top |

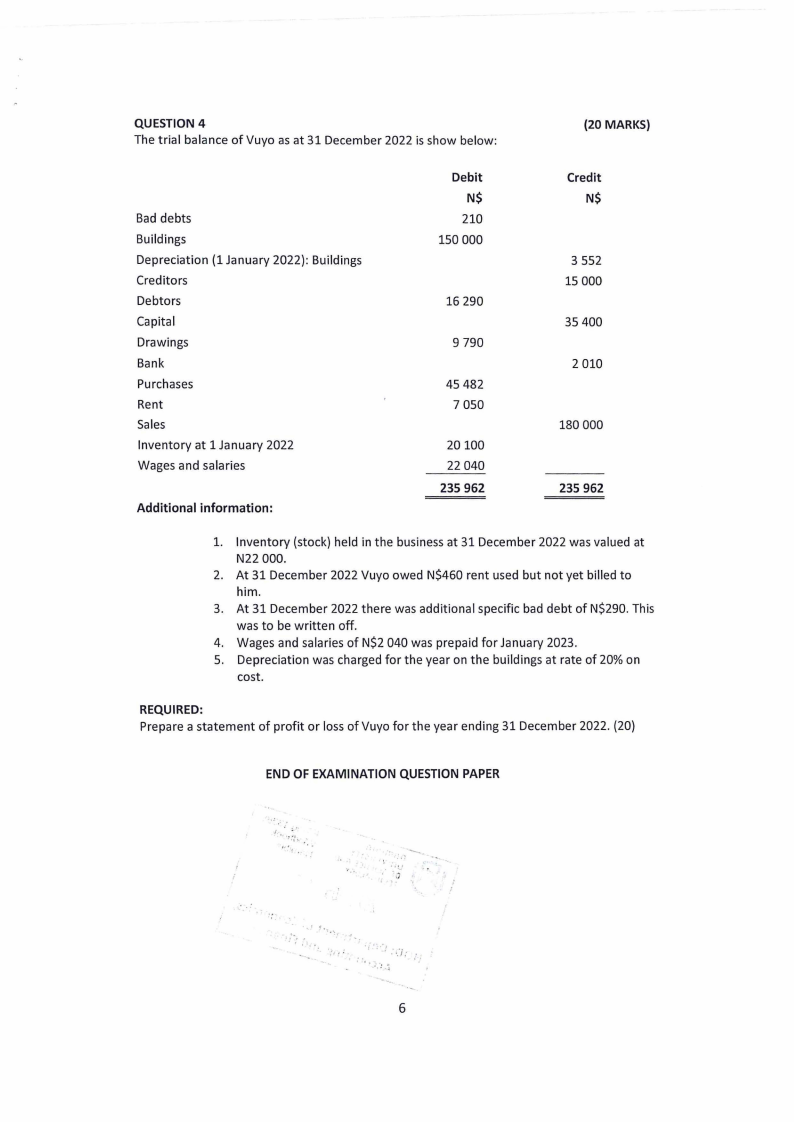

QUESTION 4

The trial balance of Vuyo as at 31 December 2022 is show below:

{20 MARKS)

Bad debts

Buildings

Depreciation (1 January 2022): Buildings

Creditors

Debtors

Capital

Drawings

Bank

Purchases

Rent

Sales

Inventory at 1 January 2022

Wages and salaries

Additional information:

Debit

N$

210

150 000

16 290

9 790

45 482

7 050

20100

22 040

235 962

Credit

N$

3 552

15 000

35 400

2 010

180 000

235 962

1. Inventory (stock) held in the business at 31 December 2022 was valued at

N22 000.

2. At 31 December 2022 Vuyo owed N$460 rent used but not yet billed to

him.

3. At 31 December 2022 there was additional specific bad debt of N$290. This

was to be written off.

4. Wages and salaries of N$2 040 was prepaid for January 2023.

5. Depreciation was charged for the year on the buildings at rate of 20% on

cost.

REQUIRED:

Prepare a statement of profit or loss of Vuyo for the year ending 31 December 2022. (20)

END OF EXAMINATION QUESTIONPAPER

.....

6