|

FAC511S - Financial Accounting 101 - June 2017 1st Opp. |

|

1 Page 1 |

▲back to top |

I

I'lFHTllBlFI UNIVERSITY

OF SCIEl‘lCE nnD TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC

LEVEL: 5

COURSE CODE: FAC5115

COURSE NAME: FINANCIAL ACCOUNTING 101

SESSION: JUNE 2017

PAPER: THEORY

DURATION: 3 HOURS

MARKS: 100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Mr. G Jansen, Mr. C Mahindi and Mr. A Ketjinganda

MODERATOR:

“45- J Van va

INSTRUCTIONS

This question paper is made up of four (4) questions.

P941”?

Answer ALL the questions and in blue or black ink.

Start each question on a new page in your answer booklet.

Questions relating to this examination may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

GENERAL

The names of people and businesses used throughout this examination paper do not reflect the reality

and may be purely coincidental.

QUESTION 1

This question consists of two independent parts.

(30 MARKS)

PART A

(15 MARKS)

a) List one (1) primary user of financial statements as per Conceptual Framework for Financial

Reporting and also explain for what purpose they could use the financial statements.

(2)

b) List six (6) Qualitative Characteristics of Financial Statements.

(6)

0) Explain what the underlying assumption of going concern means.

(1)

d) Define the element liability as per Conceptual Framework for Financial Reporting.

(3)

e) Explain the difference between input VAT and output VAT.

(2)

f) What does the abbreviation VAT stands for?

(1)

PART B

(15 MARKS)

CATERNAM (Pty) Ltd supplies fine dining catering services for high end functions and events in all

regions of Namibia. While at the Hage Geingob Soccer Cup final match on 30 May 2017, the owner Mr.

Baloyi bumped into an old university friend, Ms. Masango who owns an events management company,

Events Today (Pty) Ltd.

While they chatted, Ms. Masango indicated that she would like CATERNAM (Pty) Ltd to provide

catering services for some of her company’s events. CATERNAM (Pty) Ltd would prepare fine dining

meals with invoicing based on the number of people attending each event. Events Today (Pty) Ltd

would provide the number of guests to be catered for at each event. Invoices would be paid within 30

days from the date of receipt of the invoice by Events Today (Pty) Ltd. The two parties agreed on the

terms and shook hands. In addition it was also agreed that Ms. Masango would send a written contract

by the end of the business on 7 June 2017 for signatures by both parties.

At the end of the Hage Geingob Soccer Cup final match, Ms. Chabalala, who had overheard the

conversation between the two, called Mr. Baloyi aside. She alerted him to the fact that she had recently

provided catering services for Events Today (Pty) Ltd but not all payments were received as the

company is experiencing some financial difficulty.

REQUIRED:

Determine whether the arrangement between Mr. Baloyi and Ms. Masango satisfies the requirements

of a contract in terms of IFRS 15 Revenue from contracts with customers in the records of CATERNAM

(Pty) Ltd on 30 May 2017.

(15)

Page 1 of 6

|

3 Page 3 |

▲back to top |

QUESTION 2

(25 MARKS)

Beer Pressure Limited brews their own beer in central Windhoek, where they rent a property from Broll

and list Namibia (Pty) Ltd. The reporting period of Beer Pressure Limited ends on 31 December 2017.

The chief accountant of Beer Pressure Limited has always expressed explicit and unreserved

compliance with International Financial Reporting Standards (IFRS) in its annual financial statements.

The following information relates to the property, plant and equipment of Beer Pressure Limited.

SPECIAL FACTORY PLANT

Beer Pressure Limited purchased a special factory plant on 1 January 2017. Details of the cost incurred

to acquire the plant are as follows:

Purchase price (including VAT of 15%)

Initial operating loss

Delivery costs

import duties (non-refundable)

Staff training to use plant

Installation costs

Proceeds from sale of samples produced during testing

Testing to ensure plant is fully operational

Inauguration function to introduce the plant

N$

1 140 000

70 000

90 000

200 000

24 000

60 000

26 000

84 246

28 000

Additional information:

1. The initial operating loss was incurred as a result of having to dump unsold “bad beer" since the

colour of this sample was dark orange.

2. Beer Pressure is a VAT vendor.

3. All amounts are stated exclusive of VAT unless stated othenrvise.

MOTOR VEHICLES

The following information is obtained from the books of Beer Pressure Limited on 31 December 2016 in

respect of motor vehicles:

Motor vehicle

2015 Nissan

2016 Toyota Carola

Cost Price

N$ 100 000

N$ 140 000

Date of purchase

1 July 2015

1 Sept 2016

On 1 July 2017 the 2015 Nissan was traded in for N$40 000 (excluding VAT) for a GWM single cab

which cost N$150 000 (excluding VAT). Beer Pressure provides for depreciation at 20% per annum on

the reducing balance method.

Page 2 of 6

|

4 Page 4 |

▲back to top |

REQUIRED:

a) Calculate the cost at which the special factory plant will be recognised by complying with IAS 16

Property, Plant and Equipment.

(10)

b) Prepare the following general ledger accounts for the reporting period ended 31 December 2017:

i) Motor vehicles

(5)

ii) Accumulated depreciation; motor vehicles

(6)

iii) Disposal of motor vehicles

(4)

Note: Show all your workings.

Round off all amounts to the nearest Dollar.

QUESTION 3

(15 MARKS)

Dimensions Data was established in 2015 by Mr. Angula. The organisation sells computers and its

main market is young professionals. Dimensions Data purchase its computers from a local supplier,

Business Connexions (Pty) Ltd, which is a VAT registered vendor. Dimensions Data is also a registered

VAT vendor. The price of one computer bought from its supplier, Business Connexions (Pty) Ltd

amounts to N$10 350 (VAT inclusive).

Mr. Angula has informed you that he will be travelling a lot during 2017, as the world is his oyster and

he need to be on the lookout for new business opportunities all the time.

The computers are sold by Dimensions Data at a mark-up of 35%.

The accountant of Dimensions Data had the following information regarding the financial year ending

30 June 2017:

Opening Inventory

Dell computers bought

Dell computers sold

Donations to the best IT students at the Namibia University of Science and Technology

Units__

180

750

840

12

On 7 July 2017 SangHu computers established a branch in Windhoek and they sell mostly MAC Book

(computers) which are currently in high demand and Dimensions Data will have no option but to sell

their computers at N$8 400 (excluding VAT) each, in order to keep up with the competitive market.

You may assume a VAT rate of 15% is applicable.

REQUIRED:

a) Explain to Mr. Angula what the differences are between the two inventory systems and advise him

on which system would be more appropriate for his business.

(6)

b) Calculate the selling price of each Dell computer.

(2)

c) What will your answer be in (b) above, if the profit margin was 20%?

(2)

d) Calculate the value of closing inventory computers on hand on 30 June 2017 and explain to Mr.

Angula the reason(s) for using the value per item that you used in your closing balance calculation.

(5)

Page 3 of 6

|

5 Page 5 |

▲back to top |

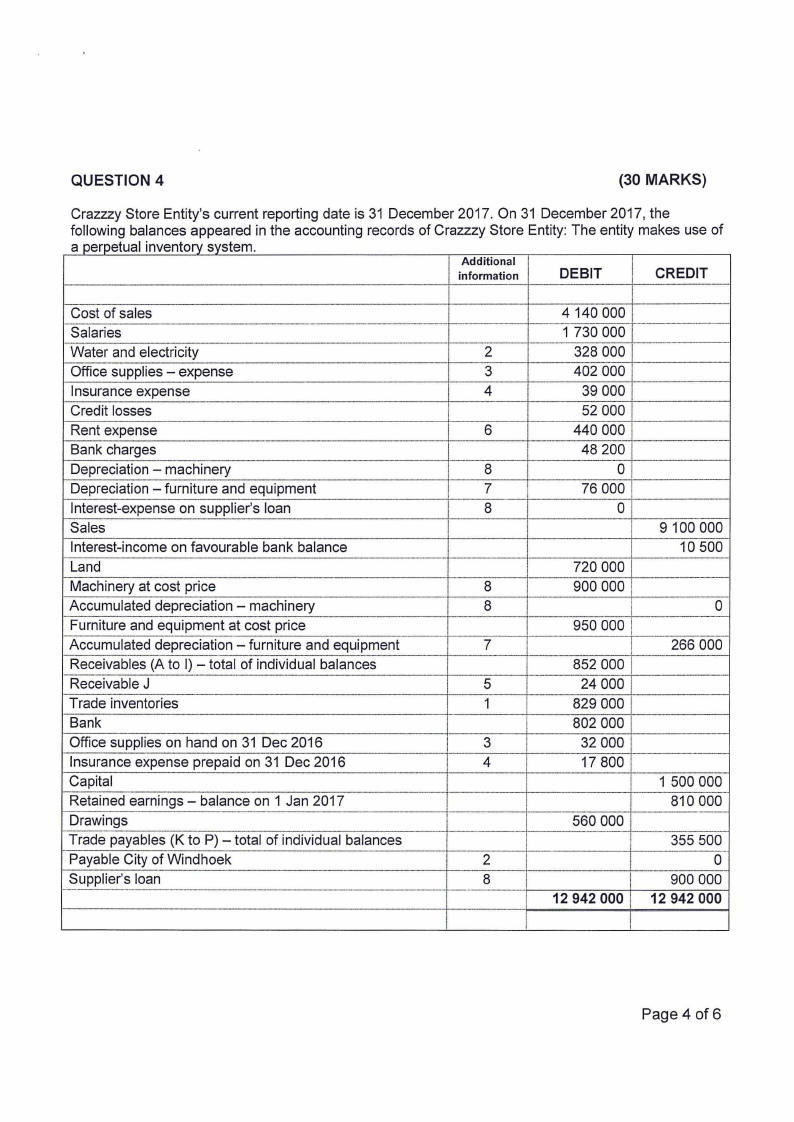

QUESTION 4

(30 MARKS)

Crazzzy Store Entity's current reporting date is 31 December 2017. On 31 December 2017, the

following balances appeared in the accounting records of Crazzzy Store Entity: The entity makes use of

a perpetual inventory system.

Additional

information

DEBIT

CREDIT

Cost of sales

Salaries

Water and electricity

Office supplies — expense

insurance expense

Credit losses

Rent expense

Bank charges

Depreciation — machinery

Depreciation - furniture and equipment

interest-expense on supplier’s loan

Sales

Interest-income on favourable bank balance

Land

Machinery at cost price

Accumulated depreciation — machinery

Furniture and equipment at cost price

Accumulated depreciation — furniture and equipment

Receivables (A to l) — total of individual balances

Receivable J

Trade inventories

Bank

Office supplies on hand on 31 Dec 2016

Insurance expense prepaid on 31 Dec 2016

Capital

Retained earnings — balance on 1 Jan 2017

Drawings

Trade payables (K to P) — total of individual balances

Payable City of Windhoek

Supplier’s loan

4 140 000

1 730 000

2

328 000

3

402 000

4

39 000

52 000

6

440 000

48 200

8

0

7

76 000

8

0

9 100 000

10 500

720 000

8

900 000

8

0

950 000

7

266 000

852 000

5

24 000

1

829 000

802 000

3

32 000

4

17 800

1 500 000

810 000

560 000

355 500

2

0

8

900 000

12 942 000

12 942 000

Page 4 of 6

|

6 Page 6 |

▲back to top |

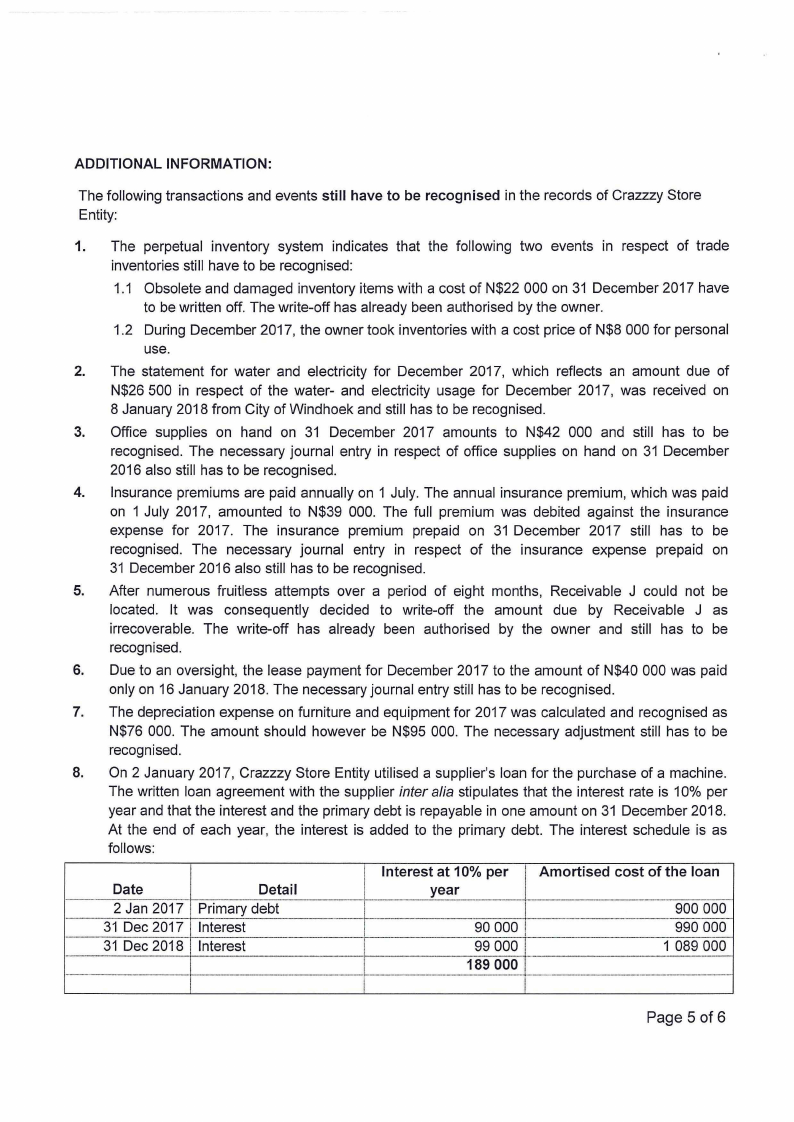

ADDITIONAL INFORMATION:

The following transactions and events still have to be recognised in the records of Crazzzy Store

Entity:

1. The perpetual inventory system indicates that the following two events in respect of trade

inventories still have to be recognised:

1.1 Obsolete and damaged inventory items with a cost of N$22 000 on 31 December 2017 have

to be written off. The write—off has already been authorised by the owner.

1.2 During December 2017, the owner took inventories with a cost price of N$8 000 for personal

use.

2. The statement for water and electricity for December 2017, which reflects an amount due of

N$26 500 in respect of the water— and electricity usage for December 2017, was received on

8 January 2018 from City of Windhoek and still has to be recognised.

3. Office supplies on hand on 31 December 2017 amounts to N$42 000 and still has to be

recognised. The necessary journal entry in respect of office supplies on hand on 31 December

2016 also still has to be recognised.

4. Insurance premiums are paid annually on 1 July. The annual insurance premium, which was paid

on 1 July 2017, amounted to N$39 000. The full premium was debited against the insurance

expense for 2017. The insurance premium prepaid on 31 December 2017 still has to be

recognised. The necessary journal entry in respect of the insurance expense prepaid on

31 December 2016 also still has to be recognised.

5. After numerous fruitless attempts over a period of eight months, Receivable J could not be

located. It was consequently decided to write-off the amount due by Receivable J as

irrecoverable. The write-off has already been authorised by the owner and still has to be

recognised.

6. Due to an oversight, the lease payment for December 2017 to the amount of N$40 000 was paid

only on 16 January 2018. The necessary journal entry still has to be recognised.

7. The depreciation expense on furniture and equipment for 2017 was calculated and recognised as

N$76 000. The amount should however be N$95 000. The necessary adjustment still has to be

recognised.

8. On 2 January 2017, Crazzzy Store Entity utilised a supplier’s loan for the purchase of a machine.

The written loan agreement with the supplier inter alia stipulates that the interest rate is 10% per

year and that the interest and the primary debt is repayable in one amount on 31 December 2018.

At the end of each year, the interest is added to the primary debt. The interest schedule is as

follows:

Date

2 Jan 2017

31 Dec 2017

31 Dec 2018

Detail

Primary debt

Interest

Interest

Interest at 10% per

year

90 000

99 000

189 000

Amortised cost of the loan

900 000

990 000

1 089 000

Page 5 of 6

|

7 Page 7 |

▲back to top |

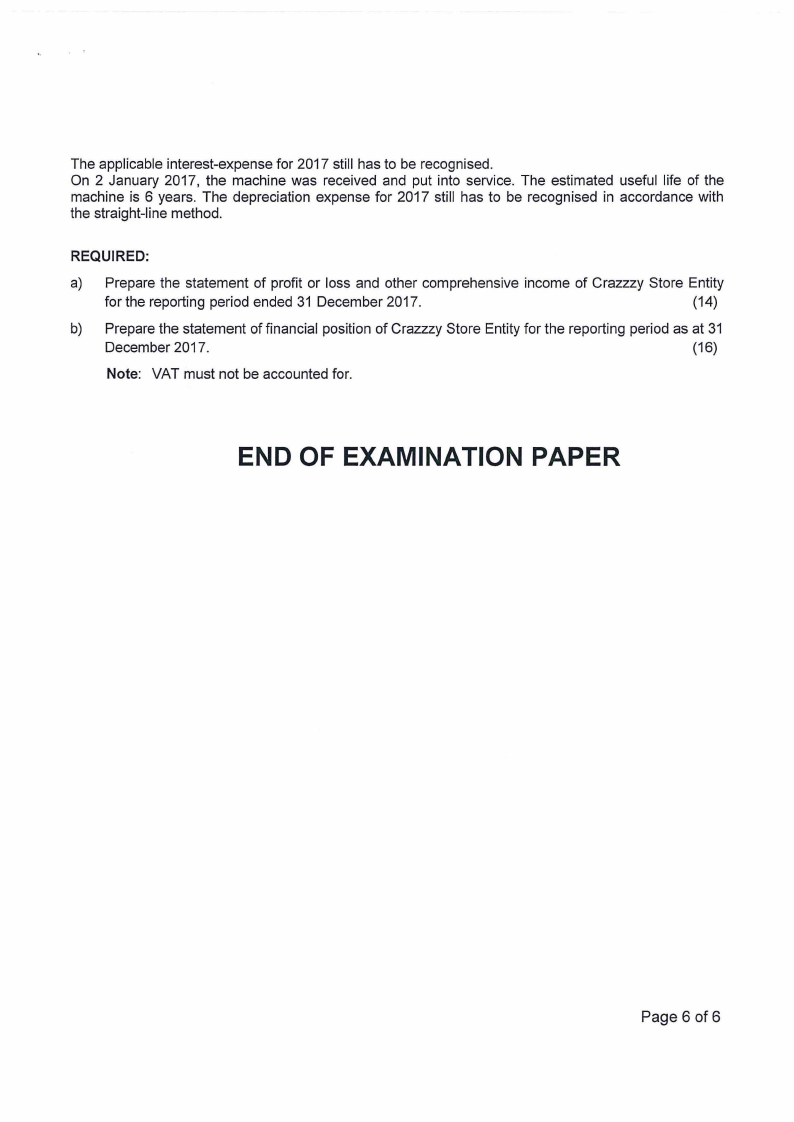

The applicable interest-expense for 2017 still has to be recognised.

On 2 January 2017, the machine was received and put into service. The estimated useful life of the

machine is 6 years. The depreciation expense for 2017 still has to be recognised in accordance with

the straight-line method.

REQUIRED:

a) Prepare the statement of profit or loss and other comprehensive income of Crazzzy Store Entity

for the reporting period ended 31 December 2017.

(14)

b) Prepare the statement of financial position of Crazzzy Store Entity for the reporting period as at 31

December 2017.

(16)

Note: VAT must not be accounted for.

END OF EXAMINATION PAPER

Page 6 of 6

|

8 Page 8 |

▲back to top |

1mm 2 [-229

Uf‘iSVEPESfiTY

GF SCIENCE nnD

EEHHOLGGY

:ek

WfiMiSifi

‘0” 2017

Efiflfifimiflls Eula: E‘Eiflf-EEE