|

FAC611S-FINANCIAL ACCOUNTING 201 -2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOFCOMMERCEH, UMANSCIENCEAS ND EDUCATION

DEPARTMENTOFACCOUNTINGE, CONOMICSAND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

COURSECODE: FAC611S

LEVEL:6

COURSENAME: FINANCIALACCOUNTING201

SESSION:JUNE 2022

PAPER:THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

EXAMINER(S)

SECONDOPPORTUNITYEXAMINATION QUESTION PAPER

Mr. C. Mahindi, Mr. C. Simasiku and Dr. A. Simasiku

MODERATOR: Dr. D. Kamotho

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. Do not write in pencil and do not use tip-ex, as this will not be marked.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

6. The names of people and businesses used throughout this assessment do not reflect the reality

and may be purely coincidental.

7. Show all workings!

PERMISSABLME ATERIALS

1. Non- programmable calculator

THERQUESTIONPAPERCONSISTSOFS PAGES(Excluding the front page)

|

2 Page 2 |

▲back to top |

Question 1

(35 marks)

Part A: Multiple choice questions

(10 marks)

Required: Write only the letter that represents the correct answer in your answer booklet.

1. Which of the following properties cannot be classified as owner-occupied property?

a. Property that is owner- occupied and awaiting disposal

b. Factory buildings or shops

c. Administration buildings

d. Land with an undetermined use

2. Which of the following terms does this statement define: "the amount of cash or cash

equivalents paid or the fair value of other consideration given to acquire an asset at the time

of its acquisition or construction"?

a. Cost

b. Deemed cost

c. Fair value

d. Present value

3. Which of the following does not define investment property?

a. Property held to earn rentals

b. Property held for capital appreciation

c. Property used in the production or supply of goods or services

d. AandC

4. An investment property shall be measured initially at its ____

_

a. Cost

b. Fair value

c. Deemed cost

d. Value in use

5. Under what circumstance can a lessee classify a leased property interest as investment

property if it is an operating lease?

a. Management believes it is more appropriate for the financial statements.

b. The lessee uses a fair value model, and the property would otherwise meet the

definition of an investment property

c. The rents and capital appreciation created from the property are a substantial source

of the firm's revenues.

d. All of the above

1

|

3 Page 3 |

▲back to top |

6. Why is the building where a manufacturing company's factory is located not considered

investment property?

a. The cash flows generated from the factory production as a result of the building is

independent from the cash flows generated as a result of other assets.

b. The cash flows generated from the factory production as a result of the building is not

independent from the cash flows generated as a result of other assets.

c. Historically the company has not seen the value of the building appreciate and does

not expect it to in the future.

d. The company is planning on moving locations in the next 3 years.

7. Which of the following illustrates an investment property?

a. An apartment that is rented by a grocery store for capital appreciation and rental

b. A building that operates and derives its cash flow from running as a hotel

c. A building that operates and derives its cash flow from running as a restaurant

d. A piece of land that is used as a farm

8. When it is probable that the future economic benefits that are associated with the

investment property will flow to the entity and the cost of the investment property can be

measured reliably, the property can be:

a. Measured as an asset

b. Measured as a liability

c. Expensed in the income statement in the period of payment

d. None of the above

9. Which of the following is not a transfer to, or from investment property?

a. Commencement of owner-occupation

b. End of owner-occupation

c. Commencement of development with a view to sale

d. Transfer from undetermined future use to operating lease

10. When an entity decides to dispose of an investment property without development:

a. It is reclassified as owner-occupied

b. It is transferred to inventory

c. It continues to treat the property as an investment property

d. None of above

2

|

4 Page 4 |

▲back to top |

PARTB

(25 marks)

Mark Limited is an investment company, with a 31 December year end that purchases buildings and

holds them for a number of purposes, such as resale, leasing and its own use.

On 1 January 2019, Mark Limited purchased an old building, Mark Towers, for N$300 000.

Conveyancer's fees amounted to N$20 000

• This building is situated in an isolated part of Windhoek and there is no development

anywhere nearby. At the time of purchase, there had been no property transactions in this

area for many years and the possibility of leasing the building to tenants was remote. It was

thus impossible to determine a fair value for this building.

• During November 2019, development began of a new industrial park in the area. As a result,

the building was able to be leased to tenants involved in the development of the industrial

park. Due to the influx of people of people into the area, the directors decided to paint one

side of the buildings with the corporate logo of Mark Limited.

• This building has never had an air-conditioning system. After numerous complaints from

tenants about not being able to tolerate the Windhoek heat, Mark Limited decided to upgrade

the building by installing a ducted air-conditioning system on 1 December 2019.

The cost of installation included the following, paid via direct bank transfer:

Adjustments to the structure of the building

Painting

Air-conditioning system

Installation costs

N$30 000

N$50 000

N$200 000

N$50 000

The ducted air-conditioning system has a 10-year life and a nil residual value

• As a result of the new industrial park, there was suddenly a demand for properties in the area.

As a result, the fair value of Mark Towers was able to be determined on 31 December 2019 at

N$420 000. Mark Limited would like to measure this investment property at fair value now

that fair values have become available.

• The building has a 10-year useful life and an estimated residual value of N$50 000

Mark Limited also holds other investment property, which is measured under the fair value model.

The fair value of this other investment property is as follows:

• 1 January 2019

• 31 December 2019

REQUIRED:

N$ 1000000

N$ 1250 000

i. Journalise the entries that would arise from the above information for the year-ended 31

December 2019. Include the classifications of the account (SFP,SPLe, tc).

(15)

ii. Disclose the Investment property note for the reporting period ended 31 December 2019.

(10)

3

|

5 Page 5 |

▲back to top |

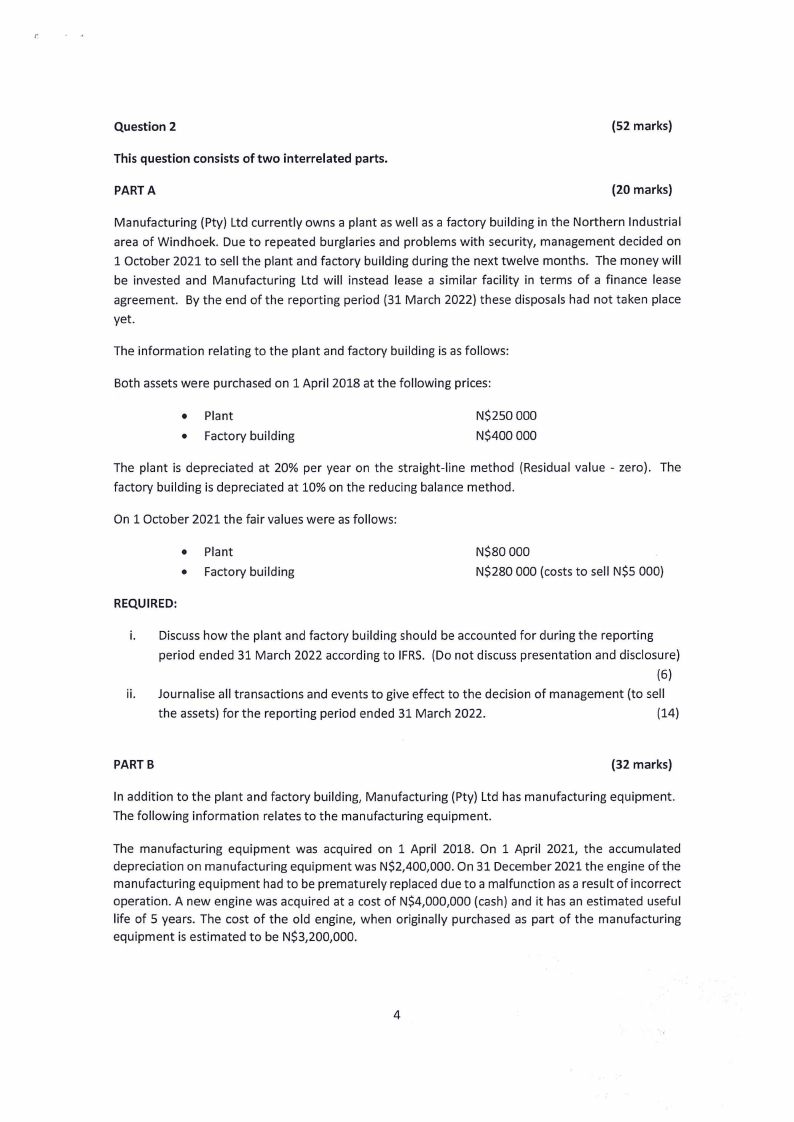

Question 2

(52 marks)

This question consists of two interrelated parts.

PART A

(20 marks)

Manufacturing (Pty) Ltd currently owns a plant as well as a factory building in the Northern Industrial

area of Windhoek. Due to repeated burglaries and problems with security, management decided on

1 October 2021 to sell the plant and factory building during the next twelve months. The money will

be invested and Manufacturing Ltd will instead lease a similar facility in terms of a finance lease

agreement. By the end of the reporting period (31 March 2022) these disposals had not taken place

yet.

The information relating to the plant and factory building is as follows:

Both assets were purchased on 1 April 2018 at the following prices:

• Plant

• Factory building

N$250 000

N$400 000

The plant is depreciated at 20% per year on the straight-line method (Residual value - zero). The

factory building is depreciated at 10% on the reducing balance method.

On 1 October 2021 the fair values were as follows:

• Plant

• Factory building

N$80 000

N$280 000 (costs to sell N$5 000)

REQUIRED:

i. Discuss how the plant and factory building should be accounted for during the reporting

period ended 31 March 2022 according to IFRS. (Do not discuss presentation and disclosure)

(6)

ii. Journalise all transactions and events to give effect to the decision of management (to sell

the assets) for the reporting period ended 31 March 2022.

(14)

PART B

(32 marks)

In addition to the plant and factory building, Manufacturing (Pty) Ltd has manufacturing equipment.

The following information relates to the manufacturing equipment.

The manufacturing equipment was acquired on 1 April 2018. On 1 April 2021, the accumulated

depreciation on manufacturing equipment was N$2,400,000. On 31 December 2021 the engine of the

manufacturing equipment had to be prematurely replaced due to a malfunction as a result of incorrect

operation. A new engine was acquired at a cost of N$4,000,000 (cash) and it has an estimated useful

life of 5 years. The cost of the old engine, when originally purchased as part of the manufacturing

equipment is estimated to be N$3,200,000.

4

|

6 Page 6 |

▲back to top |

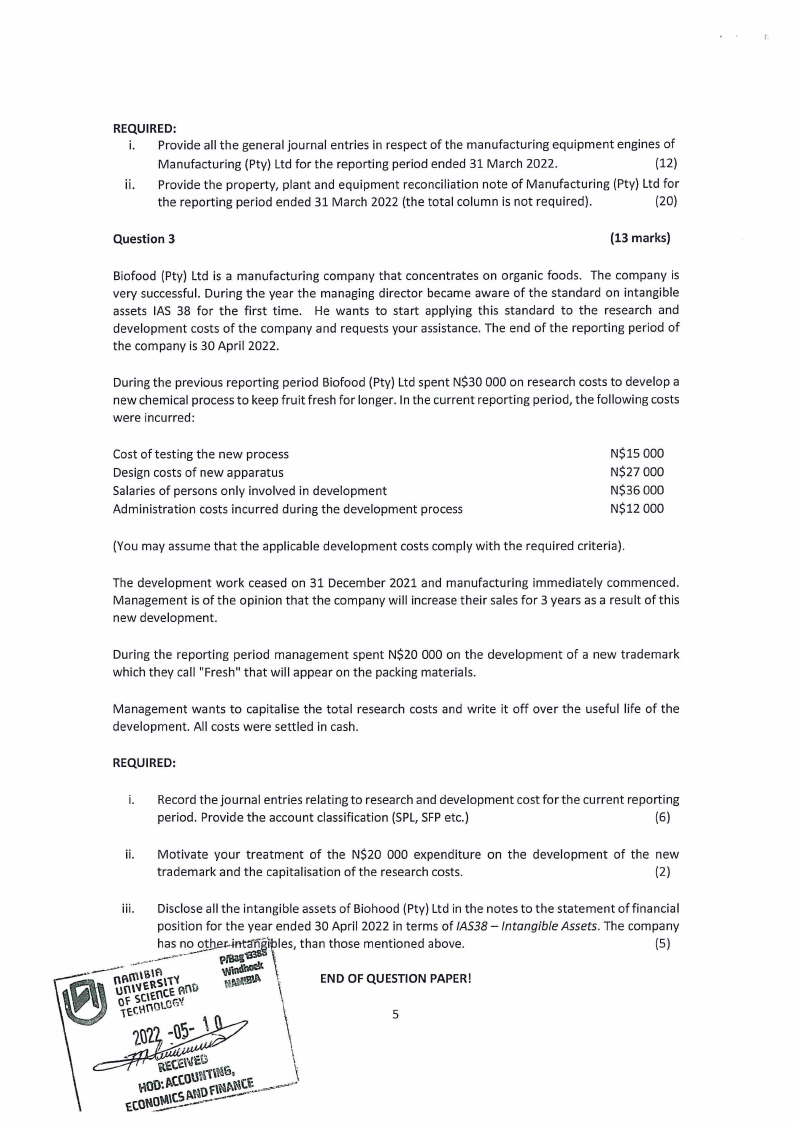

L

REQUIRED:

i. Provide all the general journal entries in respect of the manufacturing equipment engines of

Manufacturing (Pty) Ltd for the reporting period ended 31 March 2022.

(12)

ii. Provide the property, plant and equipment reconciliation note of Manufacturing (Pty) Ltd for

the reporting period ended 31 March 2022 (the total column is not required).

(20)

Question 3

(13 marks)

Biofood (Pty) Ltd is a manufacturing company that concentrates on organic foods. The company is

very successful. During the year the managing director became aware of the standard on intangible

assets IAS 38 for the first time. He wants to start applying this standard to the research and

development costs of the company and requests your assistance. The end of the reporting period of

the company is 30 April 2022.

During the previous reporting period Biofood (Pty) Ltd spent N$30 000 on research costs to develop a

new chemical process to keep fruit fresh for longer. In the current reporting period, the following costs

were incurred:

Cost of testing the new process

Design costs of new apparatus

Salaries of persons only involved in development

Administration costs incurred during the development process

N$15 000

N$27 000

N$36 000

N$12 000

(You may assume that the applicable development costs comply with the required criteria).

The development work ceased on 31 December 2021 and manufacturing immediately commenced.

Management is of the opinion that the company will increase their sales for 3 years as a result of this

new development.

During the reporting period management spent N$20 000 on the development of a new trademark

which they call "Fresh" that will appear on the packing materials.

Management wants to capitalise the total research costs and write it off over the useful life of the

development. All costs were settled in cash.

REQUIRED:

i. Record the journal entries relating to research and development cost for the current reporting

period. Provide the account classification (SPL,SFPetc.)

(6)

ii. Motivate your treatment of the N$20 000 expenditure on the development of the new

trademark and the capitalisation of the research costs.

(2)

iii. Disclose all the intangible assets of Biohood (Pty) Ltd in the notes to the statement of financial

position for the year ended 30 April 2022 in terms of IAS38 - Intangible Assets. The company

(5)

5