|

BAC512C- BUSINESS ACCOUNTING 1B- 1ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA

U nlVE RSITY

0 F SCIEnCE Ano

TECHnOLOGY

HP-65B~

HAROLPDUPKEWITZ

GraduateSchoolof Business

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLD PUPKEWITZGRADUATESCHOOLOF BUSINESS

QUALIFICATION: DIPLOMA IN BUSINESSPROCESSMANAGEMENT

QUALIFICATIONCODE:06DBPM LEVEL:6

COURSECODE: BAC521C

COURSENAME: BUSINESSACCOUNTING 1B

SESSION:JUNE 2023

PAPER:PAPER1

DURATION: 3 HOURS

MARKS: 100

EXAMINER

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Lameck Odada

MODERATOR Hendrina Kangala

INSTRUCTIONS

1. This question paper comprises FOUR (4) questions.

2. Answer ALLthe questions and in blue or black ink. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with whole numbers in all your calculations and only round off only final answers

to two (2) decimal places where necessary unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 6 PAGES(including this front page)

|

2 Page 2 |

▲back to top |

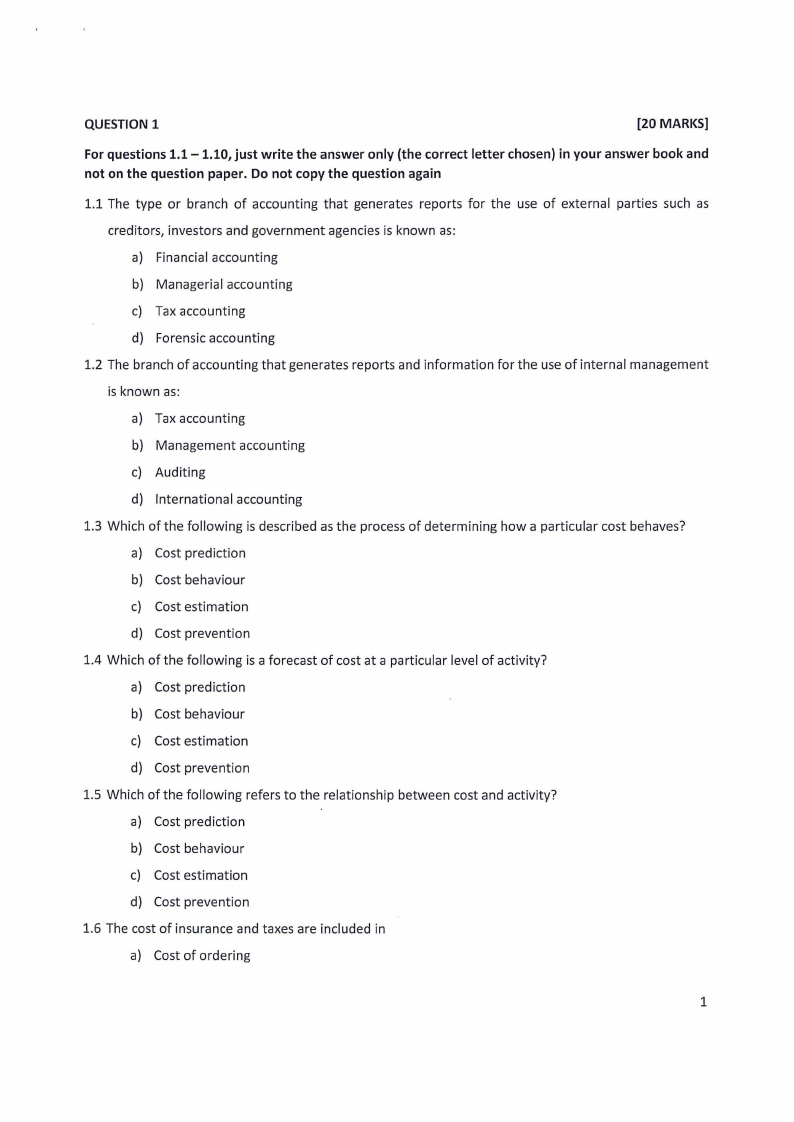

QUESTION 1

[20 MARKS]

For questions 1.1-1.10, just write the answer only (the correct letter chosen) in your answer book and

not on the question paper. Do not copy the question again

1.1 The type or branch of accounting that generates reports for the use of external parties such as

creditors, investors and government agencies is known as:

a) Financial accounting

b) Managerial accounting

c) Tax accounting

d) Forensic accounting

1.2 The branch of accounting that generates reports and information for the use of internal management

is known as:

a) Tax accounting

b) Management accounting

c) Auditing

d) International accounting

1.3 Which of the following is described as the process of determining how a particular cost behaves?

a) Cost prediction

b) Cost behaviour

c) Cost estimation

d) Cost prevention

1.4 Which of the following is a forecast of cost at a particular level of activity?

a) Cost prediction

b) Cost behaviour

c) Cost estimation

d) Cost prevention

1.5 Which of the following refers to the relationship between cost and activity?

a) Cost prediction

b) Cost behaviour

c) Cost estimation

d) Cost prevention

1.6 The cost of insurance and taxes are included in

a) Cost of ordering

1

|

3 Page 3 |

▲back to top |

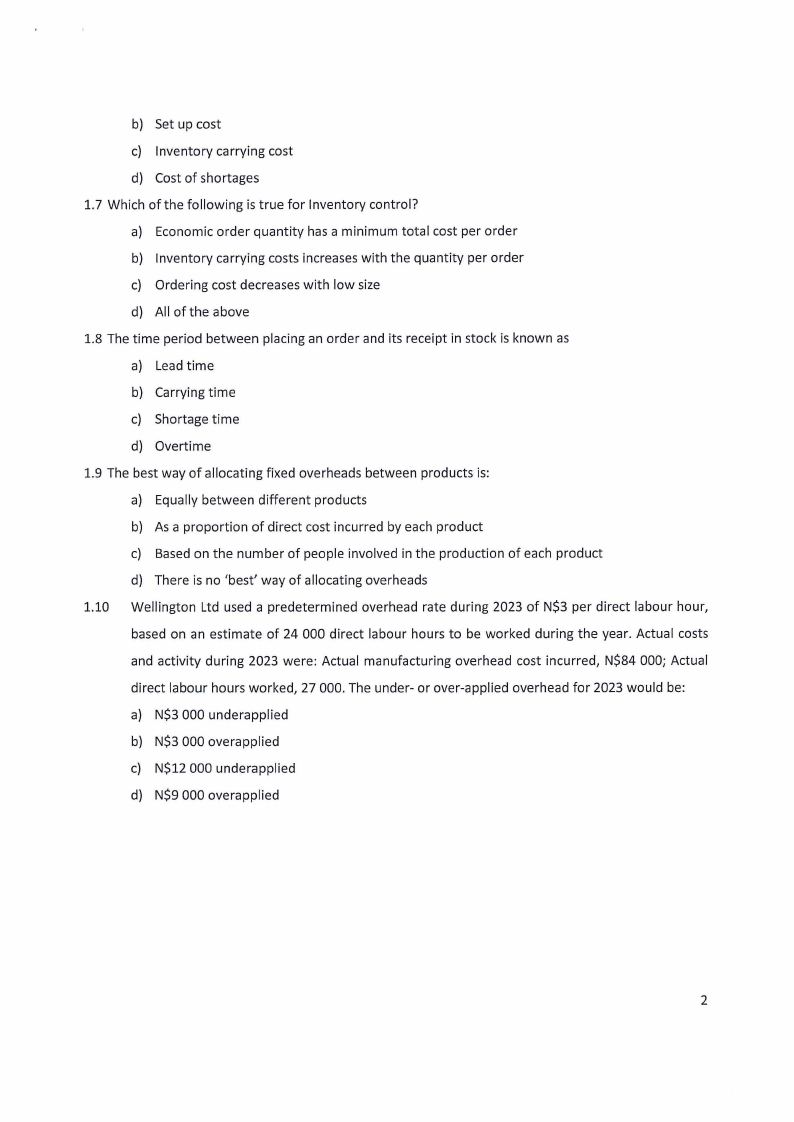

b) Set up cost

c) Inventory carrying cost

d) Cost of shortages

1.7 Which of the following is true for Inventory control?

a) Economic order quantity has a minimum total cost per order

b) Inventory carrying costs increases with the quantity per order

c) Ordering cost decreases with low size

d) All of the above

1.8 The time period between placing an order and its receipt in stock is known as

a) Lead time

b) Carrying time

c) Shortage time

d) Overtime

1.9 The best way of allocating fixed overheads between products is:

a) Equally between different products

b) As a proportion of direct cost incurred by each product

c) Based on the number of people involved in the production of each product

d) There is no 'best' way of allocating overheads

1.10 Wellington Ltd used a predetermined overhead rate during 2023 of N$3 per direct labour hour,

based on an estimate of 24 000 direct labour hours to be worked during the year. Actual costs

and activity during 2023 were: Actual manufacturing overhead cost incurred, N$84 000; Actual

direct labour hours worked, 27 000. The under- or over-applied overhead for 2023 would be:

a) N$3 000 underapplied

b) N$3 000 overapplied

c) N$12 000 underapplied

d) N$9 000 overapplied

2

|

4 Page 4 |

▲back to top |

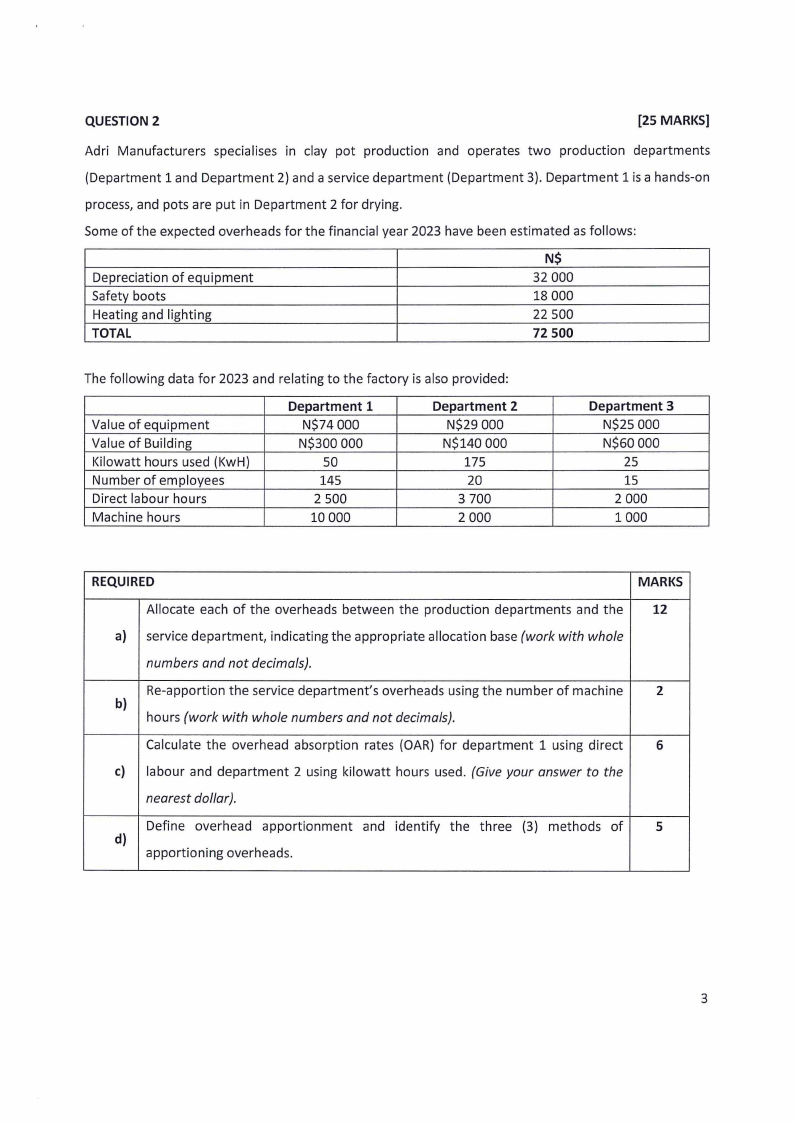

QUESTION 2

[25 MARKS]

Adri Manufacturers specialises in clay pot production and operates two production departments

(Department 1 and Department 2) and a service department (Department 3). Department 1 is a hands-on

process, and pots are put in Department 2 for drying.

Some of the expected overheads for the financial year 2023 have been estimated as follows:

Depreciation of equipment

Safety boots

Heating and lighting

TOTAL

N$

32 000

18 000

22 500

72 500

The following data for 2023 and relating to the factory is also provided:

Value of equipment

Value of Building

Kilowatt hours used (KwH)

Number of employees

Direct labour hours

Machine hours

Department 1

N$74 000

N$300 000

so

145

2 500

10000

Department 2

N$29 000

N$140 000

175

20

3 700

2 000

Department 3

N$25 000

N$60 000

25

15

2 000

1000

REQUIRED

MARKS

Allocate each of the overheads between the production departments and the

12

a) service department, indicating the appropriate allocation base (work with whole

numbers and not decimals).

Re-apportion the service department's overheads using the number of machine

2

b)

hours (work with whole numbers and not decimals).

Calculate the overhead absorption rates (OAR) for department 1 using direct

6

c) labour and department 2 using kilowatt hours used. (Give your answer to the

nearest dollar).

Define overhead apportionment and identify the three (3) methods of

5

d)

apportioning overheads.

3

|

5 Page 5 |

▲back to top |

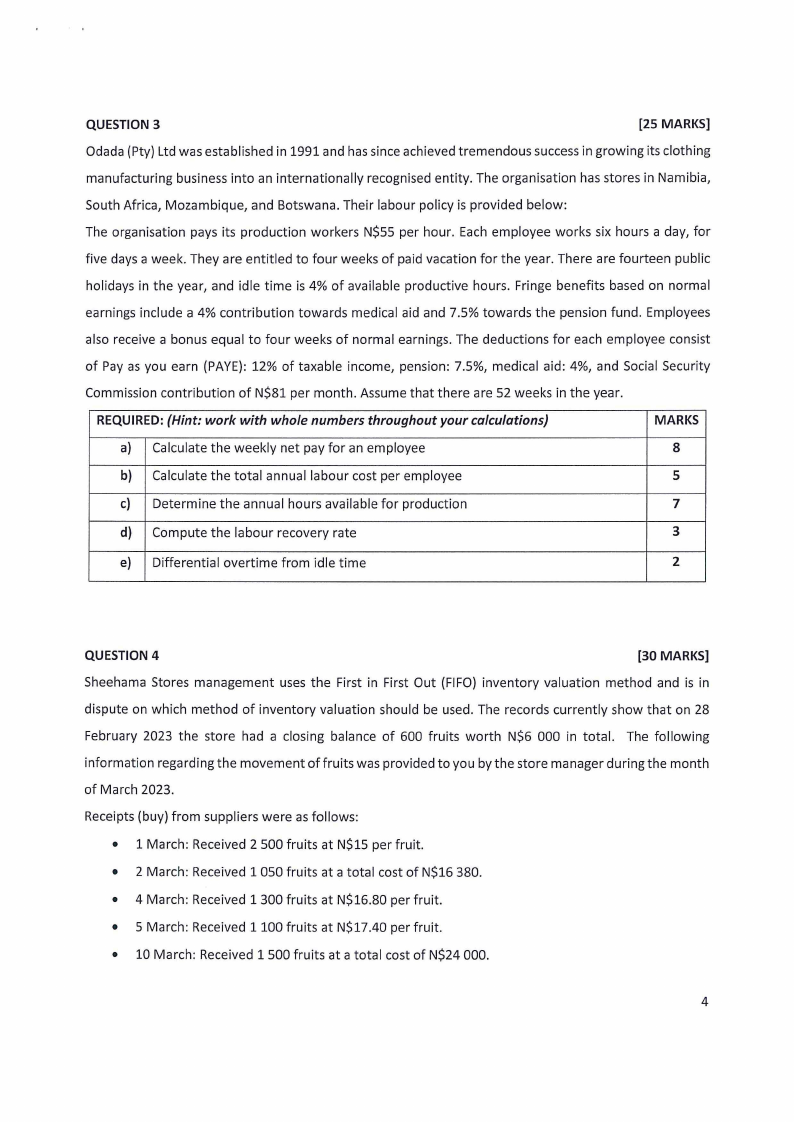

QUESTION 3

[25 MARKS]

Odada (Pty) Ltd was established in 1991 and has since achieved tremendous successin growing its clothing

manufacturing business into an internationally recognised entity. The organisation has stores in Namibia,

South Africa, Mozambique, and Botswana. Their labour policy is provided below:

The organisation pays its production workers N$55 per hour. Each employee works six hours a day, for

five days a week. They are entitled to four weeks of paid vacation for the year. There are fourteen public

holidays in the year, and idle time is 4% of available productive hours. Fringe benefits based on normal

earnings include a 4% contribution towards medical aid and 7.5% towards the pension fund. Employees

also receive a bonus equal to four weeks of normal earnings. The deductions for each employee consist

of Pay as you earn (PAYE): 12% of taxable income, pension: 7.5%, medical aid: 4%, and Social Security

Commission contribution of N$81 per month. Assume that there are 52 weeks in the year.

REQUIRED: {Hint: work with whole numbers throughout your calculations)

MARKS

a) Calculate the weekly net pay for an employee

8

b) Calculate the total annual labour cost per employee

5

c) Determine the annual hours available for production

7

d) Compute the labour recovery rate

3

e) Differential overtime from idle time

2

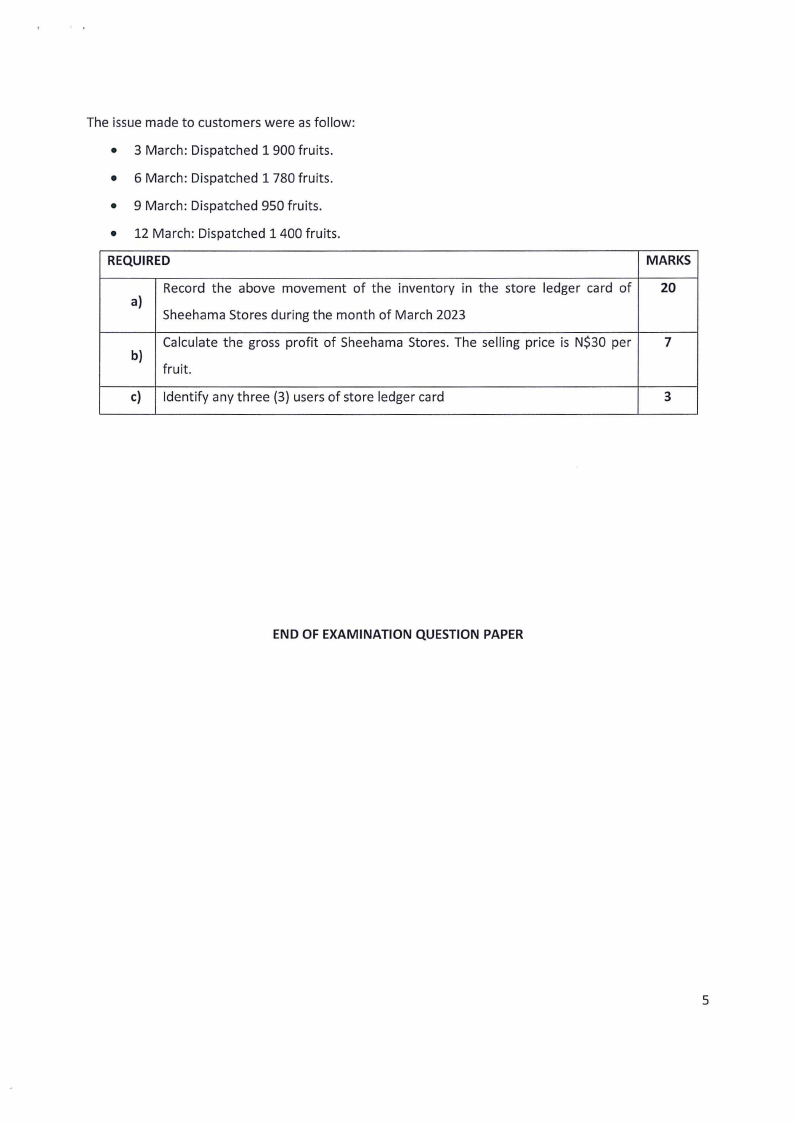

QUESTION 4

[30 MARKS]

Sheehama Stores management uses the First in First Out (FIFO) inventory valuation method and is in

dispute on which method of inventory valuation should be used. The records currently show that on 28

February 2023 the store had a closing balance of 600 fruits worth N$6 000 in total. The following

information regarding the movement of fruits was provided to you by the store manager during the month

of March 2023.

Receipts (buy) from suppliers were as follows:

• 1 March: Received 2 500 fruits at N$15 per fruit.

• 2 March: Received 1 050 fruits at a total cost of N$16 380.

• 4 March: Received 1 300 fruits at N$16.80 per fruit.

• 5 March: Received 1100 fruits at N$17.40 per fruit.

• 10 March: Received 1 500 fruits at a total cost of N$24 000.

4

|

6 Page 6 |

▲back to top |

The issue made to customers were as follow:

• 3 March: Dispatched 1 900 fruits.

• 6 March: Dispatched 1 780 fruits.

• 9 March: Dispatched 950 fruits.

• 12 March: Dispatched 1 400 fruits.

REQUIRED

MARKS

Record the above movement of the inventory in the store ledger card of 20

a)

Sheehama Stores during the month of March 2023

Calculate the gross profit of Sheehama Stores. The selling price is N$30 per

7

b)

fruit.

c) Identify any three (3) users of store ledger card

3

END OF EXAMINATION QUESTION PAPER

5