|

CMA611S- COST AND MANAGEMENT ACCOUNTING 201- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL: 6

COURSE CODE: CMA611S

COURSE NAME: COST& MANAGEMENT ACCOUNTING201

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORYAND CALCULATIONS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

Ms Kangala, H. and Sheehama, K.G.H.

MODERATOR Tjondu, K.

INSTRUCTIONS

• Answer ALL the questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round off only

final answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF_ 4_ PAGES (excluding this front page)

0

|

2 Page 2 |

▲back to top |

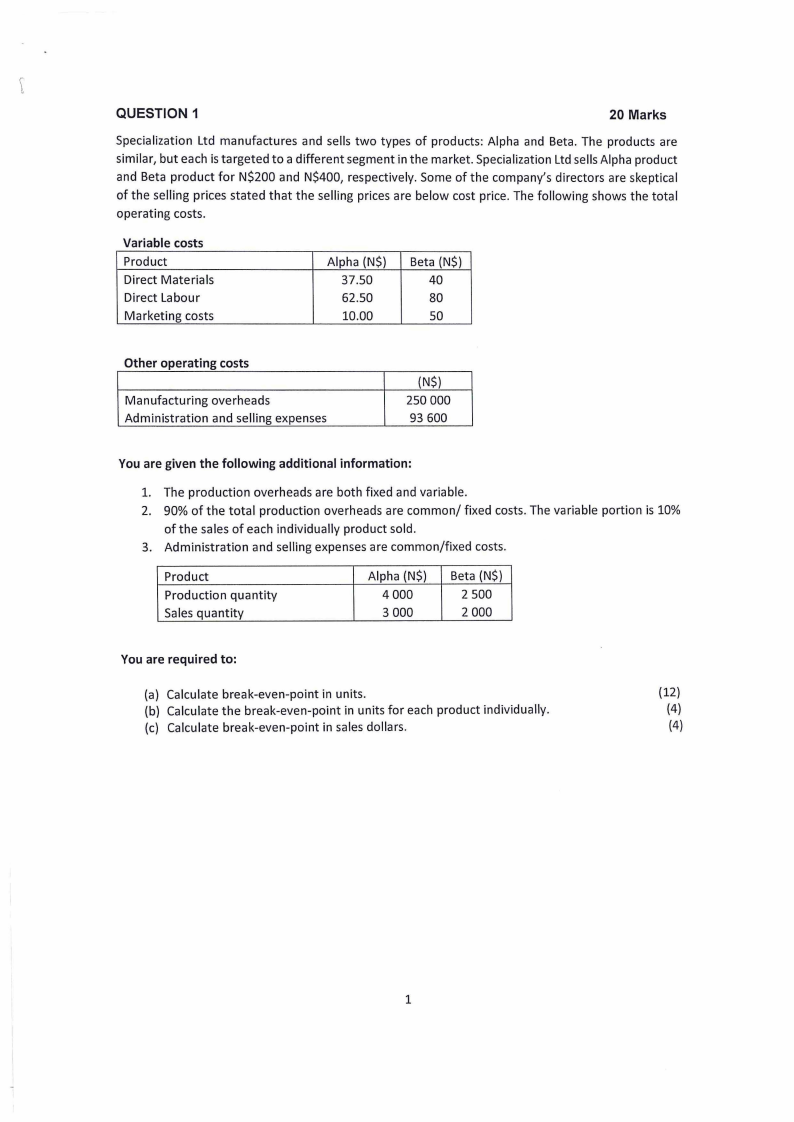

QUESTION 1

20 Marks

Specialization Ltd manufactures and sells two types of products: Alpha and Beta. The products are

similar, but each is targeted to a different segment in the market. Specialization Ltd sells Alpha product

and Beta product for N$200 and N$400, respectively. Some of the company's directors are skeptical

of the selling prices stated that the selling prices are below cost price. The following shows the total

operating costs.

Variable costs

Product

Direct Materials

Direct Labour

Marketing costs

Alpha (N$)

37.50

62.50

10.00

Beta (N$)

40

80

so

Other operating costs

Manufacturing overheads

Administration and selling expenses

(N$)

250 000

93 600

You are given the following additional information:

1. The production overheads are both fixed and variable.

2. 90% of the total production overheads are common/ fixed costs. The variable portion is 10%

ofthe sales of each individually product sold.

3. Administration and selling expenses are common/fixed costs.

Product

Production quantity

Sales quantity

Alpha (N$)

4000

3 000

Beta (N$)

2 500

2 000

You are required to:

(a) Calculate break-even-point in units.

(b) Calculate the break-even-point in units for each product individually.

(c) Calculate break-even-point in sales dollars.

(12)

(4)

(4)

1

|

3 Page 3 |

▲back to top |

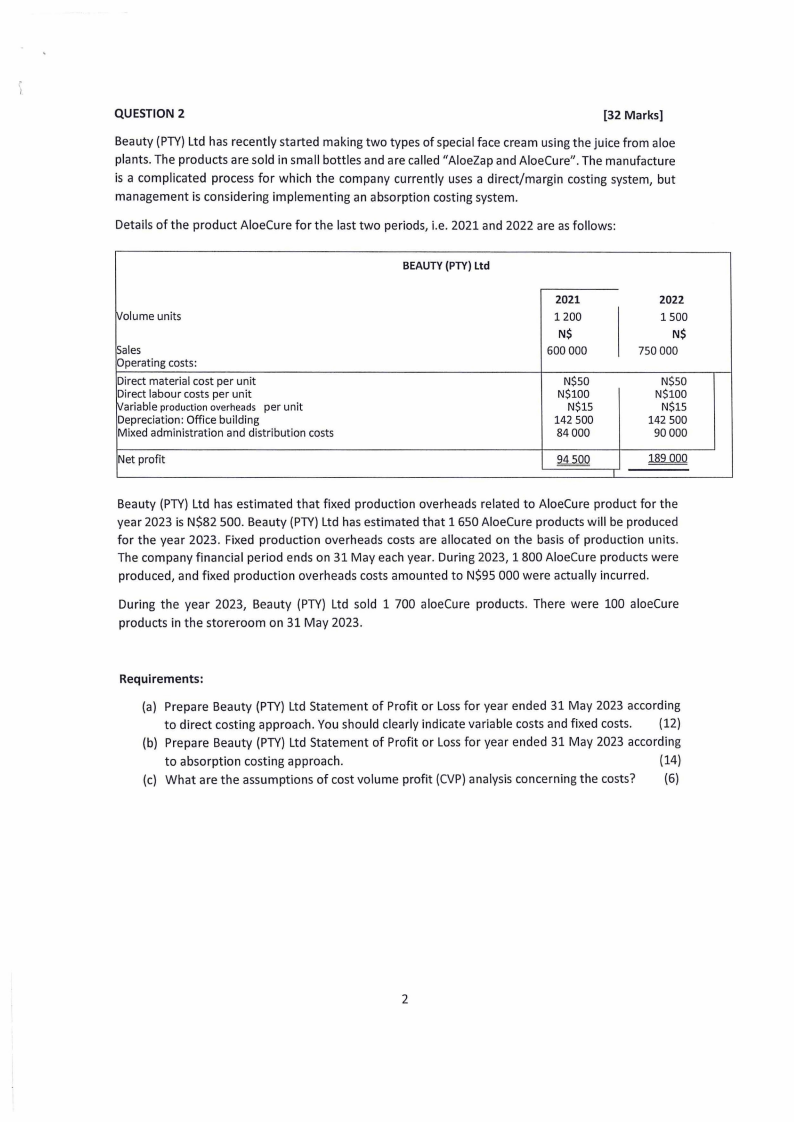

QUESTION 2

[32 Marks]

Beauty (PTY)Ltd has recently started making two types of special face cream using the juice from aloe

plants. The products are sold in small bottles and are called "AloeZap and AloeCure". The manufacture

is a complicated process for which the company currently uses a direct/margin costing system, but

management is considering implementing an absorption costing system.

Details of the product AloeCure for the last two periods, i.e. 2021 and 2022 are as follows:

BEAUTY(PTY) Ltd

il/olume units

~ales

Operating costs:

Direct material cost per unit

Direct labour costs per unit

Variable production overheads per unit

Depreciation: Office building

Mixed administration and distribution costs

Net profit

2021

1200

N$

600 000

2022

1500

N$

750 000

N$50

N$100

N$15

142 500

84000

94 500

I

N$50

N$100

N$15

142 500

90000

189 000

Beauty (PTY)Ltd has estimated that fixed production overheads related to AloeCure product for the

year 2023 is N$82 500. Beauty (PTY)Ltd has estimated that 1 650 AloeCure products will be produced

for the year 2023. Fixed production overheads costs are allocated on the basis of production units.

The company financial period ends on 31 May each year. During 2023, 1800 AloeCure products were

produced, and fixed production overheads costs amounted to N$95 000 were actually incurred.

During the year 2023, Beauty (PTY) Ltd sold 1 700 aloeCure products. There were 100 aloeCure

products in the storeroom on 31 May 2023.

Requirements:

(a) Prepare Beauty (PTY) Ltd Statement of Profit or Loss for year ended 31 May 2023 according

to direct costing approach. You should clearly indicate variable costs and fixed costs. (12)

(b) Prepare Beauty (PTY)Ltd Statement of Profit or Lossfor year ended 31 May 2023 according

to absorption costing approach.

(14)

(c) What are the assumptions of cost volume profit (CVP)analysis concerning the costs? (6)

2

|

4 Page 4 |

▲back to top |

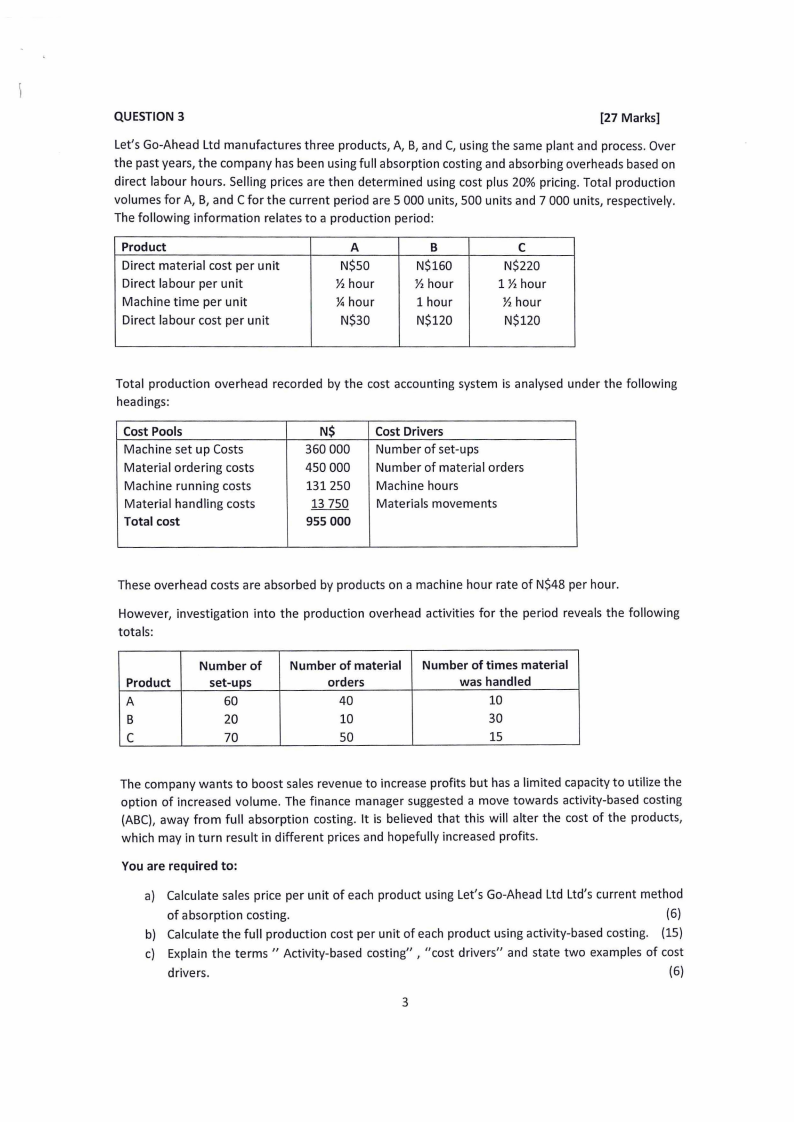

QUESTION 3

[27 Marks]

Let's Go-Ahead Ltd manufactures three products, A, B, and C, using the same plant and process. Over

the past years, the company has been using full absorption costing and absorbing overheads based on

direct labour hours. Selling prices are then determined using cost plus 20% pricing. Total production

volumes for A, B, and C for the current period are 5 000 units, 500 units and 7 000 units, respectively.

The following information relates to a production period:

Product

Direct material cost per unit

Direct labour per unit

Machine time per unit

Direct labour cost per unit

A

N$50

½ hour

¼ hour

N$30

B

N$160

½ hour

1 hour

N$120

C

N$220

1 ½ hour

½ hour

N$120

Total production overhead recorded by the cost accounting system is analysed under the following

headings:

Cost Pools

Machine set up Costs

Material ordering costs

Machine running costs

Material handling costs

Total cost

N$

360 000

450 000

131250

13 750

955 000

Cost Drivers

Number of set-ups

Number of material orders

Machine hours

Materials movements

These overhead costs are absorbed by products on a machine hour rate of N$48 per hour.

However, investigation into the production overhead activities for the period reveals the following

totals:

Product

A

B

C

Number of

set-ups

60

20

70

Number of material

orders

40

10

50

Number of times material

was handled

10

30

15

The company wants to boost sales revenue to increase profits but has a limited capacity to utilize the

option of increased volume. The finance manager suggested a move towards activity-based costing

(ABC), away from full absorption costing. It is believed that this will alter the cost of the products,

which may in turn result in different prices and hopefully increased profits.

You are required to:

a) Calculate sales price per unit of each product using Let's Go-Ahead Ltd Ltd's current method

of absorption costing.

(6)

b) Calculate the full production cost per unit of each product using activity-based costing. (15)

c) Explain the terms " Activity-based costing" , "cost drivers" and state two examples of cost

drivers.

(6)

3

|

5 Page 5 |

▲back to top |

(

I

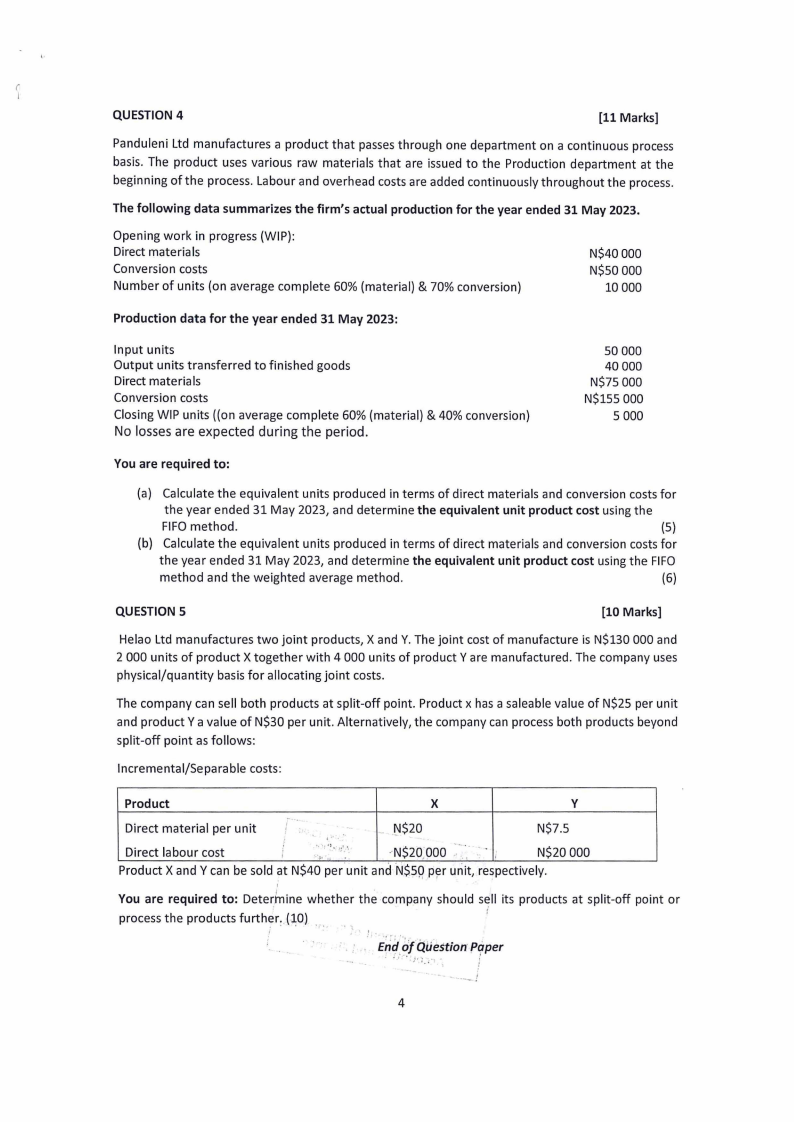

QUESTION 4

[11 Marks]

Panduleni Ltd manufactures a product that passes through one department on a continuous process

basis. The product uses various raw materials that are issued to the Production department at the

beginning of the process. Labour and overhead costs are added continuously throughout the process.

The following data summarizes the firm's actual production for the year ended 31 May 2023.

Opening work in progress (WIP):

Direct materials

Conversion costs

Number of units (on average complete 60% (material) & 70% conversion)

N$40 000

N$50 000

10000

Production data for the year ended 31 May 2023:

Input units

Output units transferred to finished goods

Direct materials

Conversion costs

Closing WIP units ((on average complete 60% (material) & 40% conversion)

No losses are expected during the period.

50 000

40000

N$75 000

N$155 000

5 000

You are required to:

(a) Calculate the equivalent units produced in terms of direct materials and conversion costs for

the year ended 31 May 2023, and determine the equivalent unit product cost using the

FIFO method.

(5)

(b) Calculate the equivalent units produced in terms of direct materials and conversion costs for

the year ended 31 May 2023, and determine the equivalent unit product cost using the FIFO

method and the weighted average method.

(6)

QUESTION 5

[10 Marks]

Helao Ltd manufactures two joint products, X and Y. The joint cost of manufacture is N$130 000 and

2 000 units of product X together with 4 000 units of product Y are manufactured. The company uses

physical/quantity basis for allocating joint costs.

The company can sell both products at split-off point. Product x has a saleable value of N$25 per unit

and product Ya value of N$30 per unit. Alternatively, the company can process both products beyond

split-off point as follows:

Incremental/Separable costs:

Product

X

y

- ..

Direct material per unit

I

I

.. _['1$20

N$7.5

Direct labour cost

;

,.·,.,i ·1;'_·,

I

.•,."

--.

.·.N$20;000

-

N$20 000

Product X and Y can be sold at N$40 per unit and N$5R p~r unit, respectively.

'

You are required to: Determ. ine whether the company should sei ll its products at split-off

process the products furth?L (-10) ... . ,

point or

EnddfQuestion paper

. ... .

i

4