|

BAC511C-BUSINESS ACCOUNTING 1A-1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA

unlVERSITY

OF SCIEnCE

TECHnOLOGY

HAROLDPUPKEWITZ

GraduateSchoolof Business

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLD PUPKEWITZGRADUATESCHOOLOF BUSINESS

QUALIFICATION:DIPLOMA IN BUSINESS PROCESSMANAGEMENT

QUALIFICATIONCODE: 06DBPM LEVEL:6

COURSECODE: BACSllC

COURSENAME: BUSINESSACCOUNTING lA

SESSION:NOVEMBER 2024

PAPER:PAPER 1

DURATION: 3 HOURS

MARKS: 100

EXAMINER

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Gerhardt Sheehama

MODERATOR Lameck Odada

INSTRUCTIONS

1. This question paper comprises four (4) questions.

2. Answer ALLthe questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Round off only final answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 7 PAGES(including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[30 MARKS]

For questions 1. - 15 just write the answer only (the correct letter chosen) in your answer book provided, and

not on the question paper. Do not copy the question and the answers again.

1. Accounting equation should always be in balance, given that, if total liabilities increased by N$4 000, then:

a) assets must have decreased by N$4 000.

b) owner's equity must have decreased by N$4 000.

c) assets must have increased by N$4 000 and owner's equity must have decreased by N$4 000.

d) assets and owner's equity each increased by N$2 000.

2. Nam-Dancing has a dancing school, and it sells dancing shoes to its customers. It won an important

dancing competition. Recently the management proposed to include dancing skills and experience in the

statement of financial position. You inform them that this is not allowed. Which of the following

accounting rules is applied?

a) The rule periodicity rule

b) The realization rule

c) The quantitative rule

d) The prudence rule

3. At the end of year 2023, a business owes N$10 000 electricity charges. How will this be recorded in the

statement of financial position?

a) As an account payable

b) As a prepaid expense

c) As an accounts receivable

d) As an accrual expense

4. A business is considering making a provision for depreciation on the vehicle. Which of the following

statements best describes depreciation?

a) Depreciation always provides an equal amount to be charged as a business expense each year

b) Depreciation is the name given to describe the interest paid on a long- term loan

c) Depreciation is a way of charging the cost of a non-current asset to the statement of profit or

loss.

d) Depreciation is an adjustment that usually takes the form of an increase in the existing

account

2

|

3 Page 3 |

▲back to top |

5. Business decides to make a provision for depreciation of vehicle which was bought on 1 July 2023. The

business financial year ends on 31 December 2023. It is agreed that depreciation on the vehicle to be

charged for the year at rate of 5% on a cost. The value of the vehicle is N$250 000 on 1 July 2024. What is

the amount of depreciation that should be recorded in the statement of profit or loss for the year ending

31 December 2024?

a) N$15 500

b) N$12 500

c) N$6 250

d) N$2 500

6. A business agreed to write off an amount of N$5 000 owed by an account receivables as a bad debt. Which

of the following entries in the final accounts should the business record?

a) Charge the bad debt to the profit and loss account only

b) Reduce the value of the debtors/accounts receivables balance to allow for the bad debt

c) Reduce the value of the accounts receivables balance AND charge the bad debt to the

statement of profit or loss.

d) Increase the value of the accounts payables balance and add to the gross profit balance.

7. The following attributes are correct in respect of accounting equation except one of them:

a) Accounting equation underlies always the accounting entries made in the books of account.

b) Accounting equation shows the financing sources and the use of finance in a business

c) Accounting equation is written as follows: Assets+ Liabilities= capital

d) Assets - Liabilities= Net asset value of the business

8. The following statement suits best the definition of assets:

a) The assets are resources owned or owing to the business from which future benefits expected

to flow to the business

b) The assets are debts which are borrowed from banks in order to purchases non-current assets

c) The assets are contributions made by the owners of the business

d) The assets are expenses incurred by the business in a given period

9. The following statement suits best the definition of expenses:

a) Expensesare resources used, consumed or sold in a given accounting period

b) Expensesare income earned during one accounting period

c) Expenses are liabilities made by the business in order to expand its activities

d) Expensesare assets acquired by the business to meet the demand of clients

3

|

4 Page 4 |

▲back to top |

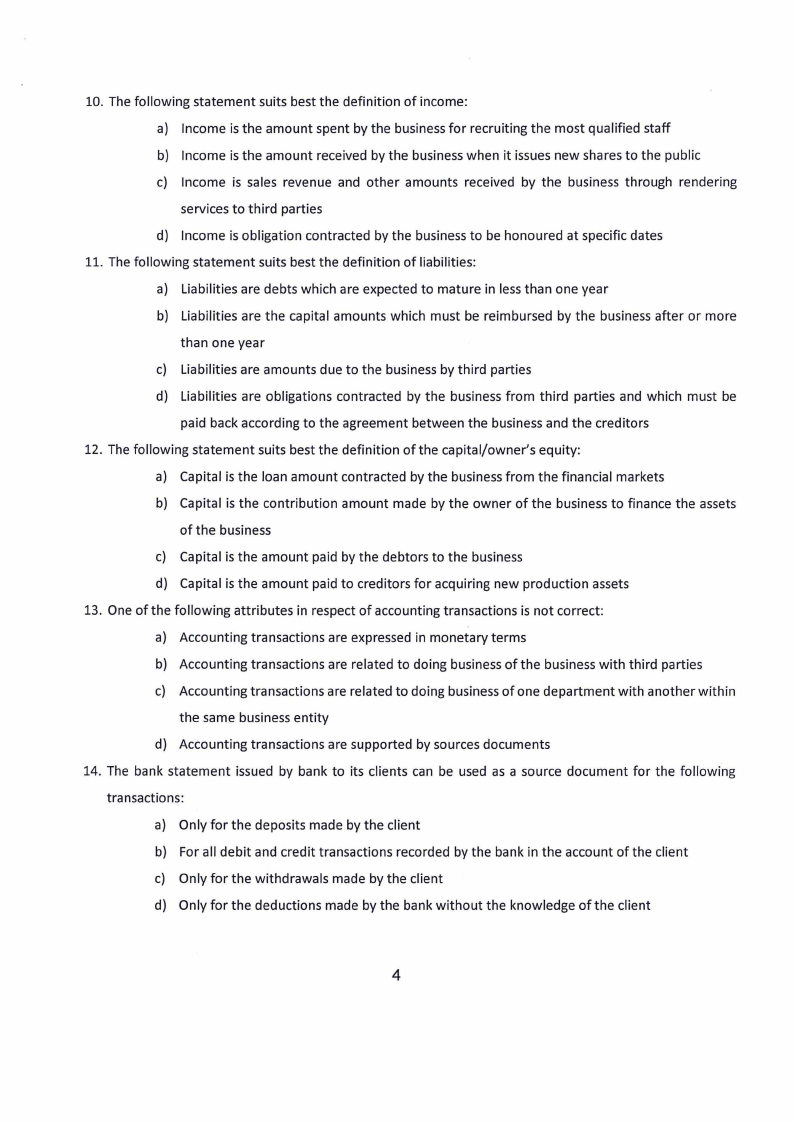

10. The following statement suits best the definition of income:

a) Income is the amount spent by the business for recruiting the most qualified staff

b) Income is the amount received by the business when it issues new shares to the public

c) Income is sales revenue and other amounts received by the business through rendering

services to third parties

d) Income is obligation contracted by the business to be honoured at specific dates

11. The following statement suits best the definition of liabilities:

a) Liabilities are debts which are expected to mature in less than one year

b) Liabilities are the capital amounts which must be reimbursed by the business after or more

than one year

c) Liabilities are amounts due to the business by third parties

d) Liabilities are obligations contracted by the business from third parties and which must be

paid back according to the agreement between the business and the creditors

12. The following statement suits best the definition of the capital/owner's equity:

a) Capital is the loan amount contracted by the business from the financial markets

b) Capital is the contribution amount made by the owner of the business to finance the assets

of the business

c) Capital is the amount paid by the debtors to the business

d) Capital is the amount paid to creditors for acquiring new production assets

13. One of the following attributes in respect of accounting transactions is not correct:

a) Accounting transactions are expressed in monetary terms

b) Accounting transactions are related to doing business of the business with third parties

c) Accounting transactions are related to doing business of one department with another within

the same business entity

d) Accounting transactions are supported by sources documents

14. The bank statement issued by bank to its clients can be used as a source document for the following

transactions:

a) Only for the deposits made by the client

b) For all debit and credit transactions recorded by the bank in the account of the client

c) Only for the withdrawals made by the client

d) Only for the deductions made by the bank without the knowledge of the client

4

|

5 Page 5 |

▲back to top |

15. Name the error which was made under the following circumstances: the business sold goods on credit for

N$12 000. The bookkeeper recorded the transaction as follows:

Dr: Sales

N$12 000

Cr: Debtors

N$12 000

a) Compensating error

b) Error of original entry

c) Error of complete reversal

d) Error of commission

QUESTION 2

[20 MARKS]

Insert the missing word/sin each gap marked (a) - (j) in the following table. (Write your answers on the answer

book provided not on this question paper)

Journal

Transaction

Source Document

(a)

Receipt of money

(b)

(c)

Payment of bank charges

(d)

Purchases Journal

(e)

Invoice

Sales Journal

Goods sold on credit

(f)

(g)

Return of goods to account payables

debit notes

Sales returns Journal

(h)

Credit notes

Petty cash Journal

(i)

Petty cash vouchers-original

Cash receipt Journal

Cash deposited by customer

(j)

QUESTION 3

[25 MARKS]

Shandi has decided to set up her own music retail business on 1 May 2018. Here is summary of the transactions

in the first month of the business.

2024

May 1 Shandi opened a business bank account and deposited N$30 000

3

Bought inventory of goods for resale costing N$7 200 on credit from Mrs Paula Co.

5 Purchased a cash register (till) for N$360 paying by cheque.

10 Sold goods for N$1000 on credit to Lela

5

|

6 Page 6 |

▲back to top |

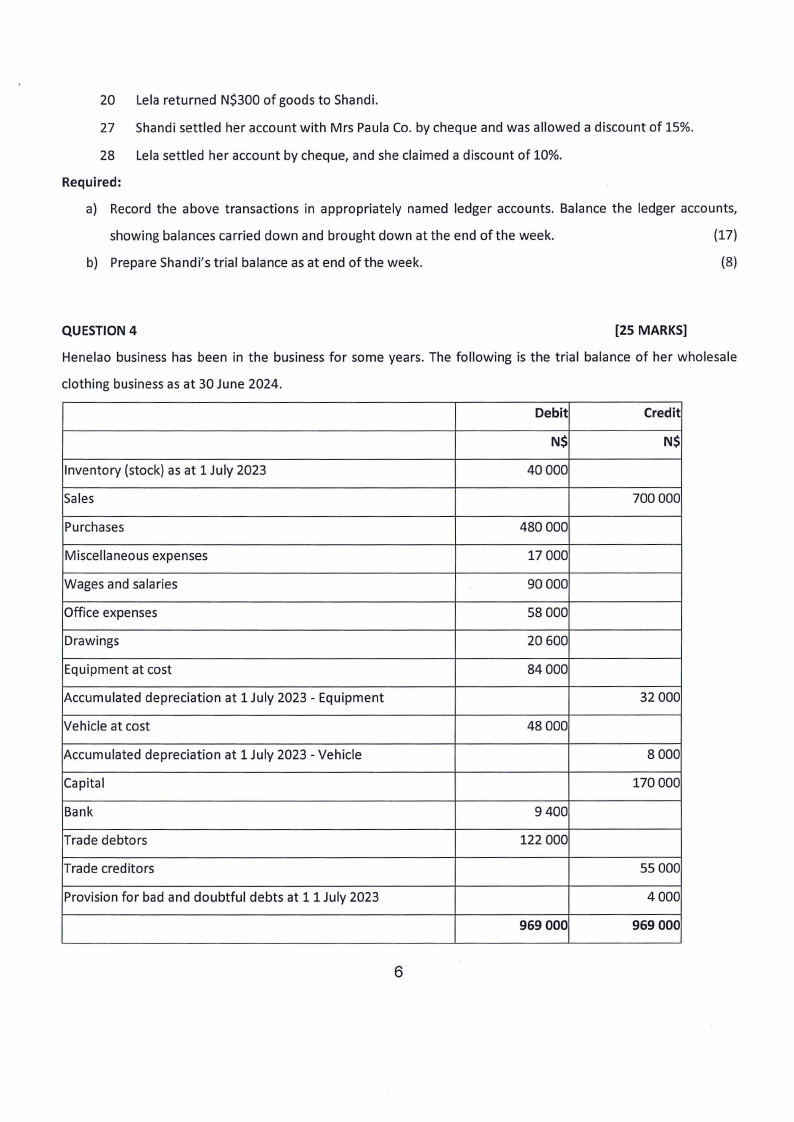

20 Lela returned N$300 of goods to Shandi.

27 Shandi settled her account with Mrs Paula Co. by cheque and was allowed a discount of 15%.

28 Lela settled her account by cheque, and she claimed a discount of 10%.

Required:

a) Record the above transactions in appropriately named ledger accounts. Balance the ledger accounts,

showing balances carried down and brought down at the end of the week.

(17)

b) Prepare Shandi's trial balance as at end of the week.

(8)

QUESTION 4

[25 MARKS]

Henelao business has been in the business for some years. The following is the trial balance of her wholesale

clothing business as at 30 June 2024.

Debit

Credit

N$

N$

Inventory (stock) as at 1 July 2023

40000

Sales

700 000

Purchases

480 000

Miscellaneous expenses

17 000

Wages and salaries

90000

Office expenses

58 000

Drawings

20 600

Equipment at cost

84000

Accumulated depreciation at 1 July 2023 - Equipment

32 000

Vehicle at cost

48000

Accumulated depreciation at 1 July 2023 - Vehicle

8000

Capital

170 000

Bank

9 400

Trade debtors

122 000

Trade creditors

55 000

Provision for bad and doubtful debts at 11 July 2023

4000

969 000

969 000

6

|

7 Page 7 |

▲back to top |

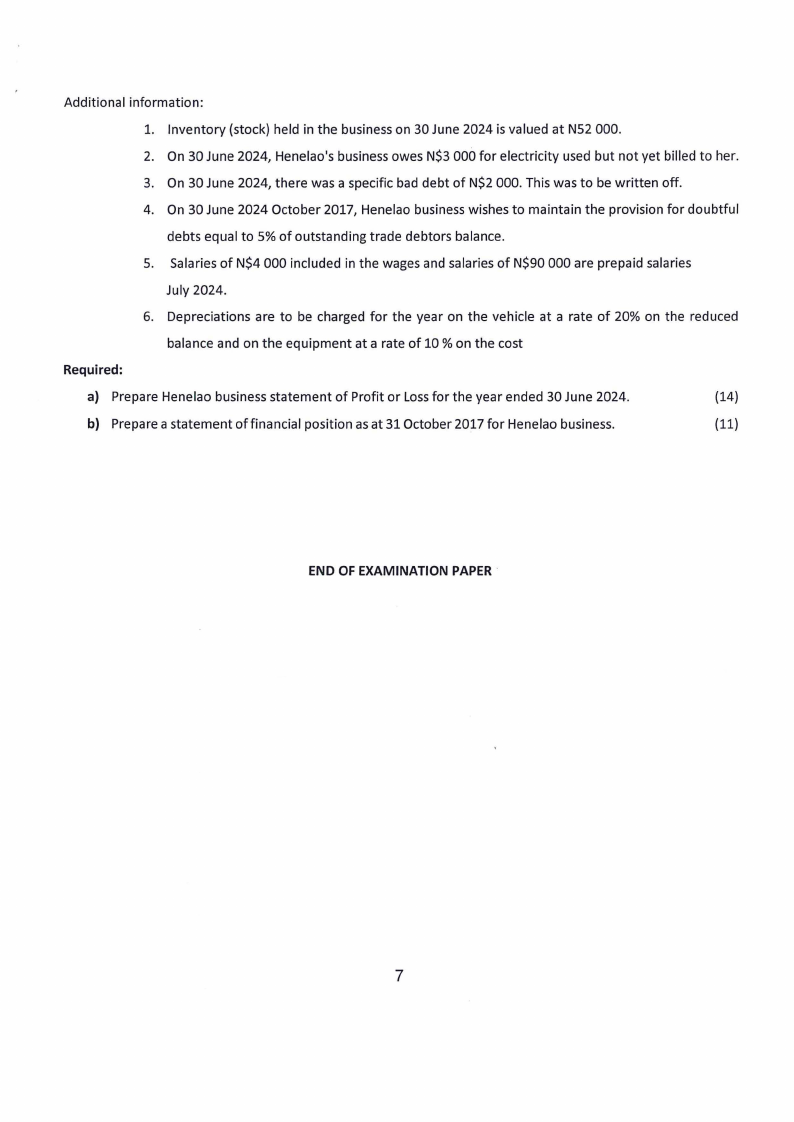

Additional information:

1. Inventory (stock) held in the business on 30 June 2024 is valued at N52 000.

2. On 30 June 2024, Henelao's business owes N$3 000 for electricity used but not yet billed to her.

3. On 30 June 2024, there was a specific bad debt of N$2 000. This was to be written off.

4. On 30 June 2024 October 2017, Henelao business wishes to maintain the provision for doubtful

debts equal to 5% of outstanding trade debtors balance.

5. Salaries of N$4 000 included in the wages and salaries of N$90 000 are prepaid salaries

July 2024.

6. Depreciations are to be charged for the year on the vehicle at a rate of 20% on the reduced

balance and on the equipment at a rate of 10 % on the cost

Required:

a) Prepare Henelao business statement of Profit or Lossfor the year ended 30 June 2024.

(14)

b) Prepare a statement offinancial position as at 31 October 2017 for Henelao business.

(11)

END OF EXAMINATION PAPER·

7