|

CMA611S- COST AND MANAGEMENT ACCOUNTING 201- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL:6

COURSE CODE: CMA611S

COURSE NAME: COST & MANAGEMENT ACCOUNTING 201

SESSION: JULY 2023

DURATION: 3 HOURS

PAPER: THEORY AND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

Ms Kangala, H. and Sheehama, K.G.H.

MODERATOR Tjondu, K.

INSTRUCTIONS

• Answer ALL the questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round off final

answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after the

start of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF_ 4_ PAGES (excluding this front page)

0

|

2 Page 2 |

▲back to top |

QUESTION 1

The following information is available from the books of Jones Ltd.

Actual Manufacturing cost per unit:

Fixed

Variable (Material - N$2; Labour - N$3; Overheads - N$1)

Actual Selling and administrative cost:

Total fixed selling and administrative cost

Variable per unit

N$

N$4.00

N$6.00

N$8,000

N$2.00

Actual Selling price per unit

Company Budgeted Figures:

Pre-determined overhead absorption rate per unit

Normal monthly production

N$15.00

N$5.00

9,000 units

(16 Marks)

In March 2023, Jones Ltd produced and sold 9,000 units, while in April 2023, Jones manufactured

8,500 units and sold 8,000 of them.

Required:

l. Compile separate Statements of Profit or Lossfor the month of April 2023 in accordance with:

a) The absorption costing method

(8 Marks)

b) The variable costing method

(8 Marks)

QUESTION 2

(19 Marks)

Flowers Ltd sells two products, Roses and Tulips, with contribution margin ratios of 40% and 30%

respectively. Roses are sold at N$50 per unit, while Tulips sell at N$25 per unit. The company's fixed

costs amount to $72,000 a month. Monthly sales average 30,000 units of Roses and 45,000 units of

Tulips.

Required:

a) Calculate the weighted average contribution

(4 Marks)

b) Calculate the break-even sales value (N$) of the individual products

(5 Marks)

c) Flowers Ltd is considering spending an additional $9,678.40 a month on advertising, giving

more emphasis on the sale of Roses and less emphasis on the sale of Tulips. If its analysis is

correct, sales of Roses will increase to 39,600 units a month, but sales of Tulips will fall to

32,400 units a month.

i. Recalculate the break-even in sales volume, at this new product mix.

(4 Marks)

ii. Should the proposal to spend the additional $9,678.40 a month be accepted?

Show all your calculations.

(6 Marks)

1

|

3 Page 3 |

▲back to top |

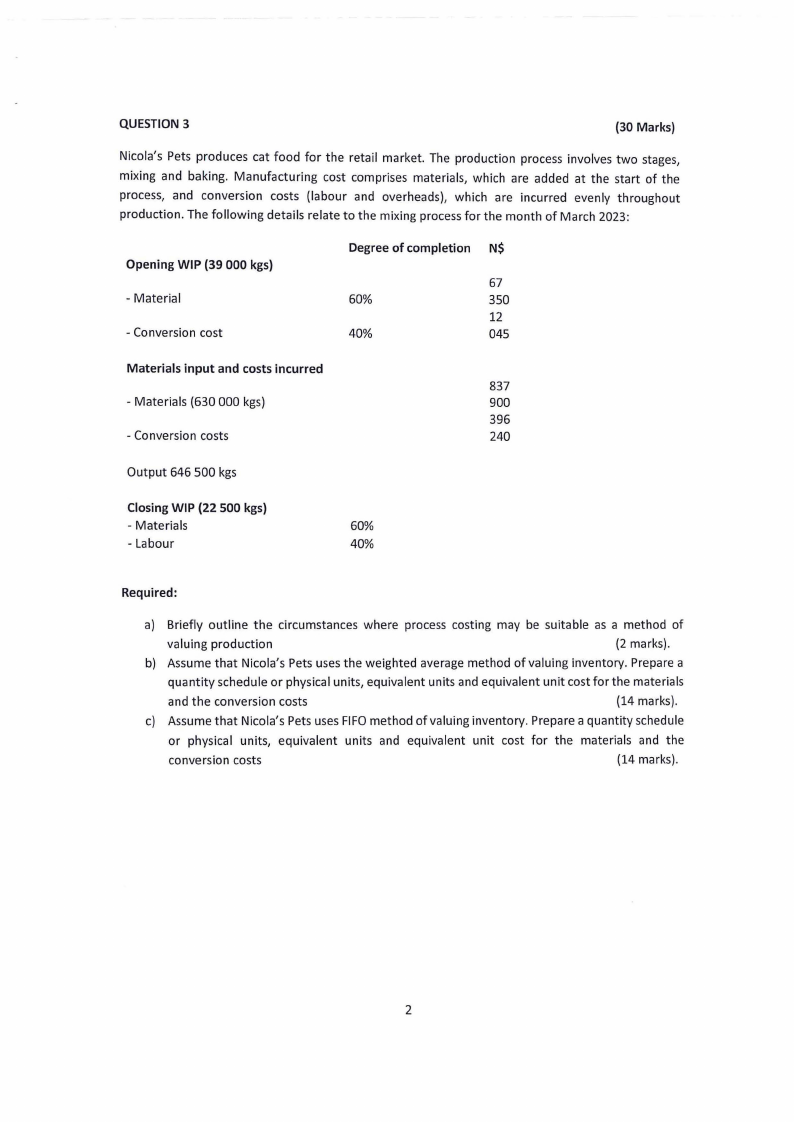

QUESTION 3

(30 Marks)

Nicola's Pets produces cat food for the retail market. The production process involves two stages,

mixing and baking. Manufacturing cost comprises materials, which are added at the start of the

process, and conversion costs (labour and overheads), which are incurred evenly throughout

production. The following details relate to the mixing process for the month of March 2023:

Opening WIP (39 000 kgs)

- Material

- Conversion cost

Degree of completion N$

67

60%

350

12

40%

045

Materials input and costs incurred

837

- Materials (630 000 kgs)

900

396

- Conversion costs

240

Output 646 500 kgs

Closing WIP (22 500 kgs)

- Materials

- Labour

60%

40%

Required:

a) Briefly outline the circumstances where process costing may be suitable as a method of

valuing production

(2 marks).

b) Assume that Nicola's Pets uses the weighted average method of valuing inventory. Prepare a

quantity schedule or physical units, equivalent units and equivalent unit cost for the materials

and the conversion costs

(14 marks).

c) Assume that Nicola's Pets uses FIFOmethod of valuing inventory. Prepare a quantity schedule

or physical units, equivalent units and equivalent unit cost for the materials and the

conversion costs

(14 marks).

2

|

4 Page 4 |

▲back to top |

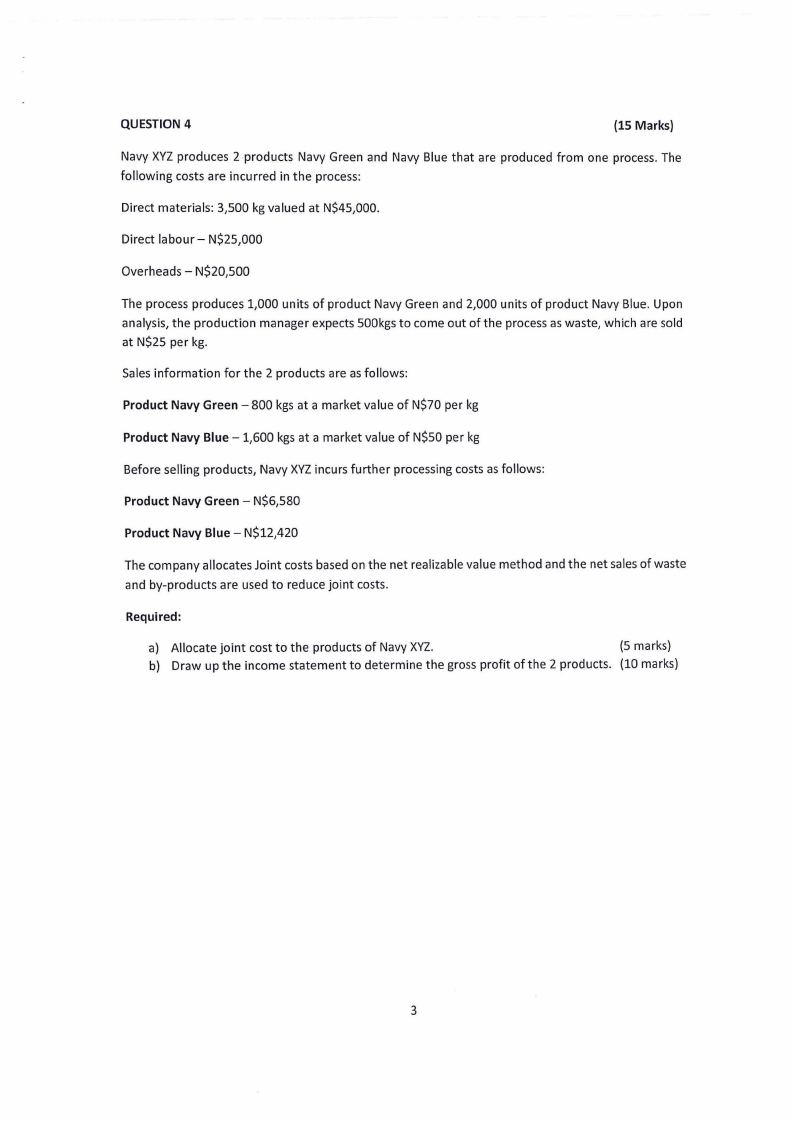

QUESTION 4

{15 Marks)

Navy XYZ produces 2 products Navy Green and Navy Blue that are produced from one process. The

following costs are incurred in the process:

Direct materials: 3,500 kg valued at N$45,000.

Direct labour - N$25,000

Overheads - N$20,500

The process produces 1,000 units of product Navy Green and 2,000 units of product Navy Blue. Upon

analysis, the production manager expects S00kgs to come out of the process as waste, which are sold

at N$25 per kg.

Sales information for the 2 products are as follows:

Product Navy Green - 800 kgs at a market value of N$70 per kg

Product Navy Blue - 1,600 kgs at a market value of N$50 per kg

Before selling products, Navy XYZincurs further processing costs as follows:

Product Navy Green - N$6,580

Product Navy Blue - N$12,420

The company allocates Joint costs based on the net realizable value method and the net sales of waste

and by-products are used to reduce joint costs.

Required:

a) Allocate joint cost to the products of Navy XYZ.

(5 marks)

b) Draw up the income statement to determine the gross profit of the 2 products. (10 marks)

3

|

5 Page 5 |

▲back to top |

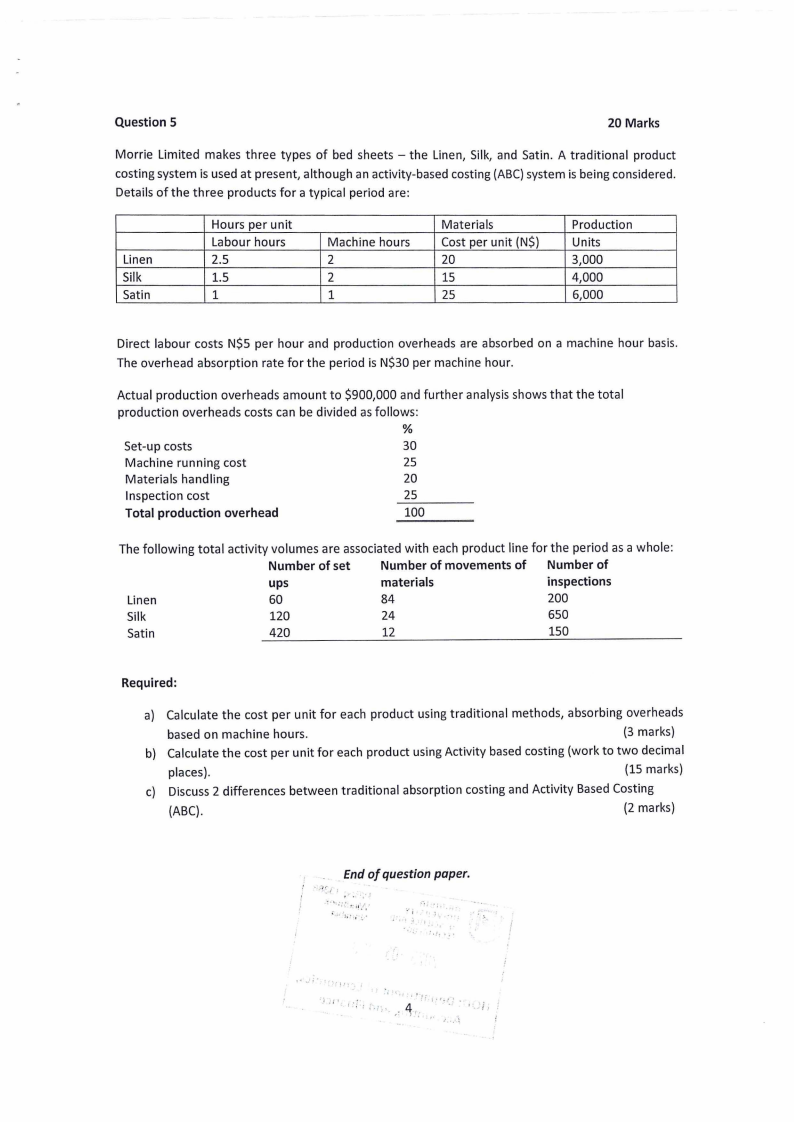

Question 5

20 Marks

Morrie Limited makes three types of bed sheets - the Linen, Silk, and Satin. A traditional product

costing system is used at present, although an activity-based costing (ABC) system is being considered.

Details of the three products for a typical period are:

Linen

Silk

Satin

Hours per unit

Labour hours

2.5

1.5

1

Machine hours

2

2

1

Materials

Cost per unit (N$)

20

15

25

Production

Units

3,000

4,000

6,000

Direct labour costs N$5 per hour and production overheads are absorbed on a machine hour basis.

The overhead absorption rate for the period is N$30 per machine hour.

Actual production overheads amount to $900,000 and further analysis shows that the total

production overheads costs can be divided as follows:

%

Set-up costs

30

Machine running cost

25

Materials handling

20

Inspection cost

25

Total production overhead

100

The following total activity volumes are associated with each product line for the period as a whole:

Number of set

Number of movements of Number of

ups

materials

inspections

Linen

60

84

200

Silk

120

24

650

Satin

420

12

150

Required:

a) Calculate the cost per unit for each product using traditional methods, absorbing overheads

based on machine hours.

(3 marks)

b) Calculate the cost per unit for each product using Activity based costing (work to two decimal

places).

(15 marks)

c) Discuss 2 differences between traditional absorption costing and Activity Based Costing

(ABC).

(2 marks)

Endof question paper.

':.•.- ..·

.-. ·;, .

I)

•

....

'\\!\\

'

j ,:1

,. i,