|

PFN712S- PUBLIC FINANCE- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmI BIA un IVERS ITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: 07BECO

LEVEL: 7

COURSE CODE: PFN712S

COURSE NAME: PUBLICFINANCE

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S)

MR. MALLY LIKUKELA

MODERATOR:

MR. M MBAHA

INSTRUCTIONS

1. Answer ALL the questions.

2. Read all the questions carefully before answering.

3. Number the answers clearly

THIS QUESTION PAPER CONSISTS OF _S_ PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

A: [SECTION ,MU~TlplE•~H,QICE,r

•

•

p

1. Operational Efficiency is

(a} States that agencies should provide goods and services at a cost that

achieves ongoing efficiency gains

(b} The budget system should facilitate reallocation from lesser to higher

priorities and from less to more effective programs

(c} is the ability of a firm to produce as much output as possible with a

specified level of inputs, given the existing technology.

(d} All of the above

2. A pure private good is

a} non rival in consumption and subject to exclusion.

b} rival in consumption and subject to exclusion.

c} rival in consumption and not subject to exclusion.

d} all of the above

3. Positive Economics is based on:

a} Statements that contain opinions and value judgement. i.e. "what ought

to be" or "what should be

b} based on factual statements and such statements contain no value

judgement

c} Statements that cannot be settled by science or by an appeal to and such

statement

d} All of the above

4. The economic incidence of a unit tax is

a. Generally borne by the buyers

b. Generally borne by sellers

c. Generally borne by the government

d. Independent of the statutory incidence for the tax

5. Market failure can occur when

(a} monopoly power exists in the market.

(b} markets are missing.

(c} consumers can influence prices.

(d} all of the above.

|

3 Page 3 |

▲back to top |

6. Progressive tax

a) is when a taxpayer pay higher taxes if he earns more income and lower

taxes if he earns less

b) Is when low income individuals pay a higher percentage of their incomes

in taxes, than richer individuals

c) a tax in which the tax rate decreases as the taxable amount increases

d) All of the above

7. Pareto points in the Edgeworth Box are

a) Found when indifference curves are tangent.

b) Found when MRS are equal.

c) Found when one person cannot be made better off without making

another person worse off.

d) all of the above.

8. The slope of budget line is called

a) the diminishing marginal return

b) the marginal rate of substitution

c) the Marginal Rate of Transformation

d) the rate of marginal substitution

9. Movement from an inefficient allocation to an efficient allocation in the

Edgeworth Box will

a) Increase the utility of all individualsls what explain the law of demand

b) Increase the utility of at least one individual, but may decrease the level of

utility of another person.

c) Increase the utility of one individual, but cannot decrease the utility of any

individual

d) Decrease the utility of all individuals

10. Allocative efficiency

a) Tells us the relationship between the quantity allocated, and the price

b) Is about allocating resources such that the maximum utility is generated

c) Is the ability of a firm to produce as much output as possible with a

specified level of inputs, given the existing technology.

d) All of the above

|

4 Page 4 |

▲back to top |

SECTIONB::rRUEOR FALS!:

10MARKS

1. The private sector and businesses are not involved at all in government

budgeting process because they don't receive money from state.

2. Market failure refer to situation where government intervene and make things

worse.

3. Transfer Payments are direct transfers in cash or in kind to poor individuals and

households.

4. Namibia has never run a Budget surplus since independence.

5. Allocative efficiency relates to output.

6. Citizens have a legal right to payments from the government regardless of

budget conditions.

7. Most externalities are negative, as the production process often entails

byproducts, waste, and other consequential outcomes that do not have further

benefits.

8. As long as the oil refinery company can pay the cost of pollution, it would be

inefficient for the oil refinery to stop producing oil.

9. The Office of the President provides overall oversight of the budget and

budgeting process in Namibia.

10. Marginal Rate of substitution implies that, as a consumer increases the amount

of Good X, he will be willing to forgo the equivalent amount of Good Y.

QUESTION 1

Define the following terms;

1. Pareto Efficiency

2. Tax reform

3. Technical efficiency

4. Externality

5. Budget Deficit

QUESTION 2

Define and explain the scope for Public Finance

[40MARKS~

10MARKS

[S MARKS]

|

5 Page 5 |

▲back to top |

QUESTION 3

Describe the five solutions to the problem of externalities

[25MARKS]

- 2JOM'ARKS

QUESTION 1

[S MARKS]

Taxes are sometimes referred to as direct tax or indirect tax, distinguish between

Direct and indirect taxes (with appropriate examples).

QUESTION 2

Describe the main disadvantages of VAT.

[lOMARKS]

QUESTION 3

Explain the Basic Elements of Effective Government Budgeting

[lSMARKS]

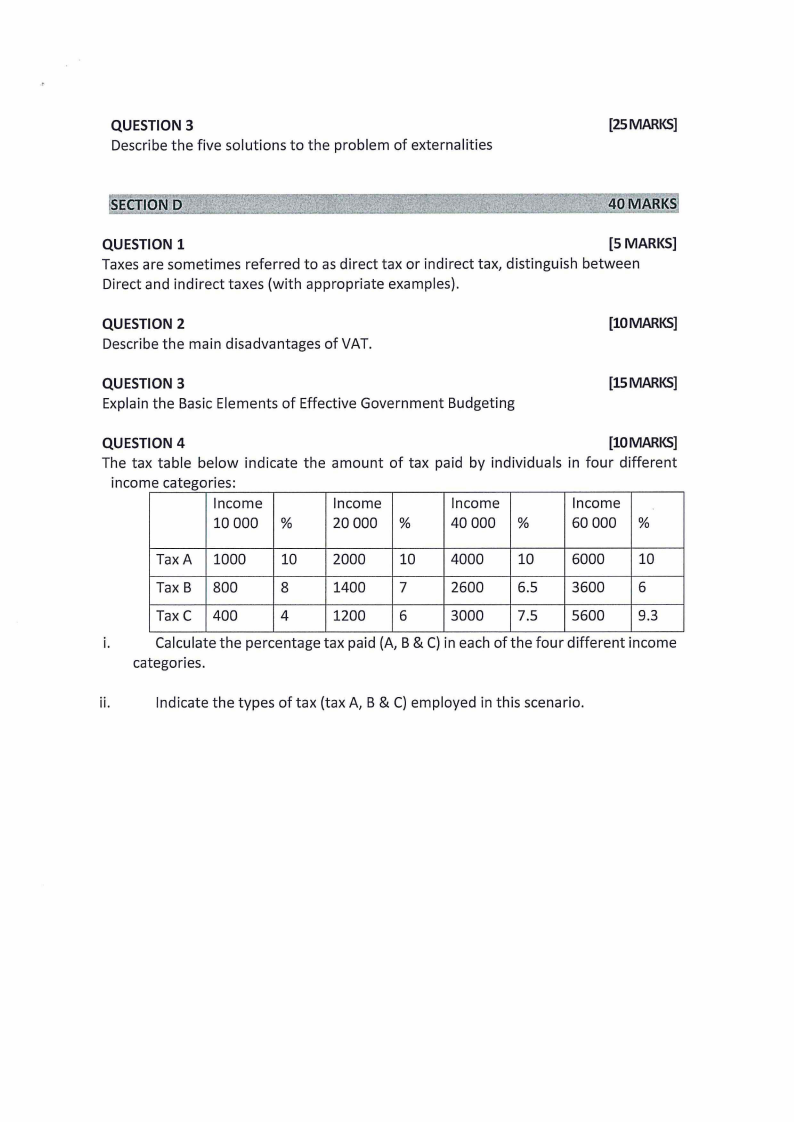

QUESTION 4

[lOMARKS]

The tax table below indicate the amount of tax paid by individuals in four different

income categories:

Income

Income

Income

Income

10 000 %

20 000 %

40 000 %

60 000 %

Tax A 1000 10 2000 10 4000 10 6000 10

Tax B 800

8

1400 7

2600 6.5 3600 6

Tax C 400

4

1200 6

3000 7.5 5600 9.3

i.

Calculate the percentage tax paid (A, B & C) in each of the four different income

categories.

ii.

Indicate the types of tax (tax A, B & C) employed in this scenario.