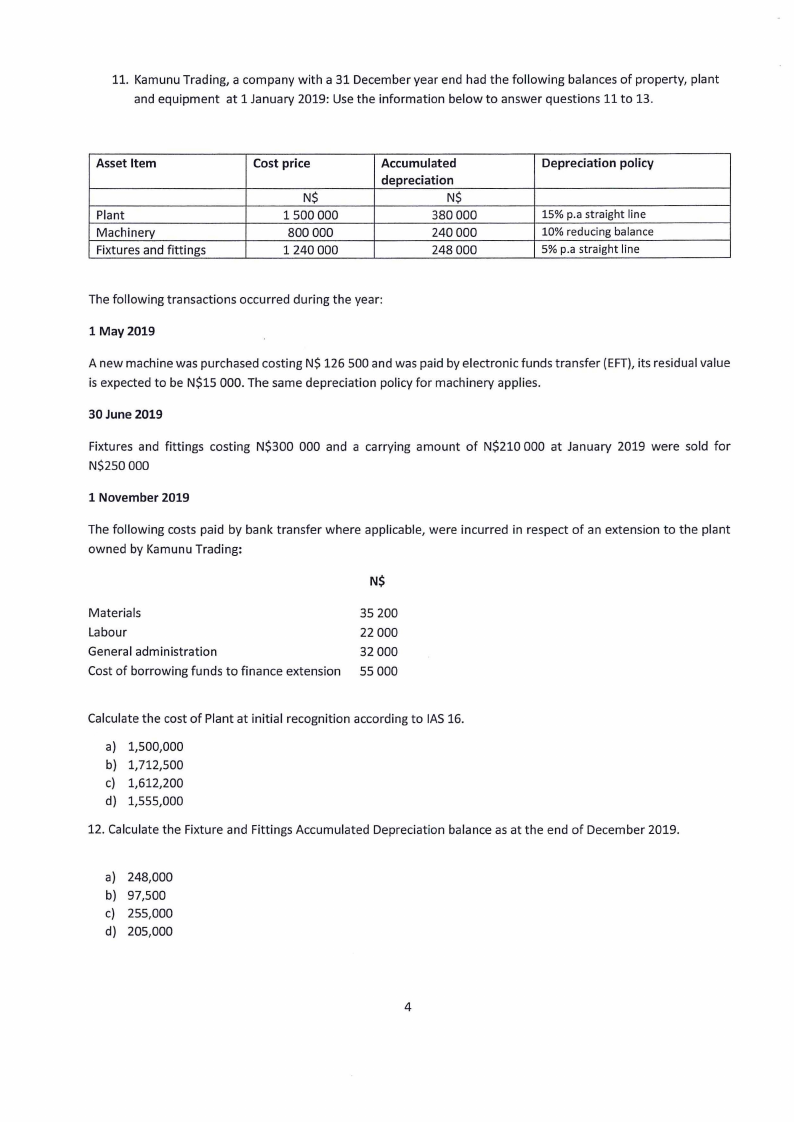

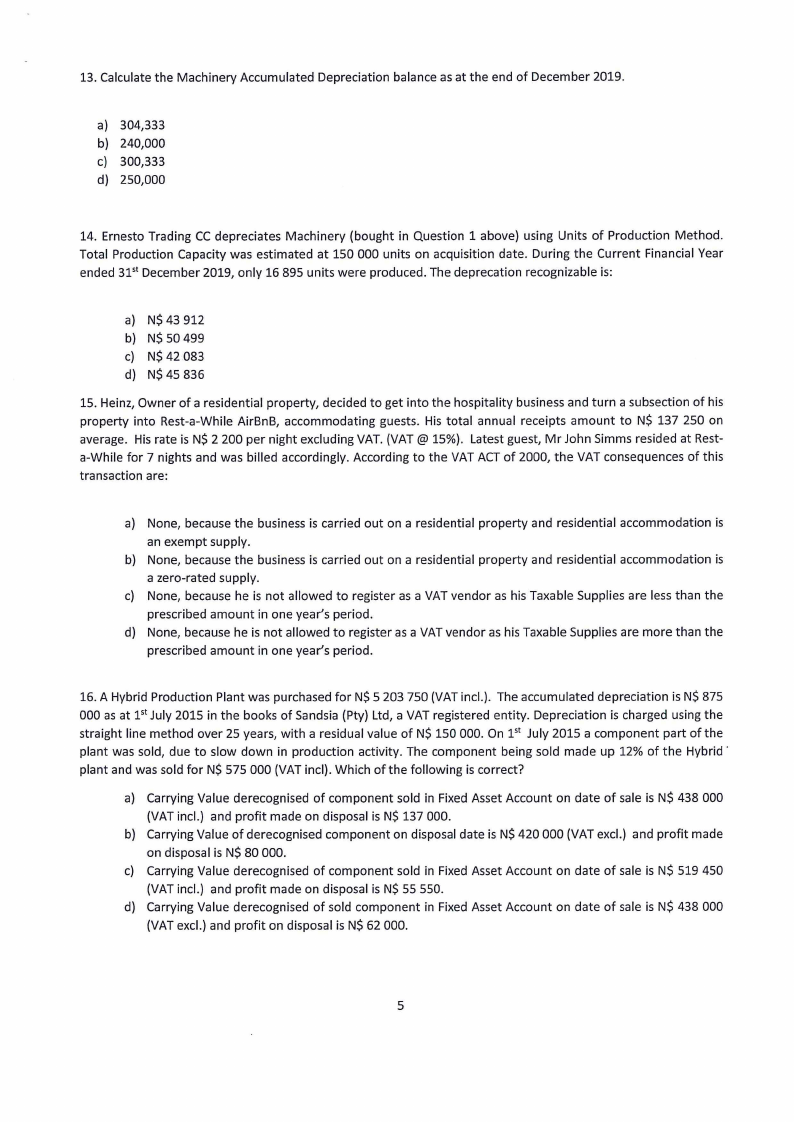

13. Calculate the Machinery Accumulated Depreciation balance as at the end of December 2019.

a) 304,333

b) 240,000

c) 300,333

d) 250,000

14. Ernesto Trading CC depreciates Machinery (bought in Question 1 above) using Units of Production Method.

Total Production Capacity was estimated at 150 000 units on acquisition date. During the Current Financial Year

ended 31st December 2019, only 16 895 units were produced. The deprecation recognizable is:

a) N$ 43 912

b) N$ 50 499

c) N$ 42 083

d) N$ 45 836

15. Heinz, Owner of a residential property, decided to get into the hospitality business and turn a subsection of his

property into Rest-a-While AirBnB, accommodating guests. His total annual receipts amount to N$ 137 250 on

average. His rate is N$ 2 200 per night excluding VAT. (VAT@ 15%). Latest guest, Mr John Simms resided at Rest-

a-While for 7 nights and was billed accordingly. According to the VAT ACT of 2000, the VAT consequences of this

transaction are:

a) None, because the business is carried out on a residential property and residential accommodation is

an exempt supply.

b) None, because the business is carried out on a residential property and residential accommodation is

a zero-rated supply.

c) None, because he is not allowed to register as a VAT vendor as his Taxable Supplies are less than the

prescribed amount in one year's period.

d) None, because he is not allowed to register as a VAT vendor as his Taxable Supplies are more than the

prescribed amount in one year's period.

16. A Hybrid Production Plant was purchased for N$ 5 203 750 (VAT incl.). The accumulated depreciation is N$ 875

000 as at 1st July 2015 in the books of Sandsia (Pty) Ltd, a VAT registered entity. Depreciation is charged using the

straight line method over 25 years, with a residual value of N$ 150 000. On 1st July 2015 a component part of the

plant was sold, due to slow down in production activity. The component being sold made up 12% of the Hybrid·

plant and was sold for N$ 575 000 (VAT incl). Which of the following is correct?

a) Carrying Value derecognised of component sold in Fixed Asset Account on date of sale is N$ 438 000

(VAT incl.) and profit made on disposal is N$ 137 000.

b) Carrying Value of derecognised component on disposal date is N$ 420 000 (VAT excl.) and profit made

on disposal is N$ 80 000.

c) Carrying Value derecognised of component sold in Fixed Asset Account on date of sale is N$ 519 450

(VAT incl.) and profit made on disposal is N$ 55 550.

d) Carrying Value derecognised of sold component in Fixed Asset Account on date of sale is N$ 438 000

(VAT excl.) and profit on disposal is N$ 62 000.

5